| Filed Pursuant to Rule 424(b)(5) Registration No. 333-264647 |

| PROSPECTUS SUPPLEMENT (To the Prospectus dated May 4, 2022) | |

IDAHO STRATEGIC RESOURCES, INC.

$10,000,000

COMMON STOCK

This prospectus supplement and the accompanying prospectus relate to the issuance and sale of up to $10,000,000 of shares of common stock, no par value, of Idaho Strategic Resources, Inc. (the “Company”, “we”, or “us”), from time to time through our sales agent, Roth Capital Partners (or the “Sales Agent”). These sales, if any, will be made pursuant to the terms of the Sales Agreement (the “Sales Agreement”), by and between the Company and the Sales Agent.

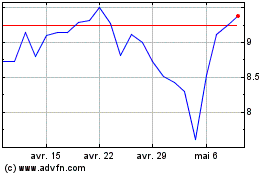

Our common stock is traded on the NYSE American, LLC (“NYSE American”), under the symbol “IDR.” On June 3, 2022, the closing sale price of our common stock on the NYSE American was $8.52 per share.

Sales of shares of our common stock under this prospectus supplement, if any, may be made by any method deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act.

The sales agent is not required to sell any specific number of shares of our common stock. The sales agent has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between the sales agent and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. The sales agent will be entitled to compensation under the terms of the sales agreement at a commission rate equal to 3% of the gross proceeds of the sales price of common stock that they sell. The net proceeds from any sales under this prospectus supplement will be used as described under “Use of Proceeds.” The proceeds we receive from sales of our common stock, if any, will depend on the number of shares actually sold and the offering price of such shares.

In connection with the sale of common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act, and its compensation as the sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Roth Capital Partners with respect to certain liabilities, including liabilities under the Securities Act.

As of June 3, 2022, the aggregate market value of our outstanding common stock held by non-affiliates was $87,233,775 based on 11,783,306 shares of outstanding common stock, of which 10,238,706 shares are held by non-affiliates, and a per share price of $8.52, which was the closing sale price of our common stock as quoted on the NYSE American on June 3, 2022. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus supplement with a value of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75,000,000. During the 12 calendar months prior to, and including, the date of this prospectus supplement, we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities is highly speculative and involves a high degree of risk. You should read carefully and consider the information contained in and incorporated by reference under “Risk Factors” beginning on page S-5 of this prospectus supplement, and the risk factors contained in other documents incorporated by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus supplement is June 7, 2022

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process and consists of two parts. The first part is the prospectus supplement, including the documents incorporated by reference herein, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference therein, provides more general information.

In general, when we refer only to the prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information described under the heading “Where You Can Find More Information.” These documents contain information you should carefully consider when deciding whether to invest in our common stock. Neither we nor the Sales Agent have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for and can provide no assurance of any other information that others may provide to you. We are not making offers to sell or solicitations to buy the securities described in this prospectus supplement in any jurisdiction in which an offer or solicitation is not authorized, or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should not assume that the information in this prospectus supplement or any prospectus, as well as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus supplement or any prospectus, is accurate as of any date other than its respective date. Our business, financial condition, results of operations, and prospects may have changed since those dates.

This prospectus supplement may add, update, or change information contained in the accompanying prospectus. To the extent there is a conflict between the information contained in this prospectus supplement and the accompanying prospectus, you should rely on information contained in this prospectus supplement, provided that if any statement in, or incorporated by reference into, one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement. Any statement so modified will be deemed to constitute a part of this prospectus supplement and the accompanying prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus supplement and the accompanying prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus supplement in that jurisdiction. Persons who come into possession of this prospectus supplement in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement applicable to that jurisdiction.

Unless otherwise stated, all references to “us,” “our,” “IDR,” “we,” the “Company” and similar designations refer to Idaho Strategic Resources, Inc. and its consolidated subsidiaries. Our logo, trademarks and service marks are the property of Idaho Strategic Resources, Inc. and its consolidated subsidiaries. Other trademarks or service marks appearing in this prospectus supplement are the property of their respective holders.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement. This summary does not contain all the information that you should consider before buying our securities. You should carefully read this prospectus supplement and accompanying prospectus in their entirety, including all documents incorporated by reference herein before making an investment decision. In particular, attention should be directed to our “Risk Factors,” and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, including in our most recent Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022.

Business Overview

Headquartered in North Idaho, Idaho Strategic Resources produces gold at the Golden Chest Mine and holds a significant land package in the Murray Gold Belt (“MGB”). The MGB is an overlooked gold producing region within the Coeur d’Alene Mining District, located north of the prolific Silver Valley. In addition to gold and gold production, the Company maintains a strategic and domestic presence in the Critical Minerals and Energy Minerals sectors and is focused on advancing its officially recognized Diamond Creek and Roberts Rare Earth Element projects in central Idaho as well as its Thorium project in Lemhi Pass, ID. IDR is one of the few companies possessing the combination of officially recognized U.S. based domestic Rare Earth Element and Thorium properties (in Idaho) and Idaho-based gold production in an established mining community.

Idaho Strategic Resources possesses the in-house expertise ranging, from early-stage exploration and core drilling to mine development and production, including the design and operation of the New Jersey Mill – all while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings.

IDR has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine.

Our executive offices are located at 201 N. Third Street, Coeur d’Alene, ID 83814. You can also contact us by telephone at (208) 625-9001.

