Caledonia Mining Corporation Plc ("Caledonia" or the

"Company") (NYSE AMERICAN: CMCL; AIM: CMCL; VFEX: CMCL)

announces its operating and financial results for the quarter ended

March 31, 2023 (the "Quarter"). Further information on the

financial and operating results for the Quarter can be found in the

Management Discussion and Analysis ("MD&A") and the unaudited

interim financial statements which are available on the Company's

website and which have been filed on SEDAR.

This Quarter’s results are the first to reflect

Caledonia’s ownership of Bilboes, the acquisition of which was

completed on January 6, 2023. The near-term actions relating to

Bilboes are to re-start oxide mining operations and prepare a

revised feasibility study in respect of the larger sulphide

project. Technical challenges were encountered on re-starting the

oxide mining, but it is hoped that gold mining from near surface

oxide deposits will be cash neutral and will help the Company to

maintain Bilboes’ operational integrity pending completion of the

feasibility study. In addition, the waste material that will be

moved as part of the oxide mining activities is material that would

have had to be moved later when work starts on the main sulphide

project.

As stated in the first quarter production update

dated April 24, Blanket Mine (“Blanket”) suffered some technical

challenges which adversely affected its contribution in the

Quarter. Management believes these challenges have now been

resolved and is encouraged by production and cost data in April and

to date in May. Accordingly, Caledonia reiterates its production

guidance of 75,000-80,000 ounces for Blanket for 2023.

Financial

Highlights

Financial performance

was largely affected, as expected, by the integration and start-up

of the Bilboes operation and technical challenges at Blanket:

- Gross revenues of $29.4 million (Q1

2022: $35.1 million). Lower revenues reflect lower gold production

at Blanket.

- Reduced EBITDA contribution in

the period of $2.25 million (Q1 2022: $14.5 million). The

disappointing contribution was due to lower revenues and higher

operating costs at Blanket and the costs at the Bilboes oxide mine.

Blanket Mine contributed EBITDA of $11.3m in the Quarter (Q1 2022:

$19.5m).

- On-mine cost1 per ounce increased

by almost $500 per ounce from $698 in Q1 2022 to $1,196 per ounce.

Approximately $300 of the increase was due to the Bilboes oxides

mining activities where production only commenced in the last week

of the Quarter, but operating costs were incurred for much of the

Quarter. The on-mine cost per ounce at Blanket increased due to

lower gold production (which meant that fixed costs were spread

across fewer ounces) and higher than anticipated electricity

costs.

- All-in sustaining cost of $1,412

per ounce (Q1 2022: $848 per ounce). The increase was due to the

higher on-mine cost and advisory fees payable on the completion of

the Bilboes acquisition.

- Adjusted loss per share of 29.1

cents (Q1 2022: profit of 62.5 cents). Reduced EBITDA for the

Quarter was exacerbated by higher administrative expenses, a higher

interest charge and an increase in the effective tax rate.

- Net cash outflow from operating

activities of $0.9 million (Q1 2022: net cash inflow of $10.2

million).

- Net cash and cash equivalents of

$3.2 million (Q1 2022: $14.4 million). The net cash position at

March 31, 2023 was negatively impacted by a build-up in undelivered

gold to a value of approximately $2.8 million at the end of the

Quarter pending the implementation of a new gold sale mechanism in

early April. In early April net cash was enhanced by these gold

sales and the receipt of approximately $5.0 million from the

Zimbabwe leg of the equity raise.

- Dividends of 14 cents per share

were paid in January.

___________

1 Non-IFRS measures such as “On-mine cost per ounce”, “AISC”,

“average realised gold price” and “adjusted EPS” are used

throughout this document. Refer to section 10 of the MD&A for a

discussion of non-IFRS measures.

