As

filed with the Securities and Exchange Commission on May 17, 2024.

Registration

No. 333-278175

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No.1

to

FORM

F-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Indonesia

Energy Corporation Limited

(Exact

name of registrant as specified in its charter)

Not

Applicable

(Translation

of registrant’s name into English)

| Cayman

Islands |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification Number) |

GIESMART

PLAZA 7th Floor

Jl.

Raya Pasar Minggu No. 17A

Pancoran

– Jakarta 12780 Indonesia

(Address

and telephone number of Registrant’s principal executive offices)

James

J. Huang

Chief

Investment Officer

GIESMART

PLAZA 7th Floor

Jl.

Raya Pasar Minggu No. 17A

Pancoran

– Jakarta 12780 Indonesia

+62

21 576 8888

(Name,

address, and telephone number of agent for service)

Copies

to:

Barry

I. Grossman Esq.

Lawrence

A. Rosenbloom, Esq.

Ellenoff

Grossman &Schole LLP

1345

Avenue of the Americas, 11th Floor

New

York, NY 10105

Tel:

(212) 370-1300

Fax:

(212) 370-7889

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains:

| |

● |

a

base prospectus, which covers the offering, issuance and sale by the registrant of up to a maximum aggregate offering price of $50,000,000

of the registrant’s ordinary shares, preferred shares, warrants, debt securities, rights, depositary shares, and/or units from

time to time in one or more offerings; and |

| |

|

|

| |

● |

a

sales agreement prospectus, which covers the offering, issuance and sale by the registrant of up to a maximum aggregate offering

price of approximately $9,600,000 of the registrant’s ordinary shares that may be issued and sold from time to

time under an At The Market Offering Agreement, dated December 14, 2022, as amended on March 22, 2024, with H.C. Wainwright &

Co., LLC, as sales agent. |

The

base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus

will be specified in a prospectus supplement to the base prospectus. The sales agreement prospectus immediately follows the base prospectus.

The $9,600,000 of ordinary shares that may be offered, issued and sold by the registrant under the sales agreement prospectus

is included in the $50,000,000 of securities that may be offered, issued and sold by the registrant under the base prospectus. In connection

with such offers and when accompanied by the base prospectus included in the registration statement of which this prospectus forms a

part, such sales agreement prospectus will be deemed a prospectus supplement to such base prospectus. Upon termination of the sales agreement

with H.C. Wainwright & Co., LLC, any portion of the $9,600,000 included in the sales agreement prospectus that is not sold

pursuant to the sales agreement will be available for sale in other offerings pursuant to the base prospectus and a corresponding prospectus

supplement, and if no shares are sold under the sales agreement, the full $50,000,000 of securities may be sold in other offerings pursuant

to the base prospectus and a corresponding prospectus supplement.

The

information in this prospectus is not complete and may be changed. We cannot sell these securities until the registration statement that

we have filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where their offer or sale is not permitted.

| PROSPECTUS |

Subject

to Completion, dated May 17, 2024. |

Indonesia

Energy Corporation Limited

US$50,000,000

Ordinary

Shares

Preferred

Shares

Warrants

Debt

Securities

Rights

Depositary

Shares

Units

Indonesia

Energy Corporation Limited (the “Company,” “we,” “us,” “our”) may offer the securities

described in this prospectus from time to time in amounts, at prices and on terms to be determined at or prior to the time of the offering.

We refer to the ordinary shares, the preferred shares, the warrants, the debt securities, the rights, the depositary shares and the units

comprised of, or other combinations of, the foregoing securities as the “Securities”. This prospectus describes the general

manner in which the Securities may be offered using this prospectus. We will provide specific terms and offering prices of these Securities

in supplements to this prospectus. Any supplement to this prospectus may also add, update or change information contained in this prospectus.

You should read this prospectus and the accompanying prospectus supplements carefully before you invest in the Securities.

We

may offer the Securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents

or directly to investors (including our shareholders), on a continuous or delayed basis. The supplement to this prospectus for each offering

of Securities will describe in detail the plan of distribution for that offering.

Our

ordinary shares are listed on the NYSE American under the symbol “INDO”.

We

are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company

reporting requirements.

So

long as the aggregate market value worldwide of our outstanding common equity held by non-affiliates (which we refer to as our public

float) is less than US$75 million, the aggregate market value of Securities sold by us under this prospectus during the period of 12

calendar months immediately prior to, and including, the date of sale may be no more than one-third of the public float. The aggregate

market value of our outstanding ordinary shares held by non-affiliates was approximately $28,808,815, based on 10,202,694 ordinary shares

outstanding as of May 15, 2024, of which 4,738,292 ordinary shares were held by non-affiliates, and a per share price of $6.08, which

was the highest closing price on the NYSE American of our ordinary shares during the last 60 days.

An

investment in our Securities is speculative and involves significant risks. See “Risk Factors” beginning on page 2

of this prospectus and under similar headings in any amendment or supplement to this prospectus or as updated by any subsequent filing

with the Securities and Exchange Commission that is incorporated by reference herein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

You

should rely only on the information provided by this prospectus, any prospectus supplement and any information incorporated by reference.

