PARTS iD, Inc. (NYSE American: ID) (“PARTS iD” or “Company”),

the owner and operator of, among other verticals, “CARiD.com,” a

leading digital commerce platform for the automotive aftermarket,

today announced results for the third quarter ended September 30,

2022.

Third Quarter 2022 Financial Summary (Comparisons versus

Third Quarter 2021)

- Net revenue was $79.9 million as compared to $102.6

million.

- Gross margin was 19.9% as compared to 19.8%.

- Operating expenses as a percent of net revenue were 23.7% as

compared to 23.9%.

- Operating loss was $(3.0) million as compared to operating loss

of $(4.2) million.

- Net loss was $(6.3) million as compared to net loss of $(3.3)

million.

- Adjusted EBITDA was $0.2 million compared to $(0.1)

million.

First Nine Months 2022 Financial Summary (Comparisons versus

First Nine Months 2021)

- Net revenue was $279.0 million as compared to $342.1

million.

- Gross margin was 19.7% as compared to 20.2%.

- Operating expenses as a percent of net revenue were 22.8% as

compared to 21.5%.

- Operating loss was $(8.8) million as compared to operating loss

of $(4.2) million.

- Net loss was $(11.1) million as compared to net loss of $(3.4)

million.

- Adjusted EBITDA was $(0.2) million compared to $5.3

million.

Management Commentary

“Despite the challenging operating environment that includes

supply chain constraints, high inflation, rising interest rates and

softening consumer demand for discretionary goods, we preserved

margins and liquidity and achieved positive adjusted EBITDA,” said

Nino Ciappina, Chief Executive Officer of PARTS iD. “With our

top-line under pressure, we have taken several cost savings actions

including rightsizing headcount, further optimizing advertising

spend, and reducing corporate overheard, which helped deliver a

slight improvement in third quarter adjusted EBITDA compared with a

year ago despite a 22% reduction in net revenue. More recently, we

negotiated an improved shipping contract that is projected to yield

a 15% net reduction in outbound shipping costs and secured a $5

million term loan to preserve liquidity. Looking ahead, in the

short term, until the macroeconomic factors improve, we remain

focused on improving our liquidity and profitability by optimizing

our margins, expenses and investments.”

Third Quarter 2022 Financial Results

Third quarter 2022 net revenue decreased 22.1% to $79.9 million,

compared to $102.6 million in the third quarter of 2021. This

decrease was attributable to a 28.0% decline in traffic and a 9.5%

decrease in conversion rates, partially offset by a 5.8% increase

in average order value. Furthermore, Repair Parts realized positive

growth while demand for Accessories remains moderate.

Gross profit for the third quarter of 2022 decreased to $15.9

million compared to $20.3 million in the same prior year period.

Gross margin was 19.9% for the third quarter of 2022 compared to

19.8% in the third quarter of 2021.

Operating expenses were $18.9 million for the third quarter of

2022 compared to $24.5 million for the third quarter of 2021. The

decrease in operating expenses was primarily attributable to

SG&A expense savings resulting from the company-wide

restructuring plan implemented in June of 2022 coupled with lower

sales volumes and advertising expenses due to a decrease in site

traffic. Operating expenses as a percent of net revenue were 23.7%

compared to 23.9% in the same prior year period.

Operating loss for the third quarter of 2022 was $(3.0) million

compared to an operating loss of $(4.2) million for the third

quarter of 2021.

Net loss for the third quarter of 2022 was $(6.3) million

compared to a net loss of $(3.3) million in the same prior year

period. Net loss for the third quarter of 2022 and 2021 includes

deferred tax valuation allowance of $3.9 million and $0.0 million

respectively.

Adjusted EBITDA was $0.2 million in the third quarter of 2022

compared to $(0.1) million in the same prior year period.

First Nine Months 2022 Financial Results

Net revenue for the first nine months of 2022 decreased 18.4% to

$279.0 million, compared to $342.1 million in the same period of

2021. This decrease was attributable to a 19.2% decline in traffic

and a 13.1% decrease in conversion rates partially offset by a 8.7%

increase in average order value.