A segmental analysis

showing the summarised financial performance of Blanket and Bilboes

is set out below.

|

Segmental Analysis |

|

|

|

|

|

|

|

|

|

|

|

|

|

Blanket |

|

Bilboes Oxides |

|

Other1 |

|

Consolidated |

|

|

Q1 2023($’m) |

Q1 2022($’m) |

|

Q1 2023($’m) |

Q1 2022($’m) |

|

Q1 2023($’m) |

Q12022($’m) |

|

Q1 2023($’m) |

Q1 2022($’m) |

|

Revenues |

29.3 |

|

35.1 |

|

|

0.2 |

|

- |

|

- |

|

- |

|

|

29.4 |

|

35.1 |

|

|

Royalty |

(1.5 |

) |

(1.8 |

) |

|

- |

|

- |

|

- |

|

- |

|

|

(1.5 |

) |

(1.8 |

) |

|

Production costs |

(16.1 |

) |

(13.7 |

) |

|

(3.3 |

) |

- |

|

(0.4 |

) |

(0.7 |

) |

|

(19.9 |

) |

(14.4 |

) |

|

Depreciation |

(2.8 |

) |

(2.6 |

) |

|

- |

|

- |

|

0.6 |

|

0.5 |

|

|

(2.3 |

) |

(2.1 |

) |

|

Gross profit/(loss) |

8.9 |

|

17.0 |

|

|

(3.2 |

) |

- |

|

0.2 |

|

(0.2 |

) |

|

5.9 |

|

16.8 |

|

|

Other2 |

(0.4 |

) |

(0.1 |

) |

|

(0.3 |

) |

- |

|

(5.2 |

) |

(4.3 |

) |

|

(5.9 |

) |

(4.4 |

) |

|

Net finance cost |

(0.5 |

) |

(0.2 |

) |

|

(0.1 |

) |

- |

|

(0.4 |

) |

0.1 |

|

|

(0.8 |

) |

(0.1 |

) |

|

Profit/(loss) before tax |

8.0 |

|

16.7 |

|

|

(3.4 |

) |

- |

|

(5.4 |

) |

(4.4 |

) |

|

(0.8 |

) |

12.3 |

|

|

Taxation |

(3.0 |

) |

(4.4 |

) |

|

- |

|

- |

|

(0.5 |

) |

(0.3 |

) |

|

(3.5 |

) |

(4.7 |

) |

|

(Loss)/profit after tax |

5.0 |

|

12.3 |

|

|

(3.4 |

) |

|

|

(5.9 |

) |

(4.7 |

) |

|

(4.3 |

) |

7.6 |

|

Source: note 24 to the

unaudited interim financial statements for the Quarter

- Comprises costs relating to the

South African operations, intergroup eliminations and adjustments,

and corporate and other reconciling amounts.

- Comprises other income, other

expenses, administrative expenses, cash and equity settled

share-based expenses, net foreign exchanges gains and losses and

fair value loss on derivative instruments.

Safety

- Regrettably, a fatality occurred on

February 16, 2023 as a result of a secondary blasting accident. The

directors and management of Caledonia and Blanket express their

sincere condolences to the family and colleagues of the deceased.

Management has provided the necessary assistance to the Ministry of

Mines Inspectorate Department in its enquiries into the

incident.

Operating

Highlights

- 16,141 ounces of gold produced in

the Quarter (Q1 2022: 18,515 ounces) of which 16,036 ounces were

produced at Blanket and 105 ounces were produced at the Bilboes

oxide mine. Gold produced in the Quarter was lower due to lower

mine production at Blanket than anticipated and the

slower-than-expected restart of the Bilboes oxide mine.

- Production at Blanket was lower

than expected due to minor mechanical breakdowns and logistical

issues which have now been resolved. The rate of production

improved in April with 5,202 ounces of gold being produced in the

month (which has 23 scheduled production days due to public

holidays and production cut-off), which equates to an annualised

production rate of approximately 80,000 ounces per annum.