We have not authorized anyone else to provide you with different or additional information or to make any representations other than

those contained in or incorporated by reference to this prospectus or any accompanying prospectus supplement. We have not taken any action

to permit a public offering of the Securities described in this prospectus outside the United States or to permit the possession or distribution

of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must observe

any restrictions relating to the offering of the Securities described in this prospectus and the distribution of this prospectus outside

of the United States. This prospectus is not an offer to sell, or solicitation of an offer to buy, any Securities in any circumstances

under which the offer of solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process. Under this process, we may, from time to time, sell any combination of the Securities in

one or more offerings. The Securities to be sold pursuant to this registration statement may have a total aggregate value of up to US$50,000,000.

This prospectus does not contain all of the information included in the registration statement. You should refer to the registration

statement including the exhibits before making a decision to purchase any Securities described in this prospectus.

The

information in this prospectus is accurate as of the date on the front cover of this prospectus. Neither the delivery of this prospectus

nor the sale of any Securities described in this prospectus means that information contained in this prospectus is correct after the

date of this prospectus or as of any other date. We will provide a prospectus supplement each time we sell any Securities described in

this prospectus and you should read both this prospectus and the prospectus supplement, together with any information incorporated by

reference, before making an investment decision.

A

prospectus supplement may provide updated, changed or additional information to the information contained in this prospectus. You should

rely on the information contained in the prospectus supplement to the extent there is any conflict between the information contained

in this prospectus and the prospectus supplement. Any statement in a prospectus supplement or any document incorporated by reference

with a later date will supersede or modify an earlier statement in any document with an earlier date. Any information incorporated by

reference is only accurate as of the date of the document incorporated by reference. You may access the registration statement, exhibits

and other reports we file with the SEC on its website. More information regarding how you can access this and other information is included

under the heading “Where You Can Find Additional Information.”

Unless

otherwise indicated or the context implies otherwise:

| |

● |

“debt securities” refers to our debt securities which may be issued under this registration statement; |

| |

|

|

| |

● |

“depositary

shares” refers to our depositary shares which may be issued under this registration

statement;

|

| |

|

|

| |

● |

“Government” refers

to the government of Indonesia or its agencies; |

| |

|

|

| |

● |

“Indonesia

Energy”, “we”, “us”, “our” or the “Company” refers to Indonesia Energy Corporation

Limited and its direct and indirect subsidiaries, unless the context requires otherwise;

|

| |

|

|

| |

● |

“ordinary

shares” refers to our ordinary shares, par value $0.00267 per share, which may be issued under this registration statement; |

| |

|

|

| |

● |

“preferred

shares” refers to our preferred shares which may be issued under this registration statement; |

| |

|

|

| |

● |

“rights” refers to rights to purchase Securities which may be issued under this registration statement; |

| |

|

|

| |

● |

“Securities” refers to ordinary

shares, preferred shares, warrants, debt securities, rights, depositary shares and units comprised of, or other combinations of, the foregoing

securities; |

| |

|

|

| |

● |

“units” refers to units of Securities which may be issued under this registration statement;

and |

| |

|

|

| |

● |

“warrants”

refers to our warrants which may be issued under this registration statement. |

Unless

otherwise noted, all other financial and other data related to our Company in this prospectus and any prospectus supplement is presented

in U.S. dollars. All references to “$” or “US$” in this prospectus and any prospectus supplement mean U.S. dollars

unless the context otherwise requires. Our fiscal year end is December 31. References to a particular “fiscal year” are to

our fiscal year ended December 31 of that calendar year.

CAUTIONARY

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This

prospectus, any prospectus supplement, any free writing prospectus, and the documents incorporated by reference may contain forward-looking

statements that are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than

statements of historical fact included in this prospectus, any prospectus supplement, any free writing prospectus, or the documents incorporated

by reference, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management

are forward-looking statements. When used in this prospectus, any prospectus supplement, any free writing prospectus, or the documents

incorporated by reference, the words “could,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “may,” “continue,” “predict,” “potential,” “project,”

or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors

that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed

or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement

contained in this prospectus, any prospectus supplement, any free writing prospectus, and the documents incorporated by reference, we

caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations

of the future, about which we cannot be certain.

Forward-looking

statements may include statements about:

| |

● |

our

overall ability (including our anticipated timing) to meet our goals and strategies, including our plans to continue to conduct seismic interpretation activities, and drill additional wells at Kruh Block, to drill and develop Citarum Block or acquire

rights in additional oil and gas assets in the future; |

| |

|

|

| |

● |

The

economic and capital markets impact of macro-economic and other conditions beyond our control (such as the war between Russia

and Ukraine, the conflict between Israel and Hamas, inflation, interest rates and the political situation in Indonesia) on the

demand for our oil and gas products in Indonesia and the price of our oil and gas products; |

| |

|

|

| |

● |

our

ability to estimate our oil reserves; |

| |

|

|

| |

● |

our

ability to anticipate our capital needs, financial condition and results of operations; |

