Westhaven Gold Corp. (TSX-V:WHN) (“Westhaven” or

the

“Company”) is pleased to announce that the

Company has entered into an agreement with Red Cloud Securities

Inc. (the “

Agent”) to act as sole agent and

bookrunner in connection with a best efforts, private placement

(the "

Marketed Offering")

for aggregate gross proceeds of up to C$5,000,000 from the sale of

the following:

-

10,000,000 units of the Company (each, a

“Unit”) at a price of C$0.15 per Unit for gross

proceeds of up to C$1,500,000 from the sale of Units; and

- gross proceeds of

up to C$3,500,000 from the sale of any combination of (i) common

shares of the Company that will quality as “flow-through shares”

within the meaning of subsection 66(15) of the Income Tax Act

(Canada) (each, a “Traditional FT Share”) at a

price of C$0.175 per Traditional FT Share and (ii) flow-through

units of the Company to be sold to charitable purchasers (each, a

“Charity FT Unit”, and collectively with the Units

and Traditional FT Shares, the “Offered

Securities”) at a price of C$0.22 per Charity FT

Unit.

Each Unit will consist of one common share of

the Company (each, a “Unit Share”) and one half of

one common share purchase warrant (each whole warrant, a

“Warrant”). Each Charity FT Unit will consist of

one Traditional FT Share and one half of one Warrant. Each Warrant

shall entitle the holder to purchase one common share of the

Company (each, a “Warrant Share”) at a price of

C$0.22 at any time on or before that date which is 24 months after

the closing date of the Offering (as defined below).

The Agent will have an option, exercisable in

full or in part, up to 48 hours prior to the closing of the

Offering, to sell up to an additional C$1,000,000 in any

combination of Units, Traditional FT Shares and Charity FT Units at

their respective offering prices (the “Agents’

Option” and together with the Marketed Offering, the

“Offering”).

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 –

Prospectus Exemptions (“NI 45-106”), those Units,

Traditional FT Shares and Charity FT Units representing gross

proceeds of up to C$5,000,000 (the “LIFE

Securities”) will be offered for sale to purchasers in the

provinces of Alberta, British Columbia, Manitoba, Ontario and

Saskatchewan (the “Canadian Selling

Jurisdictions”) pursuant to the listed issuer financing

exemption under Part 5A of NI 45-106 (the “Listed Issuer

Financing Exemption”). The Unit Shares, Traditional FT

Shares, Warrants and Warrant Shares issuable pursuant to the sale

of the LIFE Securities are expected to be immediately freely

tradeable under applicable Canadian securities legislation if sold

to purchasers resident in Canada. The Units may also be sold in

offshore jurisdictions and in the United States on a private

placement basis pursuant to one or more exemptions from the

registration requirements of the United States Securities Act of

1933 (the "U.S. Securities Act"), as amended.

Any Units and Charity FT Units sold in excess of

gross proceeds of C$5,000,000 as well as the Traditional FT Shares

(collectively, the “Non-LIFE Securities”) will be

offered by way of the “accredited investor” and “minimum amount

investment” exemptions under NI 45-106 in the Canadian Selling

Jurisdictions, or in the case of the Units, also in offshore

jurisdictions and the United States on a private placement basis

pursuant to one or more exemptions from the registration

requirements of the U.S. Securities Act. The Unit Shares,

Traditional FT Shares, Warrants and Warrant Shares issuable from

the sale of Non-LIFE Securities will be subject to a hold period

ending on the date that is four months plus one day following the

closing date of the Offering under applicable Canadian securities

laws.

The Company intends to use the net proceeds from

the sale of Units for working capital and general corporate

purposes. The gross proceeds from the issuance of the Traditional

FT Shares and the Charity FT Units will be used for Canadian

exploration expenses on the Company’s mineral projects in British

Columbia and will qualify as “flow-through mining expenditures”, as

defined in subsection 127(9) of the Income Tax Act (Canada) (the

“Qualifying Expenditures”), which will be incurred

on or before December 31, 2025 and renounced to the subscribers

with an effective date no later than December 31, 2024 in an

aggregate amount not less than the gross proceeds raised from the

issue of the Traditional FT Shares and Charity FT Units.

The Offering is scheduled to close on or around

October 15, 2024, or such other date as the Company and the Agent

may agree, and is subject to certain conditions including, but not

limited to, receipt of all necessary approvals including the

approval of the TSX Venture Exchange.

The Company will pay to the Agent a cash

commission of 6% of the gross proceeds raised in respect of the

Offering (the “Agents’ Commission”). In addition,

the Company will issue to the Agent warrants of the Company (each

warrant, a “Broker Warrant”), exercisable for a

period of 24 months following the Closing Date, to acquire in

aggregate that number of common shares of the Company which is

equal to 6% of the number of Offered Securities sold under the

Offering at an exercise price equal to C$0.15 per Common Share.

There is an offering document related to the

Offering that can be accessed under the Company’s profile at

www.sedarplus.ca and on the Company’s website at

www.westhavengold.com. Prospective investors should read this

offering document before making an investment decision.

To the extent that any directors and/or officers

the Company participate in the Offering, such participation will

constitute a "related party transaction" within the meaning of

Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions ("MI

61-101"). The Company expects any participation by

directors and officers in the Offering will be exempt from the

formal valuation and minority shareholder approval requirements of

MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101

based on the fact that neither the fair market value of the Units,

Traditional FT Shares or Charity FT Units subscribed for by

directors and officers, nor the consideration for such securities

to be paid by them, will exceed 25% of the Company's market

capitalization.

The securities offered have not been, nor will

they be, registered under the U.S. Securities Act, as amended, or

any state securities law, and may not be offered, sold or

delivered, directly or indirectly, within the United States, or to

or for the account or benefit of U.S. persons, absent registration

or an exemption from such registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of securities in any

state in the United States in which such offer, solicitation or

sale would be unlawful.

