false

2023-11-20

0001852353

Dakota Gold Corp.

0001852353

2023-11-20

2023-11-20

0001852353

exch:XASE

dc:CommonStockParValueZeroPointZeroZeroOnePerShareMember

2023-11-20

2023-11-20

0001852353

exch:XASE

dc:WarrantsEachWarrantExercisableForOneShareOfTheRegistrantThreeNinesCommonStockAtAnExercisePriceOfTwoPointZeroEightMember

2023-11-20

2023-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2023

DAKOTA GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-41349

|

85-3475290

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

106 Glendale Drive, Suite A,

Lead, South Dakota, United States

57754

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (605) 906-8363

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share

|

|

DC

|

|

NYSE American LLC

|

|

Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08

|

|

DC.WS

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 20, 2023, Dakota Gold Corp.'s (the "Company") wholly-owned subsidiary DTRC LLC, entered into a second amendment (the "Amendment Agreement") to the option agreement (the "Option Agreement") for purchase and sale of real property dated September 7, 2021 as amended on September 30, 2021, to acquire certain of Homestake Mining Company of California's surface rights and residual facilities in the Homestake District in South Dakota.

Under the terms of the Amendment Agreement, the term of the Option Agreement was extended from September 7, 2024 to March 7, 2026.

Item 7.01. Regulation FD Disclosure.

A copy of the Company's press release announcing the Amendment Agreement is attached as Exhibit 99.1 to this report.

The information furnished under this Item 7.01, including the press release, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by reference to such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

(d) Exhibits

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DAKOTA GOLD CORP. |

| |

|

| |

/s/ Shawn Campbell |

| |

Name: Shawn Campbell |

| |

Title: Chief Financial Officer |

Date: November 22, 2023

HOMESTAKE MINING COMPANY OF CALIFORNIA

Owner

and

DTRC LLC

Option Holder

SECOND AMENDMENT TO OPTION AGREEMENT

FOR PURCHASE AND SALE OF REAL PROPERTY |

Dated as of November 20, 2023

The properties affected by the within instrument are located in Lawrence County, South Dakota

Prepared by and Record and Return to:

Homestake Mining Company of California

310 South Main Street, Suite 1150

Salt Lake City, UT 84101

SECOND AMENDMENT TO OPTION AGREEMENT

FOR PURCHASE AND SALE OF REAL PROPERTY

This Second Amendment to Option Agreement for Purchase and Sale of Real Property ("Second Amendment") is made and entered into as of November 20, 2023 (the "Effective Date"), by and between Homestake Mining Company of California, a California corporation ("Owner"), and DTRC LLC, a Nevada limited liability company ("Option Holder"). Owner and Option Holder sometimes may be referred to in this Contract individually as a "Party", and collectively as the "Parties."

RECITALS

A. Owner and Dakota Territory Resource Corp, a Nevada corporation are parties to the Option Agreement for Purchase and Sale of Real Property, dated September 7, 2021, as amended on September 30, 2021 (the "Option Agreement").

B. Option Holder is the successor entity to Dakota Territory Resource Corp. pursuant to that certain Amended and Restated Agreement and Plan of Merger, dated as of September 10, 2021, between Dakota Gold Corp. (formerly known as JR Resources Corp.), Dakota Territory Resource Corp., DGC Merger Sub I Corp. and DGC Merger Sub II LLC.

C. Owner and Option Holder wish to amend the Option Agreement to extend the Option Period.

AGREEMENT

NOW THEREFORE, in consideration of the foregoing and of the mutual promises and covenants contained in this Second Amendment, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties, hereby covenant and agree as to the following:

1. Extension of the Option Period. The definition of Option Period in Section 1.37 of the Option Agreement hereby is deleted in its entirety and replaced with the following:

"The period that begins on the Effective Date and ends on the earlier of (a) March 7, 2026, and (b) the date the Option Holder delivers to the Administrative Agent the Option Exercise Notice."