| |

|

|

| |

● |

the

anticipated prices for, and volatility in the prices for, oil and gas products and the

growth of the oil and gas market in Indonesia and worldwide; |

| |

|

|

| |

● |

our

expectations regarding our relationships with the Indonesian government (“Government”)

and its oil and gas regulatory agencies; |

| |

|

|

| |

● |

relevant

Government policies and regulations relating to our industry; and |

| |

|

|

| |

● |

our

corporate structure and related laws, rules and regulations. |

All

forward-looking statements speak only as of the date of this prospectus or, in the case of any prospectus supplement, any free writing

prospectus, or any document incorporated by reference, that prospectus supplement, free writing prospectus or document. You should not

place undue reliance on these forward-looking statements. Although we believe that our plans, objectives, expectations and intentions

reflected in or suggested by the forward-looking statements we make in this prospectus are reasonable, we can give no assurance that

these plans, objectives, expectations or intentions will be achieved. Important factors that could cause our actual results to differ

materially from our expectations are disclosed and described under “Risk Factors”, elsewhere in this prospectus, any prospectus

supplement, any free writing prospectus and in filings incorporated by reference.

The

forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made

in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events.

PROSPECTUS

SUMMARY

This

summary provides a brief overview of information contained elsewhere in this prospectus and incorporated by reference. This summary does

not contain all of the information that you should consider before investing in the Securities. You should read the entire prospectus

carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary

Note Regarding Forward-Looking Statements” and all information incorporated by reference, including our Annual Report on Form 20-F

and the accompanying historical consolidated financial statements and the related notes to those financial statements.

Overview

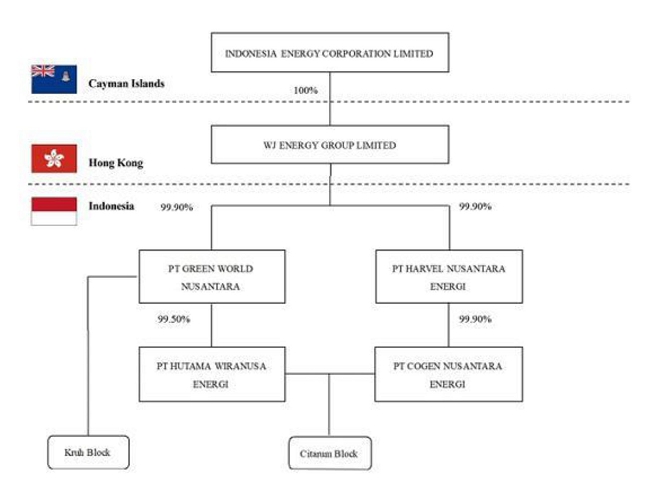

We

are an oil and gas exploration and production company focused on the Indonesian market. Alongside operational excellence, we believe

we have set the highest standards for ethics, safety and corporate social responsibility practices to ensure that we add value to society.

Led by a professional management team with extensive oil and gas experience, we seek to bring forth at all times the best of our expertise

to ensure the sustainable development of a profitable and integrated energy exploration and production business model.

We

currently have rights through contracts with the Government to one oil and gas producing block (Kruh Block) and one oil and gas exploration

block (Citarum Block). We may seek to acquire or otherwise obtain rights to additional oil and gas producing assets.

We

produce oil through PT Green World Nusantara (“Green World”), our indirect wholly-owned subsidiary which operates the Kruh

Block under an agreement with PT Pertamina (Persero), the Indonesian state-owned oil and gas company (“Pertamina”). Our operatorship

Kruh Block previously ran until May 2030 under a ten-year Operations Cooperation Agreement, known as Joint Operation Partnership (the

“KSO”), between Green World and Pertamina. Kruh Block covers an area of 258 km2 (63,753 acres) and is located onshore 16

miles northwest of Pendopo, Pali, South Sumatra. In December 2022, we started our negotiations with Pertamina for a five-year extension

of our contract for Kruh Block. Effective August 9, 2023, Green World and Pertamina executed an amendment to the KSO (the “Amended

KSO”) that extended the expiration date of our operatorship of Kruh Block to September 2035. This extension effectively

gives us 13 years to fully develop the existing three oil fields, and five other undeveloped oil and gas bearing structures

at Kruh Block. Further, the Amended KSO increases our after-tax profit split from the current 15% to 35%, for an increase of more than

100%. We received Pertamina’s signature to the Amended KSO in early September 2023.

Citarum

Block is an exploration block covering an area of 3,924.67 km2 (969,807 acres). This block is located onshore in West Java and only 16

miles south of the capital city of Indonesia, Jakarta. Our rights to Citarum Block run until July 2048 under Production Sharing Contract

(“PSC”) agreement with the Indonesian Special Task Force for Upstream Oil and Gas Business Activities (“SKK Migas”).

Corporate

Information

Our

principal executive offices are located at GIESMART PLAZA 7th Floor, Jl. Raya Pasar Minggu No.17A Pancoran Jakarta –

12780, Indonesia. Our telephone number at this address is +62 21 576 8888. Our registered office in the Cayman Islands is located at

Ogier Global (Cayman) Limited, 89 Nexus Way, Camana Bay, Grand Cayman, Cayman Islands. Our web site is located at www.indo-energy.com.

