false

0001009891

0001009891

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October

16, 2024

AIR INDUSTRIES GROUP

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

|

001-35927 |

|

80-0948413 |

| State of Incorporation |

|

Commission File Number |

|

IRS Employer I.D. Number |

1460 Fifth Avenue, Bay Shore, New York 11706

(Address of Principal Executive Offices)

Registrant’s telephone number: (631) 968-5000

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.001 |

|

AIRI |

|

NYSE American |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

Lou Melluzzo, Chief Executive Officer of Air

Industries Group will present at the MicroCap Rodeo Fall Conference, to be held on Wednesday, October 16th, 2024, in New York City.

Mr. Melluzzo’s presentation is scheduled to begin at 2:00 PM on October 16th. Mr. Melluzzo’s presentation

will include certain information with respect to Air Industries’ financial results for the quarter and nine months ended

September 30, 2024, including, its backlog, book to bill ratio, operating income, sales, gross profit and margin, operating expense,

operating income (loss) and EBITDA for the three and nine months ended September 30, 2024. Attached as Exhibit 99.2 to this Current

Report is the form of presentation that Mr. Melluzzo intends to use in connection with his presentation. The financial information

with respect to the periods ended September 30, 2024, is preliminary, based upon management’s estimations and has not been

reviewed or audited by the Company’s independent accounting firm.

Item 7.01 Regulation FD Disclosure

On October 16, 2024, Air Industries Group (the

“Company”) will issue a press release announcing that Lou Melluzzo, Chief Executive Officer of the Company will present

at the MicroCap Rodeo Fall Conference, to be held on Wednesday, October 16th, 2024, in New York City. The presentation will be at

2:00 PM on October 16th and will be webcast live. Interested parties can obtain more information regarding the conference at www.microcaprodeo.com.

The

information in this Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed as “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the

liability of such Section, nor shall it be deemed incorporated by reference in any filing by Air Industries under the Securities Act

of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly

incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: October 16, 2024

| |

AIR INDUSTRIES GROUP |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

|

Scott Glassman

Chief Financial Officer |

Exhibit 99.1

Air Industries Group

to Present at the MicroCap Rodeo Fall Conference

New York, NY – October 16, 2024 –

Air Industries Group ( NYSE - AIRI ), an integrated manufacturer of precision assemblies and components for mission-critical aerospace

and defense applications, and a prime contractor to the Department of Defense, announced

today that it will be participating in the MicroCap Rodeo Fall Conference, that will be held on Wednesday, October 16th, 2024, in New

York City.

Mr. Luciano (Lou) Melluzzo, CEO will be presenting

at the conference and will discuss:

| · | Recent

new contract wins |

| · | Improvement

in funded backlog |

| · | Improving

financial results. |

The presentation will be at 2:00pm ET on

October 16th and will be webcast live. Interested parties can register to watch the virtual presentation here. Management will also be

available for one-on-one meetings with approved investors on Wednesday, October 16th. More information and registration for the conference

can be found at www.microcaprodeo.com.

Air

Industries Group is a Tier 1 supplier to Original Equipment Manufacturers (OEMs), and a Prime Contractor to the U.S. Department of Defense.

Air Industries has been long established in the Long Island, NY, aerospace community, known as the “Cradle of Aviation,”

and Hartford, Connecticut’s “Aerospace Alley®”. Our facilities total over 200,000 square feet and employ approximately

185 highly skilled technicians.

About

Air Industries Group

Air

Industries’ products are currently deployed on important military aircraft, including Sikorsky helicopters, the UH-60 Black Hawk

and CH-53k King Stallion, the Lockheed Martin F-35 Lightning II (Joint Strike Fighter), the US Navy carrier-based E-2D and F-18 Hornet,

and the US Air Force F-15 Eagle and F-16 Fighting Falcon. Our jet engine components are used on many commercial and military engines,

including the Pratt & Whitney Geared Turbo Fan (GTF) jet engine, as well as Electric Boat’s Virginia-Class submarines.