Our Market Opportunity

The Company is an established gold producer, with surface and underground mining operations at its 100-percent owned Golden Chest Mine and conducts milling operations at its majority-owned New Jersey Mill. The Company also has an expanded focus on identifying and exploring Critical Minerals (Rare Earth Elements and Thorium). In addition to gold and gold production, the Company also maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more “at-risk” Rare Earth Elements (REE’s). The Company’s Diamond Creek and Roberts REE properties are included the U.S. National REE inventory as listed in USGS, IGS and DOE publications. Both projects are in central Idaho and participating in the USGS Earth MRI program, with the Diamond Creek Project also participating in the Idaho Department of Commerce’s IGEM program.

The Company holds mineral properties in four historic mining districts of Idaho and Montana. Its portfolio of mineral properties includes:

| | · | The Golden Chest Mine, a producing gold mine located in the Murray Gold Belt (“MGB”) of North Idaho |

| | | |

| | · | A significant portfolio of early-stage exploration properties within the MGB, many of which include historic gold mines and known gold mineralization |

| | | |

| | · | United States Geologic Survey (“USGS”) recognized Rare Earth Element potential |

| | | o | Diamond Creek-one of Idaho’s most prospective REE properties |

| | | o | Roberts Rare Earth-one of the highest grade known REE properties in the US |

| | · | Lemhi Pass District in central Idaho “thought to be the largest concentration of Thorium resources in the United States” according to the USGS |

| | | |

| | · | A significant portfolio of early-stage exploration properties in Central Idaho, primarily in the Elk City area |

| | | |

| | · | The Butte Highlands Mine (50-percent interest), an advanced-stage project which has seen considerable development work, located south of the city of Butte, in Western Montana; however, management does not expect this project to be advanced in the near future. |

In addition to its portfolio of exploration, pre-development, and producing properties, the Company is also the manager and majority owner of the New Jersey Mill, which currently processes ore from the Golden Chest Mine. The New Jersey Mill can process gold and silver ore through a 360-tonne per day flotation plant.

During the last few years, the Company has focused its efforts on expanding underground development and production at the Golden Chest Mine with an aggressive focus on consolidating and increasing its land holding within the Murray Gold Belt. With all debt associated with the start-up of operations behind it, the Company significantly increased its exploration and expansion activities in the Murray Gold Belt. This progress combined with the existing infrastructure and development over the last two years has created a solid foundation for continued growth and, we feel, a base of value regardless of market cycles.

Our Growth Strategy

The Company’s plan of operation is to generate positive cash flow and increase its gold production and asset base over time while being mindful of corporate overhead. The Company’s management is focused on utilizing its in-house technical and operating skills to build a portfolio of producing mines and milling operations with a focus on gold and exploration for minerals critical to the United States’ low carbon future, including REEs and Thorium.

The Company’s properties include: the Golden Chest Mine (currently in production), the New Jersey Mill (majority ownership interest), and a 50% carried to production interest in the past-producing Butte Highlands Mine located in Montana. In addition to its producing and near-term production projects, the Company has additional gold exploration prospects, including the McKinley-Monarch and Eastern Star located in Central Idaho, and additional holdings near the Golden Chest in the Murray Gold Belt. Recently, the Company added Rare Earth Element and Thorium properties in Idaho to its portfolio of exploration properties in an effort to diversify its holdings towards the anticipated demand for these elements in the electrification of motorized vehicles and energy independence.

Our Revenue Model

The Company’s primary source of revenue comes from its operating gold mine, the Golden Chest Mine located in the Murray Gold Belt of northern Idaho. The Company is also pursuing a Rare Earth Element (REE) and Thorium exploration strategy and has acquired properties in Idaho containing these minerals.

The Company sold all its flotation gold concentrate to H&H Metals Corporation of New York, NY which accounted for 95% of gold sales in 2021. The remaining gold sales were gold doré, which was sold to a western U.S. refinery. H&H Metals is also an IDR shareholder. Although not expected, if H&H Metals could not purchase the gold concentrate, it is anticipated another customer could be found readily as the floatation gold concentrate is a high value concentrate with minor deleterious element content. The Company ships its gold concentrate overseas to a smelter in Japan and the recent global shipping problems due to Covid-19 can result in increased inventory of gold concentrate at the New Jersey Mill.

THE OFFERING

The following summary contains basic information about our common stock and the offering and is not intended to be complete. It does not contain all of the information that may be important to you. For a more complete understanding of our common stock, you should read the section of the accompanying prospectus entitled “Description of the Securities That May Be Offered”.

| Issuer | Idaho Strategic Resources, Inc., an Idaho corporation. |

| Common stock offered by this Prospectus Supplement: | Shares of our common stock having an aggregate offering price of up to $10,000,000. |

| | |

| Common stock to be outstanding after the offering: | 12,957,015 assuming the sale of the full $10,000,000 worth of our common stock in this offering (which is 1,173,709 at an assumed sales price of $8.52 per share, which was the closing price of our common stock on the NYSE American on June 3, 2022). The actual number of shares issued in this offering will vary depending on the number of shares sold in this offering and the sales price at which shares may be sold from time to time during this offering. |

| | |

| Manner of offering: | “At the market offering” that may be made from time to time through our Sales Agent, Roth Capital Partners, LLC. See “Plan of Distribution” on page 9 of this prospectus supplement. |

