EXCELLENT QUARTER IN A TOUGHER

ENVIRONMENT

Regulatory News:

SEB SA (Paris:SK):

RESULTS

■ Nine-month sales: €5,114m, +10.5%, +8.1% LFL*

■ Third-quarter sales: €1,777m, +10.9%, +7.7% LFL*

■ Nine-month Operating Result from Activity (ORfA): €407m,

+9.3%

■ Net financial debt: €2,459m (o/w €344m from IFRS

16)

2019 OBJECTIVES

■ Ongoing solid LFL sales growth, adjusted between +6% and

+7%, vs over 7% previously

■ Increase in reported ORfA confirmed, by around +6%

GENERAL COMMENTS ON GROUP PERFORMANCE

In a global environment that grew considerably more challenging

over the summer (global economic slowdown, US/China trade dispute),

Groupe SEB posted excellent performances in the third quarter. The

latter were reflected in continued vigorous sales growth and an

increase in Operating Result from Activity (ORfA).

Revenue in the first nine months came out at €5,114 million, up

10.5%. The total includes organic growth of +8.1%, a currency

effect of +1.0% and a scope effect of +1.4%, stemming from the

consolidation of Wilbur Curtis since February 8 and that of our

Egyptian joint venture in its new configuration.

ORfA amounted to €407 million at end-September, up

9.3% on the first nine months of 2018 comprising a currency

effect of -€1 million and a scope effect (Wilbur Curtis

and Egyptian JV) and method effect (IFRS 16) of +€15

million.

Net financial debt stood at €2,459 million at September

30, 2019, compared with €2,105 million at end-September 2018 (on

the same seasonal basis). It includes the recognition of IFRS 16

debt as well as the acquisitions of Wilbur Curtis and Krampouz.

* Like-for-like: at constant exchange rates and scope of

consolidation

DETAIL OF REVENUE BY REGION

Revenue in €M

Nine-month

2018

Nine-month

2019

Change 2019/2018

Q3 2019

Like-for-like

As reported

Like-for-like*

EMEA

Western Europe

Other countries

2,053

1,536

517

2,180

1,586

594

+6.2%

+3.2%

+15.0%

+5.7%

+3.1%

+13.4%

+7.1%

+2.4%

+21.7%

AMERICAS

North America

South America

573

357

216

630

400

230

+10.2%

+12.2%

+6.8%

+8.7%

+6.5%

+12.3%

+11.6%

+11.2%

+12.5%

ASIA

China

Other

countries

1,544

1,192

352

1,715

1,339

376

+11.1%

+12.3%

+7.1%

+9.3%

+11.1%

+3.1%

+7.7%

+7.5%

+8.2%

TOTAL Consumer

4,170

4,525

+8.5%

+7.5%

+8.0%

Professional business

458

589

+28.6%

+14.4%

+4.6%

GROUPE SEB

4,628

5,114

+10.5%

+8.1%

+7.7%

*

Like-for-like: at constant exchange rates and scope

Rounded

figures in €m

%

calculated in non-rounded figures

The solid momentum on a like-for-like basis breaks down as

follows:

- Consumer business, +7.5%: growth driven by all

geographies and all product lines. In addition to the robust

increase in our core business, the number of loyalty programs was

considerably higher than in 2018.

- Professional business, +14.4%: as announced,

growth in professional coffee business has slowed down in the third

quarter due to highly demanding comparatives in 2018.

EMEA

WESTERN EUROPE

In a contrasted market, the Group reported organic sales growth

of 3.1% at end-September, following growth of +2.4% in the third

quarter. This growth was driven by brisk core business and major

loyalty programs.

In France, revenue was up slightly at end-September following

strong growth of +5% in the third quarter, fueled by a loyalty

program and by continued powerful momentum in versatile vacuum

cleaners, automatic espresso machines, garment steamers, and brunch

ranges. The sales success of the Cake Factory cake maker was

confirmed. In contrast, business remained complicated in ironing

(irons and steam generators) and canister vacuum cleaners, owing to

a contraction in these markets.

In Germany, performance over the past few months confirmed the

economic slowdown observed in Spring, reflected in more challenging

business activity, despite the success of our flagship products

(versatile vacuum cleaners and grills). Revenue in Germany also

factors in negative accounting adjustments following the recent

findings of business practices at Groupe SEB Deutschland that

derogate from the Group’s principles.

In Benelux, third-quarter sales in the Netherlands suffered from

high 2018 comparatives (Loyalty Programs), while Belgium posted

impressive growth, spurred on by several flagship products as well

as Cake Factory and yogurt makers.

