Goldman Sachs to Open Up In-House Moneymaker to Outside Investors

13 Mars 2019 - 8:24AM

Dow Jones News

By WSJ City

A Goldman Sachs profit machine that has invested the bank's own

money in Asian property, African startups and troubled US

retailers, among other ventures, is opening up to outside

investors.

KEY FACTS

--- Goldman plans to raise outside money for its

special-situations group, said people familiar with the matter.

--- Also under discussion is a broader reorganisation of the

firm's various private investing activities...

--- ...into a new unit that would seek to raise new funds across

a variety of strategies, the people said.

--- The group has grown from about $20bn on the eve of the

crisis to about $30bn today, people familiar said.

--- It pioneered go-anywhere investing and remains one of the

most profitable businesses at Goldman.

--- It will likely be combined with Goldman's merchant-banking

group.

"Based on our track record, there is an opportunity to raise

additional third-party funds across equity, credit and real estate.

We have a world-class alternative investing franchise, which has

generated strong returns over three decades [and] presents us with

extraordinary opportunities to partner with clients to invest their

capital alongside our own."

Goldman Chief Executive David Solomon, speaking to analysts

earlier this year

Why This Matters

The discussions show how much has changed on Wall Street since

the financial crisis. In Goldman's last big push into private

equity, in the 2000s, it put billions of dollars of its own money

into megabuyouts. Now it seeks raise money from outside investors

like pension funds and clip steady fees for managing it.

Shareholders today value steady, low-risk businesses like money

management, setting off an asset-gathering race across Wall Street.

The reorganisation also shows Solomon busting up silos in an effort

to modernise and streamline the firm. Under a "One Goldman" banner,

he has launched a firmwide effort to better cover top clients.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

March 13, 2019 03:09 ET (07:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

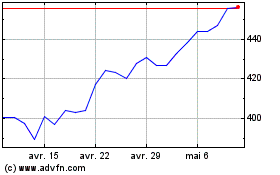

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

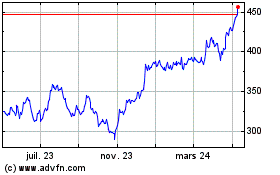

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024