Credit Agricole Shares Fall After 4Q Results Miss Expectations -- Update

14 Février 2018 - 11:57AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA (ACA.FR) shares trade lower after the

lender's fourth-quarter net profit missed expectations despite

double-digit growth.

France's second-largest listed bank by assets said on Wednesday

fourth-quarter net profit rose 33% to 387 million euros ($477.2

million) from a year earlier, when a write-down on its domestic

retail arm hit the bottom line. Revenue rose 1.6% to EUR4.65

billion.

Analysts had expected the Paris-based lender to post a net

profit of about EUR600 million, according to FactSet.

Shares in Credit Agricole were down 2.6% at 1010 GMT.

"The results for the fourth quarter of 2017 were penalized by a

high tax burden in connection to changes in tax rules in France

and, to a lesser extent, the U.S.," the bank said. The tax

adjustments had a negative impact of EUR384 million on the

quarterly profit, it said.

Underlying net income, which strips out one-off items, decreased

8.4% to EUR878 million.

"This decrease stemmed mainly from the return to a more normal

effective tax rate," the bank said.

On an underlying basis, revenue grew by 5.4%, supported by the

integration of Pioneer and organic growth, the lender said.

"Revenues increased, at constant scope, at twice the rate

expected by the 2020 Strategic Ambition Plan," Chief Executive

Philippe Brassac said.

Credit Agricole's core Tier 1 ratio, a key measure of capital

strength, was 11.7% in December, compared with 12% as of

September.

The lender said it would pay shareholders a dividend of EUR0.63

a share, up from EUR0.60 for 2016. However, this is below

expectations of EUR0.65, according to UBS analysts, who said

results were hurt by a number of exceptional items.

"Underlying trends aren't bad," UBS said, but noted the dividend

and lower core Tier 1 ratio missed expectations.

Credit Agricole also said it would compensate shareholders

eligible for the loyalty dividend, which is to be discontinued in

line with a European Central Bank ruling.

The bank will award eligible shareholders one new ordinary share

for 26 registered shares entitled to a loyalty dividend.

"The value of the compensation amounts to approximately 56 cents

per share," it said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 14, 2018 05:42 ET (10:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

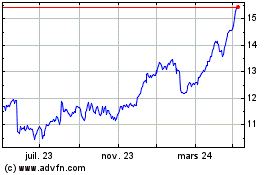

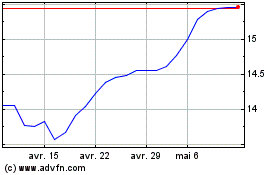

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024