| | |

| Use of Proceeds: | We intend to use the net proceeds from these sales for acquiring equipment, construction costs, and labor associated with the construction of a new mill and related facilities, and general corporate purposes. See “Use of Proceeds” on page 7 of this prospectus supplement. |

| | |

| Risk Factors: | An investment in our securities is highly speculative and subject to substantial risks. You should consider the “Risk Factors” and the “Cautionary Note Regarding Forward-Looking Statements” included and incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risk factors incorporated by reference from our filings with the SEC. |

| | |

| NYSE American symbol: | “IDR” |

| | |

| Transfer agent and Registrar | Nevada Agency and Transfer Company |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and any documents we incorporate by reference, contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and involve substantial risks and uncertainties. All statements contained in this prospectus supplement, the accompanying prospectus, and any documents we incorporate by reference other than statements of historical facts, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate”, “believe”, “estimate, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “target”, “potential”, “will”, “would”, “could”, “should”, “continue”, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

These forward-looking statements are only predictions, and we may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. We have included important factors in the cautionary statements included in this prospectus supplement and the accompanying prospectus, as well as certain information incorporated by reference into this prospectus supplement and the accompanying prospectus, that could cause actual future results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus supplement and the accompanying prospectus, whether as a result of any new information, future events or otherwise.

You should read this prospectus supplement and the accompanying prospectus, and any documents we incorporate by reference, with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

RISK FACTORS

Investing in our securities is highly speculative and involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risk factors we describe in this prospectus supplement and in any related free writing prospectus that we may authorize to be provided to you or in any report incorporated by reference into this prospectus supplement, including our Annual Report on Form 10-K for the year ended December 31, 2021, or any Annual Report on Form 10-K or Quarterly Report on Form 10-Q that is incorporated by reference into this prospectus supplement after the date of this prospectus. Although we discuss key risks in those risk factor descriptions, additional risks not currently known to us or that we currently deem immaterial also may impair our business. Our subsequent filings with the SEC may contain amended and updated discussions of significant risks. We cannot predict future risks or estimate the extent to which they may affect our financial performance.

Risks Related to This Offering

You may experience immediate and substantial dilution as a result of this offering and additional dilution in the future.

Because the price per share of our common stock being offered may be higher than the book value per share of our common stock, you may suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering. In addition, we have a significant number of warrants and options outstanding. If the holders of these securities exercise them or become vested in them, as applicable, you may incur further dilution.

Management will have broad discretion as to the use of the proceeds from this offering and may not use the proceeds effectively.

Because we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. You will be relying on the judgment of our management regarding the application of these proceeds. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value, or our management might not apply the net proceeds from this offering in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

Future sales of substantial amounts of our common stock, or the possibility that such sales could occur, could adversely affect the market price of our common stock.

We may issue up to $10,000,000 of common stock from time to time in this offering. The issuance from time to time of shares in this offering, as well as our ability to issue such shares in this offering, could have the effect of depressing the market price or increasing the market price volatility of our common stock. See “Plan of Distribution” in this prospectus supplement and the prospectus for more information about the possible adverse effects of our sales under the sales agreement.

It is not possible to predict the actual number of shares we will sell under the sales agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the sales agent at any time throughout the term of the sales agreement. The number of shares that are sold through the sales agent after delivering a placement notice will fluctuate based on a number of factors, including the market price of the common stock during the sales period, the limits we set with the sales agent in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales. Further, we are not obligated to sell any shares under the sales agreement, so you should not invest in our securities in reliance on the fact that we will actually raise new capital via the at the market sales program covered by this prospectus supplement.

The common stock offered hereby will be sold in an “at the market offering,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

Our business may be adversely affected by information technology disruptions.

Cybersecurity incidents are increasing in frequency, evolving in nature and include, but are not limited to, installation of malicious software, unauthorized access to data, and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. We believe that we have implemented appropriate measures to mitigate potential risks. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could be subject to manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our financial condition and results of operations.

USE OF PROCEEDS

We may issue and sell shares of common stock having aggregate sales proceeds of up to $10,000,000 from time to time, before deducting sales agent commissions and expenses. The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement with Roth Capital Partners. We intend to use the net proceeds of this offering for acquiring equipment, construction costs, and labor related to the construction of a mill and mill facilities at or near the Golden Chest Mine and general corporate purposes as management deems necessary.

However, the nature, amounts and timing of our actual expenditures may vary significantly depending on numerous factors. Our management has and will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering.

DIVIDEND POLICY

We have never paid or declared any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future. We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant. Our future ability to pay cash dividends on our stock may also be limited by the terms of any future debt or preferred securities or future credit facility.

DILUTION

If you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the public offering price per share and the adjusted net tangible book value per share of our common stock after this offering. Our net tangible book value on March 31, 2022 was approximately $17,300,000, or $1.47 per share. “Net tangible book value” is total assets minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total number of shares outstanding.

