AMCON Distributing Company (�AMCON�)) (AMEX:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

that the earnings for first fiscal quarter ended December 31, 2006

were $1.49 per share on a fully diluted basis. �We are now

beginning to see the tangible results of our management teams

concentrated efforts over the course of the last year�, said

Christopher Atayan, AMCON�s Chief Executive Officer. �Going forward

we still have some challenges from the past that we have to

address, however we are now in a position to be able to commit more

resources to growing our two core businesses.� AMCON reported

revenues of approximately $200.3 million in its Wholesale

Distribution business and operating income before depreciation and

amortization of approximately $2.9 million. AMCON�s Retail Health

Food business reported revenues of approximately $9.1 million and

operating income before depreciation and amortization of

approximately $0.7 million. Kathleen Evans, President of AMCON�s

Wholesale Business, commented �This was a solid quarter across the

board. We look forward to carrying the momentum into 2007.� Eric

Hinkefent, President of AMCON�s Retail Health Food business, said

�We continue to look for growth opportunities. Our business model

is working well and benefits from the trend toward natural and

organic products.� The recent Midwest winter ice storms briefly

impacted both of AMCON�s business segments. More detail will be

provided when the company reports its second fiscal quarter

results. As previously reported, AMCON divested the assets of its

Hawaiian Natural Water Company on November 20, 2006 and the results

of operations for that partial period are recorded in discontinued

operations. In addition, AMCON reported a gain on disposal net of

taxes of approximately $0.9 million. AMCON also reported two

executive appointments. Andrew Plummer the company�s interim chief

financial officer was named to the post on a permanent basis.

Additionally, Philip Campbell who has been a financial consultant

to the company in connection with its discontinued operations, was

named to the newly created position of Senior Vice President

Financial Planning and Compliance. �Andy earned his promotion the

old fashioned way, through hard work and diligence� noted Atayan.

�Philip was the logical choice for this new position, as he has

been a part of our team for several years now and is well respected

both internally and externally� continued Atayan. Plummer commented

�We are in the process of building a cutting edge financial

department that will enable us to take advantage of our many

corporate strengths. Ultimately this will not only benefit us, it

will also enable us to continue our customer service leadership

position in the industry.� AMCON is a leading wholesale distributor

of consumer products, including beverages, candy, tobacco,

groceries, food service, frozen and chilled foods, and health and

beauty care products with distribution centers in Illinois,

Missouri, Nebraska, North Dakota and South Dakota. Chamberlin's

Natural Foods, Inc. and Health Food Associates, Inc., both

wholly-owned subsidiaries of The Healthy Edge, Inc., operate health

and natural product retail stores in central Florida (6), Kansas,

Missouri, Nebraska and Oklahoma (4). The retail stores operate

under the names Chamberlin's Market & Cafe and Akins Natural

Foods Market. This news release contains forward-looking statements

that are subject to risks and uncertainties and which reflect

management's current beliefs and estimates of future economic

circumstances, industry conditions, Company performance and

financial results. A number of factors could affect the future

results of the Company and could cause those results to differ

materially from those expressed in the Company's forward-looking

statements including, without limitation, availability of

sufficient cash resources to conduct its business and meet its

capital expenditures needs. Moreover, past financial performance

should not be considered a reliable indicator of future

performance. Accordingly, the Company claims the protection of the

safe harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 with respect to all such

forward-looking statements. Visit AMCON Distributing Company's web

site at: www.amcon.com AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets December 31, 2006 and

September 30, 2006 December 2006 September 2006 (Unaudited) �

ASSETS Current assets: Cash $433,565� $481,138� Accounts

receivable, less allowance for doubtful accounts of $0.9 million

and $0.9 million, respectively 28,207,328� 27,815,751� Inventories,

net 26,291,459� 24,443,063� Deferred income taxes 1,972,988�

1,972,988� Current assets of discontinued operations 13,744�

1,172,805� Prepaid and other current assets 5,054,447� 5,369,154�

Total current assets 61,973,531� 61,254,899� � Property and

equipment, net 12,248,355� 12,528,539� Goodwill 5,848,808�

5,848,808� Other intangible assets 3,429,869� 3,439,803� Deferred

income taxes 5,857,028� 6,772,927� Noncurrent assets from

discontinued operations 2,382,648� 3,774,106� Other assets

1,313,750� 1,247,464� $93,053,989� $94,866,546� LIABILITIES AND

SHAREHOLDERS' EQUITY (DEFICIENCY) Current liabilities: Accounts

payable $13,830,334� $14,633,124� Accrued expenses 4,483,797�

4,687,789� Accrued wages, salaries and bonuses 1,362,488�

1,879,699� Income taxes payable 69,987� 168,936� Current

liabilities of discontinued operations 5,747,896� 7,461,549�

Current maturities of credit facility 3,896,000� 3,896,000� Current

maturities of long-term debt 492,816� 524,130� Total current

liabilities 29,883,318� 33,251,227� Credit facility, less current

maturities 45,661,073� 44,927,429� Long-term debt, less current

maturities 6,939,204� 7,069,357� Noncurrent liabilities of

discontinued operations 4,865,822� 5,087,230� � Series A

cumulative, convertible preferred stock, $.01 par value 100,000

shares authorized and issued, liquidation preference $25.00 per

share 2,438,355� 2,438,355� � Series B cumulative, convertible

preferred stock, $.01 par value 80,000 shares authorized and

issued, liquidation preference $25.00 per share 1,857,645�

1,857,645� � Series C cumulative, convertible preferred stock, $.01

par value 80,000 shares authorized and issued, liquidation

preference $25.00 per share 1,982,372� 1,982,372� � Commitments and

contingencies � Shareholders' equity (deficiency): Preferred stock,

$0.01 par, 1,000,000 shares authorized, none outstanding -� -�

Common stock, $.01 par value, 3,000,000 shares authorized, 527,062

outstanding 5,271� 5,271� Additional paid-in capital 6,281,476�

6,278,476� Accumulated deficit (6,860,547) (8,030,816) Total

shareholders' deficiency (573,800) (1,747,069) $93,053,989�

$94,866,546� AMCON Distributing Company and Subsidiaries Condensed

Consolidated Unaudited Statements of Operations for the three

months ended December 31, 2006 and 2005 2006 2005 Sales (including

excise taxes of $49.5 million and $48.2 million, respectively)

