- Diluted EPS of $0.81, adjusted EPS1 of

$0.78

- Pre-tax income of $219.0 million, adjusted

EBITDA1 of $251.0 million

- Operating cash flow of $141.2 million, free cash flow1 of

$176.4 million

- Total assets of $333.7 billion, a

year-over-year increase of 12%

- Completed acquisitions of two U.S. RIAs

with $7.7 billion in combined assets

- Completed acquisition of Northwood Family

Office, a Canadian leader in the family office segment

- Repurchased 4.1 million shares for $59.8 million

- Paid quarterly dividend of $0.18 a share,

totalling $34.7 million

All financial amounts in Canadian dollars at

June 30, 2022, unless stated otherwise. Financial amounts for the

quarter are unaudited.

CI Financial Corp. (“CI”) (TSX: CIX, NYSE: CIXX) today released

financial results for the quarter ended June 30, 2022.

“These results validate our corporate strategy and capital

allocation policies,” said Kurt MacAlpine, CI Chief Executive

Officer. “Our expansion in wealth management in the United States

and Canada has added stability and diversification to our business,

with our U.S. operations making increasing contributions to

revenues and earnings. Despite continued volatility in capital

markets, we achieved year-over-year growth in overall EBITDA,

earnings per share and free cash flow per share.1

“While the Canadian fund industry had total redemptions of $19

billion during the quarter, our flows in Canadian retail asset

management were relatively stable, supported by improving overall

investment performance and several successful product launches,”

Mr. MacAlpine said.

“We continue to advance our U.S. wealth management strategy,

both through acquisitions of selected, high-quality RIAs and

through an array of initiatives to capture synergies, expand our

services and support to clients, and foster organic growth. The

success of these programs can be seen in the attractive, growing

margins of our U.S. business.”

Operating and financial data

highlights

[millions of dollars, except share

amounts]

As of and for the quarters

ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Total AUM and Client Assets:

Asset Management AUM

116,065

136,271

144,247

139,380

138,187

Canada Wealth Management assets

74,128

78,957

80,633

76,859

75,521

U.S. Wealth Management assets

143,520

145,768

151,339

96,974

83,764

Total assets

333,712

360,996

376,219

313,213

297,472

Asset Management Net Inflows:

Retail

(381)

(861)

142

684

530

Institutional

(3,203)

(264)

(331)

(126)

(360)

Australia

(122)

(305)

82

159

(33)

Closed Business

(160)

(203)

(195)

(146)

(194)

U.S. Asset Management

(195)

402

260

250

413

Total

(4,060)

(1,231)

(42)

821

356

IFRS

Results

Net income attributable to

shareholders

156.2

138.1

123.7

43.8

117.6

Diluted earnings per share

0.81

0.70

0.62

0.22

0.57

Pretax income

219.0

185.8

175.1

82.4

166.6

Pretax margin

38.6 %

29.3 %

28.3 %

15.9 %

31.7 %

Operating cash flow before the change in

operating assets and liabilities

141.2

207.7

179.2

135.2

158.1

Adjusted

Results

Adjusted net income

149.1

166.8

171.0

159.2

153.0

Adjusted diluted earnings per share

0.78

0.85

0.86

0.79

0.74

Adjusted EBITDA

251.0

272.9

277.2

258.1

242.3

Adjusted EBITDA margin

44.5 %

46.5 %

47.7 %

47.0 %

48.4 %

Free cash flow

176.4

201.6

187.1

180.9

164.1

Average shares outstanding

191,151,896

196,111,771

196,816,227

199,321,002

203,039,536

Ending shares outstanding

189,037,762

192,987,082

197,422,270

197,443,135

201,327,517

Total debt

3,688

3,530

3,776

3,408

3,350

Net debt

3,538

3,352

3,453

2,655

2,461

Net debt to adjusted EBITDA

3.5

3.0

3.1

2.6

2.5

- Free cash flow, net debt, adjusted net income, adjusted

earnings per share and adjusted EBITDA are not standardized

earnings measures prescribed by IFRS. For further information, see

“Non-IFRS Measures” note below.

Financial highlights

Net income grew to $156.2 million in the quarter from $138.1

million in the first quarter. Excluding non-operating items,

adjusted net income declined to $149.1 million in the quarter from

$166.8 million in the first quarter of 2022 as higher earnings in

CI’s U.S. and Canadian wealth businesses were more than offset by

lower earnings from the Asset Management segment due to the

pressure on global financial assets.

Second quarter total net revenues declined 10.6% to $566.7

million in the quarter from $633.8 million in the first quarter of

2022. Excluding non-operating items, adjusted total net revenue

fell 3.9% to $598.3 million, primarily driven by lower revenues

from the Asset Management segment due to lower average AUM.

Second quarter total expenses declined 22.4% to $347.7 million

in the quarter from $448.0 million in the first quarter of 2022.

Excluding non-operating items, adjusted total expenses were

essentially unchanged at $386.0 million, reflecting disciplined

cost controls in a challenging operating environment, partially

offset by the impact of acquisitions that closed during the

quarter.

Capital allocation

In the second quarter of 2022, CI repurchased 4.1 million shares

at a cost of $59.8 million, for an average cost of $14.67 per

share, and paid $34.7 million in dividends at a rate of $0.18 per

share.

The Board of Directors declared a quarterly dividend of $0.18

per share, payable on January 13, 2023 to shareholders of record on

December 30, 2022. The annual dividend rate of $0.72 per share

represented a yield of 4.9% on CI’s closing share price of $14.67

on August 10, 2022.