After giving effect to the sale of shares of our common stock in the aggregate amount of $10,000,000 in this offering at an assumed offering price of $8.52 per share, which was the last reported sale price of our common stock on the NYSE American on June 3, 2022, and after deducting estimated offering commissions and expenses payable by us, our net tangible book value as of March 31, 2022 would have been approximately $27,000,000, or $2.08 per share of common stock. This represents an immediate increase in net tangible book value of $0.62 per share to our existing stockholders and an immediate dilution in net tangible book value of $6.44 per share to investors participating in this offering. The following table illustrates this dilution per share to investors participating in this offering:

| Assumed offering price per share | | $ | 8.52 | |

| Net tangible book value per share as of March 31, 2022 | | $ | 17,300,000 | |

| Increase per share attributable to this offering | | $ | 0.62 | |

| As-Adjusted Net tangible book value per share after giving effect to this offering | | $ | 27,000,000 | |

| Dilution per share to new investors | | $ | 6.44 | |

The table above assumes, for illustrative purposes, that an aggregate of 1,173,709 shares of our common stock are sold at a price of $8.52 per share, the last reported sale price of our common stock on the NYSE American on June 3, 2022, for aggregate gross proceeds of $9,999,992.16. The shares sold in this offering, if any, will be sold from time to time at various prices.

Each $1.00 increase (decrease) in the assumed public offering price of $8.52 per share (the last reported sale price of our common stock on the NYSE American on June 3, 2022) would increase (decrease) our as adjusted total shareholders’ equity and total capitalization by approximately $1.17 million, assuming no change to the dollar value of shares of common stock being offered hereby set forth on the cover page of this prospectus supplement, and after deducting underwriting discounts and estimated offering expenses payable by us.

The above discussion and table are based on 11,783,306 shares of our common stock outstanding as of June 3, 2022 and excludes, as of that date:

| | · | 408,955 shares of our common stock reserved for issuance under our 2014 Stock Option and Stock Issuance Plan with a weighted average exercise price of $5.42; |

| | | |

| | · | 336,745 shares of our common stock underlying warrants issued to investors of a private placement that closed August 28, 2020, at an exercise price of $5.60 per share; |

| | | |

| | · | 235,722 shares of our common stock underlying warrants issued to investors of a private placement that closed October 15, 2021, at an exercise price of $5.60 per share; |

| | | |

| | · | 53,572 shares of our common stock underlying warrants issued an investor of a private placement that closed November 12, 2021, at an exercise price of $7.00 per share. |

To the extent that any of our outstanding options or warrants are exercised, we grant additional options or other awards under our stock incentive plan or issue additional warrants, or we issue additional shares of common stock in the future, there may be further dilution.

PLAN OF DISTRIBUTION

We entered into a sales agreement with Roth Capital Partners, or the Sales Agent, on June 7, 2022. Under the terms of the sales agreement, we may offer and sell up to $10,000,000 of shares of our common stock from time to time through the Sales Agent. Sales of shares of our common stock, if any, under this prospectus supplement may be made by any method deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including sales made directly on or through NYSE American, the existing trading market for our common stock. We may instruct the sales agent not to sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or the sales agent may suspend the offering of common stock upon notice and subject to other conditions.

The sales agent will offer our common stock subject to the terms and conditions of the sales agreement as agreed upon by us and the sales agent. Each time we wish to issue and sell common stock under the sales agreement, we will notify the sales agent of the number or dollar value of shares to be issued, the time period during which such sales are requested to be made, any limitation on the number of shares that may be sold in one day, any minimum price below which sales may not be made and other sales parameters as we deem appropriate. Once we have so instructed the sales agent, unless the sales agent declines to accept the terms of the notice, the sales agent has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of the sales agent under the sales agreement to sell our common stock are subject to a number of conditions that we must meet.

We will pay the Sales Agent commissions for its services in acting as agent in the sale of our common stock at a commission rate equal to 3% of the gross sale price from sales of shares under this offering. We estimate that the total expenses for the offering, excluding compensation and reimbursement payable to the sales agent under the sales agreement, will be approximately $50,000.

Settlement for sales of common stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and the sales agent in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act, and its compensation as sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Roth Capital Partners against certain civil liabilities, including liabilities under the Securities Act.

The offering pursuant to the sales agreement will terminate upon the earlier of (1) the issuance and sale of all shares of our common stock subject to the sales agreement; and (2) the termination of the sales agreement as permitted therein.

The sales agent and its affiliates may in the future provide various investment banking and other financial services for us and our affiliates, for which services it has received and may in the future receive customary fees. Affiliates of the Sales Agent may be lenders or agents under our various credit facilities in the future, and affiliates of the Sales Agent may hold our securities. The Sales Agent and/or its affiliates may also make investment recommendations and/or publish or express independent research views in respect of our securities or financial instruments related to our securities and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The prospectus supplement and the prospectus for the offering in electronic format may be made available on websites maintained by the sales agent. To the extent required by Regulation M, the sales agent will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement. This summary of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions. A copy of the sales agreement is filed as an exhibit to the registration statement of which this prospectus supplement forms a part and is incorporated by reference in this prospectus supplement.

LEGAL MATTERS

Certain legal matters in connection with this offering will be passed upon for us by Lyons O’Dowd, PLLC, Coeur d’Alene, Idaho. Roth Capital Partners, LLC is being represented in connection with this offering by Pryor Cashman LLP, New York, New York.

