LINEDATA SERVICES :2017 Revenues: €179,0 M€ (+7,3%)

07 Février 2018 - 6:25PM

2017 Revenues:

€179,0 M€ (+7,3%)

| |

1st

Half |

2nd

Half |

Year |

| 2016 |

2017 |

Change |

2016 |

2017 |

Change |

2016 |

2017 |

Change |

| ASSET MANAGEMENT |

49,1 |

61,4 |

+24,9% |

50,3 |

57,5 |

+14,4% |

99,4 |

118,8 |

+19,6% |

| (1) (2) |

|

|

|

|

|

|

|

|

|

| LENDING & LEASING |

29,9 |

26,5 |

-11,4% |

29,6 |

28,4 |

-3,9% |

59,4 |

54,9 |

-7,7% |

| OTHER ACTIVITIES |

4,1 |

2,8 |

-32,3% |

3,9 |

2,5 |

-35,3% |

8,0 |

5,3 |

-33,7% |

| TOTAL LINEDATA |

83,1 |

90,6 |

+9,0% |

83,7 |

88,4 |

+5,6% |

166,8 |

179,0 |

+7,3% |

| (1) (2) |

|

|

|

|

|

|

|

|

|

Rounded unaudited

figures

(1) Includes Derivation activity from April

2016

(2) Includes Gravitas from January 2017 and QRMO

activity from August 2017

Neuilly-sur-Seine, 7 February, 2018 - Linedata (LIN:FP), the global solutions and

outsourcing services provider to the investment management and

credit finance industries, generated revenues of €179.0 million in

2017, up of 7.3% compared to 2016.

After adjustments for a negative

exchange rate impact of -€3.2M and a positive contribution made by

the latest acquisitions (Derivation in April 2016, Gravitas in

January 2017 and QRMO in August 2017) of €24.0M, Linedata is

reporting negative organic growth of 5.2% compared to 2016.

Recurring revenues for 2017 were

€127.3M, compared with €121.2M in 2016, a €6.1M increase. It

accounts for 71% of revenues.

In 2017, booking grew of 8.6% to

€56.0M, against €51.5M in 2016. In the last quarter of 2017,

bookings realized a high performance at €21.9M (up 25.5% compared

to the same period of 2016).

Performance

analysis by segment:

Asset Management

(Q1: €31.3M, +26.5%; Q2: €30.0M, +23.2%; Q3: €27.5M, +12.6%; Q4:

€29.9M, +16%)

In 2017, Asset Management has

confirmed a growth dynamic of 19.6% driven by the contributions of

Gravitas and QRMO acquired during the year. These acquisitions

bring a new dynamic to Linedata's software offering by adding a

Services and Outsourcing component that is particularly sought

after on the market.

In Europe, the asset management

industry is investing significantly in regulatory reforms such as

MiFID II, but is suffering from "wait-and-see" attitudes

post-Brexit. More globally, asset management companies are

gradually launching their digital revolution based on three major

themes: big data, artificial intelligence and blockchain. Linedata

continues to provide its customers with its expertise on these

subjects.

Lending &

Leasing (Q1: €13.0M, -5.8%; Q2: €13.5M, -16.2%; Q3: €12.7M, -8.3%;

Q4: €15.7M, -0.1%)

The recovery in business activity

in the last quarter (bookings up 22.4%) enabled Linedata to reverse

the downturn in revenues seen in the segment since the start of the

financial year, despite unfavorable base effects in Europe, due to

a high level of perpetual licenses revenues recognized in 2016 on

migrations to the new version of Linedata Ekip360. In

North America, the Company finalized the new version V11.0 of its

Linedata Capitalstream product, which allowed it to sign new

contracts.

As the end of 2017, Linedata

offers two fully modular global solutions that allow it to provide

broad functional coverage in the areas of credit origination,

administrative management of accounts receivable and fleet

management.

Outlook

In 2018, Linedata will finalize

the integrations of Gravitas and QRMO, and accelerate the ramp-up

of the major AMP (Asset Management Platform) project, aiming to

bring to market a new modernized platform that is fully focused on

the user experience and digital transformation. A first version

should be marketed by the end of the year.

In the Lending & Leasing

segment, Linedata will benefit from the positive spin-offs of its

new version of Linedata Capitalstream and the migrations of

customers to Linedata Ekip360.

Building on these developments and

the uptick in business in the last quarter of 2017, Linedata is

confident that it will be able to maintain its level of growth in

2018.

Next

communication: Publication of 2017 annual results on

13th February,

2018, after close of trading.

ABOUT LINEDATA

With 20 years' experience and 700+

clients in 50 countries, Linedata's 1300 employees in 20 offices

provide global humanized technology solutions and services for the

asset management and credit industries that help its clients to

evolve and to operate at the highest levels.

Headquartered in France, Linedata achieved revenues of EUR 179.0

million in 2017 and is listed on Euronext Paris compartment B

FR0004156297-LIN - Reuters LDSV.PA - Bloomberg LIN:FP.

linedata.com

Linedata

Finance Department

+33 (0)1 47 77 68 39

infofinances@linedata.com

|

Cap Value

Financial communication

Gilles Broquelet

+33 (0)1 80 81 50 00

info@capvalue.fr

www.capvalue.fr |

LINEDATA SERVICES:2017 Revenues:

€179,0 M€ (+7,3%)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: LINEDATA SERVICES via Globenewswire

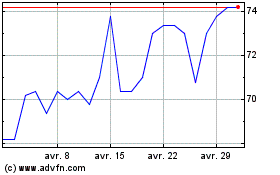

Linedata Services (EU:LIN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Linedata Services (EU:LIN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024