Gross profit for the first nine months of 2022 decreased 20.6%

to $55.0 million compared to $69.3 million in the same prior year

period. Gross margin was 19.7% compared to 20.2% in the 2021

period. The decrease in gross margin was attributable to a change

in product category revenue mix along with a year-over-year

increase in product and shipping costs associated with the ongoing

global supply chain disruptions.

Operating expenses were $63.8 million for the first nine months

of 2022 compared to $73.5 million for the first nine months of

2021. The decrease in operating expenses was primarily attributable

to SG&A expense savings resulting from the company-wide

restructuring plan implemented in June of 2022 coupled with lower

sales volumes and advertising expenses due to a decrease in site

traffic. Operating expenses as a percent of net revenue were 22.8%

compared to 21.5% in the same prior year period.

Operating loss for the first nine months of 2022 was $(8.8)

million compared to an operating loss of $(4.2) million for the

first nine months of 2021.

Net loss for the first nine months of 2022 was $(11.1) million

compared to a net loss of $(3.4) million in the same prior year

period. Net loss for the first nine months of 2022 and 2021

includes deferred tax valuation allowance of $3.9 million and $0.0

million respectively.

Adjusted EBITDA was $(0.2) million in the first nine months of

2022 compared to $5.2 million in the same prior year period.

Balance Sheet

As of September 30, 2022, the Company had cash of $4.2 million

compared to $23.2 million at December 31, 2021. The decrease in

cash in the nine- month period was primarily driven by net cash

used in operating activities of $14.4 million, of which $13.6

million was consumed by working capital. Cash used in investing

activities was $4.6 million primarily related to website and

software development expenditures.

On October 21, 2022, the Company obtained a net $5 million

senior secured term loan. The Company also has the ability to

obtain, at lender’s sole discretion, an additional net $5 million

of incremental senior secured debt pursuant to the credit

agreement. The Company intends to use the facility to improve

liquidity. The initial term loan matures in October 2025 and bears

interest at an annual rate of 8.00%.

Conference Call

PARTS iD’s Chief Executive Officer, Nino Ciappina, and Chief

Financial Officer, Kailas Agrawal, will host a live conference call

to discuss financial results on November 9, 2022 at 4:30 p.m.

Eastern Time. Investors and analysts interested in participating in

the call are invited to dial (888) 437-3179 (domestic) or (862)

298-0702 (international).

The conference call will also be available to interested parties

through a live webcast at https://www.partsidinc.com/. A telephone

replay of the call will be available until November 16, 2022, by

dialing (877) 660-6853 (domestic) or (201) 612-7415 (international)

and entering the conference identification number: 13734284.

About PARTS iD, Inc.

PARTS iD is a technology-driven, digital commerce company

focused on creating custom infrastructure and unique user

experiences within niche markets. Founded in 2008 with a vision of

creating a one-stop eCommerce destination for the automotive parts

and accessories market, PARTS iD has since become a market leader

and proven brand-builder, fueled by its commitment to delivering a

revolutionary shopping experience; comprehensive, accurate and

varied product offerings; and continued digital commerce

innovation.

Non-GAAP Financial Measures

This press release includes non-GAAP financial measures that

differ from financial measures calculated in accordance with U.S.

generally accepted accounting principles (“GAAP”). These non-GAAP

financial measures may not be comparable to similar measures

reported by other companies and should be considered in addition

to, and not as a substitute for, or superior to, other measures

prepared in accordance with GAAP. Management uses non- GAAP

financial measures internally to evaluate the performance of the

business. Additionally, management believes certain non-GAAP

measures provide meaningful incremental information to investors to

consider when evaluating the performance of the Company.

