Anfield Energy Inc.

(TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or the “Company”) announces that the

Company has entered into a subscription agreement dated January 14,

2024 with Uranium Energy Corp. (“UEC”) whereby UEC has agreed to

acquire 107,142,857 shares of Anfield (the “Shares”) at a price of

C$0.14 per Share for gross proceeds of C$15 million (the “Equity

Financing”). In addition, Anfield also announces its intent to

pursue a listing of its shares on a senior US stock exchange.

Finally, further to the Company’s press release dated

January 2, 2025, the Company has terminated its proposed

plan of arrangement (the “Arrangement”) dated October 1, 2024 with

IsoEnergy Ltd. (“IsoEnergy”). To repay IsoEnergy’s Promissory Note

dated October 1, 2024, Anfield has also entered into an indicative

term sheet with Extract Advisors LLC (“Extract”), the Company’s

existing lender, to increase the existing credit facility by an

additional US$8 million (the “Credit Facility”).

Corey Dias, CEO & Director of Anfield,

commented: “The Company has evaluated its options with regard to

moving Anfield towards uranium and vanadium production and, as

confirmed by the Board of Directors, we see compelling value in the

premium-priced C$15 million UEC strategic equity financing. In

addition to this proposed equity financing, Extract has agreed to

increase its credit facility by US$8 million. This results in total

financing of approximately C$26.5 million and provides the Company

with significant runway to pursue, amongst, other things, a listing

on a senior US stock exchange, the continuing engagement of the

State of Utah with regard to the radioactive materials license

upgrade and the Company’s Shootaring mill reactivation plan, the

addition of key personnel to facilitate the advancement of both

mines and mill, the completion of Velvet-Wood’s Plan of Operations,

the updating of Slick Rock’s uranium and vanadium resource estimate

(based on recent drill results) and the potential to apply for mine

permits to reopen certain of the Company’s DOE leases.”

Strategic Equity Financing

The Equity Financing is scheduled to close on or

about January 15, 2025 (the "Closing Date") and is subject to the

approval of the TSX Venture Exchange (“TSXV”).

The Shares to be issued under the Equity

Financing will be subject to a hold period in Canada expiring four

months and one day from the Closing Date.

Upon completion of the Equity Financing, UEC

will own 203,415,775 common shares and 96,272,918 share purchase

warrants of Anfield in aggregate, representing 17.8% of Anfield on

an outstanding basis and 24.2% on a partially diluted basis. UEC

has executed an undertaking with both the Company and the TSXV not

to exercise such number of its warrants held to the extent that,

upon exercise thereof, it would cause UEC to become a control

person (as defined in the policies of the TSXV) as at the date of

the subscription without written approval of the exchange or unless

disinterested Anfield shareholder approval is obtained.

Arrangement with IsoEnergy

Further to the Company’s press release dated

January 2, 2025, the Company continues to believe that the case to

be heard by the British Columbia Court of Appeal on January 27 and

28, 2025 was strong. However, despite numerous efforts on the part

of Anfield, IsoEnergy elected not to extend the Arrangement beyond

its December 31, 2024 outside date (the “Outside Date”). Under the

terms of the Arrangement, either party was able to unilaterally

terminate the Arrangement if it had not closed prior to the Outside

Date. Additionally, IsoEnergy submitted an alternate joint venture

proposal to Anfield on January 8, 2025. This proposal was not

viewed favorably by the Board, and in any event was deemed inferior

to the Arrangement. Therefore, the Board has determined that it is

in the best interest of Anfield’s shareholders to terminate the

Arrangement and proceed with the financings disclosed herein.

Regarding the ongoing Court actions between UEC

and Anfield, the Company will withdraw its appeal in the British

Columbia Court of Appeal and will seek an appearance in front of

Justice Weatherill in the British Columbia Supreme Court to

withdraw its petition seeking court approval of the Arrangement

with IsoEnergy. With these withdrawals, the Order that Anfield hold

a new shareholder meeting will become moot.

Pursuant to the terms of the Arrangement,

Anfield has provided its written notice of termination to

IsoEnergy. Concurrent with such termination, the C$6 million

promissory note with IsoEnergy (the “Promissory Note”) that was

entered into by Anfield in conjunction with the Arrangement is now

due. Anfield intends to provide notice to IsoEnergy that the

Promissory Note and IsoEnergy’s indemnity for up to US$3 million in

principal with respect to certain of Anfield’s property obligations

will be repaid and released immediately upon closing of the Equity

Financing.

Credit Facility Amendment

Under the terms of the indicative Credit

Facility term sheet, Extract shall provide Anfield with an

additional loan of US$8 million under the existing credit agreement

between Anfield and Extract dated September 26, 2023, as amended.

The proceeds from the additional loan shall be used to repay

IsoEnergy’s Promissory Note and indemnity.

The Credit Facility will continue to have a

maturity date of September 26, 2028 (“Maturity Date”). The Credit

Facility will continue to bear a coupon of the secured overnight

financing rate (“SOFR”) plus 5 per cent per annum, payable

semi-annually. Anfield, with written notice, may elect to

capitalize the interest payable on the facility semi-annually, in

arrears, at a rate of SOFR plus 7 per cent.

In connection with the Credit Facility, Anfield

will issue 79,900,000 share purchase warrants to Extract (the

“Facility Warrants”), with each such Facility Warrant entitling the

holder thereof to acquire one common share of the Company at an

exercise price of C$0.15 per share for a period ending on the

Maturity Date. For so long as the Credit Facility remains

outstanding, all proceeds from the exercise of the Facility

Warrants by the lender shall be used to repay the principal amount

of the Credit Facility. Extract has agreed, subject to the approval

of the TSXV, not to exercise such number of its warrants held to

the extent that, upon exercise thereof, it would cause Extract or

its affiliates to hold in excess of 20% of the outstanding voting

securities of Anfield.

