0001698113

false

0001698113

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2023

PARTS

iD, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

|

001-38296 |

|

81-3674868 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1 Corporate

Drive

Suite C

Cranbury, New Jersey 08512

(Address of Principal Executive Offices, including

Zip Code)

(609)

642-4700

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Class A Common Stock |

|

ID |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.04 Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As previously disclosed in

the Current Report on Form 8-K filed by PARTS iD, Inc., a Delaware corporation (the “Company”) on July 17, 2023, the Company

entered into a Securities Purchase Agreement (as amended “the Lind Purchase Agreement”) with Lind Global Fund II LP (“Lind”)

pursuant to which the Company issued and sold, in a private placement, (A) a senior secured convertible promissory note in the aggregate

principal amount of $5,367,500 (the “Lind Note”) and (B) 12,837,838 warrants to purchase shares of the Company’s Class

A common stock (the “Common Stock”) at an exercise price of $0.50 per share (the “Lind Warrant”).

As previously disclosed in

a Notification of Late Filing on Form 12b-25 filed with the SEC on November 14, 2023, the Company was unable to file its Quarterly Report

on Form 10-Q for the quarterly period ended September 30, 2023 (the “Quarterly Report”) by the applicable due date for such

report (the “10-Q Reporting Default”). The Company requires additional time to finalize its financial statements for the quarterly

period ended September 30, 2023 in order to complete certain open audit and technical accounting matters.

Under the Lind Purchase Agreement

and the Lind Note, the 10-Q Reporting Default is considered an Event of Default (as defined in Section 2.1 of the Lind Note and Section

7.1 of the Lind Purchase Agreement). Unless waived by Lind, the foregoing event would constitute a breach of the Lind Purchase Agreement

and the Lind Note that result in certain remedies being available to Lind, including but not limited to, the Company being obligated to

pay to Lind 110% of the outstanding principal amount of the Lind Note or that Lind may demand that all or a portion of the outstanding

principal amount of the Lind Note be converted into shares of Common Stock at the lower of (i) the then-current Conversion Price (as defined

in the Lind Note) and (ii) 80% of the average of the three (3) lowest daily VWAPs during the 20 trading days prior to the delivery by

Lind of the applicable notice of conversion. Lind may also exercise or otherwise enforce any one or more of its rights, powers, privileges,

remedies and interests under the Lind Note, the Lind Purchase Agreement, the other Transaction Documents (as defined in the Lind Purchase

Agreement) or applicable law.

Item 3.01 Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

November 21, 2023, the Company received written notice (the “Notice”) from the NYSE American LLC (the “NYSE American”)

indicating that the Company is not in compliance with the NYSE American’s continued listing standards because the Company did not

timely file its Quarterly Report on Form 10-Q for the quarter September 30, 2023 (the “Form 10-Q”), which was due on November

20, 2023.

In

accordance with Section 1007 of the NYSE American Company Guide, the Company will have six months from the date of the Notice (the “Initial

Cure Period”), to file the Form 10-Q with the Securities and Exchange Commission (the “SEC”). If the Company fails

to file the Form 10-Q during the Initial Cure Period, the NYSE American may, in its sole discretion, provide an additional six-month

cure period (the “Additional Cure Period”). The Company can regain compliance with the NYSE American’s continued listing

standards at any time during the Initial Cure Period or Additional Cure Period, as applicable, by filing the Form 10-Q and any subsequent

delayed filings with the SEC.

Reference

is made to the Notification of Late Filing on Form 12b-25 filed by the Company with the SEC on November 14, 2023 (the “Form 12b-25”)

reporting that it required additional time to complete the Form 10-Q. Although the Company has dedicated significant resources to the

completion of finalizing its consolidated financial statements and related disclosures for inclusion in the Form 10-Q, the Company was

unable to file the Form 10-Q by November 20, 2023, the extension period provided by the Form 12b-25. Additional time is needed by the

Company to complete its review of the financial statements included in the Form 10-Q in order to ensure a complete, accurate Form 10-Q.