Second quarter business highlights

- CI announced its intention to sell up to 20% of its U.S. wealth

management business via a U.S. initial public offering (“IPO”). CI

stated that it intends to use the net proceeds from the IPO to pay

down debt, and that a final decision on the IPO size, conditions

and timing is pending and will be subject to market

conditions.

- CI completed the acquisitions of two registered investment

advisors (“RIAs”): Corient Capital Partners, LLC, of Newport Beach,

California, which serves ultra-high-net-worth individuals and

families across the United States, and Galapagos Partners, LP of

Houston, a multi-family office serving wealthy families and

individuals. Both transactions closed on April 29, 2022.

- CI Private Wealth US, LLC applied for a charter to establish

and operate a South Dakota trust company, which, when granted, will

allow CI’s wealth management business to offer administrative trust

solutions.

- CI completed the acquisition of Toronto-based Northwood Family

Office Ltd., giving CI a leading presence in the country’s

multi-family office segment. The transaction was completed on April

1, 2022.

- In the latest initiatives to modernize CI’s asset management

business, CI Global Asset Management (“CI GAM”) continued to

enhance and broaden its product lineup. The firm introduced a

private infrastructure investment solution managed by HarbourVest

Partners, a global leader in private markets investing. CI GAM also

launched CI Galaxy Blockchain ETF, CI Galaxy Metaverse ETF and CI

Floating Rate Income Fund (ETF Series).

- Additionally, CI GAM claimed compliance with the Global

Investment Performance Standards (“GIPS®”) from CFA Institute. The

GIPS standards are universal and voluntary standards based on the

fundamental principles of full disclosure and fair representation

of investment performance.

- CI’s success in implementing innovative technologies and

processes across its organization was recognized through a 2022

Digital Transformation Award (Large Private Sector category) from

IT World Canada.

- CI joint venture Axia Real Assets launched a new U.S. real

estate fund, the Axia U.S. Grocery Net Lease Fund II LP, through a

private placement. The investment vehicle will be used to acquire a

portfolio of dominant net lease grocery real estate assets across

the U.S.

Analysts’ conference call

CI will hold a conference call with analysts today at 9:00 a.m.

EDT, led by Chief Executive Officer Kurt MacAlpine and Chief

Financial Officer Amit Muni. A live webcast of the call and slide

presentation can be accessed here, or through the Investor

Relations section of CI’s website.

Alternatively, investors may listen to the discussion through

the following numbers (access code: 884850):

- Canada toll-free: 1-833-950-0062

- United States toll-free: 1-844-200-6205

- United States (New York local): 1-646-904-5544

- All other locations: 1-929-526-1599.

A recording of the webcast will be archived on CI’s Investor

Relations site.

About CI Financial

CI Financial Corp. is an integrated global wealth and asset

management company. CI’s primary asset management businesses are CI

Global Asset Management (CI Investments Inc.) and GSFM Pty Ltd.,

and it operates in Canadian wealth management through CI Assante

Wealth Management (Assante Wealth Management (Canada) Ltd.), CI

Private Counsel LP, Aligned Capital Partners Inc., Northwood Family

Office Ltd., CI Direct Investing (WealthBar Financial Services

Inc.), and CI Investment Services Inc.

CI’s U.S. wealth management businesses consist of Barrett Asset

Management, LLC, Balasa Dinverno Foltz LLC, Bowling Portfolio

Management LLC, Brightworth, LLC, BRR OpCo, LLC (Budros, Ruhlin

& Roe), The Cabana Group, LLC, Corient Capital Partners, LLC,

CPWM, LLC (Columbia Pacific Wealth Management), Columbia Pacific

Advisors, LLC, Congress Wealth Management LLC, Dowling &

Yahnke, LLC, Doyle Wealth Management, LLC, Galapagos Partners, LP,

GLASfunds, LLC, Gofen & Glossberg, LLC, Matrix Capital

Advisors, LLC, McCutchen Group LLC, OCM Capital Partners, LLC,

Portola Partners Group LLC, Radnor Financial Advisors, LLC,

RegentAtlantic Capital, LLC, The Roosevelt Investment Group, LLC,

RGT Wealth Advisors, LLC, R.H. Bluestein & Co., Segall Bryant

& Hamill, LLC, Stavis & Cohen Private Wealth, LLC, and

Surevest LLC.

CI is listed on the Toronto Stock Exchange under CIX and on the

New York Stock Exchange under CIXX. Further information is

available at www.cifinancial.com.

Commissions, trailing commissions, management fees and expenses

all may be associated with an investment in mutual funds and

exchange-traded funds (ETFs). Please read the prospectus before

investing. Important information about mutual funds and ETFs is

contained in their respective prospectus. Mutual funds and ETFs are

not guaranteed; their values change frequently, and past

performance may not be repeated. You will usually pay brokerage

fees to your dealer if you purchase or sell units of an ETF on

recognized Canadian exchanges. If the units are purchased or sold

on these Canadian exchanges, investors may pay more than the

current net asset value when buying units of the ETF and may

receive less than the current net asset value when selling

them.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition and

its intention to conduct an IPO of its US wealth management

business. Forward-looking statements are typically identified by

words such as “believe”, “expect”, “foresee”, “forecast”,

“anticipate”, “intend”, “estimate”, “goal”, “plan” and “project”