- The Company is reviewing the

commercial viability of the low margin oxides mining activities,

which includes assessing the scope to mine and process oxide

material from the recently acquired Motapa property, which is

immediately adjacent to Bilboes. Approximately 217 ounces of gold

were produced from the Bilboes oxide mine in April; a further

approximately 338 ounces of gold was contained in material that was

deposited onto the leach pad in April and is expected to report to

production in May.

- The 12.2MWac solar plant was fully

commissioned on February 2, 2023 and is generating slightly more

power than anticipated.

Outlook

- Production guidance for Blanket for

the year to December 31, 2023 of between 75,000 and 80,000 ounces

of gold is maintained.

- On mine costs at Blanket are

expected to fall in future quarters due to increased production and

lower electricity costs. Accordingly, guidance for on-mine costs at

Blanket for 2023 is maintained at the range of $770 to $850 per

ounce of gold produced at Blanket.

- Guidance for consolidated all-in

sustaining costs per ounce was between $1,150 and $1,250 per ounce,

which included the anticipated production and associated costs at

the Bilboes oxide mine in respect of which production and cost

guidance has been withdrawn. Guidance for AISC is re-stated to

exclude production and related production costs at the Bilboes

oxide mine. AISC excluding Bilboes oxides is

expected to be in the range of $935 to $1,035 per ounce.

- Deep level drilling at Blanket has

re-commenced with the objectives of upgrading inferred mineral

resources and identifying new resources thereby extending the life

of mine.

- The feasibility study on the

Bilboes sulphide project should be completed in Q1 2024 with the

objective of maximising value accretion for Caledonia’s

shareholders.

Commentary

The inclusion, for the

first time, of Bilboes in this Quarter’s report inevitably makes it

difficult to carry out like-for-like comparisons with the

equivalent quarter in 2022.

Production from

Blanket in the Quarter was below target due to equipment failures

and logistical issues. These included two separate failures of the

No.4 Shaft winder and a persistent blockage in an ore-pass at

Central Shaft which required alternative tramming arrangements

which were more expensive and reduced tramming capacity. These

issues have been resolved and production in April has been higher

than expected, equating to an annualised production rate of

approximately 80,000 ounces of gold per annum. This improved

performance has continued into May and we confirm production

guidance from Blanket for the year to December 31, 2023 in the

range of 75,000 to 80,000 ounces.

The increased on-mine cost per ounce was due to

the high cost per ounce at the Bilboes oxide mine where production

only commenced in the last week of the Quarter. The remainder of

the increase was due to higher on-mine costs at Blanket where lower

production meant that fixed costs were spread across fewer

production ounces and a higher electricity use. The increased

electricity cost was a combination of higher consumption due to the

continued heavy use of certain elements of infrastructure which had

been expected to be used more sparingly and an increase in the

tariff for grid power. From April, Blanket has seen a reduction on

the cost of grid power following the implementation of alternative

supply arrangements on April 1.

The 12.2MWac solar plant was commissioned in

February and generated slightly more power than anticipated and has

contributed to a substantial reduction in the amount of diesel

consumed at Blanket.

In January, Caledonia announced that it had

satisfied the conditions precedent to purchase Bilboes, a large,

high-grade gold deposit located approximately 75 km north of

Bulawayo. The main objective at Bilboes is to construct a large,

open-pit operation to extract sulphide resources. Work on a revised

feasibility study has commenced, with the objective of identifying

the optimal way to commercialise the Bilboes sulphide project with

a view to maximizing the uplift in value for Caledonia

shareholders.

The start-up of the additional, small oxide

mining and processing activity at Bilboes was affected by

contractors’ drill rigs underperforming and variations between the

realised and anticipated grade at the first target mining area. We

are evaluating other target areas for oxide mining - both at

Bilboes and next door at Motapa with the objective of focusing

future mining on areas where we have a high confidence level in the

target mining areas. Caledonia has withdrawn guidance for the oxide

mining activity and in future will report production and costs

retrospectively.