EXPERTS

Our balance sheets as of December 31, 2021, and 2020, and the related statement of operations, changes in statement of stockholders’ equity (deficit), and statement of cash flows for the years ended December 31, 2021, and 2020, incorporated in this prospectus supplement by reference have been audited by Assure CPA, LLC, with respect thereto, and has been so included in reliance upon the report of such firm given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and accompanying prospectus are part of the registration statement on Form S-3 we filed with the SEC under the Securities Act registering the securities that may be offered and sold hereunder. The registration statement, including exhibits thereto, contains additional relevant information about us and these securities, which as permitted by the rules and regulations of the SEC, we have not included in this prospectus supplement and accompanying base prospectus. A copy of the registration statement can be obtained at the address set forth below or at the SEC’s website as noted below. Whenever a reference is made in this prospectus supplement, or the prospectus, to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus supplement, the prospectus, or incorporated filings, for a copy of such contract, agreement, or other document.

Because we are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, we file annual, quarterly, and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because our common stock is listed on the NYSE American, you may also inspect reports, proxy statements and other information at the offices of the NYSE American.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We are “incorporating by reference” certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents instead of having to repeat the information in this prospectus supplement. The information in the documents incorporated by reference is part of this prospectus supplement. Statements contained in documents that we file with the SEC and that are incorporated by reference in this prospectus supplement will automatically update and supersede information contained in this prospectus supplement, including information in previously filed documents or reports that have been incorporated by reference in this prospectus supplement and the Prospectus, to the extent the new information differs from or is inconsistent with the old information. This prospectus supplement incorporates by reference any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, between the date of the initial registration statement and prior to the effectiveness of the registration statement and the documents listed below that we have previously filed with the SEC:

| | 1. | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission on March 31, 2022. |

| | | |

| | 2. | Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022, filed with the Securities and Exchange Commission on May 16, 2022. |

| | | |

| | 3. | Our proxy statement on Schedule 14A filed with the SEC on May 13, 2022. |

| | | |

| | 4. | Our Current Reports on Form 8-K filed with the Securities and Exchange Commission on January 14, 2022, February 15, 2022, March 9, 2022, March 10, 2022 and April 22, 2022. |

We also incorporate by reference all documents that we file with the SEC on or after the effective time of this prospectus supplement pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act and prior to the sale of all the securities registered hereunder or the termination of the registration statement. Nothing in this prospectus supplement shall be deemed to incorporate information furnished but not filed with the SEC.

Any statement contained in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference in this prospectus supplement shall be deemed modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus, or in any subsequently filed document that also is deemed to be incorporated by reference, modifies, or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

You may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporate by reference), by contacting John Swallow, c/o Idaho Strategic Resources, Inc., at 201 N 3rd Street, Coeur d’Alene, Idaho 83814. Telephone number (208) 625-9001.

Statements contained in this prospectus supplement as to the contents of any contract or other documents are not necessarily complete, and in each instance, you are referred to the copy of the contract or other document filed as an exhibit to the registration statement or incorporated herein, each such statement being qualified in all respects by such reference and the exhibits and schedules thereto.

The information in this prospectus is not complete and may be changed. We may not sell the securities until the Registration Statement filed with the Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 3, 2022

PRELIMINARY PROSPECTUS

$35,000,000

COMMON STOCK

WARRANTS

RIGHTS

DEBT SECURITIES

UNITS

and

Up to 360,134 Shares of Common Stock Offering by the Selling Stockholders

We may offer and sell from time to time up to $35,000,000 in the aggregate of common stock, senior debt securities (which may be convertible into or exchangeable for common stock), subordinate debt securities (which may be convertible into or exchangeable for common stock), warrants, rights and units that include any of these securities. We will offer the securities in amounts, at prices and on terms to be determined at the time of the offering.

Each time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms of the offering, including the price at which we are offering the securities to the public. In the case of an offering by the selling stockholders, information about the selling stockholders, including the relationship between the selling stockholders and us, will also be included in the applicable prospectus supplement. The prospectus supplement may also add, update or change information contained or incorporated in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Information Incorporated by Reference” before you make your investment decision. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this prospectus, the information incorporated by reference in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus carefully before you invest in our securities.

The securities hereunder may be offered directly by us, through agents designated from time to time by us or to or through underwriters or dealers. If any agents, dealers or underwriters are involved in the sale of any securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the section entitled “About This Prospectus” for more information.

We may offer and sell these securities separately or together, in one or more series or classes and in amounts, at prices and on terms described in one or more offerings. We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

This prospectus also relates to the possible resale by holders from a previous private placement, who we will refer to in this prospectus as the “selling stockholders” of up to 360,134 shares that were issued and outstanding prior to the original date of filing of the registration statement of which this prospectus forms a part. The shares of our common stock included in this prospectus were originally acquired by the selling stockholders in a private placement of our common stock dated February 9, 2022.

The selling stockholders named in this prospectus may also offer up to 360,134 shares of our common stock from time to time in connection with one or more offerings, at prices and on terms that will be determined by the selling stockholders. We will not receive any proceeds from the sale of any securities by the selling stockholders.

Our common stock is quoted on the NYSE American under the symbol “IDR.” The closing sales price of our common stock on the NYSE American on April 28, 2022 was $9.24 per share.

As of April 28, 2022, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was $94,505,269, which was calculated based on 10,227,843 shares outstanding held by non-affiliates and a per share closing price of $9.24 reported on the NYSE on that date. We have not offered securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar months ending on and including the date of this prospectus. Pursuant to General Instruction I.B.6, in no event will we sell securities registered on this registration statement with a value exceeding more than one-third of our public float in any 12-month period if our public float is below $75 million.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 3 of this prospectus, as well as in supplements to this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 3, 2022.

