Discount Doctor to Visit United Kingdom in Support of Investment Trusts

28 Janvier 2025 - 9:34PM

David Schachter, Senior Vice President of GAMCO Investors, Inc.,

will visit the United Kingdom to convey support for the British

investment trust industry.

With over 40 years of experience exclusively

with retail, long term, closed-end fund investors, Mr. Schachter, a

most senior and experienced veteran of the U.S. Closed End Fund

industry, was recently given the title of Discount Doctor by the

Trustees of The GAMCO Natural Resources, Gold & Income Trust

(GNT), which trades on the NYSE.

Mr. Schachter said, “The way I see it, the

United States owes a debt to the British Investment Trust Industry,

which helped build our railroads in the 1800s. Last week in his

inauguration speech, President Trump spoke of America’s

achievements stating, ‘In America, the impossible is what we do

best…Together they laid down the railroads …and triumphed over

every single challenge that they faced.’”

During the 19th century, capital was raised

through closed-end funds. These funds helped build the railroads,

which linked the American continent from sea to sea and led to the

nation’s economic success.

Today, in the early 21st century, closed-end

funds are being threatened for elimination by hedged activists for

short-term and short-sighted value extraction.

“Closed-end funds are a metaphor for long-term,

patient capital, but they also represent freedom for investors who,

in a sector where mass redemptions could force portfolio managers

to sell, is an essential ability to those who may not want to be

herded into selling.”

Mr. Schachter plans to visit the offices of the

Association of Investment Companies (AIC) and speak with the press

and interested U.K. investors.

He remarked that recent activism is emblematic

of short-termism and notes activist claims of being aligned with

“Mom and Pop” investors as being absurd. “When it comes to

activism, the playing field isn’t level at all…unlike Mom and Pop,

sophisticated activists are hedged on a fund’s underlying

portfolio.” Schachter commented, “As the Discount Doctor, it is

critical to cure the ill without killing the patient in the

process.”

Financial professionals and investors are

invited to contact Mr. Schachter directly at (914) 921-5057 or

(800) GABELLI.

Gabelli Funds, LLC is the adviser to thirteen

closed-end funds which trade on the NYSE: Gabelli Equity Trust

(NYSE: GAB), Gabelli Convertible & Income Securities Fund

(NYSE: GCV), Gabelli Multimedia Trust (NYSE: GGT), Gabelli Utility

Trust (NYSE: GUT), Gabelli Dividend & Income Trust (NYSE: GDV),

Gabelli Global Utility & Income Trust (NYSE American: GLU),

GAMCO Global Gold Natural Resources & Income Trust (NYSE

American: GGN), The GDL Fund (NYSE: GDL), Gabelli Healthcare &

WellnessRX Trust (NYSE: GRX), GAMCO Natural Resources, Gold &

Income Trust (NYSE: GNT), Gabelli Global Small and Mid-Cap Value

Trust (NYSE: GGZ), Bancroft Fund (NYSE American: BCV) and Ellsworth

Growth & Income Fund (NYSE American: ECF). As of December 31,

2024, the thirteen Gabelli closed-end funds had total assets of

$7.3 billion.

Investors should carefully consider the

investment objectives, risks, charges, and expenses of a Fund

before investing. For more information regarding the Funds,

call:

David Schachter(914) 921-5057

A Fund’s NAV per share will fluctuate with

changes in the market value of the Fund’s portfolio securities.

Stocks are subject to market, economic, and business risks that

cause their prices to fluctuate. Investors acquire shares of the

Fund on a securities exchange at market value, which fluctuates

according to the dynamics of supply and demand. When Fund shares

are sold, they may be worth more or less than their original cost.

Consequently, you can lose money by investing in a Fund.

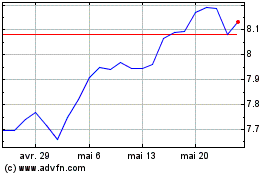

Ellsworth Growth and Inc... (AMEX:ECF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

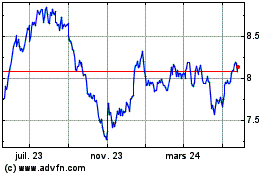

Ellsworth Growth and Inc... (AMEX:ECF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025