and similar references to future periods, or conditional verbs such

as “will”, “may”, “should”, “could” or “would”. These statements

are not historical facts but instead represent management beliefs

regarding future events, many of which by their nature are

inherently uncertain and beyond management’s control. Although

management believes that the expectations reflected in such

forward-looking statements are based on reasonable assumptions,

such statements involve risks and uncertainties. The material

factors and assumptions applied in reaching the conclusions

contained in these forward-looking statements include that CI will

proceed with the IPO, that all outstanding acquisitions will be

completed and their asset levels will remain stable, that the

investment fund industry will remain stable and that interest rates

will remain relatively stable. Factors that could cause actual

results to differ materially from expectations include, among other

things, general economic and market conditions, including interest

and foreign exchange rates, global financial markets, the risk that

the IPO may not occur in its expected timeframe or at all, changes

in government regulations or in tax laws, industry competition,

technological developments and other factors described or discussed

in CI’s disclosure materials filed with applicable securities

regulatory authorities from time to time. The foregoing list is not

exhaustive and the reader is cautioned to consider these and other

factors carefully and not to place undue reliance on

forward-looking statements. Other than as specifically required by

applicable law, CI undertakes no obligation to update or alter any

forward-looking statement after the date on which it is made,

whether to reflect new information, future events or otherwise.

This communication is provided as a general source of

information and should not be considered personal, legal,

accounting, tax or investment advice, or construed as an

endorsement or recommendation of any entity or security discussed.

Individuals should seek the advice of professionals, as

appropriate, regarding any particular investment. Investors should

consult their professional advisors prior to implementing any

changes to their investment strategies.

CI Global Asset Management is a registered business name of CI

Investments Inc.

CONSOLIDATED STATEMENT OF

INCOME

For the three-month period ended June

30

2022

2021

[in thousands of Canadian dollars, except

per share amounts]

$

$

REVENUE

Canada asset management fees

404,279

441,139

Trailer fees and deferred sales

commissions

(123,952)

(137,685)

Net asset management fees

280,327

303,454

Canada wealth management fees

130,103

119,901

U.S. wealth management fees

168,949

71,400

Other revenues

21,210

17,982

Foreign exchange gains (losses)

(32,864)

8,174

Other gains (losses)

(1,069)

3,830

Total net revenues

566,656

524,741

EXPENSES

Selling, general and administrative

239,521

173,936

Advisor and dealer fees

99,711

93,412

Interest and lease finance

36,235

24,249

Amortization and depreciation

11,909

9,702

Amortization of intangible assets from

acquisitions

27,436

11,669

Transaction, integration, restructuring

and legal settlements

4,587

17,543

Change in fair value of contingent

consideration

(74,977)

22,410

Other

3,230

5,258

Total expenses

347,652

358,179

Income before income taxes

219,004

166,562

Provision for (recovery of) income

taxes

Current

46,835

54,764

Deferred

13,901

(6,614)

60,736

48,150

Net income for the period

158,268

118,412

Net income attributable to

non-controlling interests

2,057

792

Net income attributable to

shareholders

156,211

117,620

Basic earnings per share attributable

to shareholders

$0.82

$0.58

Diluted earnings per share attributable

to shareholders

$0.81

$0.57

Other comprehensive income (loss), net

of tax

Exchange differences on translation of

foreign operations

17,662

(10,475)

Total other comprehensive income (loss),

net of tax

17,662

(10,475)

Comprehensive income for the

period

175,930

107,937

Comprehensive income attributable to

non-controlling interests

2,996

792

Comprehensive income attributable to

shareholders

172,934

107,145

CONSOLIDATED BALANCE SHEET

As at

As at

June 30, 2022

December 31, 2021

[in thousands of Canadian dollars]

$

$

ASSETS

Current

Cash and cash equivalents

154,844

230,779

Client and trust funds on deposit

1,462,148

1,199,904

Investments

37,981

131,772

Accounts receivable and prepaid

expenses

247,057

272,962

Income taxes receivable

12,556

3,607

Total current assets

1,914,586

1,839,024

Capital assets, net

54,687

52,596

Right-of-use assets

140,266

142,606

Intangibles

6,471,980

6,185,237

Deferred income taxes

45,887

56,901

Other assets

439,440

383,187

Total assets

9,066,846

8,659,551

LIABILITIES AND EQUITY

Current

Accounts payable and accrued

liabilities

283,796

369,081

Current portion of provisions and other

financial liabilities

321,062

572,432

Redeemable non-controlling interests

598,130

—

Dividends payable

68,054

71,072

Client and trust funds payable

1,467,614

1,202,079

Income taxes payable

12,841

19,035

Current portion of long-term debt

314,573

444,486

Current portion of lease liabilities

20,390

20,216

Total current liabilities

3,086,460

2,698,401

Long-term debt

3,373,540

3,331,552

Provisions and other financial

liabilities

248,414

379,641

Deferred income taxes

484,511

480,777

Lease liabilities

150,921

153,540

Total liabilities

7,343,846

7,043,911

Equity

Share capital

1,742,376

1,810,153

Contributed surplus

35,374

28,368

Deficit

(72,182)

(226,715)

Accumulated other comprehensive loss

(12,629)

(23,289)

Total equity attributable to the

shareholders of the Company

1,692,939

1,588,517

Non-controlling interests

30,061

27,123

Total equity

1,723,000

1,615,640

Total liabilities and equity

9,066,846

8,659,551

STATEMENT OF CASH FLOWS

For the three-month period ended June

30

2022

2021

[in thousands of Canadian dollars]

$

$

OPERATING ACTIVITIES (*)

Net income for the period

158,268

118,412

Add (deduct) items not involving cash

Other (gains) losses

1,069

(5,307)

Change in fair value of contingent

consideration

(74,977)

