Orange Press Release : Third Quarter 2021 Results

Press releaseParis, 26 October

2021

Third quarter 2021 financial information at 30

September 2021

Orange delivers a

sustained commercial

performance and

confirms all of its 2021

objectives

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

10,508 |

(0.4)% |

(0.7)% |

|

31,374 |

0.9 % |

0.1 % |

|

EBITDAaL |

|

3,550 |

(0.7)% |

(1.0)% |

|

9,387 |

(0.5)% |

(1.2)% |

|

eCAPEX (excluding licenses) |

|

1,709 |

(1.0)% |

(1.2)% |

|

5,554 |

14.3 % |

13.7 % |

|

EBITDAaL - eCAPEX |

|

1,841 |

(0.4)% |

(0.7)% |

|

3,833 |

(16.2)% |

(16.9)% |

- Continued good

commercial performances:

-

11.3 million convergent customers

-

10.8 million Fiber (FTTH) customers out of 53.8 million

connectable households. The FTTH client base rose 25.5% year on

year, driven in particular by France and Poland

- Revenues down

slightly (-0.4%)1 in Q3 2021.

- They rose 1.3%

excluding co-financing:

- strong

performance in retail services2 with an acceleration in revenue

growth from convergence (+2.9%), mobile (+5.6%) and fixed broadband

(+5.2%)

- France recorded

a 4.1% decline, but was virtually stable excluding co-financing

thanks to retail services where growth accelerated (+3.7% excluding

PSTN)

- Europe excluding

Spain rose 2.0% with retail services growth accelerating (+5.7%).

Spain was down 4.4% despite a slight pick-up in retail

services

- Africa &

Middle East: another very strong performance at +12.0%

- Enterprise

declined (-1.4%) due to a decrease in fixed services (-5.2%) which

was not offset by the growth in IT & Integration services

(+2.1%) and mobile services (+3.5%)

- International

Carriers & Shared Services grew 10.8%

- EBITDAaL decline

was limited to 0.7%, impacted by the lower level of co-financing

received in France. EBITDAaL grew 4.5% excluding co-financing.

- eCAPEX was down

slightly: -1.0% in Q3 2021 after a strong increase in the first

half due to investments in Fiber and in Africa & Middle East,

in line with the objectives for 2021.

The Group is maintaining its financial

objectives for 2021after allocation of the tax refund3:

- stable but

negative EBITDAaL,

- eCAPEX of 7.6 to

7.7 billion euros,

- organic cash

flow from telecoms activities of over 2.2 billion euros

- net

debt/EBITDAaL ratio for telecom activities remaining at around 2x

in the medium term.

Dividend

Orange will make an interim dividend payment for

2021 of 0.30 euros in cash on December 15, 20214. In respect of the

2021 financial year, a dividend of 0.70 euros per share will be

proposed to the 2022 Shareholders’ Meeting.

Commenting on the publication of these results,

Stéphane Richard, Chairman and Chief Executive Officer of the

Orange group, said:

"Orange’s sustained commercial performance in

the third quarter, marked by solid momentum in retail services

across all the countries where we are present, allows us to confirm

all of our financial commitments. In an economy still showing the

effects of the health crisis, including the acceleration of the

digital transformation, our customers' appetite for very high-speed

access is evidenced in their take up of fiber and 5G, and of our

convergent offers.

In France, the good momentum continued with

growth of 1.2 points in retail services. Orange fiber now has 5.6

million customers in France, an increase of 36% year on year.

However, as yet our accounts reflect little of this promising trend

owing to the decline in co-financing received from other operators

on our fiber network in 2021 compared to 2020.

In Spain, while the market remains very

fragmented and impacted by the health crisis, the revenue trend in

retail services is improving quarter by quarter, further supported

by positive commercial results, with customer gains across all

segments. The results are therefore encouraging and while much

remains to be done, we are fully engaged in the execution of our

turnaround strategy.

The other European countries continue to make a

positive contribution to the Group’s results, with a 5.7% growth in

retail services, due both to our convergence strategy and the

enthusiasm seen for fiber, where Orange is the stand-out European

leader. The acquisition of TKR in Romania will also strengthen our

leadership position in convergence, providing us with a quality

fixed network with which to pursue our strategy.

In Africa, the Group's main growth engine, our

revenues rose strongly, up 12%, with all countries contributing,

driven in particular by mobile data, which is expanding fast.

Orange now has more than 40 million 4G customers, a 33.6% increase

compared to last year."

Comments on Group key

figures

Revenues

Orange group

revenues were 10.5 billion euros in the third quarter

of 2021, down 0.4% year on year on a comparable basis. This slight

decline was mainly due to the lower level of co-financing of the

Fiber network received in France.

