(April-September 2018)

Accelerating second-quarter growth

2018/19 full-year guidance confirmed

Regulatory News:

Rémy Cointreau (Paris:RCO) generated sales of

€571.4 million in the first half of its 2018/19 financial

year, up 5.0% in reported terms and up 7.7% in organic terms

(at constant exchange rates and consolidation scope). After coming

in at 5.9% in the first quarter, organic growth picked up to

9.1% in the second quarter.

First-half performance was once again supported by remarkable

growth in Group Brands (up 8.9%*), and particularly at the

House of Rémy Martin (up 11.7%*), buoyed by continuing

strong trends in the Asia-Pacific region, as well as a solid US

market. The Liqueurs & Spirits division (up 0.8%*)

had a more moderate start to the year but should pick up nicely in

the second half, boosted by a number of communication campaigns.

Partner Brands continued to decline, consistent with the

Group’s strategy to gradually refocus on the Group Brands.

Geographically, Asia-Pacific delivered excellent performance in

the first-half, thanks to continuing strong trends across the whole

region, particularly in Greater China. The Americas region

accelerated in the second quarter as expected, driven by good

momentum for our cognac brands, while the termination of Partner

Brand distribution agreements continued to weigh on performance in

Europe, the Middle East and Africa (EMEA).

Breakdown of sales by division:

Pre-IFRS 15 Post-IFRS 15

6 months 6 months Change

6 months (€m) to 30/09/18

to 31 Dec 2014

to 30/09/17

to 31 Dec 2014

Reported Organic(*)

to 31 Dec 2014

to 30/09/18 House of Rémy Martin 398.0 367.0 8.5%

11.7% 359.6 Liqueurs & Spirits 127.1 129.2 -1.6% 0.8%

121.9

Subtotal: Group Brands 525.1 496.1

5.8% 8.9% 481.5 Partner Brands 46.3 48.2 -4.0%

-4.5% 45.5

Total 571.4 544.4

5.0% 7.7% 527.0

House of Rémy Martin

The House of Rémy Martin once again posted strong growth

in the half-year (up 11.7% in organic terms), thanks to

continuing excellent trends in Greater China, as well as in other

key markets in the Asia-Pacific region (Singapore, Australia and

Japan) and in Travel Retail. As expected, growth picked up in the

second quarter in the Americas region, amid favorable cognac market

trends, especially for the highest-end products. Within the EMEA

region, key markets (Russia, the United Kingdom, Switzerland and

India) posted sustained growth.

The creativity of the House’s brands and its global strategy of

brand elevation once again bore fruit over the period, with organic

growth of 11.7%, breaking down into volume growth of 6.4% and a

5.3% contribution from mix and price benefits.

Liqueurs & Spirits

The Liqueurs & Spirits division posted modest

growth in the early part of the year (up 0.8%*) but should pick up

nicely in the second half, supported by a number of communication

campaigns.

Throughout the first semester, the House of Cointreau

rolled out its new campaign “The Art of the Mix” as well as

marketing activities celebrating the 70th anniversary of the

Margarita. As such, the brand should benefit from enhanced sales

over the second half of the year.

The House of Metaxa launched the new version of its

“Don’t Drink It, Explore It” campaign, and celebrated the 130th

anniversary of the brand this summer in Greece with the

limited-edition AEN Cask No. 2 (AEN means “forever” in Greek).

The upscaling strategy at Mount Gay and St-Rémy

resulted in a further decline in volumes but significant growth in

value per case.

The Botanist gin continued to deliver strong growth

across all regions, while the Whisky business unit posted a

remarkable performance, driven by the Scottish single malts, in

particular, thanks to the success of the new Port Charlotte

bottle.

Partner Brands

Sales continued to decline (-4.5% in organic terms) over the

first half, due to the termination of new distribution contracts

with third-party brands. However, second-quarter performance was

boosted by a successful one-off promotional campaign in the United

States.

2018/19 outlook

On the heels of this positive first-half performance, Rémy

Cointreau confirms its guidance of growth in Current Operating

Profit over the financial year 2018/19, assuming constant exchange

rates and consolidation scope.