22,410

Contingent consideration recorded as

compensation

670

939

Recognition of vesting of redeemable

non-controlling interests

(3,420)

—

Equity-based compensation

6,325

6,660

Amortization and depreciation

39,345

21,371

Deferred income taxes

13,901

(6,614)

Loss on repurchases of long-term debt

—

212

Cash provided by operating activities

before net change in operating assets and liabilities

141,181

158,083

Net change in operating assets and

liabilities

22,929

(27,989)

Cash provided by operating

activities

164,110

130,094

INVESTING ACTIVITIES

Purchase of investments

(78)

(1,384)

Proceeds on sale of investments

71

6,194

Additions to capital assets

(5,553)

(1,255)

Decrease (increase) in other assets

13,287

(41,780)

Additions to intangibles

(2,713)

(2,113)

Cash paid to settle acquisition

liabilities

(38,626)

(45,468)

Acquisitions, net of cash acquired

(155,828)

(371,958)

Cash used in investing

activities

(189,440)

(457,764)

FINANCING ACTIVITIES

Repayment of long-term debt

—

(16,514)

Issuance of long-term debt

85,000

1,075,460

Repurchase of long-term debt

—

(4,779)

Repurchase of share capital

(59,248)

(132,043)

Payment of lease liabilities

(5,110)

(4,203)

Issuance of redeemable non-controlling

interest

9,577

—

Net distributions to non-controlling

interest

(1,348)

(580)

Dividends paid to shareholders

(34,748)

(36,728)

Cash provided by (used in) financing

activities

(5,877)

880,613

Net increase (decrease) in cash and

cash equivalents during the period

(31,207)

552,943

Cash and cash equivalents, beginning of

period

186,051

248,394

Cash and cash equivalents, end of

period

154,844

801,337

(*) Included in operating activities are

the following:

Interest paid

55,574

30,281

Income taxes paid

54,951

46,401

ASSETS UNDER MANAGEMENT AND NET

FLOWS

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning AUM

136.3

144.2

139.4

138.2

132.6

Gross inflows

4.8

4.9

5.2

5.1

6.1

Gross outflows

8.7

6.6

5.5

4.5

6.1

Net inflows/(outflows)

(3.9)

(1.6)

(0.3)

0.6

(0.1)

Acquisitions

—

—

—

—

0.2

Market move and FX

(16.3)

(6.3)

5.2

0.6

5.5

Ending AUM

116.1

136.3

144.2

139.4

138.2

Proprietary AUM

30.8

34.5

36.2

34.7

34.5

Non-proprietary AUM

85.3

101.8

108.0

104.7

103.7

Average assets under management

125.4

138.2

143.0

141.1

135.9

Annualized organic growth

(11.4) %

(4.6) %

(0.9) %

1.6 %

(0.2) %

Gross management fee/average AUM

1.31 %

1.30 %

1.30 %

1.31 %

1.31 %

Net management fee/average AUM

0.89 %

0.88 %

0.88 %

0.88 %

0.88 %

Net

Inflows

Retail

(0.4)

(0.9)

0.1

0.7

0.5

Institutional

(3.2)

(0.3)

(0.3)

(0.1)

(0.4)

Closed business

(0.2)

(0.2)

(0.2)

(0.1)

(0.2)

Total Canada net inflows

(3.7)

(1.3)

(0.4)

0.4

—

Australia

(0.1)

(0.3)

0.1

0.2

—

Total net inflows/(outflows)

(3.9)

(1.6)

(0.3)

0.6

(0.1)

RETAIL (ex Closed Business)

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning AUM

108.4

114.6

110.4

109.1

103.9

Net Flows

(0.4)

(0.9)

0.1

0.7

0.5

Market Move / FX

(12.9)

(5.3)

4.1

0.6

4.5

Acquisitions

___

___

___

0.2

___

Ending AUM

95.1

108.4

114.6

110.4

109.1

Average AUM

101.4

109.6

113.8

111.8

106.8

INSTITUTIONAL

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning AUM

12.7

13.3

13.0

13.0

12.7

Net Flows

(3.2)

(0.3)

0.3

(0.1)

(0.4)

Market Move / FX

(1.1)

(0.3)

0.6

0.1

0.7

Acquisitions

___

___

___

___

___

Ending AUM

8.4

12.7

13.3

13.0

13.0

Average AUM

10.2

12.9

13.2

13.3

13.0

AUSTRALIA

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning AUM

6.6

7.3

7.0

6.9

7.1

Net Flows

(0.1)

(0.3)

0.1

0.1

(0.0)

Market Move / FX

(1.4)

(0.4)

0.2

0.0

(0.2)

Acquisitions

___

___

___

___

___

Ending AUM

5.1

6.6

7.3

7.0

6.9

Average AUM

5.8

7.0

7.1

7.0

7.1

CLOSED BUSINESS

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning AUM

8.6

9.1

9.0

9.1

8.9

Net Flows

(0.2)

(0.2)

(0.2)

(0.2)

(0.2)

Market Move / FX

(0.9)

(0.3)

0.3

(0.0)