The information contained on our website is not incorporated by reference into this prospectus or any prospectus supplement hereto, and

the reference to our website in this prospectus is an inactive textual reference only.

The

Securities We May Offer

We

may offer and sell from time to time up to an aggregate of $50,000,000 of any of, or units comprised of, or other combinations of, the

following Securities: ordinary shares, preferred shares, warrants, debt securities, rights to purchase securities, depositary

shares or units.

We

will describe the terms of any such offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change

information contained in this prospectus. Such prospectus supplement will contain, among other pertinent information, the following information

about the offered Securities:

| |

● |

title

and amount; |

| |

● |

offering

price, underwriting discounts and commissions or agency fees, and our net proceeds; |

| |

● |

any

market listing and trading symbol; |

| |

● |

names

of lead or managing underwriters or placement or other agents and description of underwriting or agency arrangements; and |

| |

● |

the

specific terms of the offered Securities. |

This

prospectus may not be used to offer or sell Securities without a prospectus supplement which includes a description of the method and

terms of the particular offering.

RISK

FACTORS

An

investment in our Securities is speculative and involves significant risks. You should carefully consider the risks described

under “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023 (“2023 Annual Report”),

as filed with the SEC on April 26, 2024, and all other information contained in, or incorporated by reference in, this prospectus

and any prospectus supplement or related free writing prospectus before you decide to invest in the Securities. If any such risks actually

occur, our business, prospects, financial condition, results of operations and cash flow could be materially and adversely affected,

thus potentially causing the trading price of any or all of our Securities to decline and you could lose all or part of your investment.

Such

risks are not exhaustive. We may face additional risks that are presently unknown to us or that we believe to be immaterial as of the

date of this prospectus. Known and unknown risks and uncertainties may significantly impact and impair our business operations.

In

addition to the risks described under “Risk Factors” in our 2023 Annual Report and our future

annual and other reports as filed with the SEC from time to time, important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking statements include among other things:

| |

● |

Our

overall ability (including our anticipated timing) to meet our goals and strategies, including

our plans to continue to conduct seismic interpretation activities and drill additional wells at Kruh Block, to drill and develop

Citarum Block or acquire rights in additional oil and gas assets in the future; |

| |

|

|

| |

● |

The

economic and capital markets impact of macro-economic and other conditions beyond our control (such as the war between Russia

and Ukraine, the conflict between Israel and Hamas, inflation, interest rates and the political situation in Indonesia) on the

demand for our oil and gas products in Indonesia and the price of our oil and gas products; |

| |

● |

Our

ability to estimate our oil reserves; |

| |

|

|

| |

● |

Our

ability to anticipate our capital needs, financial condition and results of operations; |

| |

|

|

| |

● |

The

anticipated prices for, and volatility in the prices for, oil and gas products and the

growth of the oil and gas market in Indonesia and worldwide; |

| |

|

|

| |

● |

Our

expectations regarding our relationships with the Government and its oil and gas regulatory agencies; |

| |

|

|

| |

● |

Relevant

Government policies and regulations relating to our industry; and |

| |

|

|

| |

● |

Our

corporate structure and related laws, rules and regulations. |

OFFER

STATISTICS AND EXPECTED TIMETABLE

We

may sell from time to time pursuant to this prospectus (as may be detailed in one or more prospectus supplements) an indeterminate number

of Securities as shall have a maximum aggregate offering price of $50,000,000. The actual price and terms of the Securities that we will

offer pursuant hereto will depend on a number of factors that may be relevant as of the time of offer.

Pursuant

to General Instruction I.B.5 of Form F-3, in no event will we sell Securities pursuant to the registration statement of which this prospectus

forms a part with a value of more than one-third of the aggregate market value of our ordinary shares held by non-affiliates in any 12

calendar month period, so long as the aggregate market value of our ordinary shares held by non-affiliates is less than $75,000,000.

In the event that subsequent to the effective date of the registration statement of which this prospectus forms a part, the aggregate

market value of our outstanding ordinary shares held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation on

sales shall not apply to additional sales made pursuant to this registration statement. We will state on the cover of each prospectus

supplement the amount of our outstanding ordinary shares held by non-affiliates, the amount of Securities being offered and the amount

of Securities sold during the prior 12 calendar month period that ends on, and includes, the date of the prospectus supplement.

USE

OF PROCEEDS

Unless

otherwise indicated in an accompanying prospectus supplement, we intend to use the net proceeds from the sale of the Securities for general

corporate purposes and to advance our commercial seismic, drilling and exploration operations. We may also use a portion of the net proceeds

towards the possible acquisition of, or investment in, additional oil producing or exploratory blocks. Proceeds may also be used at our

discretion for specific purposes described in any prospectus supplement. Pending these uses, we intend to invest the net proceeds primarily

in bank deposits.