Excluding co-financing, revenues would have

risen by 1.3%, driven by retail services5, while the growth in

equipment sales slowed sharply (+2.1% after +27.5% increase in the

second quarter) due to the catch-up effect of the previous

quarter.

Customer base growth

There were 11.3 million convergent

customers Group-wide at September 30, 2021, up 3.1% year

on year.

Mobile

services had 221.8 million lines at September

30, 2021, up 4.7% year on year, including 80.1 million

contracts, an increase of 5.1% compared to a year ago.

Fixed services had

44.7 million access lines at September 30, 2021 (down 1.0%

year on year), of which 11.3 million were very high-speed

broadband, which continues to grow strongly (+25.3% year on year

with nearly 528,000 net additions during the quarter). Fixed

narrowband access lines were down 13.4% year on year.

Mobile financial services had

nearly 1.6 million customers in Europe and 0.6 million

customers in Africa.

EBITDAaL

Group EBITDAaL

was 3.55 billion euros in the third quarter of 2021, down

0.7%. Excluding co-financing, this would have increased by 4.5%,

driven by the good commercial performance and decreased costs.

Over the first nine months of the year, the

decline in EBITDAaL was limited to -0.5%.

EBITDAaL from telecom

activities was 3.58 billion euros in the third

quarter, down 0.8%.

eCAPEX

Group eCAPEX was

1.7 billion euros in the third quarter, a slight 1.0% decline

compared to the third quarter of 2020. It was nevertheless up by

14.3% over the first nine months of the year, due to the

acceleration of investment in the networks, in particular in Fiber

in France and in Africa. This remains in line with the Group’s

objectives for the full-year 2021.

At September 30, 2021, Orange had

53.8 million households with FTTH connectivity worldwide (up

20.8% year on year). The number of connectable households in France

rose 31.4% at 27.4 million.

Changes in asset portfolio

On September 30, 2021, Orange Romania announced

that it had completed its acquisition of a 54% controlling stake in

the operator Telekom Romania Communications (TKR) for an enterprise

value of 497 million euros. TKR, Romania’s second largest

fixed telecoms operator, had revenues of 633 million euros in

2020.

On August 31, 2021, Orange Polska and APG Asset

Management (APG) completed the creation of their 50-50 joint

venture FiberCo in Poland, which represents 2.4 million lines

including an additional 1.7 million FTTH lines to be deployed

over the next five years.

__________________________________________________________________________________

The Board of Directors of Orange SA met on

October 25, 2021 to review the consolidated financial results for

the period ended September 30, 2021.

More detailed information on the Group’s

financial results and performance indicators is available on the

Orange website www.orange.com/en/consolidated-results.

Review by operating segment

France

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

4,483 |

(4.1)% |

(4.5)% |

|

13,433 |

(1.7)% |

(2.1)% |

|

Retail services |

|

2,723 |

1.2 % |

1.2 % |

|

8,106 |

0.5 % |

0.5 % |

|

Convergence |

|

1,180 |

3.8 % |

3.8 % |

|

3,497 |

2.7 % |

2.7 % |

|

Mobile Only |

|

577 |

2.8 % |

2.3 % |

|

1,699 |

1.1 % |

0.7 % |

|

Fixed Only |

|

966 |

(2.7)% |

(2.4)% |

|

2,910 |

(2.4)% |

(2.2)% |

|

Wholesale |

|

1,291 |

(15.4)% |

(16.3)% |

|

4,011 |

(8.1)% |

(9.1)% |

|

Equipment sales |

|

300 |

(0.4)% |

(0.4)% |

|

823 |

8.4 % |

8.4 % |

|

Other revenues |

|

169 |

7.3 % |

7.6 % |

|

494 |

3.6 % |

3.9 % |

Continuing solid commercial

performances

Orange France’s revenues were impacted by the

lower level of co-financing received compared to the third quarter

of 2020. Excluding co-financing, revenues would be virtually stable

(-0.4%).

Retail

services showed a continued acceleration in growth (+1.2%

vs. +0.4% in the second quarter and -0.2% in the first quarter).

Excluding PSTN, growth would be 3.7%, offsetting the effect of the

structural decline of copper.

Equipment sales recorded a

slight decline after the very strong growth in the second quarter

(+23.4%) which had benefited from the reopening of stores compared

to 2020.

Revenues from wholesale

services were down sharply due to the major co-financing

of the Fiber network received in the third quarter of 2020.

Orange France maintained its strong

sales momentum despite continued intense

competition. Mobile contracts (excluding M2M) continued their

excellent performance with +121,000 net sales over the quarter

driven by the Orange-branded convergent offers. Mobile ARPO

continued to improve (+0.3 euros year on year) notably due to the

effect of the gradual return of roaming. The mobile churn rate of

11.0% is at a particularly low level.