[SIGNATURE PAGE TO FOLLOW]

IN WITNESS WHEREOF, the Parties have executed this Contract as of the Effective Date.

| |

OWNER: |

| |

|

| |

HOMESTAKE MINING COMPANY OF CALIFORNIA, a California corporation |

| |

|

| |

By: |

"Michael R. McCarthy" |

| |

Name: |

Michael R. McCarthy |

| |

Title: |

Director |

| |

OPTION HOLDER |

| |

|

| |

DTRC LLC, a Nevada limited liability company |

| |

|

| |

By: |

"Jonathan Awde" |

| |

Name: |

Jonathan Awde |

| |

Title: |

On behalf of Dakota Gold Corp., its manager |

November 20, 2023

Dakota Gold Corp. Announces Extension of

the Option Covering Certain Surface Rights of the Homestake

Mine Property with Barrick Gold Corporation to 2026

LEAD, SOUTH DAKOTA - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce that it has extended the option term from September 7, 2024 to March 7, 2026 of its option agreement with Homestake Mining Company of California ("Homestake"), a wholly owned subsidiary of Barrick Gold Corporation ("Barrick"), over certain of Homestake's surface rights and residual facilities in the Homestake District in South Dakota.

Jonathan Awde, President, CEO and Director of Dakota Gold stated, "Extending the term of this option agreement provides the Company with much greater flexibility and alignment. We appreciate Barrick's support and collaboration and value Barrick as our partner in revitalizing the Homestake District. In addition, after the closing of our recent $17 million financing with Orion Mine Finance, our exploration program is fully funded for 2024 and we look forward to exciting results from the four drills we have operating at our Maitland and Richmond Hill Gold Projects."

The surface option agreement includes exclusive access to all of Homestake's extensive historic data sets which chronicle its 145-year exploration and mining history throughout South Dakota. This data helps to inform our drilling programs in the Homestake District. Additionally, the agreement provides the potential for the Company to repurpose already disturbed land for exploration and development within the Homestake District.

About Dakota Gold Corp.

Dakota Gold (NYSE American: DC) is a South Dakota-based responsible gold exploration and development company with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold has high-caliber gold mineral properties covering over 46 thousand acres surrounding the historic Homestake Mine. More information about the Company can be found at www.dakotagoldcorp.com.

The Dakota Gold team is focused on new gold discoveries and opportunities that build on the legacy of the Homestake District and its 145 years of gold mining history.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com/contact-us/sign-up/ to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jonathan Awde, President and Chief Executive Officer

Tel: +1 604-761-5251

Email: JAwde@dakotagoldcorp.com

Forward Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others, the execution and timing of our planned exploration activities, our use and evaluation of historic data, our ability to achieve our strategic goals, the state of the economy and financial markets generally and the effect on our industry, and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-KT for the nine-month transition period ended December 31, 2022, as amended, as updated by annual, quarterly and other reports and documents that we file with the SEC. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

v3.23.3

Document and Entity Information Document

|

Nov. 20, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Nov. 20, 2023

|

| Document Period End Date |

Nov. 20, 2023

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Dakota Gold Corp.

|

| Entity Address, Address Line One |

106 Glendale Drive, Suite A,

|

| Entity Address, City or Town |

Lead

|

| Entity Address, State or Province |

SD

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

57754

|

| Entity Incorporation, State Country Name |

NV

|

| City Area Code |

605

|

| Local Phone Number |

906-8363

|

| Entity File Number |

001-41349

|

| Entity Central Index Key |

0001852353

|

| Entity Emerging Growth Company |

true

|

| Entity Tax Identification Number |

85-3475290

|

| Entity Ex Transition Period |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| NYSE MKT LLC [Member] | Common Stock, par value $0.001 per share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

DC

|

| Security Exchange Name |

NYSEAMER

|

| NYSE MKT LLC [Member] | Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08

|

| Trading Symbol |

DC.WS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XASE |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dc_CommonStockParValueZeroPointZeroZeroOnePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dc_WarrantsEachWarrantExercisableForOneShareOfTheRegistrantThreeNinesCommonStockAtAnExercisePriceOfTwoPointZeroEightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

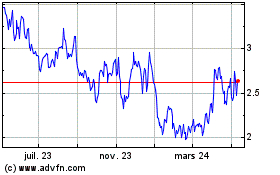

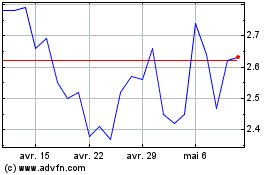

Dakota Gold (AMEX:DC)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Dakota Gold (AMEX:DC)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024