About the MicroCap Rodeo Conference:

The MicroCap Rodeo Conferences stand out

as they are organized by money managers and investors, specifically for money managers and investors. This fall, executive management

teams from approximately 25 microcap companies across a diverse range of industries will be participating. Investors will have the opportunity

to harness top stock ideas for their portfolios through group presentations and 1x1 meetings, offering insights into key value drivers

and emerging trends for 2025. Additionally, the event will feature industry guest speakers and ample networking opportunities.

For more information please contact info@microcaprodeo.com

Forward Looking Statements

Certain matters discussed

in this press release are 'forward-looking statements' intended to qualify for the safe harbor from liability established by the Private

Securities Litigation Reform Act of 1995. In particular, the Company's statements regarding trends in the marketplace, future

revenues, earnings and Adjusted EBITDA, the ability to realize firm backlog and projected backlog, cost cutting measures, potential

future results and acquisitions, are examples of such forward-looking statements. The forward-looking statements are subject to numerous

risks and uncertainties, including, but not limited to, the timing of projects due to variability in size, scope and duration, the inherent

discrepancy in actual results from estimates, projections and forecasts made by management, regulatory delays, changes in government

funding and budgets, and other factors, including general economic conditions, not within the Company's control. The factors discussed

herein and expressed from time to time in the Company's filings with the Securities and Exchange Commission could cause actual results

and developments to be materially different from those expressed in or implied by such statements. The forward-looking statements are

made only as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements

to reflect subsequent events or circumstances.

Contact Information

Air Industries Group

Investor Relations

Mr. Scott Glassman

ir@airindustriesgroup.com

Exhibit 99.2

INVESTOR PRESENTATION OCTOBER 16, 2024 NYSE AMEX: AIRI A leading manufacturer of precision components and assemblies used in flight - critical military and commercial applications. www.AirIndustriesGroup.com

Except for the historical information contained herein, the matters discussed in this presentation contain forward - looking statements. The accuracy of these statements is subject to significant risks and uncertainties. Actual results could differ materially from those contained in the forward - looking statements. See the Company’s SEC filings on Forms 10 - K and 10 - Q for important information about the Company and related risks. SAFE HARBOR - FORWARD LOOKING STATEMENTS USE OF NON - GAAP FINANCIAL MEASURES This presentation includes a Non - GAAP financial measure called Adjusted EBITDA used to supplement GAAP financial information. Our definition of Adjusted EBITDA may differ from the definition used by other companies or similarly titled measures. We believe this measure is appropriate to enhance an investor’s overall understanding of our past financial performance prospects for the future. However, Adjusted EBITDA is not meant to be considered in isolation or a substitute for measures of financial performance prepared in accordance with GAAP. A reconciliation between Adjusted EBITDA and the most comparable financial information prepared in accordance with GAAP is prepared in the Appendix to this Presentation. This presentation is being made October 16, 2024. The content of this presentation contains time - sensitive information that is accurate only as of the time hereof. If any portion of this presentation is rebroadcast, retransmitted or redistributed on a later date, we will not be reviewing or updating the material that is contained herein. DATE OF PRESENTATION

Air Industries Group Overview NYSE AMEX: AIRI TAKING OFF

AIR INDUSTRIES OVERVIEW – LOCATIONS AND CAPABILITIES Ensuring the safety of our warfighters and commercial passengers since 1941. UH - 60 Blackhawk F - 18 Hornet Advanced E - 2D Hawkeye PW1000G (GTF) CH - 53K King Stallion F - 35 Lightning II (JSF) www.AirIndustriesGroup.com Strategic Locations = Access to Customers, Deep Talent Pool, Suppliers and Processors 2 Facilities 200,000 Square Feet 185 80% Military BARKHAMSTED, CT Turbine Engine Components » Jet Engine Components » Ground Power Turbines » Helicopter Assemblies » Special Processes – New Initiative! BAY SHORE, NY Complex Machining » Landing & Arresting Gear » Flight Safety Controls » Aircraft Structural Assemblies » Helicopter Assemblies

03 02 01 0 0 ESSENTIAL SUPPLIER IN THE AEROSPACE INDUSTRY We play a critical role in the supply chains of military and commercial primes, U.S government, international users, tier 1 and tier 2 integrators, as well as suppliers. We often receive Long - Term Agreements (“LTAs”) from our customers, leading us to become the exclusive supplier for certain high precision parts and assemblies. www.AirIndustriesGroup.com PRIMES SYSTEM INTEGRATORS ASSEMBLY / EQUIPMENT SUPPLIERS BUILD - TO - PRINT COMPONENTS OR SUB - ASSEMBLY SUPPLIERS TIER TIER TIER