The solid sales trend was also confirmed in

fixed broadband with +80,000 net sales in the third quarter, thanks

to the continued excellent results in Fiber (+343,000 net sales)

reinforcing our leadership position. Still more than half of the

new Fiber customers are new customers for the Group.

Convergent ARPO increased by 1.1 euros year on

year, an acceleration compared to the second quarter, thanks in

particular to our "more for more" actions.

Europe

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

2,583 |

(1.1)% |

(2.0)% |

|

7,747 |

(0.6)% |

(1.5)% |

|

Retail services |

|

1,741 |

(1.0)% |

(1.7)% |

|

5,192 |

(2.5)% |

(3.3)% |

|

Convergence |

|

679 |

1.2 % |

0.8 % |

|

2,016 |

(1.3)% |

(1.7)% |

|

Mobile Only |

|

732 |

(3.8)% |

(4.5)% |

|

2,166 |

(4.8)% |

(5.5)% |

|

Fixed Only |

|

251 |

(5.7)% |

(6.9)% |

|

773 |

(4.1)% |

(5.3)% |

|

IT & Integration services |

|

79 |

31.5 % |

29.0 % |

|

237 |

15.9 % |

13.6 % |

|

Wholesale |

|

452 |

(5.0)% |

(5.7)% |

|

1,378 |

(3.0)% |

(3.8)% |

|

Equipment sales |

|

347 |

0.2 % |

(2.3)% |

|

1,065 |

12.7 % |

10.2 % |

|

Other revenues |

|

42 |

42.3 % |

39.6 % |

|

112 |

13.3 % |

11.5 % |

Strong growth in retail

services6, excluding Spain which

recorded a good commercial performance while continuing its

transformation

Revenues from Europe (that groups Spain, Poland,

Belgium and Luxembourg, Romania, Slovakia and Moldova) were down

1.1% in the third quarter compared to 2020. These were

principally impacted by the year-on-year decline in lower-margin

activities, in particular fixed interconnection traffic in Spain

and Poland, and the slowdown in equipment sales compared with the

second quarter, which had benefited from a catch-up effect

following the end of the lockdown.

The trend in retail services is

improving, despite recording a slight decline (-1.0%) due to Spain,

thanks to the accelerated growth in Other European countries

(+5.7%).

Europe recorded a solid commercial performance

in the third quarter with +188,000 net mobile contract sales

excluding M2M and +66,000 net fixed broadband sales, of which

+122,000 were net Fiber sales.

The performance of fixed broadband was driven by

all countries, which all posted positive net sales, with Spain

buoyed by a rebound in Fiber and a lower rate of churn year on

year.

In Spain, revenues declined

4.4% due to a decrease in fixed interconnection traffic and a

slowdown of equipment sales compared to the second quarter,

although the trend in retail services shows a slight improvement

(-7.9% vs. -8.3% in the second quarter and -10.2% in the first

quarter).

Spain experienced strong sales momentum in the

third quarter, despite the back-to-school promotional period, with

+8,000 net sales of convergent offers, +76,000 net sales of mobile

contracts excluding M2M and +10,000 net sales of fixed broadband

offers (including +43,000 net FTTH sales) while reducing the churn

rate in all these segments.

Following the successful migration of the

Republica Movil customers to Simyo, Orange Spain continued its

operational transformation by starting the migration of Amena’s

customers to the Orange brand, which will enable it to reduce its

portfolio from five to three brands.

Africa & Middle East

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

1,652 |

12.0 % |

12.0 % |

|

4,694 |

11.2 % |

8.7 % |

|

Retail services |

|

1,450 |

15.0 % |

14.9 % |

|

4,110 |

13.6 % |

10.9 % |

|

Mobile Only |

|

1,271 |

14.5 % |

13.9 % |

|

3,600 |

12.8 % |

9.8 % |

|

Fixed Only |

|

168 |

16.1 % |

19.7 % |

|

486 |

18.5 % |

18.5 % |

|

IT & Integration services |

|

11 |

82.2 % |

86.9 % |

|

24 |

26.7 % |

46.5 % |

|

Wholesale |

|

166 |

(6.3)% |

(6.0)% |

|

476 |

(5.9)% |

(8.2)% |

|

Equipment sales |

|

26 |

13.2 % |

22.0 % |

|

81 |

23.2 % |

30.0 % |

|

Other revenues |

|

9 |

(32.5)% |

(33.2)% |

|

28 |

(13.3)% |

(16.3)% |

Double-digit growth

maintained

Africa & Middle East continued to post very

strong revenue growth, thanks to the performance of retail

services.