To this end, we provide EBITDA and Adjusted EBITDA, which are

non-GAAP financial measures. EBITDA consists of net income (loss)

plus (a) interest expense; (b) income tax provision (or less

benefit); and (c) depreciation expense. Adjusted EBITDA consists of

EBITDA plus costs, fees, expenses, write offs and other items that

do not impact the fundamentals of our operations, as described

further below following the reconciliation of these metrics.

Management believes these non-GAAP measures provide useful

information to investors in their assessment of the performance of

our business. The exclusion of certain expenses in calculating

EBITDA and Adjusted EBITDA facilitates operating performance

comparisons on a period-to- period basis as these costs may vary

independent of business performance. Accordingly, we believe that

EBITDA and Adjusted EBITDA provide useful information to investors

and others in understanding and evaluating our operating results in

the same manner as our management and board of directors.

EBITDA and Adjusted EBITDA have limitations as an analytical

tool, and you should not consider these measures in isolation or as

a substitute for analysis of our results as reported under GAAP.

Some of these limitations are:

- Although depreciation is a non-cash charge, the assets being

depreciated may have to be replaced in the future, and EBITDA and

Adjusted EBITDA do not reflect cash capital expenditure

requirements for such replacements or for new capital expenditure

requirements;

- EBITDA and Adjusted EBITDA do not reflect changes in our

working capital;

- EBITDA and Adjusted EBITDA do not reflect income tax payments

that may represent a reduction in cash available to us;

- EBITDA and Adjusted EBITDA do not reflect depreciation and

interest expenses associated with the lease financing obligations;

and

- Other companies, including companies in our industry, may

calculate Adjusted EBITDA differently, which reduces its usefulness

as a comparative measure.

Because of these limitations, you should consider EBITDA and

Adjusted EBITDA alongside other financial performance measures,

including various cash flow metrics, net income (loss) and our

other GAAP results.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in this

press release.

Cautionary Note Regarding Forward-Looking Statements

All statements made in this press release relating to future

financial or business performance, conditions, plans, prospects,

trends, or strategies and other such matters, including without

limitation, expected future performance, consumer adoption,

anticipated success of our business model or the potential for long

term profitable growth, are forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. In addition, when or if used in this press release, the words

“may,” “could,” “should,” “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan,” “predict,” “potential,” “confident,”

“look forward” and similar expressions and their variants, as they

relate to us may identify forward-looking statements. We operate in

a changing environment where new risks emerge from time to time and

it is not possible for us to predict all risks that may affect us,

particularly those associated with the COVID-19 pandemic, which has

had wide-ranging and continually evolving effects. We caution that

these forward-looking statements are subject to numerous

assumptions, risks, and uncertainties, which change over time,

often quickly and in unanticipated ways.

Important factors that may cause actual results to differ

materially from the results discussed in the forward-looking

statements include risks and uncertainties, including without

limitation: costs related to operating as a public company;

difficulties in managing our international business operations,

particularly due to the ongoing conflict in Ukraine, including with

respect to enforcing the terms of our agreements with our

contractors and managing increasing costs of operations; the impact

of health epidemics, including the COVID-19 pandemic, on our

business and the actions we may take in response thereto; changes

in our strategy, future operations, financial position, estimated

revenues and losses, product pricing, projected costs, prospects

and plans; the outcome of actual or potential litigation,

complaints, product liability claims, or regulatory proceedings,

and the potential adverse publicity related thereto; the

implementation, market acceptance and success of our business

model, expansion plans, opportunities and initiatives, including

the market acceptance of our planned products and services;

competition and our ability to counter competition, including

changes to the algorithms of Google and other search engines;

developments and projections relating to our competitors and

industry; our expectations regarding our ability to obtain and

maintain intellectual property protection and not infringe on the

rights of others; ability to maintain and enforce intellectual

property rights and ability to maintain technology leadership; our

future capital requirements, our ability to raise capital and

utilize sources of cash; our ability to obtain funding for our

operations; changes in applicable laws or regulations; the effects

of current and future U.S. and foreign trade policy and tariff

actions; disruptions in the marketplace for online purchases of

aftermarket auto parts; disruptions in the supply chain; and the

possibility that we may be adversely affected by other economic,

business, and/or competitive factors.