Mark

Learmonth, Chief Executive Officer, commented:

“The first quarter of 2023 presented several

operational challenges at Blanket which resulted in lower

production and higher costs. We are confident these issues have

been identified and addressed, and we reiterate our production

guidance for Blanket of between 75,000 and 80,000 ounces of

gold.

"We were pleased to complete the acquisition of

Bilboes at the start of the Quarter. Although the start-up of the

Bilboes oxide mining activity was disappointing, this does not

detract from the attraction of the main sulphide project.

“The sulphide resource is based on direct

drilling results and has been subjected to independent third-party

reviews. Caledonia has commenced work on a revised feasibility

study for the sulphide project which will consider updated

commercial assumptions and will focus on the most judicious way to

commercialise this project with the objective of maximising value

for Caledonia shareholders.

“Following Caledonia’s oversubscribed fundraise

in March and April, which raised approximately $16.5m, our balance

sheet and operational flexibility have been improved and we are

delighted to have new shareholders on our register who believe in

our vision, and we hope will support us in the next stage of our

growth.”

Conference Call Details

A presentation of the results for the Quarter

and outlook for Caledonia is available on Caledonia's website

(www.caledoniamining.com). Management will host a conference call /

webinar at 3pm London time on May 16, 2023.

When: May 16, 2023 – 3pm London time

Topic: Q1 2023 Shareholder Call

Register in advance for this webinar:

https://caledoniamining.zoom.us/webinar/register/WN_5VLZvSeeQyOZ0BAr1saBqA

After registering, you will receive a confirmation email

containing information about joining the webinar.

Enquiries:

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel: +44

7817 841 793 |

| Cenkos Securities plc

(Nomad and Joint Broker)Adrian Hadden Neil McDonaldPearl

Kellie |

Tel: +44 207 397 1965Tel:

+44 131 220 9771Tel: +44 131 220 9775 |

| Liberum Capital Limited

(Joint Broker)Scott Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

| BlytheRay Financial PR

(UK)Tim Blythe/Megan Ray |

Tel: +44 207 138 3204 |

| 3PPB (Financial PR, North

America)Patrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1

203 940 2538 |

| Curate Public Relations

(Zimbabwe)Debra Tatenda |

Tel: +263 77802131 |

| IH Securities (Private)

Limited (VFEX Sponsor - Zimbabwe)Lloyd Mlotshwa |

Tel: +263 (242) 745

119/33/39 |

Note: This announcement contains inside

information which is disclosed in accordance with the Market Abuse

Regulation (EU) No. 596/2014 (“MAR”)

as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018 and is disclosed in accordance

with the Company's obligations under Article 17 of

MAR.

Cautionary Note Concerning

Forward-Looking Information

Information and statements contained in this

news release that are not historical facts are “forward-looking

information” within the meaning of applicable securities

legislation that involve risks and uncertainties relating, but not

limited, to Caledonia’s current expectations, intentions, plans,

and beliefs. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “target”, “intend”, “estimate”, “could”, “should”,

“may” and “will” or the negative of these terms or similar words

suggesting future outcomes, or other expectations, beliefs, plans,

objectives, assumptions, intentions or statements about future

events or performance. Examples of forward-looking information in

this news release include: production guidance, estimates of

future/targeted production rates, and our plans and timing

regarding further exploration and drilling and development. This

forward-looking information is based, in part, on assumptions and

factors that may change or prove to be incorrect, thus causing

actual results, performance or achievements to be materially

different from those expressed or implied by forward-looking

information. Such factors and assumptions include, but are not

limited to: failure to establish estimated resources and reserves,

the grade and recovery of ore which is mined varying from

estimates, success of future exploration and drilling programs,

reliability of drilling, sampling and assay data, assumptions

regarding the representativeness of mineralization being

inaccurate, success of planned metallurgical test-work, capital and

operating costs varying significantly from estimates, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, inflation, changes in

exchange rates, fluctuations in commodity prices, delays in the

development of projects and other factors.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to estimates of