The main driver of this growth is Mobile, buoyed

by data which is benefiting from a continual increase in the 4G

customer base (+33.6% year on year). For its part, Orange Money,

which is facing a tougher competitive environment, has an active

customer base of 22.6 million, up 12.5% over one year.

Fixed broadband also continued to have excellent

momentum, with a customer base that has increased 23.4% year on

year.

Likewise, B2B services posted spectacular

growth, even though this still only contributes slightly to total

revenues.

All countries recorded growth in the third

quarter, ten of which delivered double-digit growth.

Enterprise

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

1,864 |

(1.4)% |

(1.8)% |

|

5,704 |

0.4 % |

(0.9)% |

|

Fixed Only |

|

899 |

(5.2)% |

(5.6)% |

|

2,733 |

(4.7)% |

(6.1)% |

|

Voice |

|

268 |

(11.3)% |

(11.5)% |

|

837 |

(9.8)% |

(10.5)% |

|

Data |

|

631 |

(2.3)% |

(2.8)% |

|

1,896 |

(2.3)% |

(4.0)% |

|

IT & Integration services |

|

745 |

2.1 % |

1.6 % |

|

2,311 |

6.4 % |

4.6 % |

|

Mobile7 |

|

220 |

3.5 % |

3.5 % |

|

660 |

3.5 % |

3.4 % |

|

Mobile Only |

|

154 |

(3.1)% |

(3.4)% |

|

472 |

(2.1)% |

(2.9)% |

|

Wholesale |

|

10 |

(8.1)% |

(8.1)% |

|

31 |

(2.6)% |

(2.6)% |

|

Equipment sales |

|

56 |

31.1 % |

32.6 % |

|

157 |

26.9 % |

31.0 % |

Revenues down, due in particular to the

sharp drop in voice services

Enterprise revenues declined in the third

quarter, although still recorded growth over the first nine months

of the year.

This was mainly the result of the continuing

decline of voice which was not offset this quarter by growth in

Mobile and IT & Integration services. The transformation in

customer usage, which is shifting ever more to fully digital

solutions, has accelerated the decline of voice compared to its

historical trend with voice now representing just 14% of total

revenues.

Growth in IT & Integration services slowed

but remained positive thanks to Cybersecurity (+14%) and Cloud and

Digital & Data activities (both up more than 8%).

International Carriers & Shared

Services

|

In millions of euros |

|

3Q 2021 |

changecomparablebasis |

changehistoricalbasis |

|

9M 2021 |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

392 |

10.8 % |

11.3 % |

|

1,135 |

4.9 % |

5.0 % |

|

Wholesale |

|

270 |

7.3 % |

8.1 % |

|

792 |

1.0 % |

1.6 % |

|

Other revenues |

|

122 |

19.6 % |

19.1 % |

|

343 |

14.9 % |

13.9 % |

Revenue from International Carriers & Shared

Services grew 10.8%.

Services to international carriers, whose

activities were severely impacted by the health crisis in 2020,

posted strong growth thanks to the partial lifting of restrictions

on international travel. They also benefited from the good

performance of voice and messaging activities.

Other revenue growth accelerated thanks to

Orange Marine, driven by its new Survey activities and the strong

revival in cable laying, as in the second quarter.

Mobile Financial Services

Mobile financial services now have 1.6 million

customers in Europe and 0.6 million customers in Africa.

In France, the share of new customer relationships

represented by paying offers continued to grow, reaching 97% in the

third quarter of 2021 compared with 88% in the same quarter

of 2020.

Calendar of upcoming events

17 February 2022 - Publication

of Full-Year 2021 results

Contacts

|

press: Tom Wrighttom.wright@orange.com ; +33 6 78 91 35 11 |

financial communication: +33 1 44 44 04 32(analysts and

investors)Patrice Lambert-de Diesbachp.lambert@orange.com Samuel

Castelosamuel.castelo@orange.com Aurélia

Rousselaurelia.roussel@orange.comAndrei

Dragoliciandrei.dragolici@orange.com Louise

Racinelouise.racine@orange.comHong Hai

Vuonghonghai.vuong@orange.comindividual shareholders: 0 800 05 10

10 |

Disclaimer

This press release contains forward-looking

statements about Orange’s financial situation, results of

operations and strategy. Although we believe these statements are

based on reasonable assumptions, they are subject to numerous risks

and uncertainties, including matters not yet known to us or not

currently considered material by us, and there can be no assurance

that anticipated events will occur or that the objectives set out

will actually be achieved. More detailed information on the

potential risks that could affect our financial results is included

in the Universal Registration Document filed on 17 March 2021

with the French Financial Markets Authority (AMF) and in the annual

report (Form 20-F) filed on 18 March 2021 with the U.S. Securities

and Exchange Commission. Forward-looking statements speak only as

of the date they are made. Other than as required by law, Orange

does not undertake any obligation to update them in light of new

information or future developments.