Traction remained dynamic in Italy (core business and cookware

Loyalty Program), and in Portugal which delivered good performances

across all product categories. In Spain, third-quarter activity

remained well oriented.

OTHER EMEA COUNTRIES

Recording a 22% increase in revenue on a like-for-like basis,

the region posted a record performance, becoming the leading

contributor to Group’s growth in the third quarter. This

accelerated growth is due to virtually all our major markets,

leveraging all distribution networks. Moreover, the growth in our

business on e-commerce platforms and the sharp increase in the

sales of our proprietary distribution network significantly

contributed to this performance.

Substantial growth in Central Europe was underpinned by vigorous

core business – propelled by high-growth markets- and loyalty

programs. Growth was reflected in market share gains.

In Russia, we stepped up our outperformance relative to the

market and consolidated our positions in small electrical

appliances. In parallel, growth momentum remained very solid in

Central Asia (particularly in Kazakhstan). Ukraine confirmed its

excellent performances, particularly in versatile vacuum cleaners

and automatic espresso machines.

In Turkey, the difficult overall environment continued to weigh

on business activity. But thanks notably to the local development

of products intended for the domestic market, our sales in Turkish

lira were stable in the third quarter.

AMERICAS

NORTH AMERICA

In a favorable monetary environment since the start of the year

for the three currencies of the region, sales at end-September

increased by over 12%, with organic growth of 6.5%, bolstered by a

strong third quarter.

The outstanding momentum in the third quarter was driven

primarily by the implementation of a specific deal in electrical

cooking and the rollout of a Rowenta linen-care assortment at mass

retail chains in the United States. Moreover, the Group achieved

highly satisfactory performances in the United States under its

T-Fal, All-Clad and Imusa brands, in a cookware market that

continued to contract, hence strengthening its positions.

Nevertheless, the retail environment in the country remains tough

and demand is slowing down. In addition, the gradual introduction

of customs tariffs as from September on products imported from

China will ultimately impact cookware items and small electrical

appliances with potential effects on consumption.

In Canada, overall backdrop and core business remain complicated

while, conversely, third-quarter revenue in Mexico was particularly

brisk, fueled by cookware and the brunch ranges and buoyed by a new

loyalty program with one of our key accounts.

SOUTH AMERICA

The notable difference between growth in euros and growth on a

like-for-like basis results from the continued depreciation of the

Brazilian real, Argentine peso and Colombian peso. Excluding the

negative currency impact, our sales in South America rose by over

12%, both for the nine-month period and the third quarter. But this

solid organic growth includes contrasting trends.

In Brazil, which accounts for approximately two-thirds of our

revenue in the region, the business recovery observed in the first

half, on weak 2018 comparatives - particularly in the second

quarter - slowed substantially in the third quarter. This softening

in growth was offset by the recognition of a tax credit worth €8

million, following that of €32 million accounted for in

fourth-quarter 2018. Excluding this exceptional item, our sales in

Brazil would increase slightly in the third quarter despite

heightened competitive and promotional pressure that affected our

sales in several product categories, including ironing and food

preparation appliances.

However, our fan sales continued to rise, thanks to favorable

weather, while business trended positively in beverage preparation

and is developing gradually in electrical cooking.

The Group posted an excellent third quarter in Colombia, driven

by strong momentum in fans and the gradual rollout of “oil-less”

fryer range. Cookware and kitchen tools sales were stable over the

quarter.

ASIA

CHINA

Despite more moderate economic Chinese growth and the US/China

trade war, which penalized demand, Supor maintained solid

third-quarter momentum, continuing to outperform the market in

virtually all product families and to strengthen its positions,

both offline and online.

In cookware and kitchenware, sales expansion slowed somewhat

versus first-half 2019. But it remained boosted by flagship product

families such as woks, pots & pans, thermal mugs and kitchen

utensils.

Small electrical appliance business continued to be vibrant in

the third-quarter, with, on one hand, ongoing excellent performance

in kitchen electrics, in particular in blenders, electrical

pressure cookers, baking pans and kettles (both classic and “health

pots”). On the other hand, new categories also confirmed their

strong sales impetus, particularly garment steamers and vacuum

cleaners.

Finally, as in first-half 2019, Supor achieved solid sales

growth in large kitchen appliances such as extractor hoods, gas

stoves and water purifiers.

