Today's Logistics Report: Electrified Supply Chains; Suing Online Commerce; Cybersecurity for Suppliers

06 Décembre 2019 - 4:57PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The electrification of vehicles is triggering bigger changes in

automotive supply chains. General Motors Co. and South Korea's LG

Chem plan to jointly build a $2.3 billion battery-cell factory in

Ohio, the WSJ's Mike Colias reports, the latest example of how auto

makers are plowing big money into technology that is transforming

the sector. Consultancy AlixPartners LP says auto makers are

gearing up to spend $225 billion over the next few years to develop

new electric vehicles and are partnering with and investing in

battery makers to help provide the power. Volkswagen AG plans to

spend $1 billion on battery production, including a joint-venture

investment with a Swedish startup, and Tesla Inc. established its

massive Gigafactory battery plant in Nevada in partnership with

Japan's Panasonic Corp. The GM-LG battery factory will be built

near Lordstown, Ohio, where GM last spring shuttered a large

vehicle-assembly plant.

E-COMMERCE

Hoverboards' brief ride as a consumer toy of choice a few years

ago has left behind major legal liability questions for Amazon.com

Inc. and other e-commerce companies. The popularity of the

self-balancing scooters flamed out in a series of fires that hit

households in 2015 and 2016, causing some $2.3 million in property

damage and triggering at least 17 lawsuits against Amazon. Several

cases remain active, the WSJ's Alexandra Berzon writes, and they

are testing the longtime argument by modern technology companies

that they provide only the platform that connects buyers and

sellers and aren't responsible for ensuring safety standards. Those

questions hit the shipping industry as growing awareness of the

hoverboard transport hazards set off alarms for carriers and

regulators. The hoverboard cases have produced a trove of documents

that show the vulnerability in the vast scale and relatively

anonymous structure of Amazon's platform.

SUPPLY CHAIN STRATEGIES

Cybersecurity protection is taking on a more prominent role for

companies assessing their suppliers. Security professionals are

looking for more sophisticated tools to evaluate the risks that

providers present in the supply chain, the WSJ's James Rundle and

Catherine Stupp report, and are going beyond the general vendor

surveys that have long been a favored procurement due-diligence

tool. It's part of a broader effort to protect businesses from

hacking, ransomware and other threats that have emerged in the

digital era. Forrester Research Inc. analyst Alla Valente says the

first step should be creating a catalog of all suppliers and the

data they have access to. Assessing the security of suppliers is

more challenging since operators may have thousands of companies on

their list. Some experts say the best solution for companies with

long supplier lists may be using third-party certification to

assure the vendor has been closely vetted.

QUOTABLE

IN OTHER NEWS

U.S. imports of consumer goods declined 4.4% in October.

(WSJ)

Canadian exports rose 0.8% in October and imports advanced 0.5%.

(WSJ)

Germany's manufacturing orders fell unexpectedly from September

to October. (WSJ)

Beijing officials say China's trade negotiations with the U.S.

remain on track. (WSJ)

French cities were paralyzed by a massive public transport

strike against a planned overhaul of France's pensions system.

(WSJ)

Oscar Munoz is stepping down as chief executive of United

Airlines Holding Inc. and will be replaced by Scott Kirby.

(WSJ)

Kroger Co.'s quarterly profit fell 17% to $263 million despite a

2.5% gain in same-store sales. (WSJ)

Retailer Michaels Co. lowered its outlook after comparable store

sales fell 2.2% in the third quarter. (WSJ)

Quarterly same-store sales at Dollar General Corp. jumped 4.4%.

(WSJ)

Retailer Tractor Supply Co. named Hal Lawton, a former executive

at Macy's Inc., eBay Inc. and Home Depot Inc., as chief executive.

(WSJ)

A jury convicted former Bumble Bee Foods LLC CEO Christopher

Lischewski for his role in a scheme to fix canned tuna prices.

(WSJ)

California has recovered more than $23 million from 52

automobile parts makers in settlements over a bid-rigging

investigation. (Associated Press)

Amazon is challenging Japan's traditional service culture by

leaving packages at the door. (Nikkei Asian Review)

Indian e-commerce company Flipkart Group led a $60 million

investment round in logistics startup Shadowfax. (Economic

Times)

European Union member states want to review the EU tax exemption

for ship fuel oil. (Shipping Watch)

China State Shipbuilding Corp. is designing a l iquefied natural

gas-powered containership with capacity for 25,000 20-foot

containers. (Lloyd's List)

Several new chemical plants are coming online that signal coming

growth in U.S. resin production. (Petrochemical Update)

DP World-owned regional shipping line Unifeeder Group took a

controlling stake in Singapore operator Feedertech Group. (Port

Technology)

A majority of British businesses in a survey say they value cost

savings from suppliers over innovation. (Logistics Manager)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

December 06, 2019 10:42 ET (15:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

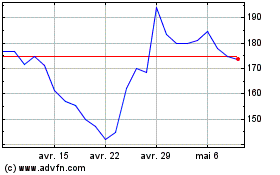

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024