Appendix 1:

key financial indicators

Quarterly data

|

In millions of euros |

|

3Q 2021 |

3Q 2020comparablebasis |

3Q 2020historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

10,508 |

10,551 |

10,584 |

(0.4)% |

(0.7)% |

|

France |

|

4,483 |

4,676 |

4,693 |

(4.1)% |

(4.5)% |

|

Europe |

|

2,583 |

2,610 |

2,636 |

(1.1)% |

(2.0)% |

|

Africa & Middle East |

|

1,652 |

1,474 |

1,474 |

12.0 % |

12.0 % |

|

Enterprise |

|

1,864 |

1,891 |

1,898 |

(1.4)% |

(1.8)% |

|

International Carriers & Shared Services |

|

392 |

353 |

352 |

10.8 % |

11.3 % |

|

Intra-Group eliminations |

|

(466) |

(453) |

(468) |

|

|

|

EBITDAaL (1) |

|

3,550 |

3,576 |

3,584 |

(0.7)% |

(1.0)% |

|

o/w Telecom activities |

|

3,579 |

3,607 |

3,613 |

(0.8)% |

(1.0)% |

|

As % of revenues |

|

34.1 % |

34.2 % |

34.1 % |

(0.1 pt) |

(0.1 pt) |

|

o/w Mobile Financial Services |

|

(29) |

(31) |

(29) |

7.8 % |

2.2 % |

|

eCAPEX |

|

1,709 |

1,727 |

1,730 |

(1.0)% |

(1.2)% |

|

o/w Telecom activities |

|

1,707 |

1,718 |

1,723 |

(0.6)% |

(0.9)% |

|

as % of revenues |

|

16.2 % |

16.3 % |

16.3 % |

(0.0 pt) |

(0.0 pt) |

|

o/w Mobile Financial Services |

|

1 |

8 |

7 |

(82.3)% |

(79.6)% |

|

EBITDAaL - eCAPEX |

|

1,841 |

1,849 |

1,854 |

(0.4)% |

(0.7)% |

(1) EBITDAaL adjustments are described in

Appendix 2.

30 September data

|

In millions of euros |

|

9M 2021 |

9M 2020comparablebasis |

9M 2020historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

31,374 |

31,104 |

31,353 |

0.9 % |

0.1 % |

|

France |

|

13,433 |

13,667 |

13,717 |

(1.7)% |

(2.1)% |

|

Europe |

|

7,747 |

7,791 |

7,864 |

(0.6)% |

(1.5)% |

|

Africa & Middle East |

|

4,694 |

4,222 |

4,320 |

11.2 % |

8.7 % |

|

Enterprise |

|

5,704 |

5,679 |

5,757 |

0.4 % |

(0.9)% |

|

International Carriers & Shared Services |

|

1,135 |

1,082 |

1,080 |

4.9 % |

5.0 % |

|

Intra-Group eliminations |

|

(1,339) |

(1,338) |

(1,384) |

|

|

|

EBITDAaL (1) |

|

9,387 |

9,434 |

9,498 |

(0.5)% |

(1.2)% |

|

o/w Telecom activities |

|

9,471 |

9,540 |

9,598 |

(0.7)% |

(1.3)% |

|

As % of revenues |

|

30.2 % |

30.7 % |

30.6 % |

(0.5 pt) |

(0.4 pt) |

|

o/w Mobile Financial Services |

|

(85) |

(106) |

(101) |

19.8 % |

16.1 % |

|

eCAPEX |

|

5,554 |

4,858 |

4,886 |

14.3 % |

13.7 % |

|

o/w Telecom activities |

|

5,540 |

4,834 |

4,865 |

14.6 % |

13.9 % |

|

as % of revenues |

|

17.7 % |

15.5 % |

15.5 % |

2.1 pt |

2.1 pt |

|

o/w Mobile Financial Services |

|

14 |

24 |

21 |

(40.8)% |

(33.1)% |

|

EBITDAaL - eCAPEX |

|

3,833 |

4,577 |

4,612 |

(16.2)% |

(16.9)% |

(1) EBITDAaL adjustments are described in

Appendix 2.