TABLE OF CONTENTS

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

ABOUT THIS PROSPECTUS

References in this prospectus to IDR, we, us, our, and the “Company” are to Idaho Strategic Resources, Inc., an Idaho corporation.

This prospectus is part of a registration statement on Form S-3 we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we and/or the selling stockholders to be named in a prospectus supplement to this prospectus may, from time to time, offer and sell shares of our common stock; and we may, from time to time, offer and sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides certain general information about the securities that we and/or the selling stockholders may offer hereunder. Each time we and/or the selling stockholders sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. In each prospectus supplement, we will include the following information:

| ● | the number and type of securities that we propose to sell; |

| | ● | the public offering price; |

| | ● | the names of any underwriters, agents or dealers through or to which the securities will be sold; |

| | ● | any compensation of those underwriters, agents or dealers; |

| | ● | any additional risk factors applicable to the securities or our business and operations; and |

| | ● | any other material information about the offering and sale of the securities. |

In addition, the prospectus supplement or free writing prospectus may also add, update or change the information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement or free writing prospectus will supersede this prospectus to the extent it contains information that is different from, or that conflicts with, the information contained in this prospectus or incorporated by reference in this prospectus. You should read and consider all information contained in this prospectus, any accompanying prospectus supplement and any free writing prospectus that we have authorized for use in connection with a specific offering, in making your investment decision. You should also read and consider the information contained in the documents identified under the heading “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectus.

We may sell the securities (a) through agents; (b) through underwriters or dealers; (c) directly to one or more purchasers; or (d) through a combination of any of these methods of sale. We and our agents reserve the sole right to accept and to reject in whole or in part any proposed purchase of securities. See “Plan of Distribution” below.

You should rely only on the information contained in this prospectus, any prospectus supplement and the documents we have incorporated by reference. We will disclose any material changes in our affairs in an amendment to this prospectus, a prospectus supplement or a future filing with the SEC incorporated by reference in this prospectus. No person has been authorized to give any information or to make any representations other than those contained or incorporated in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or any accompanying prospectus supplement. This prospectus and the accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and the accompanying supplement to this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front cover of this document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities sold on a later date.

THIS PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws, including statements about anticipated future operating and financial performance, financial position and liquidity, growth opportunities and growth rates, pricing plans, acquisition and divestiture opportunities, business prospects, strategic alternatives, business strategies, regulatory and competitive outlook, investment and expenditure plans, financing needs and availability and other similar forecasts and statements of expectation and statements of assumptions underlying any of the foregoing. The words “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should” and variations of these words and similar expressions are generally intended to identify these forward-looking statements. These forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond IDR’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.

Forward-looking statements by us are based on estimates, projections, beliefs and assumptions of management and are not guarantees of future performance. Such forward-looking statements may be contained in this prospectus (and the documents incorporated by reference herein) under “Risk Factors,” or may be contained in our Annual Report on Form 10-K or in our Quarterly Reports on Form 10-Q under headings such as “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” and “Business,” or in our Current Reports on Form 8-K, among other places. Some of other risk factors include, but are not limited to, the following:

| | · | adverse effects of climate changes or natural disasters; |

| | · | adverse effects of global or regional pandemic disease spread or other crises; |

| | · | global economic and capital market uncertainties; |

| | · | the speculative nature of gold or mineral exploration, including risks of diminishing quantities or grades of qualified resources; |

| | · | operational or technical difficulties in connection with exploration, processing or mining activities; |

| | · | costs, hazards and uncertainties associated with precious metal based activities, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; |

| | · | contests over our title to properties; |

| | · | potential dilution to our shareholders from our stock issuances, recapitalization and balance sheet restructuring activities; |

| | · | potential inability to comply with applicable government regulations or law; |

| | · | adoption of or changes in legislation or regulations adversely affecting our businesses; |

| | · | permitting constraints or delays; |

| | · | ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving the ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; |

| | · | changes in the United States or other monetary or fiscal policies or regulations; |

| | · | interruptions in our production capabilities due to capital constraints; |

| | · | equipment failures; |

| | · | fluctuation of prices for gold or certain other commodities (such as rare earth elements, water, diesel, gasoline and alternative fuels and electricity); |

| | · | changes in generally accepted accounting principles; |

| | · | adverse effects of war, mass shooting, terrorism and geopolitical events; |

| | · | potential inability to implement our business strategies; |

| | · | potential inability to grow revenues; |

| | · | potential inability to attract and retain key personnel; |

| | · | interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; |

| | · | assertion of claims, lawsuits and proceedings against us; |

| | · | potential inability to satisfy debt and lease obligations; |

| | · | potential inability to maintain an effective system of internal controls over financial reporting; and |

| | · | work stoppages or other labor difficulties. |

Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

SUMMARY OF OUR BUSINESS

Idaho Strategic Resources, Inc., or “IDR,” headquartered in North Idaho, Idaho Strategic Resources produces gold at the Golden Chest Mine and holds a significant land package in the Murray Gold Belt (“MGB”). The MGB is an overlooked gold producing region within the Coeur d’Alene Mining District, located north of the prolific Silver Valley. In addition to gold and gold production, the Company maintains a strategic and domestic presence in the Critical Minerals sector and is focused on advancing its officially recognized Diamond Creek and Roberts Rare Earth Element projects in central Idaho. IDR is one of the few companies possessing the combination of officially recognized U.S. based domestic rare earth element properties (in Idaho) and Idaho-based gold production in an established mining community.