Further information on the factors and risks that could cause

actual results to differ from any forward-looking statements are

contained in our filings with the United States Securities and

Exchange Commission (SEC), which are available at

https://www.sec.gov (or at https://www.partsidinc.com). The

forward-looking statements represent our estimates as of the date

hereof only, and we specifically disclaim any duty or obligation to

update forward- looking statements.

PARTS iD, INC.

Condensed Consolidated Balance

Sheets

As of September 30, 2022 and December

31, 2021

September 30,

2022

December 31,

2021

Unaudited

Audited

ASSETS

Current assets

Cash

$

4,184,006

$

23,203,230

Accounts receivable

2,423,474

2,157,108

Inventory

4,694,781

5,754,748

Prepaid expenses and other current

assets

6,638,522

4,874,704

Total current assets

17,940,783

35,989,790

Property and equipment, net

13,489,016

13,700,876

Intangible assets

262,966

262,966

Deferred tax assets

-

2,314,907

Operating lease right-of-use

1,253,724

-

Other assets

267,707

267,707

Total assets

$

33,214,196

$

52,536,246

LIABILITIES AND SHAREHOLDERS’

DEFICIT

Current liabilities

Accounts payable

$

36,200,511

$

40,591,938

Customer deposits

8,838,813

15,497,857

Accrued expenses

5,939,896

6,221,330

Other current liabilities

2,917,478

3,930,841

Operating lease liabilities

697,333

-

Total current liabilities

54,594,031

66,241,966

Other non-current liabilities

Operating lease, net of current

portion

556,391

-

Total liabilities

55,150,422

66,241,966

COMMITMENTS AND CONTINGENCIES (Note

6)

SHAREHOLDERS’ DEFICIT

100,000,000 Class A shares authorized and

34,114,449 and 33,965,804 issued and

outstanding, as of September 30, 2022 and

December 31, 2021, respectively

3,411

3,396

Additional paid in capital

9,866,946

6,973,541

Accumulated deficit

(31,806,583

)

(20,682,657

)

Total shareholders’ deficit

(21,936,226

)

(13,705,720

)

Total liabilities and shareholders’

deficit

$

33,214,196

$

52,536,246

PARTS iD, INC.

Consolidated Condensed Statements of

Operations

For the three and nine months ended

September 30, 2022 and 2021 (Unaudited)

Three months ending

September 30,

Nine months ending

September 30,

2022

(Unaudited)

2021

(Unaudited)

2022

(Unaudited)

2021

(Unaudited)

Net revenue

$

79,884,740

$

102,595,793

$

279,034,366

$

342,078,753

Cost of goods sold

63,962,534

82,316,633

224,034,701

272,826,703

Gross profit

15,922,206

20,279,160

54,999,665

69,252,050

Operating expenses:

Advertising

7,329,172

9,730,026

26,468,121

31,136,731

Selling, general and administrative

9,458,749

12,906,797

31,072,365

36,868,521

Depreciation

2,113,695

1,887,641

6,210,590

5,480,995

Total operating expenses

18,901,616

24,524,464

63,751,076

73,486,247

Loss from operations

(2,979,410

)

(4,245,304

)

(8,751,411

)

(4,234,197

)

Interest and financing expense

50,000

229

50,000

7,114

Loss before income taxes

(3,029,410

)

(4,245,533

)

(8,801,411

)

(4,241,311

)

Income tax expense (benefit)

3,241,618

(908,011

)

2,322,515

(885,088

)

Net loss

$

(6,271,028

)

$

(3,337,522

)

$

(11,123,926

)

$

(3,356,223

)

Loss per common share

Loss per share (basic and diluted)

$

(0.18

)

$

(0.10

)

$

(0.33

)

$

(0.10

)

Weighted average number of shares (basic

and diluted)

34,064,266

33,173,456

34,004,944

33,161,368

PARTS iD, INC.