On behalf of the Board of

Directors

WESTHAVEN GOLD CORP.

“Gareth Thomas”

Gareth Thomas, President, CEO & Director

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

About Westhaven Gold Corp.

Westhaven is a gold-focused exploration company

advancing the high-grade discovery on the Shovelnose project in

Canada’s newest gold district, the Spences Bridge Gold Belt.

Westhaven controls 60,950 hectares (609.5 square kilometres) with

four gold properties spread along this underexplored belt. The

Shovelnose property is situated off a major highway, near power,

rail, large producing mines, and within commuting distance from the

city of Merritt, which translates into low-cost exploration.

Westhaven trades on the TSX Venture Exchange under the ticker

symbol WHN. For further information, please call 604-681-5558 or

visit Westhaven’s website at www.westhavengold.com

Forward Looking Statements:

This press release contains "forward-looking

information" within the meaning of applicable Canadian and United

States securities laws, which is based upon the Company's current

internal expectations, estimates, projections, assumptions and

beliefs. The forward-looking information included in this press

release are made only as of the date of this press release. Such

forward-looking statements and forward-looking information include,

but are not limited to, statements concerning the Company's

expectations with respect to the Offering; the use of proceeds of

the Offering; completion of the Offering and the date of such

completion. Forward-looking statements or forward-looking

information relate to future events and future performance and

include statements regarding the expectations and beliefs of

management based on information currently available to the Company.

Such forward-looking statements and forward-looking information

often, but not always, can be identified by the use of words such

as "plans", "expects", "potential", "is expected", "anticipated",

"is targeted", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or the negatives thereof or

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved.

Forward-looking information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance, or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such risks and other factors include, among others, and

without limitation: that the Offering may not close within the

timeframe anticipated or at all or may not close on the terms and

conditions currently anticipated by the Company for a number of

reasons including, without limitation, as a result of the

occurrence of a material adverse change, disaster, change of law or

other failure to satisfy the conditions to closing of the Offering;

the Company will not be able to raise sufficient funds to complete

its planned exploration program; that the Company will not derive

the expected benefits from its current program; the Company may not

use the proceeds of the Offering as currently contemplated; the

Company may fail to find a commercially viable deposit at any of

its mineral properties; the Company’s plans may be adversely

affected by the Company’s reliance on historical data compiled by

previous parties involved with its mineral properties; mineral

exploration and development are inherently risky industries; the

mineral exploration industry is intensely competitive; additional

financing may not be available to the Company when required or, if

available, the terms of such financing may not be favourable to the

Company; fluctuations in the demand for gold or gold prices

generally; the Company may not be able to identify, negotiate or

finance any future acquisitions successfully, or to integrate such

acquisitions with its current business; the Company’s exploration

activities are dependent upon the grant of appropriate licenses,

concessions, leases, permits and regulatory consents, which may be

withdrawn or not granted; the Company’s operations could be

adversely affected by possible future government legislation,

policies and controls or by changes in applicable laws and

regulations; there is no guarantee that title to the properties in

which the Company has a material interest will not be challenged or

impugned; the Company faces various risks associated with mining

exploration that are not insurable or may be the subject of

insurance which is not commercially feasible for the Company; the

volatility of global capital markets over the past several years

has generally made the raising of capital more difficult;

inflationary cost pressures may escalate the Company’s operating

costs; compliance with environmental regulations can be costly;

social and environmental activism can negatively impact

exploration, development and mining activities; the success of the

Company is largely dependent on the performance of its directors

and officers; the Company’s operations may be adversely affected by

First Nations land claims; the Company and/or its directors and

officers may be subject to a variety of legal proceedings, the

results of which may have a material adverse effect on the

Company’s business; the Company may be adversely affected if

potential conflicts of interests involving its directors and

officers are not resolved in favour of the Company; the Company’s

future profitability may depend upon the world market prices of

gold; dilution from future equity financing could negatively impact

holders of the Company’s securities; failure to adequately meet

infrastructure requirements could have a material adverse effect on

the Company’s business; the Company’s projects now or in the future

may be adversely affected by risks outside the control of the

Company; the Company is subject to various risks associated with

climate change, the Company is subject to general global risks

arising from epidemic diseases, the ongoing conflicts in Ukraine

and the Middle East, rising inflation and interest rates and the

impact they will have on the Company’s operations, supply chains,

ability to access mining projects or procure equipment, supplies,

contractors and other personnel on a timely basis or at all is

uncertain; as well as other risk factors in the Company’s other

public filings available at www.sedarplus.ca. Readers are cautioned

that this list of risk factors should not be construed as

exhaustive. Although the Company believes that the expectations

reflected in the forward-looking information are reasonable, there

can be no assurance that such expectations will prove to be

correct. The Company cannot guarantee future results, performance,

or achievements. Consequently, there is no representation that the

actual results achieved will be the same, in whole or in part, as

those set out in the forward-looking information. The Company

undertakes no duty to update any of the forward-looking information

to conform such information to actual results or to changes in the

Company’s expectations, except as otherwise required by applicable

securities legislation. Readers are cautioned not to place undue

reliance on forward-looking information. The forward-looking

information contained in this offering document is expressly

qualified by this cautionary statement.

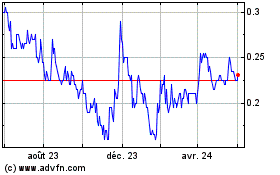

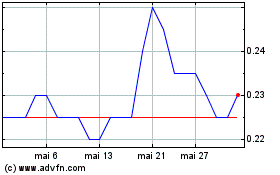

Westhaven Gold (TSXV:WHN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Westhaven Gold (TSXV:WHN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024