As

of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds we may have upon completion

of an offering or offerings. Accordingly, we will retain broad discretion over the use of these proceeds.

CAPITALIZATION

A

prospectus supplement or report on Form 6-K incorporated by reference into the registration statement of which this prospectus forms

a part will include information on our consolidated capitalization.

DESCRIPTION

OF SHARE CAPITAL

General.

We are authorized to issue 37,500,000 ordinary shares of par value US$0.00267 each. As of May 15, 2024, we had 10,202,694

ordinary shares outstanding. All of our issued and outstanding ordinary shares are fully paid and non-assessable. Certificates representing

the ordinary shares are issued in registered form and are issued when registered in our register of members. Our shareholders, whether

or not they are non-residents of the Cayman Islands, may freely hold and transfer their ordinary shares in accordance with the Memorandum

and Articles of Association.

Dividends.

The holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors. Our articles of association

provide that our board of directors may declare and pay dividends if justified by our financial position and permitted by law.

Voting

Rights. In respect of all matters subject to a shareholders’ vote, each ordinary share is entitled to one vote. Voting

at any meeting of shareholders is by show of hands unless voting by way of a poll is required by the rules of any stock exchange on which

our shares are listed for trading, or a poll is demanded by the chairman of such meeting, at least two shareholders having the right

to vote at the meeting or one or more shareholders holding not less than 10% of the total voting rights of all shareholders having the

right to vote at the meeting. A quorum required for a meeting of shareholders consists of one shareholder who holds at least one-third

of our issued voting shares. Shareholders’ meetings may be held annually. Each general meeting, other than an annual general meeting,

shall be an extraordinary general meeting. Extraordinary general meetings may be called by a majority of our board of directors or upon

a requisition of shareholders holding at the date of deposit of the requisition not less than 10% of the aggregate share capital of our

company that carries the right to vote at a general meeting, in which case an advance notice of at least 21 clear days is required for

the convening of our annual general meeting and other general meetings by requisition of the shareholders. An ordinary resolution to

be passed at a meeting by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the ordinary

shares cast at a meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes attaching

to the ordinary shares cast at a meeting. A special resolution will be required for important matters such as a change of name or making

changes to our Memorandum and Articles of Association.

Transfer

of Ordinary Shares. Subject to the restrictions set out below, any of our shareholders may transfer all or any of his or her

ordinary shares by an instrument of transfer in the usual or common form or any other form approved by our board of directors. Our board

of directors may, in its absolute discretion, decline to register any transfer of any share that has not been fully paid up or is subject

to a company lien. If our board of directors refuses to register a transfer, it shall, within three months after the date on which the

transfer was lodged, send to each of the transferor and the transferee notice of such refusal. This, however, is unlikely to affect market

transactions of the ordinary shares purchased by investors in the public offering. Since our ordinary shares are listed on the NYSE American,

the legal title to such ordinary shares and the registration details of those ordinary shares in our register of members remain with

DTC/Cede & Co. All market transactions with respect to those ordinary shares will then be carried out without the need for any kind

of registration by the directors, as the market transactions will all be conducted through the DTC systems.

The

registration of transfers may, on 14 calendar days’ notice being given by advertisement in such one or more newspapers or by electronic

means, be suspended at such times and for such periods as our board of directors may determine, provided, however, that the registration

of transfers shall not be suspended, and the register may not be closed, for more than 30 days in any year as our board of directors

may determine.

Calls

on Ordinary shares and Forfeiture of Ordinary Shares. Subject to the terms of overallotment, our board of directors may from

time to time make calls upon shareholders for any amounts unpaid on their ordinary shares in a notice served to such shareholders at

least 14 clear days prior to the specified time of payment. The ordinary shares that have been called upon and remain unpaid are subject

to forfeiture.

Redemption

of Ordinary Shares. The Companies Act and our Articles of Association permit us to purchase our own shares. In accordance with

our Articles of Association and provided the necessary shareholders or board approval have been obtained, we may issue shares on terms

that are subject to redemption, at our option or at the option of the holders of these shares, on such terms and in such manner, provided

the requirements under the Companies Act have been satisfied, including out of any combination of capital, our profits and the proceeds

of a fresh issue of shares.

Inspection

of Books and Records. Holders of our shares will have no general right under the Companies Act to inspect or obtain copies of

our register of members or our corporate records.

Issuance

of Additional Shares. Our Articles of Association authorizes our board of directors to issue additional ordinary shares from

time to time as our board of directors shall determine, to the extent of available authorized but unissued shares. Our Articles of Association

also authorizes our board of directors to establish from time to time one or more series of preferred shares and to determine, with respect

to any series of preferred shares, the terms and rights of that series, including:

| |

● |

the

designation of the series to be issued; |

| |

|

|

| |

● |

the

number of shares of the series; |

| |

|

|

| |

● |

the

dividend rights, dividend rates, conversion rights, voting rights; and |

| |

|

|

| |

● |

the

rights and terms of redemption and liquidation preferences. |

Our

board of directors may issue preferred shares without action by our shareholders to the extent authorized but unissued. Issuance of these

shares may dilute the voting power of holders of ordinary shares.

