Amended Current Report Filing (8-k/a)

22 Avril 2022 - 12:02PM

Edgar (US Regulatory)

0001030192true00010301922022-02-092022-02-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

February 9, 2022

Commission file number: 000-28837

Idaho Strategic Resources, Inc. |

(Exact Name of Registrant as Specified in its Charter) |

Idaho | | 82-0490295 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

201 N. 3rd Street, Coeur d’Alene, ID | | 83814 |

(Address of principal executive offices) | | (zip code) |

Registrant’s telephone number, including area code: (208) 625-9001

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Common Stock, no par value | | NJMC | | OTC Markets: QB |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

On February 15, 2022, Idaho Strategic Resources, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Report”) with the Securities and Exchange Commission to report the Company’s unregistered sale of equity securities. As a result of a scrivener’s error, the total amount of restricted common shares sold was misstated in the Original Report. This Amendment No. 1 to the Current Report on Form 8-K/A amends and restates Item 3.02 of the Original Report to correct the total number of common shares sold. No other changes have been made to Item 3.02 of the Original Report, and this Amendment No. 1 does not amend, modify, or otherwise update any other information in the Original Report.

Item 3.02 of the Original Report is amended and restated in its entirety to read as follows:

Item 3.02 Unregistered Sales of Equity Securities.

On February 9, 2022, Idaho Strategic Resources, Inc. (the “Company”) closed subscriptions of US$2,701,000.00 in a non-brokered private placement (the “Private Placement”) with a small group of investors which included on foreign subscriber. Proceeds from the private placement will be used, in part, to roughly double the Rare Earth Element drill program and for surface work and underground mine development of the Klondike area, lying north of current production from the Skookum shoot. Management believes, once fully completed, that the Klondike will roughly double production from the Golden Chest Mine.

The Private Placement consisted of shares issued at US$7.50 per common share of restricted common stock. No warrants were issued in connection with the Private Placement. A total of 360,134 restricted Common Shares were issued pursuant to the Private Placement.

The above-described sale and issuance of common shares were not registered under the Securities Act of 1933, as amended (“Securities Act”), or the securities laws of any state, are subject to resale restrictions and may not be offered or sold in the United States absent registration under the Securities Act. The foregoing sale of securities has been determined to be exempt from registration in reliance on Section 4(a)(2) of the Securities Act and the safe harbor provided by Rule 506(b) of Regulation D promulgated thereunder, as transactions by an issuer not involving a public offering, in which the investors are accredited and have acquired the securities for investment purposes only and not with a view to or for sale in connection with any distribution thereof. The Company has also relied on the exclusion from registration provided by Rule 903 of Regulation S under the Securities Act to offer and sell shares to the foreign subscriber.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | IDAHO STRATEGIC RESOURCES, INC. | |

| | | | |

| By: | /s/ John Swallow | |

| John Swallow | |

| Its: President & CEO | |

| Date: April 21, 2022 | |

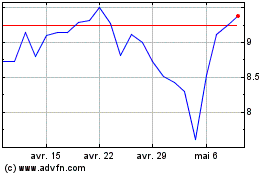

Idaho Strategic Resources (AMEX:IDR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Idaho Strategic Resources (AMEX:IDR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024