Idaho Strategic Resources possesses the in-house expertise ranging, from early-stage exploration and core drilling to mine development and production, including the design and operation of the New Jersey Mill – all while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings.

IDR has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine.

OUR BUSINESS

Idaho Strategic Resources, Inc. (formerly New Jersey Mining Company), was incorporated in the State of Idaho on July 18, 1996. The Company is an established gold producer, with surface and underground mining operations at its 100-percent owned Golden Chest Mine and milling operations at its majority-owned New Jersey Mill and an expanded focus on identifying and exploring critical strategic minerals (“Rare Earth Minerals”). Its business strategy is to grow its asset base and mineral production over time, relying primarily on its in-house skill sets to eventually become a mid-tier gold and Rare Earth Minerals producer. The Company holds mineral properties in three historic mining districts of Idaho and Montana. Its portfolio of mineral properties includes:

| | · | The Golden Chest Mine, a producing gold mine located in the Murray Gold Belt (“MGB”) of North Idaho; |

| | | |

| | · | Advanced stage, pre-development surface and underground property, adjacent to the Golden Chest Mine; |

| | | |

| | · | A significant portfolio of early-stage exploration properties within the MGB, many of which include historic gold mines and known gold mineralization; |

| | | |

| | · | USGS recognized Rare Earth Element Resource |

| | o | Diamond Creek - third largest REE resource in the US |

| | o | Roberts Rare Earth – one the highest grade REE properties in the US |

| | · | A significant portfolio of early-stage exploration properties in Central Idaho, primarily in the Elk City area, and; |

| | | |

| | · | The Butte Highlands Mine (50-percent interest), an advanced-stage project which has seen considerable development work, located south of the city of Butte, in Western Montana; |

In addition to its portfolio of exploration, pre-development, and producing properties, the Company is also the manager and majority-owner of the New Jersey Mill, which currently processes ore from the Golden Chest Mine. The New Jersey Mill can process gold and silver ore through a 360-tonne per day flotation plant.

During the last two years, the Company has focused its efforts on expanding underground development and production at the Golden Chest Mine with an aggressive focus on consolidating and increasing its land holdings within the Murray Gold Belt. After paying off nearly all debt associated with the start-up of operations, the Company significantly increased its exploration and expansion activities in the Murray Gold Belt. This progress, combined with the existing infrastructure and development over the last two years, has created a solid foundation for continued growth and a base of value regardless of market cycles. In addition to establishing the base for increasing its production profile, the Company has also taken a proactive approach adding nationally recognized Rare Earth Element Resource projects to its asset base.

Our shares of common stock are quoted on the NYSE American LLC exchange (“NYSE American Exchange”) under the symbol IDR. The last reported sales price of our common stock on April 28, 2022 was $9.24. Our executive offices are located at 201 N. Third Street, Coeur d’Alene, ID 83814. You can also contact us by telephone at (208) 625-9001. The information on IDR’s website https://idahostrategic.com is not part of this prospectus.

For additional information about IDR’s business, see IDR’s annual and quarterly reports, and the other documents IDR files with the SEC, which are incorporated into this registration statement by reference. See “Where You Can Find More Information” below.

RISK FACTORS

An investment in our securities involves a significant degree of risk. Before you invest in our securities, you should carefully consider the risk factors included in, or incorporated by reference into, this report, as updated by our subsequent filings under the Exchange Act, and those risk factors that may be included in any applicable report supplement, together with all of the other information included in this report, any report supplement and the documents we incorporate by reference, in evaluating an investment in our securities. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, cash flows and results of operations. If that occurs, the trading price of our securities could decline materially and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and/or operating results. Past financial and operational performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

Financial Risks

Diversity in application of accounting literature in the mining industry may impact our reported financial results.

The mining industry has limited industry-specific accounting literature and, as a result, we understand diversity in practice exists in the interpretation and application of accounting literature to mining-specific issues. As diversity in mining industry accounting is addressed, we may need to restate our reported results if the resulting interpretations differ from our current accounting practices.

You may lose all or part of your investment.

If we are unable to effectively develop, mine, recover and sell adequate quantities of gold or generate cash flows from our other diversified precious and strategic metals production and processing activities (including, but not limited to, metals exploration, engineering, resource development, economic feasibility assessments, mineral production, metal processing and related ventures), it is unlikely that the cash generated from our internal operations will suffice as a source of the liquidity necessary for anticipated working capital requirements. There is no assurance that the Company’s initiatives to improve its liquidity and financial position will be successful. Accordingly, there is substantial risk that the Company will be unable to continue as a going concern. In the event of insolvency, liquidation, reorganization, dissolution or other winding up of the Company, the Company’s creditors would be entitled to payment in full out of the Company’s assets before holders of common stock would be entitled to any payment, and the claims on such assets may exceed the value of such assets.

Because we may never earn significant revenues from our mine operations or our other diversified precious metal-based and strategic metals production and processing activities, our business may fail.

We recognize that if we are unable to generate significant revenues from the exploration and exploitation of our mineral reserves or our other diversified precious and strategic metals production and processing activities in the future, we will not be able to earn profits or continue operations. We have yet to generate positive operating income and there can be no assurance that we will ever operate profitably. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate significant revenues or ever achieve profitability. If we are unsuccessful, our business will fail, and investors may lose all of their investment in our Company.