0.4

Acquisitions

___

___

___

___

___

Ending AUM

7.5

8.6

9.1

8.9

9.1

Average AUM

8.0

8.7

9.0

9.0

9.0

AUM BY ASSET CLASS

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Balanced

50.9

59.4

62.1

60.3

60.3

Equity

41.4

49.3

52.3

50.1

49.8

Fixed income

11.7

13.1

14.2

14.1

13.9

Alternatives

3.6

4.9

5.7

5.0

4.3

Cash/Other

3.4

3.0

2.7

2.8

2.9

Total Canada asset management

111.0

129.7

137.0

132.4

131.3

Australia

5.1

6.6

7.3

7.0

6.9

Total asset management segment

116.1

136.3

144.2

139.4

138.2

CANADA WEALTH MANAGEMENT CLIENT

ASSETS

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning client assets

79.0

80.6

76.9

75.5

71.1

Acquisitions

2.4

—

—

—

—

Net flows and market move

(7.2)

(1.7)

3.8

1.3

4.5

Ending client assets

74.1

79.0

80.6

76.9

75.5

Average client assets

77.7

79.0

78.9

77.0

73.1

Wealth management fees/average client

assets

0.91 %

0.95 %

0.93 %

0.94 %

0.91 %

U.S. WEALTH MANAGEMENT CLIENT

ASSETS

[billions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Beginning billable client assets

141.2

146.4

96.1

82.9

30.7

Acquisitions

7.1

1.1

49.3

10.1

49.5

Net flows and market move

(9.5)

(6.3)

1.0

3.1

2.7

Ending billable client assets

138.8

141.2

146.4

96.1

82.9

Unbillable client assets

4.8

4.6

4.9

0.9

0.8

Total client assets

143.5

145.8

151.3

97.0

83.8

Fees/beginning billable client assets1

0.48 %

0.46 %

0.50 %

0.52 %

0.71 %

- 2Q/21 adjusted for the timing of Segall Bryant & Hamill

acquisition.

NON-IFRS MEASURES

In an effort to provide additional information regarding our

results as determined by IFRS, we also disclose certain non-IFRS

information which we believe provides useful and meaningful

information. Our management reviews these non-IFRS financial

measurements when evaluating our financial performance and results

of operations; therefore, we believe it is useful to provide

information with respect to these non-IFRS measurements so as to

share this perspective of management. Non-IFRS measurements do not

have any standardized meaning, do not replace nor are superior to

IFRS financial measurements and may not be comparable to similar

measures presented by other companies. The non-IFRS financial

measurements include:

- Adjusted net income and adjusted basic and diluted earnings per

share

- Adjusted EBITDA and adjusted EBITDA margin

- Free cash flow

- Net debt.

These non-IFRS measurements exclude the following revenues and

expenses which we believe allows investors a consistent way to

analyze our financial performance, allows for better analysis of

core operating income and business trends and permits comparisons

of companies within the industry, normalizing for different

financing methods and levels of taxation:

- gains or losses related to foreign currency fluctuations on our

cash balances

- costs related to our acquisitions including:

- amortization of intangible assets

- change in fair value of contingent consideration

- related advisory fees

- contingent consideration classified as compensation per

IFRS

- restructuring charges including organizational expenses for the

establishment of CIPW

- legal provisions for a class action related to market

timing

- certain gains or losses in assets and investments

- costs related to issuing or retiring debt obligations

- expenses associated with CIPW redeemable units.

Further explanations of these Non-IFRS measures can be found in

the “Non-IFRS Measures” section of Management’s Discussion and

Analysis dated August 11, 2022 available on SEDAR at www.sedar.com

or at www.cifinancial.com.

ADJUSTED NET INCOME AND ADJUSTED

EARNINGS PER SHARE

[millions of dollars, except per share

amounts]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Jun. 30, 2021

Net Income

158.3

137.5

118.4

Amortization of intangible assets from

acquisitions

27.4

24.1

12.0

Change in fair value of contingent

consideration

(75.0)

3.1

22.4

Contingent consideration recorded as

compensation

0.7

18.2

0.9

Non-controlling interest

reclassification

0.9

0.9

—

CIPW adjustments

3.1

13.2

—

FX (gains)/losses

32.9

(11.5)

(8.2)

Transaction, integration, restructuring

and legal

4.6

3.8

17.5

Other (gains)/losses

(1.2)

—

(1.4)

Bond redemption costs

—

—

0.2

Total adjustments1

(6.7)

51.7

43.6

Tax effect of adjustments

5.6

(11.5)

(8.2)

Less: Non-controlling interest

8.1

10.9

0.8

Adjusted net income

149.1

166.8

153.0

Adjusted earnings per share

0.78

0.85

0.75

Adjusted diluted earnings per

share

0.78

0.85

0.74

- Adjustment effects on income statement line items: bond

redemption costs are included in other expense, CIPW adjustments

and contingent consideration recorded as compensation are included

in SG&A, amortization of intangible assets from acquisitions,

change in fair value of contingent consideration, FX

(gains)/losses, other (gains)/losses, and bond redemption costs are

included in the line items of the same description.

EBITDA, ADJUSTED EBITDA AND ADJUSTED

EBITDA MARGIN

[millions of dollars, except per share

amounts]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Jun. 30, 2021

Pretax income

219.0

185.8

166.6

Amortization of intangible assets from

acquisitions

27.4

24.1

12.1

Depreciation and other amortization

11.9

11.4

9.7

Interest and lease finance expense

36.2

35.9

24.2

EBITDA

294.6

257.1

212.6

Change in fair value of contingent

consideration

(75.0)

3.1

22.4

Contingent consideration recorded as

compensation

0.7

18.2

0.9

Non-controlling interest

reclassification

0.9

0.9

—

CIPW adjustments

3.1

13.2

—

FX (gains)/losses

32.9

(11.5)

(8.2)

Transaction, integration, restructuring

and legal

4.6

3.8

17.5

Other (gains)/losses

(1.2)

—

(1.4)

