Eros Resources Corp. (TSXV:ERC)

(OTCQB:EROSF) (“

Eros”),

MAS

Gold Corp. (TSXV: MAS) (“

MAS Gold”) and

Rockridge Resources Ltd. (TSXV: ROCK)

(“

Rockridge”) are pleased to announce that,

further to their news release dated October 1, 2024, the companies

have completed their three-way merger transaction (the

“

Transaction”) pursuant to the business

combination agreement dated September 30, 2024 (the

“

Business Combination Agreement”), whereby Eros

acquired all of the issued and outstanding shares of both Rockridge

and MAS Gold that it did not already own by way of two plans of

arrangement under the Business Corporations Act (British Columbia)

(collectively, the “

Arrangements”). The

Transaction results in Rockridge and MAS Gold becoming wholly-owned

subsidiaries of Eros. The completion of the Transaction marks a new

era for the companies, combining the high-grade gold and copper

assets of Rockridge and MAS Gold in Saskatchewan and Eros’

portfolio of equities. The Transaction obtained requisite approval

by the shareholders of each of the companies on January 6, 2025 and

the Arrangements were approved by the Supreme Court of British

Columbia on January 9, 2025.

Under the terms of the Arrangements, former

shareholders of Rockridge are now entitled to receive 0.375 (the

“Rock Exchange Ratio”) common shares of Eros (each

full share, an “Eros Share”) for each Rockridge

common share (a “Rockridge Share”) held and former

shareholders of MAS Gold are now entitled to receive 0.25 (the

“MAS Exchange Ratio” and together with the Rock

Exchange Ratio, the “Exchange Ratio”) Eros Shares

for each MAS Gold common share (a “MAS Gold

Share”) held immediately prior to the effective time of

the Arrangements (collectively, the

“Consideration”). Existing Eros shareholders own

approximately 42.37% of the combined company, former MAS Gold

shareholders own approximately 37.33% of the combined company, and

former Rockridge shareholders own approximately 20.30%.

In order to receive the Consideration,

registered shareholders of Rockridge Shares and MAS Gold Shares

will be required to deposit their share certificate(s) or direct

registration system advises representing such Rockridge Shares or

MAS Gold Shares, as applicable, together with the duly completed

letter of transmittal, with Computershare Investor Services Inc.,

the depositary under the Arrangements. Shareholders whose Rockridge

Shares and MAS Gold Shares are registered in the name of a broker,

dealer, bank, trust company or other nominee should contact their

nominee regarding the receipt of the

Consideration.Rockridge and MAS Gold Options and

Warrants

Holders of Rockridge options ("Rockridge

Options") and MAS Gold options (“MAS

Options”) have received replacement options under the

Arrangements, exercisable for Eros Shares at the applicable

Exchange Ratio. All other terms and conditions of the replacement

options, including the term of expiry, vesting, conditions to and

manner of exercising, are the same as the Rockridge Options or MAS

Options, as applicable, for which they were exchanged and the

documents evidencing Rockridge Options or MAS Options, as

applicable, will be deemed to evidence the replacement options

issued in exchange therefor. No certificates evidencing the

replacement options will be issued.

Warrants to purchase Rockridge Shares

("Rockridge Warrants") and MAS Gold Shares

(“MAS Warrants”), other than those that have been

exercised prior to the effective time of the Arrangements, will

continue to remain outstanding as warrants of Rockridge or MAS

Gold, as applicable, which, upon exercise, will entitle the holder

thereof to receive, the Consideration in lieu of a Rockridge Share

or MAS Gold Share, as applicable, for each Rockridge Warrant or MAS

Warrant, as applicable, so exercised.

Leadership and Governance

Upon closing of the Transaction, the board of

directors of Eros was re-constituted to (5) directors, with the

appointment of Jordan Trimble, Jonathan Wiesblatt, Joseph Gallucci,

Ross McElroy and Tim Termuende. Management of the Eros is led by

Jordan Trimble as President, Jonathan Wiesblatt as Chief Executive

Officer and Chantelle Collins as Chief Financial Officer.

Delisting of Rockridge Shares and MAS

Gold Shares

The Rockridge Shares and MAS Gold Shares are

expected to be delisted from the TSXV as of the closing of the

market on January 27, 2025.

Early Warning System Matters regarding

Rockridge and MAS Gold

Pursuant to National Instrument 62-103 – The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues and in connection with the filing of Early Warning

Reports regarding the acquisitions by Eros of: (i) all the common

shares of Rockridge, a corporation incorporated under the laws of

British Columbia, with its securities trading until completion of

the Transaction on the TSXV under the symbol “ROCK” and having a

head office located at Suite #1030 – 505 Burrard Street, Vancouver,

British Columbia, Canada, and (ii) all the common shares of MAS

Gold (other than MAS Shares already owned by Eros), a corporation

incorporated under the laws of British Columbia, with its

securities trading until completion of the Transaction on the TSXV

under the symbol “MAS” and having a head office located at 107-3239

Faithfull Av., Saskatoon, Saskatchewan, S7K 8H4, Canada, Eros

advises as follows:

On January 24, 2025, Eros, of 420-789 West

Pender Street, Vancouver, British Columbia V6H 1H2, Canada,

acquired: (i) 125,006,617 Rockridge Shares in connection with the

implementation of a plan of arrangement of Rockridge under the

Business Corporations Act (British Columbia), in consideration of

the issuance of: (i) an aggregate of 46,877,482 Eros Shares (having

a market value of $2,343,874.10 based on the closing price of the

Eros Shares on the TSXV of $0.05 on January 23, 2025), being 0.375

Eros Shares for each Rockridge Share so acquired; and (ii)

349,677,036 MAS Gold Shares in connection with the implementation

of a plan of arrangement of MAS Gold under the Business

Corporations Act (British Columbia), in consideration of the

issuance of: (i) an aggregate of 87,419,206 Eros Shares (having a

market value of $4,370,960.30 based on the closing price of the

Eros Shares on the TSXV of $0.05 on January 23, 2025), being 0.25

Eros Shares for each MAS Gold Share so acquired.