mineral reserves and mineral resources proving to be inaccurate,

fluctuations in gold price, risks and hazards associated with the

business of mineral exploration, development and mining, risks

relating to the credit worthiness or financial condition of

suppliers, refiners and other parties with whom the Company does

business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards, employee relations; relationships

with and claims by local communities and indigenous populations;

political risk; risks related to natural disasters, terrorism,

civil unrest, public health concerns (including health epidemics or

outbreaks of communicable diseases such as the coronavirus

(COVID-19)); availability and increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development, including the risks of obtaining or

maintaining necessary licenses and permits, diminishing quantities

or grades of mineral reserves as mining occurs; global financial

condition, the actual results of current exploration activities,

changes to conclusions of economic evaluations, and changes in

project parameters to deal with unanticipated economic or other

factors, risks of increased capital and operating costs,

environmental, safety or regulatory risks, expropriation, the

Company’s title to properties including ownership thereof,

increased competition in the mining industry for properties,

equipment, qualified personnel and their costs, risks relating to

the uncertainty of timing of events including targeted production

rate increase and currency fluctuations. Security holders,

potential security holders and other prospective investors are

cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

|

Condensed Consolidated Statements of profit or loss and

Other comprehensive income (Unaudited) |

|

|

|

|

|

|

($’000’s) |

3 months endedMar 31 |

|

|

|

2023 |

2022 |

|

|

Revenue |

29,435 |

|

35,072 |

|

|

|

Royalty |

(1,480 |

) |

(1,758 |

) |

|

|

Production

costs |

(19,850 |

) |

(14,359 |

) |

|

|

Depreciation |

(2,255 |

) |

(2,063 |

) |

|

|

Gross profit |

5,850 |

|

16,892 |

|

|

|

Other income |

18 |

|

2 |

|

|

|

Other

expenses |

(640 |

) |

(793 |

) |

|

|

Administrative

expenses |

(5,938 |

) |

(2,371 |

) |

|

|

Net foreign

exchange gain |

1,533 |

|

909 |

|

|

|

Cash-settled

share-based expense |

(280 |

) |

(367 |

) |

|

|

Equity-settled

share-based expense |

(110 |

) |

(82 |

) |

|

|

Net derivative

financial instrument expenses |

(434 |

) |

(1,738 |

) |

|

|

Operating (loss)

profit |

(1 |

) |

12,452 |

|

|

|

Net finance

costs |

(767 |

) |

(116 |

) |

|

|

(Loss)

profit before tax |

(768 |

) |

12,336 |

|

|

|

Tax expense |

(3,502 |

) |

(4,719 |

) |

|

|

(Loss)

profit for the period |

(4,270 |

) |

7,617 |

|

|

|

|

|

|

|

|

Other

comprehensive (loss) income |

|

|

|

|

Items that

are or may be reclassified to profit or loss |

|

|

|

|

Exchange

differences on translation of foreign operations |

(369 |

) |

693 |

|

|

|

Total

comprehensive (loss) income for the period |

(4,639 |

) |

8,310 |

|

|

|

|

|

|

|

|

(Loss)

profit attributable to: |

|

|

|

|

Owners of the

Company |

(5,030 |

) |

5,940 |

|

|

|

Non-controlling

interests |

760 |

|

1,677 |

|

|

|

(Loss)

profit for the period |

(4,270 |

) |

7,617 |

|

|

|

|

|

|

|

|

Total

comprehensive (loss) income attributable to: |

|

|

|

|

Owners of the

Company |

(5,399 |

) |

6,633 |

|

|

|

Non-controlling

interests |

760 |

|

1,677 |

|

|

|

Total

comprehensive (loss) income for the period |

(4,639 |

) |

8,310 |

|

|

|

|

|

|

|

|

(Loss)