Anti-Takeover

Provisions. Some provisions of our articles may discourage, delay or prevent a change in control of our company or management

that shareholders may consider favorable, including provisions that authorize our board of directors to issue shares at such times and

on such terms and conditions as the board of directors may decide without any further vote or action by our shareholders. Under the Companies

Act, our directors may only exercise the rights and powers granted to them under our articles for what they believe in good faith to

be in the best interests of our company and for a proper purpose.

Anti-money

Laundering—Cayman Islands. In order to comply with legislation or regulations aimed at the prevention of money laundering,

we may be required to adopt and maintain anti-money laundering procedures and may require subscribers to provide evidence to verify their

identity. Where permitted, and subject to certain conditions, we may also delegate the maintenance of our anti-money laundering procedures

(including the acquisition of due diligence information) to a suitable person.

We

reserve the right to request such information as is necessary to verify the identity of a subscriber. In the event of delay or failure

on the part of the subscriber in producing any information required for verification purposes, we may refuse to accept the application,

in which case any funds received will be returned without interest to the account from which they were originally debited.

We

also reserve the right to refuse to make any redemption payment to a shareholder if our directors or officers suspect or are advised

that the payment of redemption proceeds to such shareholder might result in a breach of applicable anti-money laundering or other laws

or regulations by any person in any relevant jurisdiction, or if such refusal is considered necessary or appropriate to ensure our compliance

with any such laws or regulations in any applicable jurisdiction.

If

any person resident in the Cayman Islands knows or suspects or has reason for knowing or suspecting that another person is engaged in

criminal conduct or is involved with terrorism or terrorist property and the information for that knowledge or suspicion came to their

attention in the course of their business in the regulated sector, or other trade, profession, business or employment, the person will

be required to report such knowledge or suspicion to (i) a nominated officer (appointed in accordance with the Proceeds of Crime Act

(Revised) of the Cayman Islands) or the Financial Reporting Authority of the Cayman Islands, pursuant to the Proceeds of Crime Act (Revised),

if the disclosure relates to criminal conduct or money laundering or (ii) to a police constable or a nominated officer (pursuant to the

Terrorism Act (Revised) of the Cayman Islands) or the Financial Reporting Authority, pursuant to the Terrorism Act (Revised), if the

disclosure relates to involvement with terrorism or terrorist financing and terrorist property. Such a report shall not be treated as

a breach of confidence or of any restriction upon the disclosure of information imposed by any enactment or otherwise.

Data

Protection in the Cayman Islands – Privacy Notice. This privacy notice explains the manner in which we collect, process,

and maintain personal data about investors of the Company pursuant to the Data Protection Act, 2017 of the Cayman Islands, as amended

from time to time and any regulations, codes of practice, or orders promulgated pursuant thereto (the “DPA”).

We

are committed to processing personal data in accordance with the DPA. In our use of personal data, we will be characterized under the

DPA as a “data controller,” whilst certain of our service providers, affiliates, and delegates may act as “data processors”

under the DPA. These service providers may process personal information for their own lawful purposes in connection with services provided

to us.

By

virtue of your investment in the Company, we and certain of our service providers may collect, record, store, transfer, and otherwise

process personal data by which individuals may be directly or indirectly identified.

Your

personal data will be processed fairly and for lawful purposes, including (a) where the processing is necessary for us to perform a contract

to which you are a party or for taking pre-contractual steps at your request, (b) where the processing is necessary for compliance with

any legal, tax, or regulatory obligation to which we are subject, or (c) where the processing is for the purposes of legitimate interests

pursued by us or by a service provider to whom the data are disclosed. As a data controller, we will only use your personal data for

the purposes for which we collected it. If we need to use your personal data for an unrelated purpose, we will contact you.

We

anticipate that we will share your personal data with our service providers for the purposes set out in this privacy notice. We may also

share relevant personal data where it is lawful to do so and necessary to comply with our contractual obligations or your instructions

or where it is necessary or desirable to do so in connection with any regulatory reporting obligations. In exceptional circumstances,

we will share your personal data with regulatory, prosecuting, and other governmental agencies or departments, and parties to litigation

(whether pending or threatened), in any country or territory including to any other person where we have a public or legal duty to do

so (e.g. to assist with detecting and preventing fraud, tax evasion, and financial crime or compliance with a court order).

Your

personal data shall not be held by the Company for longer than necessary with regard to the purposes of the data processing.

We

will not sell your personal data. Any transfer of personal data outside of the Cayman Islands shall be in accordance with the requirements

of the DPA. Where necessary, we will ensure that separate and appropriate legal agreements are put in place with the recipient of that

data.

We

will only transfer personal data in accordance with the requirements of the DPA, and will apply appropriate technical and organizational

information security measures designed to protect against unauthorized or unlawful processing of the personal data and against the accidental

loss, destruction, or damage to the personal data.

If

you are a natural person, this will affect you directly. If you are a corporate investor (including, for these purposes, legal arrangements

such as trusts or exempted limited partnerships) that provides us with personal data on individuals connected to you for any reason in

relation to your investment into the Company, this will be relevant for those individuals and you should inform such individuals of the

content.