We will not be successful unless we recover precious or strategic metals and sell them for a profit.

Our success depends on our ability to recover precious or strategic metals, process them, and successfully sell them for more than the cost of production. The success of this process depends on the market prices of metals in relation to our costs of production. We may not be able to generate a profit on the sale of gold or other minerals because we have limited control over our costs and have no ability to control the market prices. The total cash costs of production at any location are frequently subject to great variation from year to year as a result of a number of factors, such as the changing composition of the grade of the mineralized material mined for production, and metallurgy and exploration activities in response to the physical shape and location of the mineral deposit. In addition, costs are affected by the price of commodities, such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production unprofitable. A material increase in production costs or a decrease in the price of gold or other minerals could adversely affect our ability to earn a profit on the sale of gold or other minerals.

Cost estimates and timing of new projects are uncertain, which may adversely affect our expected production and profitability.

The capital expenditures and time required to acquire, develop and explore our projects are considerable and changes in costs, construction schedules or both, can adversely affect project economics and expected production and profitability. There are a number of factors that can affect costs and construction schedules, including, among others:

| | · | availability of labor, energy, transportation, equipment, and infrastructure; |

| | | |

| | · | changes in input commodity prices and labor costs; |

| | | |

| | · | fluctuations in currency exchange rates; |

| | | |

| | · | availability and terms of financing; |

| | | |

| | · | changes in anticipated tonnage, grade and metallurgical characteristics of the mineralized material to be mined and processed; |

| | | |

| | · | recovery rates of gold and other metals from mineralized materials; |

| | | |

| | · | difficulty of estimating construction costs over a period of a year; |

| | | |

| | · | delays in completing any environmental review or in obtaining environmental or other government permits; |

| | | |

| | · | weather and severe climate impacts; and |

| | | |

| | · | potential delays related to health, social, political and community issues. |

Our ability to execute our strategic plan depends on many factors, some of which are beyond our control.

Our strategic plan is focused on high-value, cash-generating, precious metal-based activities, including, but not limited to, precious-metal exploration, resource development, economic feasibility assessments and cash-generating mineral production. Many of the factors that impact our ability to execute our strategic plan, such as the advancement of certain technologies, legal and regulatory obstacles and general economic conditions, are beyond our control. Changes in value or a lack of demand for the sale of non-core assets would negatively affect the Company’s financial condition and performance. Our inability to identify successful joint venture candidates and to complete joint ventures or strategic alliances as planned or to realize expected synergies and strategic benefits could impact our financial condition and performance. Our inability to deploy capital to maximize shareholder value could impact our financial performance. We cannot give assurance that we will be able to execute any or all of our strategic plan. Failure to execute any or all of our strategic plan could have a material adverse effect on our financial condition, results of operations, and cash flows.

Risks Associated with Mining Operations, Development, Exploration and Acquisition Portion of Our Business

Exploration activities involve a high degree of risk, and exploratory drilling activities may not be successful.

The Company’s future success will largely depend on the success of the exploration drilling programs at the Golden Chest Mine, adjacent properties, and other exploration properties. Participation in exploration drilling activities involves numerous risks, including the significant risk that no commercially marketable minerals will be discovered. The mining of minerals and the manufacture of mineral products involves numerous hazards, including:

| | · | Ground or slope failures; |

| | | |

| | · | Pressure or irregularities in formations affecting ore or wall rock characteristics; |

| | | |

| | · | Equipment failures or accidents; |

| | | |

| | · | Adverse weather conditions; |

| | | |

| | · | Compliance with governmental requirements and laws, present and future; |

| | | |

| | · | Shortages or delays in the availability and delivery of equipment; and |

| | | |

| | · | Lack of adequate infrastructure, including access to roads, electricity and available housing. |

Poor results from the Company’s drilling activities would materially and adversely affect the Company’s future cash flows and results of operations.

Transportation and weather interruptions may affect and delay proposed mining operations and impact our business plans.

Our mining properties are accessible by road. The climate in the area is hot and dry in the summer but cold and subject to snow and other precipitation in the winter, which could at times hamper accessibility depending on the winter season precipitation levels. As a result, our exploration and mining plans could be delayed for several months each year. Such delays could affect our anticipated business operations and increase our expenses.

Moreover, extreme weather events (such as increased frequency or intensity of storms or prolonged drought, flooded or frozen terrain) have the potential to disrupt operations at our projects. Extended disruptions to supply lines due to extreme weather could result in interruption of activities at the project sites, delay or increase the cost of construction of the projects, or otherwise adversely affect our business.

Supplies and equipment needed for exploration may not always be available. If we are unable to secure raw materials and exploration supplies we may have to delay our anticipated business operations.

Competition and unforeseen limited sources of supplies needed for our proposed exploration work could result in occasional shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms, if at all. Such delays could affect our anticipated business operations and increase our expenses.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral properties, claims or leases. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease exploration activity and/or operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral properties and the minerals that can be produced from them. While we compete with other exploration companies in the effort to locate and license mineral properties, we do not compete with them for the removal or sales of mineral products from our claims if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of gold and other mineral products, subject to market conditions and prices. Therefore, we will likely be able to sell any gold or mineral products that we identify and produce; however, such sales are subject to market fluctuations that may materially and adversely affect the Company’s future cash flows and results of operations.