Bond redemption costs

—

—

0.2

Total adjustments

(34.1)

27.7

31.6

Non-controlling interest

9.5

11.9

1.9

Adjusted EBITDA

251.0

272.9

242.3

Reported net revenue

566.7

633.8

524.7

Less: FX gains/(losses)

(32.9)

11.5

8.2

Less: Non-Operating Other

gains/(losses)

1.2

—

1.4

Less: NCI revenues

34.8

35.5

15.0

Adjusted net revenue

563.5

586.8

500.2

Adjusted EBITDA margin

44.5 %

46.5 %

48.4 %

FREE CASH FLOW

[millions of dollars]

Quarters ended

Jun. 30, 2022

Mar. 31, 2022

Jun. 30, 2021

Cash provided by operating activities

164.1

154.8

130.1

Net change in operating assets and

liabilities

(22.9)

52.9

28.1

Operating cash flow before the change

in operating assets and liabilities

141.2

207.7

158.1

FX (gains)/losses

32.9

(11.5)

(8.2)

Transaction, integration, restructuring

and legal

4.6

3.8

17.5

Other (gains)/losses

—

—

—

Total adjustments

37.5

(7.7)

9.3

Tax effect (recovery) of adjustments

(5.7)

1.2

(1.4)

Less: Non-controlling interest

(3.4)

(0.4)

1.9

Free cash flow

176.4

201.6

164.1

NET DEBT

Quarters ended

[millions of dollars]

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Current portion of long-term debt

314.6

225.3

444.5

74.2

—

Long-term debt

3,373.5

3,304.7

3,331.6

3,334.2

3,350.2

3,688.1

3,530.0

3,776.0

3,408.4

3,350.2

Less:

Cash and short-term investments

154.8

186.1

230.8

653.9

801.3

Marketable securities

18.1

20.3

116.9

122.5

121.1

Add:

Regulatory capital and non-controlling

interests

22.4

28.8

25.0

23.1

33.4

Net Debt

3,537.5

3,352.4

3,453.4

2,655.1

2,461.2

Adjusted EBITDA

251.0

272.9

277.2

258.1

242.3

Adjusted EBITDA, annualized

1,006.9

1,106.6

1,099.8

1,024.1

971.9

Gross leverage (Gross debt/Annualized

adjusted EBITDA)

3.7

3.2

3.4

3.3

3.4

Net leverage (Net debt/Annualized adjusted

EBITDA)

3.5

3.0

3.1

2.6

2.5

SUMMARY OF QUARTERLY RESULTS

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Revenues

Asset management fees

404.3

437.6

464.9

460.9

441.1

404.3

437.6

464.9

460.9

441.1

Trailer fees and deferred sales

commissions

(124.0)

(135.3)

(143.6)

(143.4)

(137.7)

(124.0)

(135.3)

(143.6)

(143.4)

(137.7)

Net asset management fees

280.3

302.3

321.3

317.5

303.5

280.3

302.3

321.3

317.5

303.5

Canada wealth management fees

130.1

138.2

134.9

132.5

119.9

130.1

138.2

134.9

132.5

119.9

U.S. wealth management fees

168.9

164.5

120.9

108.1

71.4

168.9

164.5

120.9

108.1

71.4

Other revenues

21.2

21.6

27.3

11.2

18.0

21.2

21.6

27.3

11.2

18.0

FX gains/(losses)

(32.9)

11.5

3.1

(50.3)

8.2

—

—

—

—

—

Other gains/(losses)

(1.1)

(4.4)

11.9

(1.1)

3.8

(2.3)

(4.4)

(4.9)

(1.1)

2.5

Total net revenues

566.7

633.8

619.3

517.9

524.7

598.3

622.3

599.4

568.2

515.2

Expenses

Selling, general & administrative

239.5

259.6

214.6

201.9

173.9

235.7

228.2

212.5

197.7

173.0

Advisor and dealer fees

99.7

106.9

104.8

103.4

93.4

99.7

106.9

104.8

103.4

93.4

Other

3.2

3.2

5.7

6.5

5.3

2.4

2.4

5.7

6.5

5.0

Interest and lease finance expense

36.2

35.9

32.5

31.6

24.2

36.2

35.9

32.5

31.6

24.2

Depreciation and other amortization

11.9

11.4

10.9

10.3

9.7

11.9

11.4

10.4

10.0

9.4

Amortization of intangible assets from

acquisitions

27.4

24.1

18.2

16.4

11.7

—

—

—

—

—

Transaction, integration, restructuring

and legal

4.6

3.8

13.6

3.9

17.5

—

—

—

—

—

Change in fair value of contingent

consideration

(75.0)

3.1

43.9

61.4

22.4

—

—

—

—

—

Total expenses

347.7

448.0

444.2

435.5

358.2

386.0

384.8

365.9

349.2

305.1

Pretax income

219.0

185.8

175.1

82.4

166.6

212.3

237.5

233.4

219.0

210.1

Income tax expense

60.7

48.3

51.3

37.0

48.2

55.1

59.7

62.5

58.1

56.4

Net income

158.3

137.5

123.7

45.4

118.4

157.2

177.8

171.0

160.9

153.7

Non-controlling interest

2.1

(0.6)

—

1.6

0.8

8.1

10.9

—

1.6

0.8

Net income attributable to

shareholders

156.2

138.1

123.7

43.8

117.6

149.1

166.8

171.0

159.2

153.0

Basic earnings per share

0.82

0.70

0.63

0.22

0.58

0.78

0.85

0.87

0.80

0.75

Diluted earnings per share

0.81

0.70

0.62

0.22

0.57

0.78

0.85

0.86

0.79

0.74

RESULTS OF OPERATIONS – ASSET

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Revenues

Asset management fees

408.9

442.5

469.6

465.6

445.5

408.9

442.5

469.6

465.6

445.5

Trailer fees and deferred sales

commissions

(131.9)