Condensed Consolidated Statements of

Cash Flows

For the nine months ended September 30,

2022 and 2021 (Unaudited)

Nine months ended

September 30,

2022

2021

Cash Flows from Operating Activities:

Net loss

$

(11,123,926

)

$

(3,356,223

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation

6,210,590

5,480,995

Deferred income tax expense (benefit)

2,314,907

(913,561

)

Share based compensation expense

1,601,848

3,303,145

Amortization of right-of-use asset

239,879

-

Gain on the sale of fixed assets

(63,524

)

-

Changes in operating assets and

liabilities:

Accounts receivable

(266,366

)

(270,750

)

Inventory

1,059,967

(1,524,797

)

Prepaid expenses and other current

assets

(1,763,818

)

235,245

Accounts payable

(4,391,427

)

1,124,844

Customer deposits

(6,659,044

)

1,767,997

Accrued expenses

(281,434

)

865,363

Operating lease liabilities

(239,879

)

-

Other current liabilities

(1,013,363

)

310,481

Net cash (used in) provided by operating

activities

(14,375,590

)

7,022,739

Cash Flows from Investing Activities:

Proceeds from sale of fixed assets

90,250

-

Purchase of property and equipment

(64,882

)

(306,165

)

Website and software development costs

(4,669,002

)

(5,391,016

)

Net cash used in investing activities

(4,643,634

)

(5,697,181

)

Cash Flows from Financing Activities:

Principal paid on notes payable

-

(15,956

)

Net cash used in financing activities

-

(15,956

)

Net change in cash

(19,019,224

)

1,309,602

Cash, beginning of period

23,203,230

22,202,706

Cash, end of period

$

4,184,006

$

23,512,308

Supplemental disclosure of cash flows

information:

Cash paid for interest expenses

$

-

$

7,114

Cash paid for income taxes

$

5,000

$

4,000

The following table reflects the reconciliation of net income

(loss) to EBITDA and Adjusted EBITDA for each of the periods

indicated.

Three months ended

September 30,

Nine months ended

September 30,

2022

2021

2022

2021

Net income (loss)

$

(6,271,028

)

$

(3,337,522

)

$

(11,123,926

)

$

(3,356,223

)

Interest expense

50,000

229

50,000

7,114

Income taxes (benefits)

3,241,618

(908,011

)

2,322,515

(885,088

)

Depreciation

2,113,695

1,887,641

6,210,590

5,480,995

EBITDA

(865,715

)

(2,357,663

)

(2,540,821

)

1,246,798

Stock compensation expenses

915,007

1,981,717

1,601,848

3,303,145

Legal & settlement expenses (1)

109,913

238,293

738,654

721,480

Adjusted EBITDA Total

$

159,205

$

(137,653

)

$

(200,319

)

$

5,271,423

% to revenue

0.2

%

-0.1

%

-0.1

%

1.5

%

(1) Represents legal and settlement expenses related to

significant matters that do not impact the fundamentals of our

operations, pertaining to: (i) causes of action between certain of

the Company’s shareholders and which involves claims directly

against the Company seeking the fulfillment of alleged

indemnification obligations with respect to these matters, and (ii)

trademark and intellectual property (“IP”) protection cases. We are

involved in routine IP litigation, commercial litigation and other

various litigation matters. We review litigation matters from both

a qualitative and quantitative perspective to determine if

excluding the losses or gains will provide our investors with

useful incremental information. Litigation matters can vary in

their characteristics, frequency and significance to our operating

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005744/en/

Investors: Brendon Frey ICR ir@partsidinc.com

Media: Erin Hadden FischTank PR

partsid@fischtankpr.com

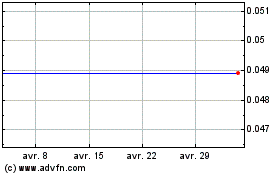

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024