CUSTOMERS AND END - USERS Aerospace & Defense Primes U.S. Government

KEY PROGRAMS AIRI IS VITAL TO U.S. DEFENSE AND COMMERICAL AEROSPACE UH - 60 Blackhawk F - 18 Hornet Advanced E - 2D Hawkeye PW1000G (GTF) CH - 53K King Stallion F - 35 Lightning II (JSF)

A FEW OF OUR PRODUCTS - RELIABILITY YOU CAN COUNT ON UH - 60 Blackhawk Mixer Assembly F - 18 Hornet Landing Gear E - 2D Advanced Hawkeye Main Landing Gear Strut PW1000G (GTF) Thrust Strut CH - 53K King Stallion Chaff Pod Assembly F35 Lightning II JSF NLG Steering Collar

Why Buy the Stock? And Why Now? Turning Sales Into Profits TAKING OFF

STRATEGIC PLAN - THREE PILLARS OF GROWTH The Company is successfully executing an integrated approach for organic growth through three initiatives: 1) Portfolio Expansion: • Quality, delivery performance, increased demand, have improved market share, evidenced by recently announced $110M contract extension. • Securing long - term customer agreements yields predictability and mitigates risk. • Large investment in CAP - EX enhances efficiency and competitiveness. 2) Aftermarket Strategy: • Partnered with a major DoD supplier to expand aftermarket business. This has yielded $5M in new orders at high margins. Additional proposals before customers now. • The Company announced an exclusive distribution agreement covering 17 foreign countries – a new and largely untapped market. 3) Industry Outreach: • Numerous & successful trade shows, and customer visits yielding unprecedented level of interest and demand. • We have added some of the world’s premier, Tier 1 Aerospace companies as customers.

CUSTOMER TRANSITION 2022 - 2024 Backlog reduction of nearly $9M with two legacy customers from 2022 - 2023 has been more than offset by increases in backlog with five new and legacy customers in 2024. (7,213) (1,223) 2,514 3,548 7,180 10,989 11,323 (10,000) (5,000) - 5,000 10,000 15,000 Change in Backlog - Major Customers September 2024 - December 2022 Collins LS Gov't Direct Fokker Sikosky Collins Aero NGC Sterling

IMPROVING BUSINESS DEVELOPMENT EFFORTS 0.75 0.75 0.89 0.92 1.20 1.13 1.20 1.39 0.40 0.60 0.80 1.00 1.20 1.40 1.60 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Book to Bill Ratio (TTM) More than 50% Increase over the past 12 - Months Our Book to Bill ratio (new bookings/sales) has increased by 50% in the last twelve months, and by 85% since December 2022, and is significantly above the industry standard.

IMPROVED BD EFFORTS LEADS TO GROWING BACKLOG 86,274 105,189 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Full Funded Backlog Over $ 100 Million 22% Increase Since December 2022 • Our improved bookings of new business results in a growing backlog. • Since December 2022 our full “funded” backlog, supported by confirmed customer orders, has grown by nearly $20 million or 22%. • It now exceeds $100 million.

CURRENT OPPORTUNITIES – PROSPECTS • The Company’s pipeline is full, with over $250M in outstanding bids: • Production Opportunities: $200M • Aftermarket Opportunities: $50M • While the Company does not expect to be awarded all of this business, a reasonable capture rate would move the revenue needle significantly. • The Company is also pursuing numerous other prospects for future business. • Commercial Landing Gear • Future Vertical Lift • Hypersonic Drones • Urban Air Mobility

OPERATING INCOME (LOSS) 2019 TO 9/30/2024 • Operating income is the primary measure of operating performance. Results have been highly variable. • In 2020 & 2021 varying greatly due to the COVID - 19 disruption. • In 2022 & 2023 due to customer transition. • Preliminary results for the nine months ended September are very encouraging. 328 (1,439) 2,487 (194) (295) 2019 2020 2021 2022 2023 9-Mos 24 Operating Income (Loss) Unaudited / Unreviewed