Appendix 2: adjusted data to income

statement items

Quarterly data

|

|

|

3Q 2021 |

|

3Q 2020historical basis |

|

In millions of euros |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Revenues |

|

10,508 |

- |

10,508 |

|

10,584 |

- |

10,584 |

|

External purchases |

|

(4,298) |

0 |

(4,298) |

|

(4,261) |

- |

(4,261) |

|

Other operating income |

|

165 |

- |

165 |

|

132 |

- |

132 |

|

Other operating expense |

|

(91) |

(5) |

(96) |

|

(112) |

(7) |

(119) |

|

Labor expenses |

|

(1,982) |

12 |

(1,970) |

|

(1,991) |

67 |

(1,924) |

|

Operating taxes and levies |

|

(339) |

- |

(339) |

|

(352) |

- |

(352) |

|

Gains (losses) on disposal of fixed assets, investments and

activities |

|

na |

362 |

362 |

|

na |

14 |

14 |

|

Restructuring costs |

|

na |

(40) |

(40) |

|

na |

2 |

2 |

|

Depreciation and amortization of financed assets |

|

(21) |

- |

(21) |

|

(15) |

- |

(15) |

|

Depreciation and amortization of right-of-use assets |

|

(363) |

- |

(363) |

|

(367) |

- |

(367) |

|

Impairment of right-of-use assets |

|

- |

- |

- |

|

- |

- |

- |

|

Interest expenses on liabilities related to financed assets |

|

(0) |

0 |

na |

|

(0) |

0 |

na |

|

Interest expenses on lease liabilities |

|

(28) |

28 |

na |

|

(33) |

33 |

na |

|

EBITDAaL |

|

3,550 |

359 |

na |

|

3,584 |

109 |

na |

|

Significant litigation |

|

- |

- |

na |

|

(3) |

3 |

na |

|

Specific labor expenses |

|

21 |

(21) |

na |

|

68 |

(68) |

na |

|

Fixed assets, investments and business portfolio review |

|

362 |

(362) |

na |

|

14 |

(14) |

na |

|

Restructuring program costs |

|

(40) |

40 |

na |

|

2 |

(2) |

na |

|

Acquisition and integration costs |

|

(13) |

13 |

na |

|

(6) |

6 |

na |

|

Interest expenses on liabilities related to financed assets |

|

na |

(0) |

(0) |

|

na |

(0) |

(0) |

|

Interest expenses on lease liabilities |

|

na |

(28) |

(28) |

|

na |

(33) |

(33) |

30 September data

|

|

|

9M 2021 |

|

9M 2020historical basis |

|

In millions of euros |

|

Adjusted data |

Presentation adjustment, |

Income statement |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Revenues |