The Company intends to file the Form 10-Q as soon as practicable and in any event within the above-referenced six-month period.

The

Notice has no immediate effect on the listing of the Company’s securities on the NYSE American. There can be no assurance, however,

that the Company will be able to regain compliance with the listing standards discussed above.

Item 8.01 Other Events.

On

November 27, 2023, in accordance with the NYSE American’s procedures, the Company issued a press release discussing the matters

disclosed in Item 3.01 above. A copy of the press release is included herewith as Exhibit 99.1, which is incorporated by reference into

this Item 8.01.

Cautionary Note Regarding Forward Looking

Statements

This Current Report on Form

8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, such as

the Company’s expectations concerning the 10-Q Reporting Default and its ability and the anticipated timing for curing the 10-Q

Reporting Default by filing the delinquent report. In some cases, you can identify forward-looking statements by terminology such as “intends,”

“plans,” and “will,” or the negative of these terms or variations of them or similar terminology. We have based

these forward-looking statements on our current expectations and assumptions and analyses made by us in light of our experience and our

perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate

under the circumstances. However, whether actual results and developments will conform with our expectations and predictions is subject

to a number of risks and uncertainties, many of which are beyond our control, including the Company’s ability to complete its delinquent

report; the Company’s ability to regain compliance with the Lind Purchase Agreement and the Lind Note within the applicable cure

periods; the Company’s ability to continue to comply with applicable covenants under the Lind Purchase Agreement, the Lind Note

and the Lind Warrant; the Company’s ability to meet the continued listing requirements of the NYSE American and to maintain the

listing of our securities thereon; and the other factors under the heading “Risk Factors” in our Annual on Form 10-K filed

with the SEC on April 17, 2023, our Quarterly Reports on Form 10-Q filed on May 22, 2023 and August 15, 2023 and in other filings that

the Company has made and may make with the SEC in the future. All of the forward-looking statements made in this Current Report on Form

8-K are qualified by these cautionary statements. The actual results or developments anticipated may not be realized or, even if substantially

realized, they may not have the expected consequences to or effects on the Company or our business or operations. Such statements are

not intended to be a guarantee of future performance and actual results or developments may differ materially from those projected in

the forward-looking statements. You should not place undue reliance on these forward-looking statements, which are made only as of the

date of this Current Report on Form 8-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed

as part of this report:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

PARTS ID, INC. |

| |

|

|

| Date: November 27, 2023 |

By: |

/s/ Lev Peker |

| |

|

Name: |

Lev Peker |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

3

Exhibit 99.1

PARTS iD Receives Notice of Non-compliance

from NYSE American

CRANBURY, N.J., November 27, 2023 -- PARTS iD, Inc. (NYSE American:

ID) (“PARTS iD” or “the Company”) today announced that it has received written notice (the “Notice”)

from the NYSE American LLC (the “NYSE American”) indicating that the Company is not in compliance with the NYSE American’s

continued listing standards because the Company did not timely file its Quarterly Report on Form 10-Q for the quarter September 30, 2023

(the “Form 10-Q”), which was due on November 20, 2023.

In accordance with Section

1007 of the NYSE American Company Guide, the Company will have six months from the date of the Notice (the “Initial Cure Period”),

to file the Form 10-Q with the Securities and Exchange Commission (the “SEC”). If the Company fails to file the Form 10-Q

during the Initial Cure Period, the NYSE American may, in its sole discretion, provide an additional six-month cure period (the “Additional

Cure Period”). The Company can regain compliance with the NYSE American’s continued listing standards at any time during the

Initial Cure Period or Additional Cure Period, as applicable, by filing the Form 10-Q and any subsequent delayed filings with the SEC.

Reference is made to

the Notification of Late Filing on Form 12b-25 filed by the Company with the SEC on November 14, 2023 (the “Form 12b-25”)

reporting that it required additional time to complete the Form 10-Q. Although the Company has dedicated significant resources to the

completion of finalizing its consolidated financial statements and related disclosures for inclusion in the Form 10-Q, the Company was

unable to file the Form 10-Q by November 20, 2023, the extension period provided by the Form 12b-25. Additional time is needed by the

Company to complete its review of the financial statements included in the Form 10-Q in order to ensure a complete, accurate Form 10-Q.