PRELIMINARY QUARTERLY & NINE MONTHS RESULTS (preliminary, unaudited / un - reviewed): THREE MONTHS SEPTEMBER • Sales – Just over $12.5 million, marginally higher than 2023 • Gross Profit and Margin - Improved significantly compared to 2023 • Operating Expense – Well controlled despite inflationary environment • Operating Loss - Reduced dramatically • EBITDA – Improved NINE MONTHS SEPTEMBER • Sales – Increased by $2M compared to 2023 • Gross Profit and Margin - Improved compared to 2023 • Operating Expense – Well controlled despite inflationary environment • Operating Loss - Reverted to profit • EBITDA – Improved significantly Revenue Gross Profit Operating Expense Operating Income EBITDA Three Months Nine Months

ATTRACTIVE SHARE PRICE MULITIPLE & VALUATION • Shares trade at an attractive valuation. A major investment bank calculates the average multiple of similar defense suppliers at 14.2X EBITDA (as of 10/02/2024) . • AIRI shares trade at 8.9X, a 37% discount. If the multiple expands to the average, it extrapolates to a price of above $ 9.00 per share, or a nearly 60% increase from recent prices. 7.5 8.0 8.6 8.9 11.1 12.0 16.5 17.4 21.3 22.3 22.9 - 5.0 10.0 15.0 20.0 25.0 30.0 1 2 3 4 5 6 7 8 9 10 11 TEV / EBITDA Multiples

Taking Off and Positioned for Growth x The Company is successfully executing it’s five - year strategic plan. x The three pillars of our growth initiative continue to solidify: x Portfolio expansion (existing customers) x New customers x Aftermarket x Strategic investments in new equipment have positioned us to win new contracts and expand our market presence x The Company is focused on financial performance and driving shareholder value. www.AirIndustriesGroup.com KEY TAKEAWAYS

The Market Supports Our Multi - Year Strategy to Grow Taking Off and Positioned for Growth

OUR GROWTH POTENTIAL IS UNLIMITED With FY 2023 net sales of $51.5 million, we have plenty of room to grow, and we are confident that we can achieve sustainable and profitable growth in 2024. We operate in the market of High Precision Machined Components with over $100B in annual spend. Based on our skills, our capabilities, and our industry assessment, we believe our addressable market in the near term is ~$6.0 billion expanding to ~$10.9 billion over the next 5 years.

FOCUS ON CORE MARKET EXPANSION Near - Term (0 - 1 year) - $4.6B Addressable www.AirIndustriesGroup.com TARGET THE DEFENSE (DLA) AFTERMARKET TARGET LEGACY COMMERCIAL CONSTRAINED MARKETS BUSINESS JET LANDING GEAR Near - Term (0 - 1 year) - $1.4B Addressable Mid - Term (1 - 3 years) - $1.6B Addressable Mid - Term (1 - 3 years) - $1.8B Addressable Mid - Term (3 - 5 years) - $1.5B Addressable

SUMMARY – WHY BUY THE STOCK? AND WHY NOW? » OPERATING RESULTS ARE IMPROVING . » OUR FUTURE IS SUPPORTED BY A GROWING BACKLOG. » GROWTH IS EVIDENT IN BOTH LEGACY AND NEW CUSTOMERS AND THE COMPANY IS ACTIVELY PURSUING PROGRAMS THAT REPRESENT THE CORE OF FUTURE FLIGHT. » THE ANNOUNCEMENT OF NEW MAJOR AWARDS IS EXPECTED IN THE NEAR FUTURE . » SHARE PRICE IS NOW STABILIZED AT NEARLY 50% HIGHER THAN EARLIER IN THE YEAR AND IS TRADING AT A LOWER MULTIPLE THAN PEERS

Thank You Air Industries Group (NYSE AMEX: AIRI)

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

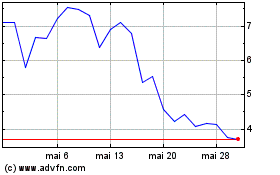

Air Industries (AMEX:AIRI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Air Industries (AMEX:AIRI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024