Closing of the Credit Facility and the issuance

of the Facility Warrants remain subject to the approval of the

TSXV.

Use of Proceeds

Funds will be used to: 1) advance the

reactivation plan for the Shootaring Canyon Mill; 2) advance the

Plan of Operations for the Velvet-Wood mine; 3) potentially seek

out mine permits for certain DOE leases; 4) add key personnel to

facilitate the advancement of both mines and mill; and 5) general

corporate purposes, including the pursuit of a listing on a US

stock exchange.

Advisors

Haywood Securities Inc. is acting as financial

advisor to Anfield.

About

Anfield

Anfield is a uranium and vanadium

development and near-term production company that is committed to

becoming a top-tier energy-related fuels supplier by creating value

through sustainable, efficient growth in its

assets. Anfield is a publicly traded corporation listed

on the TSX Venture Exchange (AEC-V), the OTCQB Marketplace (ANLDF)

and the Frankfurt Stock Exchange (0AD).

On behalf of the Board of Directors

ANFIELD ENERGY INC.Corey Dias, Chief Executive

Officer

Contact:

Anfield Energy

Inc.

Corey Dias, Chief Executive OfficerClive

Mostert, Corporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No securities

regulatory authority has either approved or disapproved of the

contents of this news release.

Cautionary Statement Regarding

Forward-Looking Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to the activities, events or

developments that the Company expects or anticipates will or may

occur in the future, including the ability of the Company to

complete the Equity Financing and enter into the Credit Facility on

the proposed terms or at all; the anticipated closing date of the

Credit Facility; the Maturity Date, coupon rate and other terms of

the Credit Facility; the anticipated Closing Date; the anticipated

use of proceeds from the Equity Financing and the exercise of the

Facility Warrants; the receipt of regulatory approvals with respect

to the Equity Financing, Credit Facility and issuance of the

Facility Warrants; the impact the Equity Financing and Credit

Facility will have on the Company’s ability to advance its projects

over the near term; the repayment of the Promissory Note; UEC’s

ownership of the Company’s securities upon completion of the Equity

Financing; and the intention to pursue a listing on a senior US

stock exchange.

Generally, but not always, forward-looking

information and statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connation thereof.

Such forward-looking information and statements

are based on numerous assumptions, including among others, that the

Company will be able to complete the Equity Financing and enter

into the Credit Facility on the terms currently anticipated, or at

all; that the closing date of the Credit Facility and other terms

of the Credit Facility will remain as currently anticipated by

management of the Company; that the Company will use the proceeds

of the Equity Financing and the exercise of the Facility Warrants

as currently anticipated; that the Equity Financing will be

completed on the Closing Date; that the Company will receive

regulatory approval with respect to the Equity Financing, Credit

Facility and issuance of the Facility Warrants; that the Equity

Financing and Credit Facility will provide the Company with

sufficient funding to independently advance its projects over the

near term; that the Company will repay the Promissory Note upon

closing the Equity Financing; that UEC’s ownership of the Company’s

securities upon completing the Equity Financing will be as

currently anticipated; and that the Company will be able to pursue

a listing on a senior US stock exchange. Although the assumptions

made by the Company in providing forward-looking information or

making forward-looking statements are considered reasonable by

management at the time, there can be no assurance that such

assumptions will prove to be accurate.

There can be no assurance that such statements

will prove to be accurate and actual results and future events

could differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from the Company’s plans or expectations include the

risk that the Company will not be able to complete the Equity

Financing and enter into the Credit Facility on the terms and

timeline as anticipated by management, or at all; that the Company

may not use the proceeds of the Equity Financing and exercise of

the Facility Warrants as currently anticipated; that the

anticipated closing date of the Credit Facility and other terms of

the Credit Facility may change; that the Company may not receive

regulatory approval with respect to the Equity Financing, Credit

Facility and issuance of the Facility Warrants; that the Equity

Financing and Credit Facility, if completed, may not have the

impact on the Company’s operations as currently anticipated by

management; the risk that the Company may not be able to repay the

Promissory Note if the Equity Financing is not completed; the risk

that UEC’s ownership of the Company’s securities upon completion of

the Equity Financing may not be as currently anticipated; the risk

that the Company may not have the resources, or may otherwise be

unable to pursue a listing on a senior US stock exchange; risks

relating to the actual results of the Company’s operational

activities, fluctuating commodity prices, availability of capital

and financing, general economic, market or business conditions,

regulatory changes, timeliness of government or regulatory

approvals and other risks detailed herein and from time to time in

the filings made by the Company with securities regulators.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or

information.

The Company expressly disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise

except as otherwise required by applicable securities legislation.

We seek safe harbor.

Head

Office:4390 Grange

Street, Suite 2005

Burnaby, B.C. V5H 1P6

www.anfieldenergy.com

Office:

604.669.5762Fax:

604.608.4804

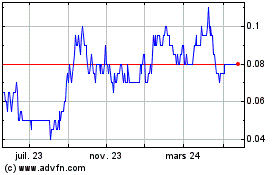

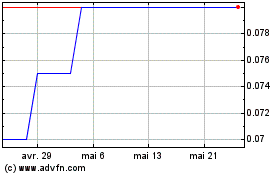

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Anfield Energy (TSXV:AEC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025