Immediately prior to the Transaction, Eros held,

directly or indirectly, or exercised control or direction over, nil

Rockridge Shares and 39,228,572 MAS Gold Shares, representing

approximately 10.21% of the outstanding MAS Gold Shares on a

non-diluted basis. After giving effect to the Transaction, Eros

acquired control and ownership over an aggregate of 125,006,617

Rockridge Shares, representing 100% of Rockridge’s issued and

outstanding common shares and 349,677,036 MAS Gold Shares not

already owned by Eros, representing 100% of MAS Gold’s issued and

outstanding common shares.

Copies of the Early Warning Reports disclosing

the Transaction in respect of Rockridge and MAS Gold will be filed

in accordance with applicable Canadian securities laws and will be

available under Rockridge’s and MAS Gold’s, as applicable, SEDAR+

profiles at www.sedarplus.ca and can be obtained from Eros at

420-789 West Pender Street, Vancouver, British Columbia V6H

1H2.

Shares for Debt Settlement

In connection with the Transaction and pursuant

to a debt conversion agreement dated September 30, 2024 entered

into between Eros and Ronald Netolitzky, a former director of Eros

and former Interim Chief Executive Officer of MAS Gold, Eros has

issued an aggregate of 2,352,000 preferred shares (“Debt

Shares”) at a deemed price of $1.00 per share to Mr.

Netolitzky as settlement for an aggregate of $2,352,000 owing to

Mr. Netolitzky pursuant to a promissory note issued by Eros.

Additional Information

Full details of the Transaction, the

Arrangements and certain other matters are set out in the joint

management information circular of Eros, Rockridge and MAS Gold

dated November 26, 2024 and can be found under each of the

companies’ respective profiles on SEDAR+ at www.sedarplus.ca.

About Eros Resources Corp.

Eros Resources Corp. is a Canadian public

mineral exploration company listed on the TSXV focused on the

acquisition, exploration and development of mineral resources

properties in Canada and advancing its copper and gold exploration

projects in Saskatchewan, including four properties in the

prospective La Ronge Gold Belt totaling 35,175.6 hectares (86,920.8

acres), as well as the 100% owned Knife Lake Project and Raney Gold

Project, which is a high-grade gold exploration project located in

the same greenstone belt that hosts the world class Timmins and

Kirkland Lake lode gold mining camps.

Additional information about Rockridge Resources

and its project portfolio can be found on the Company’s website at

www.rockridgeresourcesltd.com.

Rockridge Resources Ltd.

“Jonathan

Wiesblatt” Jonathan

WiesblattCEO

For further information contact myself or:

Jonathan Wiesblatt, Chief Executive Officer

Rockridge Resources Ltd.Telephone: 647-203-9190Email:

Jwiesblatt@rockridgeresourcesltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

None of the securities to be issued pursuant to

the Transaction have been, nor will be, registered under the United

States Securities Act of 1933, as amended (the “U.S. Securities

Act”) or any U.S. state securities laws, and may not be offered or

sold in the United States or to, or for the account or benefit of,

United States persons absent registration or an applicable

exemption from the registration requirements of the U.S. Securities

Act and applicable U.S. state securities laws. This press release

does not constitute an offer to sell or the solicitation of an

offer to buy securities in the United States, nor in any other

jurisdiction.

Forward-Looking Information and

Statements

Certain of the information or statements

contained in this news release constitute “forward-looking

statements” and “forward-looking information” within the meaning of

applicable securities laws, which are collectively referred to as

“forward-looking statements”. When used in this news release, words

such as “will”, “expect” and similar expressions are intended to

identify these forward-looking statements as well as phrases or

statements that certain actions, events or results “may”, “could”,

“would” or “should” occur or be achieved or the negative

connotation of such terms. Such forward-looking statements,

including but not limited to statements relating to: the

Transaction; the ability of the parties to satisfy the conditions

to closing of the Transaction; and the anticipated timing of the

completion of the Transaction, which involve numerous risks,

uncertainties and other factors which may cause the actual results

to be materially different from those expressed or implied by such

forward-looking statements, including the risk factors identified

in the Joint Management Information Circular respecting the

Transaction and the documents incorporated by reference therein,

which is available on the companies’ profiles on SEDAR+ at

www.sedarplus.ca. Such factors include, among others, obtaining

required regulatory approvals, exercise of any termination rights

under the Business Combination Agreement, meeting other conditions

in the Business Combination Agreement, material adverse effects on

the business, properties and assets of the companies, and whether

any superior proposal will be made. Although the companies have

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The companies

undertake no obligation to update any forward-looking statements,

except in accordance with applicable securities laws. All

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

The forward-looking statements in this news

release involve known and unknown risks, uncertainties and other

factors that may cause the companies’ actual results, performance

and achievements to be materially different from the results,

performance or achievements expressed or implied therein.

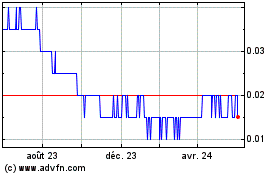

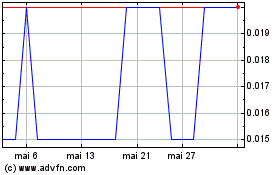

Eros Resources (TSXV:ROCK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Eros Resources (TSXV:ROCK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025