2018 Results

| 2018

results |

March 14, 2019 |

The Board of Directors of Blue Solutions, which

met on March 14, 2019, approved the 2018 financial statements.

Revenue totaled €38 million, down 53% at

constant scope and exchange rates (and on a reported basis)

compared with 2017 due to developments in its technology.

Blue Solutions is one of the very few global

companies producing solid-state batteries, considered by many to be

the future technology for energy storage.

The first production version of this battery

enabled the powering of vehicles for numerous car-sharing

operations around the world: Paris, Lyon, Bordeaux, Turin,

Indianapolis, London, Los Angeles, and more recently Singapore. Its

technology has proven to be robust and efficient. It was the

same for the buses. During the 2018 fiscal year, Bluebus sold 18

buses in the 6-meter class and 23 in the 12-meter class (versus 23

and 22 respectively in 2017). Bluebus received an order from the

RATP for 41 buses in the 12-meter class, which are scheduled for

delivery in 2019.

Blue Solutions has designed a vastly improved

version of its dry battery both in terms of power and density. To

this end, its plants in Canada and Brittany are both in the process

of being transformed accordingly, with production of the new

batteries set to start in the fall of 2019. Besides continuing to

supply more efficient batteries for the bus industry, Blue

Solutions is currently participating in calls for tenders for

stationary energy storage systems.

Blue Solutions also invests in research and

development for solid-state batteries operating at ambient

temperature.

EBITDA1 was a

negative €14 million (vs. a negative €4 million in 2017), and

operating income was a negative €30 million (vs. a

negative €19 million in 2017). The deterioration is mainly

attributable to the decline in revenue following the release of the

improved version of the solid-state battery, the necessary

adjustments to production capacity in Canada in the second half of

2018 and the continuation of research and development efforts.

Consolidated net income was a

loss of €33 million (vs. a loss of €19 million in 2017).

Net debt amounted to €46

million, including a €33 million return to better fortune clause in

favor of Bolloré.

Additional information

In July 2018, Bolloré Group announced an

agreement with Daimler, which may lead to the equipping of eCitaro

buses manufactured by Daimler with Lithium Metal Polymer (LMP®)

batteries from Blue Solutions.

Following the simplified public tender offer for

Blue Solutions shares carried out in July 2017, the Bolloré Group

reiterates its commitment to submitting a tender offer at 17 euros

per Blue Solutions share during the first half of 2020. The terms

of this commitment can be found in Section 1.3.1 of the Bolloré SA

Securities Note approved by the AMF on July 4, 2017 (approval

no.17-326).

|

Blue Solutions consolidated results |

|

(in millions of euros) |

2018 |

|

2017 |

|

Change |

|

Revenue |

38 |

|

81 |

|

- 53 |

% |

|

EBITDA |

(14 |

) |

(4 |

) |

na |

|

Operating income |

(30 |

) |

(19 |

) |

na |

|

Financial income |

(2 |

) |

(2 |

) |

na |

|

Net income |

(33 |

) |

(19 |

) |

na |

|

Net income Group share |

(33 |

) |

(19 |

) |

na |

|

|

|

|

|

|

Shareholders' equity group

share |

88 |

|

118 |

|

(30 |

) |

| Net

debt |

46 |

|

31 |

|

15 |

|

|

Gearing (%) (1) |

53 |

% |

26 |

% |

- |

|

(1) Gearing = Net debt / Equity

ratio

The audit of the 2018 consolidated financial

statements has been completed, and the certification report will be

issued after review of the management report.

1 EBITDA: operating income less depreciation, amortization and

operating provisions (including the share of net income of

companies accounted for under the equity method).

- 2019 03 14_CP BS resultats_EN

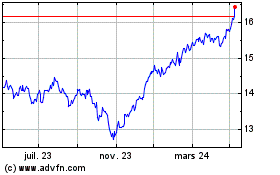

BNP PARIBAS EASY ECPI GL... (EU:BLUE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

BNP PARIBAS EASY ECPI GL... (EU:BLUE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024