(143.9)

(152.6)

(152.4)

(146.3)

(131.9)

(143.9)

(152.6)

(152.4)

(146.3)

Net asset management fees

277.0

298.6

316.9

313.2

299.3

277.0

298.6

316.9

313.2

299.3

Other revenues

5.6

10.2

19.9

3.2

12.2

5.6

10.2

19.9

3.2

12.2

FX gains/(losses)

(32.8)

11.4

(1.4)

(19.0)

1.2

—

—

—

—

—

Other gains/(losses)

(1.1)

(4.4)

12.0

(1.1)

3.8

(2.3)

(4.4)

(4.8)

(1.1)

2.5

Total net revenues

248.7

315.8

347.5

296.3

316.5

280.2

304.4

332.1

315.3

313.9

Expenses

Selling, general & administrative

97.3

96.8

108.7

109.6

104.9

97.3

96.8

108.7

109.6

104.9

Other

—

—

(0.5)

1.6

0.2

—

—

(0.5)

1.6

0.2

Interest and lease finance expense

1.0

1.0

0.5

0.5

0.6

1.0

1.0

0.5

0.5

0.6

Depreciation and other amortization

5.0

5.0

5.4

5.5

5.5

5.0

5.0

5.4

5.5

5.5

Amortization of intangible assets from

acquisitions

0.6

0.6

0.6

0.6

0.6

—

—

—

—

—

Transaction, integration, restructuring

and legal

2.3

(0.9)

10.4

0.4

14.6

—

—

—

—

—

Change in fair value of contingent

consideration

(3.9)

4.0

14.2

1.9

10.0

—

—

—

—

—

Total expenses

102.3

106.5

139.3

120.2

136.4

103.3

102.8

114.1

117.2

111.1

Pretax income

146.4

209.3

208.1

176.1

180.1

176.9

201.6

218.0

198.1

202.8

Non-IFRS adjustments

Pretax income

146.4

209.3

208.1

176.1

180.1

176.9

201.6

218.0

198.1

202.8

Amortization of intangible assets from

acquisitions

0.6

0.6

0.6

0.6

0.6

—

—

—

—

—

Depreciation and other amortization

5.0

5.0

5.4

5.5

5.5

5.0

5.0

5.4

5.5

5.5

Interest and lease finance expense

1.0

1.0

0.5

0.5

0.6

1.0

1.0

0.5

0.5

0.6

EBITDA

153.0

215.9

214.7

182.7

186.7

183.0

207.6

223.9

204.1

208.8

Contingent consideration recorded as

compensation (included in SG&A)

(3.9)

4.0

14.2

1.9

10.0

—

—

—

—

—

FX (gains)/losses

32.8

(11.4)

1.4

19.0

(1.2)

—

—

—

—

—

Transaction, integration, restructuring

and legal

2.3

(0.9)

10.4

0.4

14.6

—

—

—

—

—

Other (gains)/losses

(1.2)

—

(16.8)

—

(1.4)

—

—

—

—

—

Total adjustments

30.0

(8.3)

9.2

21.4

22.1

—

—

—

—

—

Less: Non-controlling interest

0.3

0.4

0.1

0.5

0.2

0.3

0.4

0.1

0.5

0.2

Adjusted EBITDA

182.7

207.2

223.8

203.6

208.6

182.7

207.2

223.8

203.6

208.6

RESULTS OF OPERATIONS – CANADA WEALTH

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Revenues

Canada wealth management fees

175.6

185.7

184.3

181.7

166.5

175.6

185.7

184.3

181.7

166.5

Other revenues

21.3

17.1

16.0

14.8

13.9

21.3

17.1

16.0

14.8

13.9

FX gains/(losses)

—

0.1

0.8

0.7

0.7

—

—

—

—

—

Other gains/(losses)

—

—

(0.1)

—

—

—

—

(0.1)

—

—

Total net revenues

196.9

202.9

201.1

197.2

181.1

196.9

202.8

200.3

196.5

180.4

Expenses

Selling, general & administrative

45.5

41.4

39.9

37.8

35.7

45.3

41.4

39.9

37.8

35.7

Advisor and dealer fees

135.9

145.6

145.2

143.5

131.3

135.9

145.6

145.2

143.5

131.3

Other

2.6

2.9

3.2

1.8

1.3

1.7

2.0

3.2

1.8

1.3

Interest and lease finance expense

(0.1)

0.2

0.2

0.2

0.1

(0.1)

0.2

0.2

0.2

0.1

Depreciation and other amortization

2.8

2.5

2.3

2.4

2.5

2.8

2.5

2.3

2.4

2.5

Amortization of intangible assets from

acquisitions

2.1

1.6

1.5

1.7

1.3

—

—

—

—

—

Transaction, integration, restructuring

and legal

0.4

0.8

0.1

0.1

—

—

—

—

—

—

Change in fair value of contingent

consideration

(0.6)