|

31,374 |

- |

31,374 |

|

31,353 |

- |

31,353 |

|

External purchases |

|

(13,031) |

(3) |

(13,034) |

|

(12,808) |

- |

(12,808) |

|

Other operating income |

|

487 |

- |

487 |

|

403 |

- |

403 |

|

Other operating expense |

|

(318) |

(73) |

(391) |

|

(387) |

(181) |

(568) |

|

Labor expenses |

|

(6,355) |

(36) |

(6,391) |

|

(6,333) |

33 |

(6,300) |

|

Operating taxes and levies |

|

(1,527) |

(31) |

(1,558) |

|

(1,584) |

- |

(1,584) |

|

Gains (losses) on disposal of fixed assets, investments and

activities |

|

na |

374 |

374 |

|

na |

73 |

73 |

|

Restructuring costs |

|

na |

(284) |

(284) |

|

na |

(11) |

(11) |

|

Depreciation and amortization of financed assets |

|

(62) |

- |

(62) |

|

(37) |

- |

(37) |

|

Depreciation and amortization of right-of-use assets |

|

(1,093) |

- |

(1,093) |

|

(1,019) |

- |

(1,019) |

|

Impairment of right-of-use assets |

|

- |

(60) |

(60) |

|

- |

(6) |

(6) |

|

Interest expenses on liabilities related to financed assets |

|

(1) |

1 |

na |

|

(1) |

1 |

na |

|

Interest expenses on lease liabilities |

|

(86) |

86 |

na |

|

(91) |

91 |

na |

|

EBITDAaL |

|

9,387 |

(26) |

na |

|

9,498 |

(0) |

na |

|

Significant litigation |

|

(89) |

89 |

na |

|

(172) |

172 |

na |

|

Specific labor expenses |

|

(21) |

21 |

na |

|

40 |

(40) |

na |

|

Fixed assets, investments and business portfolio review |

|

374 |

(374) |

na |

|

73 |

(73) |

na |

|

Restructuring program costs |

|

(344) |

344 |

na |

|

(17) |

17 |

na |

|

Acquisition and integration costs |

|

(34) |

34 |

na |

|

(16) |

16 |

na |

|

Interest expenses on liabilities related to financed assets |

|

na |

(1) |

(1) |

|

na |

(1) |

(1) |

|

Interest expenses on lease liabilities |

|

na |

(86) |

(86) |

|

na |

(91) |

(91) |

Appendix 3: economic CAPEX to

investments in property, plant and intangible

investment

|

In millions of euros |

|

3Q 2021 |

3Q 2020historicalbasis |

|

9M 2021 |

9M 2020historicalbasis |

|

eCAPEX |

|

1,709 |

1,730 |

|

5,554 |

4,886 |

|

Elimination of proceeds from sales of property, plant and equipment

and intangible assets |

|

51 |

68 |

|

99 |

266 |

|

Telecommunication licenses |

|

420 |

5 |

|

713 |

47 |

|

Financed assets |

|

2 |

56 |

|

25 |

173 |

|

Investments in property, plant and equipment and intangible

assets |

|

2,182 |

1,860 |

|

6,391 |

5,372 |

Appendix 4: key performance

indicators

|

In thousand, at the end of the period |

|

September 302021 |

|

September 302020 |

|

Number of convergent customers |

|

11,256 |

|

10,914 |

|

Number of mobile accesses (excluding MVNOs)

(1) |

|

221,788 |

|

211,856 |

|

o/w |

Mobile accesses of convergent customers |

|

20,371 |

|

19,484 |

|

|

Mobile only accesses |

|

201,417 |

|

192,371 |

|

o/w |

Contract customers |

|

80,115 |

|

76,252 |

|

|

Prepaid customers |

|

141,673 |

|

135,604 |

|

Number of fixed accesses (2) |

|

44,674 |

|

45,128 |

|

|

Number of fixed retail accesses |

|

29,301 |

|

29,357 |

|

|

|

Number of fixed broadband accesses |

|

22,323 |

|

21,301 |

|

|

|

o/w |

Accesses with very high-speed broadband |

|

11,270 |

|

8,997 |

|

|

|

|

Accesses of convergent customers |

|

11,256 |

|

10,914 |

|

|

|

|

Fixed only accesses |

|

11,067 |

|

10,387 |

|

|

|

Number of fixed narrowband accesses |

|

6,978 |

|

8,055 |

|

|

Number of fixed wholesale accesses |

|

15,373 |

|

15,771 |

|

Group total accesses (1+2) |

|

266,462 |

|

256,983 |

2020 data is presented on a comparable

basis.

Key indicators by country are presented in the

"Orange investors data book Q3 2021", available on www.orange.com,

under Finance/Results

www.orange.com/en/latest-consolidated-results

Appendix 5: glossary

Key figures

Data on a comparable basis: data based on

comparable accounting principles, scope of consolidation and

exchange rates are presented for previous periods. The transition

from data on an historical basis to data on a comparable basis

consists of keeping the results for the period ended and then

restating the results for the corresponding period of the preceding

year for the purpose of presenting, over comparable periods,

financial data with comparable accounting principles, scope of

consolidation and exchange rate. The method used is to apply to the

data of the corresponding period of the preceding year, the

accounting principles and scope of consolidation for the period

just ended as well as the average exchange rate used for the income

statement for the period ended. Changes in data on a comparable

basis reflect organic business changes. Data on a comparable basis

is not a financial aggregate as defined by IFRS and may not be

comparable to similarly-named indicators used by other

companies.

EBITDAaL or “EBITDA after Leases”: operating

income (i) before depreciation and amortization of fixed assets,

effects resulting from business combinations, reclassification of

cumulative translation adjustment from liquidated entities,

impairment of goodwill and fixed assets, share of profits (losses)

of associates and joint ventures, (ii) after interest on debts

related to financed assets and on lease liabilities, and (iii)

adjusted for significant litigation, specific labor expenses, fixed

assets, investments and businesses portfolio review, restructuring

programs costs, acquisition and integration costs and, where

appropriate, other specific elements. EBITDAaL is not a financial

aggregate as defined by IFRS standards and may not be directly

comparable to similarly-named indicators in other companies.

eCAPEX or “economic CAPEX”: (i) acquisitions of

property, plant and equipment and intangible assets, excluding

telecommunications licenses and financed assets, (ii) less the

price of disposal of property, plant and equipment and intangible

assets. eCAPEX is not a financial performance indicator as defined

by IFRS standards and may not be directly comparable to indicators

referenced by similarly-named indicators in other companies.

Organic Cash Flow (telecoms activities): for the

perimeter of the telecoms activities, this corresponds to the net

cash provided by operating activities, minus (i) lease liabilities

repayments and debts related to financed assets repayments, and

(ii) purchases and sales of property, plant and equipment and

intangible assets, net of the change in the fixed assets payables,

(iii) excluding effect of telecommunication licenses paid and

significant litigations paid or received. Organic Cash Flow

(telecoms activities) is not a financial aggregate defined by IFRS

and may not be comparable to similarly-named indicators used by

other companies.