$209,366,149� $198,217,081� � Cost of sales 194,325,018�

184,189,751� Gross profit 15,041,131� 14,027,330� � Selling,

general and administrative expenses 12,405,083� 12,650,217�

Depreciation and amortization 457,843� 478,725� 12,862,926�

13,128,942� Operating income 2,178,205� 898,388� Other expense

(income): Interest expense 1,268,662� 1,157,466� Other (income),

net (31,081) (20,782) 1,237,581� 1,136,684� Income (loss) from

continuing operations before income taxes 940,624� (238,296) Income

tax expense (benefit) 363,000� (79,000) Income (loss) from

continuing operations 577,624� (159,296) Discontinued operations �

Gain on disposal of discontinued operations, net of income tax

expense of $0.7 million 895,588� -� � (Loss) from discontinued

operations, net of income tax (benefit) of ($0.1) million and

($0.6) million, respectively (197,410) (1,027,638) Income (loss) on

discontinued operations 698,178� (1,027,638) Net income (loss)

1,275,802� (1,186,934) � Preferred stock dividend requirements

(105,533) (74,867) Net income (loss) available to common

shareholders $1,170,269� $(1,261,801) Basic earnings (loss) per

share available to common shareholders: Continuing operations

$0.90� $(0.44) Discontinued operations 1.32� (1.95) Net basic

earnings (loss) per share available to common shareholders $2.22�

$(2.39) Diluted earnings (loss) per share available to common

shareholders: Continuing operations $0.68� $(0.44) Discontinued

operations 0.81� (1.95) Net diluted earnings (loss) per share

available to common shareholders $1.49� $(2.39) � Weighted average

shares outstanding: Basic 527,062� 527,062� Diluted 854,427�

527,062� AMCON Distributing Company and Subsidiaries Condensed

Consolidated Unaudited Statements of Cash Flows for the three month

periods ended December 31, 2006 and 2005 2006 � 2005 CASH FLOWS

FROM OPERATING ACTIVITIES: Net income (loss) $1,275,802�

$(1,186,934) Deduct: income (loss) from discontinued operations,

net of tax 698,178� (1,027,638) Income (loss) from continuing

operations 577,624� (159,296) � Adjustments to reconcile net income

(loss) from continuing operations to net cash flows from operating

activities: Depreciation 447,909� 468,792� Amortization 9,934�

9,933� (Gain) loss on sale of property and equipment (11,116)

2,035� Stock based compensation 3,000� 15,000� Deferred income

taxes 915,899� (543,423) Provision for losses on doubtful accounts

(76,196) -� Provision for losses on inventory obsolescence 172,503�

88,132� � Changes in assets and liabilities: Accounts receivable

(315,381) 1,686,986� Inventories (2,020,899) (4,710,930) Other

current assets 314,707� 579,042� Other assets (66,286) (7,836)

Accounts payable (802,790) 1,672,707� Accrued expenses and accrued

wages, salaries and bonuses (721,203) (935,357) Income tax payable

and receivable (98,949) (118,798) Net cash flows from operating

activities - continuing operations (1,671,244) (1,953,013) Net cash

flows from operating activities - discontinued operations

(1,844,710) (529,260) Net cash flows from operating activities

(3,515,954) (2,482,273) � CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment (170,809) (133,871) Proceeds

from sales of property and equipment 14,200� 29,599� Net cash flows

from investing activities - continuing operations (156,609)

(104,272) Net cash flows from investing activities - discontinued

operations 3,753,394� (17,771) Net cash flows from investing

activities 3,596,785� (122,043) � CASH FLOWS FROM FINANCING

ACTIVITIES: Net borrowings on bank credit agreements 733,644�

3,194,790� Dividends paid on preferred stock (105,533) (74,867)

Principal payments on long-term debt (161,467) (163,491) Net cash

flows from financing activities - continuing operations 466,644�

2,956,432� Net cash flows from financing activities - discontinued

operations (595,048) 633,543� Net cash flows from financing

activities (128,404) 3,589,975� Net change in cash (47,573)

985,659� � Cash, beginning of period 481,138� 546,273� Cash, end of

period $433,565� $1,531,932� � Supplemental disclosure of cash flow

information: Cash paid during the period for interest $1,262,202�

$1,162,291� Cash paid (refunded) during the period for income taxes

98,949� (26,890) � Supplemental disclosure of non-cash information:

Buyer's assumption of HNWC lease in connection with the sale of

HNWC's assets - discontinued operations 225,502� -�

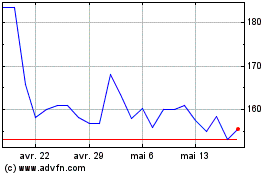

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

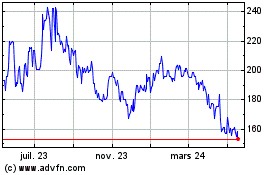

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024