Altisource Asset Management Corporation (“AAMC” or the

“Company”) (NYSE American: AAMC) today announced financial and

operating results for the first quarter of 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230515005457/en/

First Quarter 2023 Results and Recent

Developments (Graphic: Business Wire)

First Quarter 2023 Results and Recent Developments

- Through May 12, 2023, the Company has received total net loan

submissions of $107 million from both its direct to borrower and

wholesale channels.

- The Company entered into forward contracts to sell alternative

credit products to three additional institutional counterparties,

bringing our total to five, that manage insurance and credit

investments. One of the new institutions has over $500 billion in

assets under management.

- AAMC repurchased 27,441 shares of its common stock for a total

of $1.5 million during the first quarter of 2023.

- First quarter earnings improved by $1.1 million, reducing the

first quarter loss to $3.0 million on revenue of $2.1 million from

the fourth quarter 2022.

About AAMC

AAMC is a private credit provider that originates alternative

assets to provide liquidity and capital to under-served markets.

Additional information is available at www.altisourceamc.com.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding management’s beliefs, estimates, projections,

anticipations, and assumptions with respect to, among other things,

the Company’s financial results, margins, employee costs, future

operations, business plans including its ability to sell loans and

obtain funding, and investment strategies as well as industry and

market conditions. These statements may be identified by words such

as “anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other

expressions or words of similar meaning. We caution that

forward-looking statements are qualified by the existence of

certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the

forward-looking statements. Factors that could cause our actual

results to differ materially from these forward-looking statements

may include, without limitation, our ability to develop our

businesses, and to make them successful or sustain the performance

of any such businesses; our ability to purchase, originate, and

sell loans, our ability to obtain funding, market and industry

conditions, particularly with respect to industry margins for loan

products we may purchase, originate, or sell as well as the current

inflationary economic and market conditions and rising interest

rate environment; our ability to hire employees and the hiring of

such employees; developments in the litigation regarding our

redemption obligations under the Certificate of Designations of our

Series A Convertible Preferred Stock; and other risks and

uncertainties detailed in the “Risk Factors” and other sections

described from time to time in the Company’s current and future

filings with the Securities and Exchange Commission. The foregoing

list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the

date of this press release only. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or any other information contained herein, whether as a

result of new information, future events or otherwise.

Altisource Asset Management

Corporation

Condensed Consolidated

Statements of Operations

(In thousands, except share

and per share amounts)

(Unaudited)

Three months ended March

31,

2023

2022

Revenues:

Loan interest income

$

2,036

$

—

Loan fee income

85

—

Realized gains on loans held for sale,

net

10

—

Total revenues

2,131

—

Expenses:

Salaries and employee benefits

1,864

924

Legal fees

441

1,357

Professional fees

480

266

General and administrative

934

729

Servicing and asset management expense

183

—

Acquisition charges

—

424

Interest expense

1,082

—

Direct loan expense

263

—

Loan sales and marketing expense

409

—

Total expenses

5,656

3,700

Other income (expense):

Change in fair value of loans

849

—

Realized losses on sale of held for

investment loans, net

(275

)

—

Other

(2

)

8

Total other income

572

8

Net loss before income taxes

(2,953

)

(3,692

)

Income tax expense (benefit)

35

5

Net loss attributable to common

stockholders

$

(2,988

)

(3,697

)

Gain on preferred stock transaction

—

5,122

Numerator for earnings per

share

$

(2,988

)

$

1,425

(Loss) income per share of common stock

– Basic:

(Loss) income per basic common share

$

(1.68

)

$

0.69

Weighted average common stock

outstanding

1,777,135

2,056,666

(Loss) income per share of common stock

– Diluted:

(Loss) income per diluted common share

$

(1.68

)

$

0.66

Weighted average common stock

outstanding

1,777,135

2,174,002

Altisource Asset Management

Corporation

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share amounts)

March 31, 2023

December 31, 2022

(unaudited)

ASSETS

Loans held for sale, at fair value

$

13,475

$

11,593

Loans held for investment, at fair

value

65,316

83,143

Cash and cash equivalents

11,836

10,727

Restricted cash

2,049

2,047

Other assets

10,642

10,137

Total assets

$

103,318

$

117,647

LIABILITIES AND EQUITY

Liabilities

Accrued expenses and other liabilities

$

8,862

$

10,349

Lease liabilities

1,232

1,323

Credit facilities

43,234

51,653

Total liabilities

53,328

63,325

Commitments and contingencies

Redeemable preferred stock:

Preferred stock, $0.01 par value, 250,000

shares authorized as of March 31, 2023 and December 31, 2022.

144,212 shares issued and outstanding and $144,212 redemption value

as of March 31, 2023 and December 31, 2022, respectively.

144,212

144,212

Stockholders' deficit:

Common stock, $0.01 par value, 5,000,000

authorized shares; 3,434,294 and 1,758,421 shares issued and

outstanding, respectively, as of March 31, 2023 and 3,432,294 and

1,783,862 shares issued and outstanding, respectively, as of

December 31, 2022.

34

34

Additional paid-in capital

149,170

149,010

Retained earnings

38,528

41,516

Accumulated other comprehensive income

20

20

Treasury stock, at cost, 1,675,873 shares

as of March 31, 2023 and 1,648,432 shares as of December 31,

2022.

(281,974

)

(280,470

)

Total stockholders' deficit

(94,222

)

(89,890

)

Total Liabilities and Equity

$

103,318

$

117,647

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230515005457/en/

Investor Relations T: +1-704-275-9113 E:

IR@AltisourceAMC.com

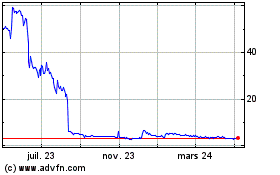

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

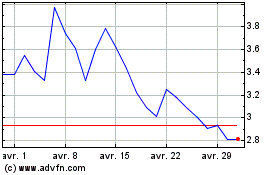

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024