earnings per share (cents) |

|

|

|

|

Basic |

(30.3 |

) |

44.6 |

|

|

|

Diluted |

(30.2 |

) |

44.6 |

|

|

|

Adjusted

(loss) earnings per share (cents) |

|

|

|

|

Basic |

(29.1 |

) |

62.5 |

|

|

|

Dividends paid per share (cents) |

14.0 |

|

14.0 |

|

|

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

|

|

|

($’000’s) |

|

|

|

|

|

3 months endedMarch 31 |

|

|

|

2023 |

2022 |

|

|

|

|

|

|

Cash inflow from operations |

|

664 |

|

11,844 |

|

| Interest

received |

|

5 |

|

1 |

|

| Net

finance costs paid |

|

(200 |

) |

(31 |

) |

| Tax

paid |

|

(1,345 |

) |

(1,659 |

) |

|

Net cash (outflow) inflow from operating

activities |

|

(876 |

) |

10,155 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Acquisition of property, plant and equipment |

|

(4,593 |

) |

(9,734 |

) |

|

Acquisition of exploration and evaluation assets |

|

(144 |

) |

(224 |

) |

|

Net cash outflow from investing activities |

|

(4,737 |

) |

(9,958 |

) |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

| Dividends

paid |

|

(2,424 |

) |

(1,788 |

) |

| Payment

of lease liabilities |

|

(37 |

) |

(40 |

) |

| Shares

issued - equity raise (net of transaction cost) |

|

10,823 |

|

- |

|

| Loan note

instruments - Motapa payment |

|

(5,399 |

) |

- |

|

| Loan note

instruments - Solar bond issue receipts |

|

4,500 |

|

- |

|

|

Net cash inflow (outflow) from financing

activities |

|

7,463 |

|

(1,828 |

) |

|

|

|

|

|

|

Net increase (decrease) in cash and cash

equivalents |

|

1,850 |

|

(1,631 |

) |

| Effect of

exchange rate fluctuations on cash and cash equivalents |

|

(157 |

) |

(204 |

) |

| Net cash

and cash equivalents at beginning of the period |

|

1,496 |

|

16,265 |

|

|

Net cash and cash equivalents at end of the

period |

|

3,189 |

|

14,430 |

|

|

Summarised Consolidated Statements of Financial Position

(Unaudited) |

|

($’000’s) |

As at |

|

Mar 31 |

Dec 31 |

|

|

|

|

2023 |

2022 |

|

Total non-current assets |

|

|

269,069 |

196,764 |

|

Inventories |

|

|

18,477 |

18,334 |

|

Prepayments |

|

|

3,356 |

3,693 |

| Trade and

other receivables |

|

|

9,957 |

9,185 |

| Income

tax receivable |

|

|

82 |

40 |

| Cash and

cash equivalents |

|

|

19,021 |

6,735 |

|

Derivative financial assets |

|

|

6 |

440 |

|

Total assets |

|

|

319,968 |

235,191 |

|

Total non-current liabilities |

|

|

13,196 |

9,291 |

| Loan

notes payable – short term portion |

|

|

2,514 |

7,104 |

| Lease

liabilities – short term portion |

|

|

136 |

132 |

| Trade and

other payables |

|

|

26,048 |

17,454 |

| Income

tax payable |

|

|

2,210 |

1,324 |

|

Overdraft |

|

|

15,832 |

5,239 |

| Cash-settled

share-based payments - short term portion |

|

482 |

1,188 |

|

Total liabilities |

|

|

60 412 |

41,732 |

|

Total equity |

|

|

259,550 |

193,459 |

|

Total equity and liabilities |

|

|

319 968 |

235,191 |

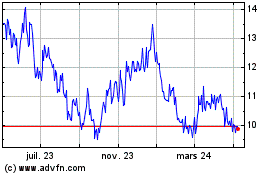

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

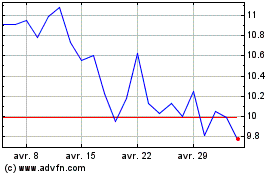

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024