—

—

—

—

—

—

—

—

—

Total expenses

188.5

195.0

192.6

187.5

172.3

185.6

191.7

191.0

185.7

171.0

Pretax income

8.4

7.9

8.5

9.7

8.8

11.4

11.1

9.3

10.8

9.5

Non-IFRS adjustments

Pretax income

8.4

7.9

8.5

9.7

8.8

11.4

11.1

9.3

10.8

9.5

Amortization of intangible assets from

acquisitions

2.1

1.6

1.6

1.8

1.4

—

—

0.1

0.1

0.1

Depreciation and other amortization

2.8

2.5

2.3

2.4

2.5

2.8

2.5

2.3

2.4

2.5

Interest and lease finance expense

(0.1)

0.2

0.2

0.2

0.1

(0.1)

0.2

0.2

0.2

0.1

EBITDA

13.1

12.1

12.6

14.0

12.8

14.0

13.8

11.9

13.5

12.2

Change in fair value of contingent

consideration

(0.6)

—

—

—

—

—

—

—

—

—

Contingent consideration recorded as

compensation

0.1

—

—

—

—

—

—

—

—

—

CIPW adjustments (included in

SG&A)

0.1

—

—

—

—

—

—

—

—

—

FX (gains)/losses

—

(0.1)

(0.8)

(0.7)

(0.7)

—

—

—

—

—

Transaction, integration, restructuring

and legal

0.4

0.8

0.1

0.1

—

—

—

—

—

—

NCI reclassification (included in

Other)

0.9

0.9

—

—

—

—

—

—

—

—

Total adjustments

0.8

1.6

(0.7)

(0.6)

(0.6)

—

—

—

—

—

Less: Non-controlling interest

1.0

0.9

(1.5)

0.7

0.5

1.0

0.9

(1.5)

0.7

0.5

Adjusted EBITDA

13.0

12.9

13.5

12.8

11.6

13.0

12.9

13.5

12.8

11.6

RESULTS OF OPERATIONS – U.S. WEALTH

MANAGEMENT SEGMENT

[millions of dollars, except per share

amounts]

IFRS Results

Adjusted Results

For the quarters ended

For the quarters ended

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Jun. 30, 2022

Mar. 31, 2022

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Revenues

U.S. wealth management fees

168.9

164.5

120.9

108.1

71.4

168.9

164.5

120.9

108.1

71.4

Other revenues

4.5

4.8

1.3

2.6

0.9

4.5

4.8

1.3

2.6

0.9

FX gains/(losses)

—

—

3.7

(31.9)

6.3

—

—

—

—

—

Total net revenues

173.4

169.2

125.9

78.8

78.6

173.5

169.2

122.2

110.7

72.3

Expenses

Selling, general & administrative

112.8

136.9

80.8

68.8

46.9

109.2

105.5

78.7

64.6

46.0

Other

0.7

0.4

2.9

3.1

3.5

0.7

0.4

2.9

3.1

3.5

Interest and lease finance expense

0.6

0.5

0.4

0.4

0.2

0.6

0.5

0.4

0.4

0.2

Depreciation and other amortization

4.1

3.9

3.1

2.5

1.7

4.1

3.9

3.1

2.5

1.7

Amortization of intangible assets from

acquisitions

24.7

21.9

16.1

14.1

9.8

—

—

—

—

—

Transaction, integration, restructuring

and legal

2.0

3.9

3.1

3.4

2.9

—

—

—

—

—

Change in fair value of contingent

consideration

(70.5)

(0.9)

29.7

59.5

12.4

—

—

—

—

—

Total expenses

74.4

166.5

136.1

151.7

77.4

114.6

110.3

85.2

70.5

51.4

Pretax income

99.0

2.7

(10.2)

(72.9)

1.2

58.9

59.0

37.0

40.2

20.9

Non-IFRS adjustments

Pretax income

99.0

2.7

(10.2)

(72.9)

1.2

58.9

59.0

37.0

40.2

20.9

Amortization of intangible assets from

acquisitions

24.7

21.9

16.5

14.4

10.1

—

—

0.5

0.3

0.3

Depreciation and other amortization

4.1

3.9

3.1

2.5

1.7

4.1

3.9

3.1

2.5

1.7

Interest and lease finance expense

0.6

0.5

0.4

0.4

0.2

0.6

0.5

0.4

0.4

0.2

EBITDA

128.4

29.1

9.9

(55.6)

13.2

63.5

63.4

41.0

43.4

23.1

Change in fair value of contingent

consideration

(70.5)

(0.9)

29.7

59.5

12.4

—

—

—

—

—

Contingent consideration recorded as

compensation (included in SG&A)

0.6

18.2

2.1

4.2

0.9

—

—

—

—

—

CIPW adjustments (included in

SG&A)

3.0

13.2

—

—

—

—

—

—

—

—

FX (gains)/losses

—

—

(3.7)

31.9

(6.3)

—

—

—

—

—

Transaction, integration, restructuring

and legal

2.0

3.9

3.1

3.4

2.9

—

—

—

—

—

Total adjustments

(64.9)

34.3

31.1

99.0

9.9

—

—

—

—

—

Less: Non-controlling interest

8.2

10.9

1.0

1.7

1.0

8.2

10.9

1.0

1.7

1.0

Adjusted EBITDA

55.4

52.5

40.0

41.7

22.1

55.4

52.5

40.0

41.7

22.1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005280/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Canada Murray Oxby Vice-President, Communications

416-681-3254 moxby@ci.com

United States Jimmy Moock Managing Partner, StreetCred

610-304-4570 jimmy@streetcredpr.com ci@streetcredpr.com

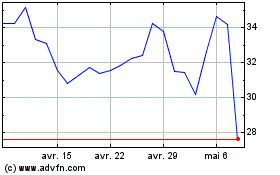

CompX (AMEX:CIX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

CompX (AMEX:CIX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024