At end-September, Supor’s organic sales growth in its domestic

market ended at 11.1%, following a third-quarter that saw organic

growth of 7.5%. As in the first-half, these performances are to be

seen in the context of exceptional comparatives in 2018

(third-quarter revenue at +26.5% LFL), which will slow slightly in

the fourth quarter. The Group maintains its full-year target for

double-digit growth in China.

OTHER ASIAN COUNTRIES

Excluding China, the Group reported a vigorous third quarter

performance, showing a clear acceleration on the first half of the

year.

Japan was the main driver of the faster growth. Our revenue in

yen increased by nearly 20%, reflecting both the ongoing robust

momentum – driven by cookware, kettles and garment steamers, as

well as the brisk development of the Cook4me multicooker sales –

and purchases made ahead of the VAT increase on October 1. Our 37

proprietary stores continued to make a positive contribution to

business expansion.

In South Korea, where consumption is being negatively impacted

by tensions relating to the trade conflict with Japan, revenue

remained down on 2018 despite highly satisfactory performances in

versatile vacuum cleaners.

Conversely, the third quarter in Australia confirmed the return

to firmer sales growth, the result of new listings and new product

roll-outs in linen care and electrical cooking.

The third quarter in South-East Asia was contrasted. As in the

first half, business dynamic remained strong in Thailand, while

sales stabilized in Vietnam following a difficult first half.

Momentum slowed in Malaysia on demanding comparatives in the same

period in 2018, but accelerated in Taiwan, thanks in particular to

the extension of our small electrical appliance product range

Revenue for the Professional business (coffee machines and hotel

equipment) came to €589 million at end-September, up 29%. The total

includes a €52 million contribution from Wilbur Curtis, a US

company specialized in professional filter coffee, consolidated

since February 8, 2019. On a like-for-like basis, growth came out

at 14.4%, reflecting, as anticipated, a more modest sales increase

of WMF-Schaerer professional coffee machines in the third quarter.

This is due to considerably more demanding comparatives in 2018

stemming from the shipment, starting in summer 2018, of major

contracts signed with fast-food and coffee shop companies as well

as convenience store chains in the United States and Asia. The 2018

comparative will remain high in the fourth quarter. However,

excluding these deals, the core business in Professional Coffee

continues to trend positively.

In parallel, growth in Wilbur Curtis revenue at end-September

was consistent with our expectations. The integration process still

under way is advancing satisfactorily.

Hotel equipment sales in the first nine months of the year rose

slightly following a third quarter lacking in major projects.

OPERATING RESULT FROM ACTIVITY

(ORfA)

ORfA totaled €407 million at end-September, up

9.3% on the first nine months of 2018 . The total

includes a currency effect of -€1 million and a scope

effect (Wilbur Curtis and Egyptian joint venture) and method

effect (IFRS 16 standard relating to lease contracts applied)

of +€15 million.

Third-quarter ORfA amounted to €178 million, up 8% on the €165

million for the same period in 2018. Operating margin ended at

10%.

DEBT AT SEPTEMBER 30, 2019

At September 30, 2019, net financial debt stood at €2,459

million, compared with €2,105 million at end-September 2018 (on

the same seasonal basis). The figure includes the recognition of

IFRS 16 debt, totaling €344 million, and the acquisitions of Wilbur

Curtis and Krampouz. It also includes, as announced, an increase in

investments as compared to 2018 (in France and China and in WMF

Professional).

OUTLOOK

Despite the very good performances posted so far in 2019, the

global economic slowdown and the increasing geopolitical tensions

since the summer are prompting us to be more cautious.

In these circumstances, the Group is slightly adjusting its 2019

objective on organic sales growth which is now expected between +6%

and +7%, rather than over 7% as announced at end-July. In the

current environment, this very solid dynamic outperforms the

industry and confirms the relevance of the Group’s strategic

model.

The Group confirms its objective of around +6% increase in

reported Operating Result from Activity in 2019, in a more

favorable currency and raw material environment than expected.