The Company intends to file the Form 10-Q as soon as practicable and in any event within the above-referenced six-month period.

The Notice has no immediate

effect on the listing of the Company’s securities on the NYSE American. There can be no assurance, however, that the Company will

be able to regain compliance with the listing standards discussed above.

About PARTS iD, Inc.

PARTS iD is a technology-driven, digital commerce company focused on

creating custom infrastructure and unique user experiences within niche markets. Founded in 2008 with a vision of creating a one-stop

eCommerce destination for the automotive parts and accessories market, we believe that PARTS iD has since become a market leader and proven

brand-builder, fueled by its commitment to delivering a revolutionary shopping experience; comprehensive, accurate and varied product

offerings; and continued digital commerce innovation.

Cautionary Note Regarding Forward-Looking Statements

All statements made in this press release relating to future financial

or business performance, conditions, plans, prospects, trends, or strategies and other such matters, including without limitation, expected

future performance, consumer adoption, anticipated success of our business model or the potential for long term profitable growth, are

forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In addition, when or if used

in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “plan,” “predict,” “potential,”

“confident,” “look forward,” “optimistic” and similar expressions and their variants, as they relate

to us may identify forward-looking statements. We operate in a changing environment where new risks emerge from time to time and it is

not possible for us to predict all risks that may affect us, particularly those associated with the COVID-19 pandemic and the conflict

in Ukraine, which have had wide-ranging and continually evolving effects. We caution that these forward-looking statements are subject

to numerous assumptions, risks, and uncertainties, which change over time, often quickly and in unanticipated ways.

Important factors that may cause actual results to differ materially

from the results discussed in the forward-looking statements include risks and uncertainties, including without limitation: the ongoing

conflict between Ukraine and Russia has affected and may continue to affect our business; competition and our ability to counter competition,

including changes to the algorithms of Google and other search engines and related impacts on our revenue and advertisement expenses;

the impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto; disruptions

in the supply chain and associated impacts on demand, product availability, order cancellations and cost of goods sold including inflation;

difficulties in managing our international business operations, particularly in the Ukraine, including with respect to enforcing the terms

of our agreements with our contractors and managing increasing costs of operations; changes in our strategy, future operations, financial

position, estimated revenues and losses, product pricing, projected costs, prospects and plans; the outcome of actual or potential litigation,

complaints, product liability claims, or regulatory proceedings, and the potential adverse publicity related thereto; our ability to meet

the continued listing requirements of the NYSE American and to maintain the listing of our securities thereon; the implementation, market

acceptance and success of our business model, expansion plans, opportunities and initiatives, including the market acceptance of our planned

products and services; developments and projections relating to our competitors and industry; our expectations regarding our ability to

obtain and maintain intellectual property protection and not infringe on the rights of others; our ability to maintain and enforce intellectual

property rights and ability to maintain technology leadership; our future capital requirements; our ability to raise capital and utilize

sources of cash; our ability to obtain funding for our operations; changes in applicable laws or regulations; the effects of current and

future U.S. and foreign trade policy and tariff actions; disruptions in the marketplace for online purchases of aftermarket auto parts;

costs related to operating as a public company; and the possibility that we may be adversely affected by other economic, business, and/or

competitive factors.

Further information on the factors and risks that could cause actual

results to differ from any forward-looking statements are contained in our filings with the SEC, which are available at https://www.sec.gov

(or at https://www.partsidinc.com). The forward-looking statements represent our estimates as of the date hereof only, and we specifically

disclaim any duty or obligation to update forward-looking statements.

Investors:

Brendon Frey

ICR

ir@partsidinc.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

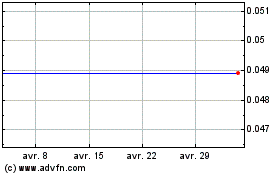

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

PARTS iD (AMEX:ID)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024