You

have certain rights under the DPA, including (a) the right to be informed as to how we collect and use your personal data (and this privacy

notice fulfils our obligation in this respect), (b) the right to obtain a copy of your personal data, (c) the right to require us to

stop direct marketing, (d) the right to have inaccurate or incomplete personal data corrected, (e) the right to withdraw your consent

and require us to stop processing or restrict the processing, or not begin the processing of your personal data, (f) the right to be

notified of a data breach (unless the breach is unlikely to be prejudicial), (g) the right to obtain information as to any countries

or territories outside the Cayman Islands to which we, whether directly or indirectly, transfer, intend to transfer, or wish to transfer

your personal data, general measures we take to ensure the security of personal data, and any information available to us as to the source

of your personal data, (h) the right to complain to the Office of the Ombudsman of the Cayman Islands, and (i) the right to require us

to delete your personal data in some limited circumstances.

If

you consider that your personal data has not been handled correctly, or you are not satisfied with our responses to any requests you

have made regarding the use of your personal data, you have the right to complain to the Cayman Islands’ Ombudsman. The Ombudsman

can be contacted by accessing their website at www.ombudsman.ky.

DESCRIPTION

OF PREFERRED SHARES

We

are authorized to issue 3,750,000 preferred shares of a par value of $0.00267 each. Subject to the Companies Act, our directors may,

in their absolute discretion and without the approval of the shareholders, create and designate out of the unissued preferred shares

of our company one or more classes or series of preferred shares, comprising such number of preferred shares and having such designations,

powers, preferences, privileges and other rights, including dividend rights, voting rights, conversion rights, terms of redemption and

liquidation preferences, as our directors may determine.

We

do not have any preferred shares issued and outstanding as of the date of this prospectus. In the future we may issue preferred shares

that could be converted into ordinary shares. A prospectus supplement will contain and describe the material terms of any preferred shares

that we offer to the public in the United States, along with any material U.S. federal or foreign income tax considerations relating

to the offer of such preferred shares.

DESCRIPTION

OF WARRANTS

We

may issue warrants to purchase ordinary shares in one or more series, together with other Securities or separately, as described in the

applicable prospectus supplement. A general description of terms and provisions of the warrants we may offer is included below. A prospectus

supplement and warrant agreement will contain specific terms of any warrants.

The

prospectus supplement relating to any warrants will contain, as applicable, the following:

| |

● |

the

designation, amount and terms of the Securities purchasable on exercise of the warrants; |

| |

|

|

| |

● |

the

specific designation and aggregate number of, and the price at which we will issue, the warrants; |

| |

|

|

| |

● |

the

exercise price for ordinary shares and the number of ordinary shares to be received upon exercise of the warrants, if applicable; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants will begin and the date on which that right will expire; |

| |

|

|

| |

● |

whether

the warrants will be issued in fully registered form or bearer form, in definitive or global form, or in any combination of these

forms; |

| |

● |

any

material U.S. federal or foreign income tax consequences; |

| |

|

|

| |

● |

the

identity of the warrant agent and of any other depositaries, paying agents, transfer agents, registrars or other agents; |

| |

|

|

| |

● |

the

proposed listing, if any, of the warrants or any Securities purchasable upon exercise of the warrants on any securities exchange; |

| |

|

|

| |

● |

the

date from and after which the warrants and the ordinary shares will be separately transferable, if applicable; |

| |

|

|

| |

● |

the

minimum or maximum amount of the warrants that may be exercised at any time, if applicable; |

| |

|

|

| |

● |

any

information with respect to book-entry procedures; |

| |

|

|

| |

● |

any

anti-dilution provisions of the warrants; |

| |

|

|

| |

● |

any

redemption or call provisions of the warrants; and |

| |

|

|

| |

● |

any

additional terms of the warrants, including procedures and limitations with regard to the exercise and exchange of the warrants. |

DESCRIPTION

OF DEBT SECURITIES

As

used in this prospectus, the term “debt securities” means the debentures, notes, bonds and other evidences of indebtedness

that we may issue from time to time. The debt securities will either be senior debt securities, senior subordinated debt or subordinated

debt securities. We may also issue convertible debt securities. Debt securities issued under an indenture (which we refer to herein as

an Indenture) will be entered into between us and a trustee to be named therein.

The

Indenture or forms of Indentures, if any, will be filed as exhibits to the registration statement of which this prospectus is a part.

The statements and descriptions in this prospectus or in any prospectus supplement regarding provisions of the Indentures and debt securities

are summaries thereof, do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of

the provisions of the Indentures (and any amendments or supplements we may enter into from time to time which are permitted under each

Indenture) and the debt securities, including the definitions therein of certain terms.

General.

Unless otherwise specified in a prospectus supplement, the debt securities will be direct secured or unsecured obligations of our

company. The senior debt securities will rank equally with any of our other unsecured senior and unsubordinated debt. The subordinated

debt securities will be subordinate and junior in right of payment to any senior indebtedness.