Appendices:

Sales and organic growth by business

First-quarter 2018/19 sales (April-June 2018)

Pre-IFRS 15 Post-IFRS 15

€m Reported

18-19

Forex effect

18-19

Organic

18-19 (*)

Reported

17-18

Reported change Change

Organic (*)

Reported

18-19

A B

C A/C-1 B/C-1

House of Rémy Martin 163.5 -10.5 174.0 156.6 4.4% 11.1% 147.0

Liqueurs & Spirits 57.8 -2.4 60.3 58.6 -1.3% 2.8% 55.3

Subtotal: Group Brands 221.3 -12.9

234.3 215.2 2.8% 8.8% 202.3

Partner Brands 20.2 0.1 20.1 25.0 -19.2% -19.7% 20.0

Total

241.5 -12.8 254.4

240.2 0.5% 5.9%

222.2

Second-quarter 2018/19 sales (July-September 2018)

Pre-IFRS 15 Post-IFRS 15

€m Reported

18-19

Forex effect

18-19

Organic

18-19 (*)

Reported

17-18

Reported change Change

Organic (*)

Reported

18-19

A B

C A/C-1 B/C-1

House of Rémy Martin 234.5 -1.5 236.0 210.3 11.5% 12.2% 212.6

Liqueurs & Spirits 69.2 -0.7 69.9 70.6 -1.9% -0.9% 66.6

Subtotal: Group Brands 303.7 -2.1 305.9

280.9 8.1% 8.9% 279.3 Partner Brands

26.1 0.1 26.0 23.2 12.3% 11.8% 25.5

Total

329.8 -2.0 331.8

304.1 8.5% 9.1%

304.7

First-half 2018/19 sales (April-September 2018)

Pre-IFRS 15 Post-IFRS 15

€m Reported

18-19

Forex effect

18-19

Organic

18-19 (*)

Reported

17-18

Reported change Change

Organic (*)

Reported

18-19

A B

C A/C-1 B/C-1

House of Rémy Martin 398.0 -12.0 410.0 367.0 8.5% 11.7% 359.6

Liqueurs & Spirits 127.1 -3.1 130.2 129.2 -1.6% 0.8% 121.9

Subtotal: Group Brands 525.1 -15.1

540.1 496.1 5.8% 8.9% 481.5

Partner Brands 46.3 0.2 46.1 48.2 -4.0% -4.5% 45.5

Total

571.4 -14.8 586.2

544.4 5.0% 7.7%

527.0

Definitions of alternative performance

indicators

Rémy Cointreau's management process is based on the following

alternative performance indicators, chosen for planning and

reporting. The Group management considers that these indicators

provide financial statement users with useful additional

information for understanding the Group's performance. These

alternative performance indicators should be considered as

supplementing those included in the consolidated financial

statements and the resulting movements.

Starting on April 1st 2018, the Rémy Cointreau Group applied the

standard “IFRS 15 – Revenue from Contracts with Customers.” For the

transition, the Group did not opt for retrospective application.

Thus, the comparative period has not been restated and organic

growth is calculated using turnover which excludes the impact of

IFRS 15. The main effect of this standard is the reclassification

of some SG&A costs (notably some promotional expenses) in

deduction of net sales. Its estimated impact on the full-year is a

reduction in net sales amounting to 8% and an accretive effect of

about 1.5 points on the Current Operating Margin.

Organic sales growth

Organic growth is calculated excluding the impacts of variations

in exchange rates as well as acquisitions and disposals.

The impact of exchange rates is calculated by converting sales

for the current financial year into the exchange rate of the

previous financial year.

For acquisitions in the current financial year, the sales of the

acquired entity are not included in organic growth calculations.

For acquisitions in the previous financial year, the sales of the

acquired entity are included in the previous financial year but are

only included in organic growth calculations for the current year

starting from the anniversary date of the acquisition.

For significant disposals, we use data following the application

of IFRS 5, which systematically reclassifies the sales of the sold

entity in "Net profit from activities sold or to be sold" for the

current and previous financial year.

This indicator serves to focus on Group performance common to

both financial years, which local management is more directly

capable of influencing.

(*) Organic growth is calculated assuming constant exchange

rates and consolidation scope.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181018005878/en/

Rémy CointreauLaetitia Delaye, +33 (0) 1 44 13 45 25

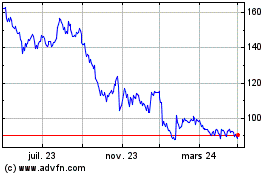

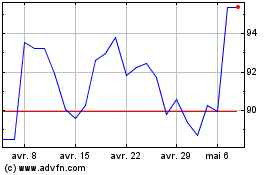

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024