Other revenue: other revenue includes equipment

sales to dealers and brokers, revenue from portals, on‑line

advertising revenue and corporate transversal business line

activities of the Group, and other miscellaneous revenue.

Retail services: aggregation of Convergent

services, Mobile only services, Fixed only services and IT &

integration services. Concerns only France, Europe and Africa &

Middle East operating segments.

Convergence

The customer base and the revenues invoiced to

convergence services customers (excluding equipment sales) was for

convergent offers defined as the combination of, at a minimum, a

fixed broadband access and a mobile contract subscribed by retail

market customers.

Convergent ARPO: the average quarterly revenues

per convergent offer (ARPO) is calculated by dividing revenues from

retail convergent services offers invoiced to customers generated

over the past three months (excluding IFRS 15 adjustments) by the

weighted average number of retail convergent offers over the same

period. ARPO is expressed by monthly revenues per convergent

offer.

Performance indicators

The fixed retail accesses correspond to the

number of fixed broadband accesses (xDSL (ADSL and VDSL), FTTx,

cable, Fixed-4G (fLTE) and other broadband accesses (satellite,

Wimax and others)) and fixed narrowband accesses (mainly PSTN) and

payphones.

The fixed wholesale accesses correspond to the

number of fixed broadband and narrowband wholesale accesses

operated by Orange.

Mobile Only services

Revenues from Mobile Only services consists of

revenues invoiced to customers of mobile offers excluding retail

convergence and equipment sales. The customer base includes

customers with a contract excluding retail convergence,

machine-to-machine contracts and prepaid cards.

Mobile Only ARPO: the average quarterly revenues

from Mobile Only (ARPO) is calculated by dividing the revenue from

Mobile Only services (excluding machine-to-machine and IFRS 15

adjustments) generated over the past three months by the weighted

average of Mobile Only customers (excluding machine-to-machine)

over the same period. The ARPO is expressed as monthly revenues per

Mobile Only customer.

Fixed Only services

Revenues from Fixed Only services include the

revenue of fixed services excluding retail convergence and

equipment sales: traditional fixed-line telephony, fixed broadband

and enterprise solutions and networks (with the exception of

France, where enterprise solutions and networks are listed under

the Enterprise segment). For the Enterprise segment, fixed-only

service revenues include sales of network equipment related to the

operation of voice and data services. The customer base consists of

fixed-line telephony and fixed broadband customers, excluding

retail convergence customers.

Fixed Only Broadband ARPO: the average quarterly

revenues from Fixed Only Broadband (ARPO) is calculated by dividing

the revenue from Fixed Only Broadband services (excluding IFRS 15

adjustments) generated over the past three months by the weighted

average of Fixed Only Broadband customers over the same period.

ARPO is expressed as monthly revenues per Fixed Only Broadband

customer.

IT & integration

services

Revenues from IT and integration services

include revenue from unified communication and collaboration

services (Local Area Network and telephony, consulting,

integration, project management and video conferencing offers),

hosting and infrastructure services (including cloud computing),

application services (customer relations management and other

application services), security services, machine-to-machine

services (excluding connectivity), as well as equipment sales for

the products and services above.

Wholesale

Revenues from other carriers consists of (i)

mobile services to other carriers including incoming traffic,

visitor roaming, network sharing, national roaming and Mobile

Virtual Network Operators (MVNOs), and (ii) fixed services to other

carriers including national networking, services to international

carriers, high-speed and very high-speed broadband access (fibre

access, unbundling of telephone lines and xDSL access sales) and

the sale of telephone lines on the wholesale market.

1

Unless otherwise

stated, the changes presented in this press release are on a

comparable basis.2 Includes B2C and B2B services. See

the definition in Appendix 5: glossary.

3

These targets take

into account the allocation of the 2.2 billion-euro tax refund

received at the end of 2020 after the French Council of State ruled

in the Group’s favor in a long-running tax dispute, which is

intended to generate long-term added value for the Group but will

have an impact on objectives in the short term.4 The ex-dividend

date is set for December 13.5 Includes B2C and B2B services. See

the definition in Appendix 5: glossary.

6 Includes B2C and B2B services. See the definition

in Appendix 5: glossary.7 Mobile revenues include mobile services

and mobile equipment sales invoiced to businesses and incoming

mobile traffic from businesses invoiced to other carriers.

- PR_Orange_3Q_2021_EN_261021

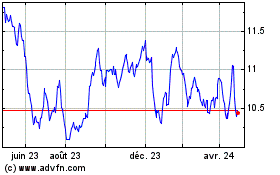

Orange (EU:ORA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

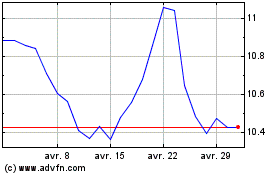

Orange (EU:ORA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024