APPENDIX

REVENUE BY REGION – THIRD QUARTER

Revenue in €M

Q3

2018

Q3

2019

Change 2019/2018

As reported

Like-for-like*

EMEA

Western Europe

Other countries

715

539

176

779

553

226

+8.8%

+2.4%

+28.5%

+7.1%

+2.4%

+21.7%

AMERICAS

North America

South America

235

152

83

268

176

92

+14.3%

+15.7%

+11.7%

+11.6%

+11.2%

+12.5%

ASIA

China

Other countries

485

367

118

533

401

132

+10.0%

+9.1%

+12.9%

+7.7%

+7.5%

+8.2%

TOTAL Consumer

1,435

1,579

+10.1%

+8.0%

Professional Business

168

198

+17.8%

+4.6%

GROUPE SEB

1,603

1,777

+10.9%

+7.7%

* Like-for-like: at constant exchange rates

and scope

Rounded

figures in €m

%

calculated on non-rounded figures

GLOSSARY

On a like-for-like basis (LFL) – Organic

The amounts and growth rates at constant exchange rates and

consolidation scope in a given year compared with the previous year

are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter);

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Operating Result from Activity (ORfA)

Operating Result from Activity (ORfA) is Groupe SEB’s main

performance indicator. It corresponds to sales minus operating

costs, i.e. the cost of sales, innovation expenditure (R&D,

strategic marketing and design), advertising, operational marketing

as well as commercial and administrative costs. ORfA does not

include discretionary and non-discretionary profit-sharing or other

non-recurring operating income and expense.

Adjusted EBITDA

Adjusted EBITDA is equal to Operating Result from Activity minus

discretionary and non-discretionary profit-sharing, to which are

added operating depreciation and amortization.

Loyalty program (LP)

These programs, led by the distribution retailers, consist in

offering promotional offers on a product category to loyal

consumers who have made a series of purchases within a short period

of time. These promotional programs allow distributors to boost

footfall in their stores and our consumers to access our products

at preferential prices.

Net debt – Net indebtedness

This term refers to all recurring and non-recurring financial

debt minus cash and cash equivalents as well as derivative

instruments linked to Group financing having a maturity of under

one year and easily disposed of. Net debt may also include

short-term investments with no risk of a substantial change in

value but with maturities of over three months.

Operating cash flow

Operating cash flow corresponds to the “net cash from operating

activities / net cash used by operating activities” item in the

consolidated cash flow table, restated from non-recurring

transactions with an impact on the Group’s net debt (for example,

cash outflows related to restructuring) and after taking account of

recurring investments (CAPEX).

Product Cost Optimization (PCO)

Group program regrouping and formalizing productivity and

value-accretive initiatives.

Operation Performance SEB (OPS)

Group program targeting improvement in overall performance,

striving for excellence

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

environment, demand in the Group’s large markets and the impact of

new product launches by competitors.

As a result of these uncertainties, SEB cannot be held liable

for potential variance on its current forecasts, which result from

unexpected events or unforeseeable developments.

The factors which could considerably influence Groupe SEB’s

economic and financial result are presented in the Annual Financial

Report and Registration Document filed with the Autorité des

Marchés Financiers, the French financial markets authority.

Listen to the audiocast of the presentation on

our website on October 29th from 9 pm: www.groupeseb.com or

click here

Next key dates - 2020

January 22 | after market closes

Provisional 2019 sales

February 27 | before market opens

2019 sales and results

April 27 | after market closes

Q1 2020 sales and financial data

May 19 | 3:00 pm (Paris time)

Annual General Meeting

July 23 | before market opens

H1 2020 sales and results

October 26 | after market closes

9-month 2020 sales and financial

data

Find us on… www.groupeseb.com

World reference in small domestic equipment, Groupe SEB operates

with a unique portfolio of 30 top brands including Tefal, Seb,

Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor,

marketed through multi-format retailing. Selling more than 350

million products a year, it deploys a long-term strategy focused on

innovation, international development, competitiveness and service

to clients. With products being present in over 150 countries,

Groupe SEB generated sales of approximately €6.8 billion in 2018

and had more than 34,000 employees worldwide.

SEB SA ■ SEB SA - N° RCS 300 349 636

RCS LYON – with a share capital of €50,307,064 –

Intracommunity VAT: FR 12300349636

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191029005898/en/

Investor/Analyst Relations

Groupe SEB Financial Communication & IR

Dept

Isabelle Posth and Raphaël Hoffstetter

comfin@groupeseb.com

Phone: +33 (0) 4 72 18 16 04

Media Relations

Groupe SEB Corporate Communication Dept

Cathy Pianon

com@groupeseb.com

Phone: . + 33 (0) 6 33 13 02 00

Image Sept Caroline Simon Claire Doligez

Isabelle Dunoyer de Segonzac

caroline.simon@image7.fr cdoligez@image7.fr isegonzac@image7.fr

Phone: +33 (0) 1 53 70 74

70

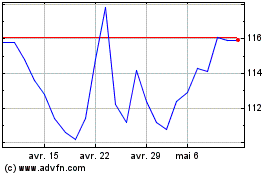

SEB (EU:SK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

SEB (EU:SK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024