We

may issue debt securities from time to time in one or more series, in each case with the same or various maturities, at par or at a discount.

Unless indicated in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the

holders of the debt securities of such series outstanding at the time of the issuance. Any such additional debt securities, together

with all other outstanding debt securities of that series, will constitute a single series of debt securities under the applicable Indenture

and will be equal in ranking.

Should

an indenture relate to unsecured indebtedness, in the event of a bankruptcy or other liquidation event involving a distribution of assets

to satisfy our outstanding indebtedness or an event of default under a loan agreement relating to secured indebtedness of our company

or its subsidiaries, the holders of such secured indebtedness, if any, would be entitled to receive payment of principal and interest

prior to payments on the senior indebtedness issued under an Indenture.

Prospectus

Supplement. Each prospectus supplement will describe the terms relating to the specific series of debt securities being offered.

These terms will include some or all of the following:

| |

● |

the

title of debt securities and whether they are subordinated, senior subordinated or senior debt securities; |

| |

|

|

| |

● |

any

limit on the aggregate principal amount of debt securities of such series; |

| |

|

|

| |

● |

the

percentage of the principal amount at which the debt securities of any series will be issued; |

| |

|

|

| |

● |

the

ability to issue additional debt securities of the same series; |

| |

|

|

| |

● |

the

purchase price for the debt securities and the denominations of the debt securities; |

| |

|

|

| |

● |

the

specific designation of the series of debt securities being offered; |

| |

|

|

| |

● |

the

maturity date or dates of the debt securities and the date or dates upon which the debt securities are payable and the rate or rates

at which the debt securities of the series shall bear interest, if any, which may be fixed or variable, or the method by which such

rate shall be determined; |

| |

|

|

| |

● |

the

basis for calculating interest if other than 360-day year or twelve 30-day months; |

| |

|

|

| |

● |

the

date or dates from which any interest will accrue or the method by which such date or dates will be determined; |

| |

|

|

| |

● |

the

duration of any deferral period, including the maximum consecutive period during which interest payment periods may be extended; |

| |

|

|

| |

● |

whether

the amount of payments of principal of (and premium, if any) or interest on the debt securities may be determined with reference

to any index, formula or other method, such as one or more currencies, commodities, equity indices or other indices, and the manner

of determining the amount of such payments; |

| |

|

|

| |

● |

the

dates on which we will pay interest on the debt securities and the regular record date for determining who is entitled to the interest

payable on any interest payment date; |

| |

|

|

| |

● |

the

place or places where the principal of (and premium, if any) and interest on the debt securities will be payable, where any securities

may be surrendered for registration of transfer, exchange or conversion, as applicable, and notices and demands may be delivered

to or upon us pursuant to the applicable Indenture; |

| |

|

|

| |

● |

the

rate or rates of amortization of the debt securities; |

| |

|

|

| |

● |

if

we possess the option to do so, the periods within which and the prices at which we may redeem the debt securities, in whole or in

part, pursuant to optional redemption provisions, and the other terms and conditions of any such provisions; |

| |

|

|

| |

● |

our

obligation or discretion, if any, to redeem, repay or purchase debt securities by making periodic payments to a sinking fund or through

an analogous provision or at the option of holders of the debt securities, and the period or periods within which and the price or

prices at which we will redeem, repay or purchase the debt securities, in whole or in part, pursuant to such obligation, and the

other terms and conditions of such obligation; |

| |

|

|

| |

● |

the

terms and conditions, if any, regarding the option or mandatory conversion or exchange of debt securities; |

| |

|

|

| |

● |

the

period or periods within which, the price or prices at which and the terms and conditions upon which any debt securities of the series

may be redeemed, in whole or in part at our option and, if other than by a board resolution, the manner in which any election by

us to redeem the debt securities shall be evidenced; |

| |

● |

any

restriction or condition on the transferability of the debt securities of a particular series; |

| |

|

|

| |

● |

the

portion, or methods of determining the portion, of the principal amount of the debt securities which we must pay upon the acceleration

of the maturity of the debt securities in connection with any event of default if other than the full principal amount; |

| |

|

|

| |

● |

the

currency or currencies in which the debt securities will be denominated and in which principal, any premium and any interest will

or may be payable or a description of any units based on or relating to a currency or currencies in which the debt securities will

be denominated; |

| |

|

|

| |

● |

provisions,

if any, granting special rights to holders of the debt securities upon the occurrence of specified events; |

| |

|

|

| |

● |

any

deletions from, modifications of or additions to the events of default or our covenants with respect to the applicable series of

debt securities, and whether or not such events of default or covenants are consistent with those contained in the applicable Indenture; |

| |

|

|

| |

● |

any

limitation on our ability to incur debt, redeem stock, sell our assets or other restrictions; |

| |

|

|

| |

● |

the

application, if any, of the terms of the applicable Indenture relating to defeasance and covenant defeasance (which terms are described

below) to the debt securities; |

| |

|

|

| |

● |

what

subordination provisions will apply to the debt securities; |

| |

● |

the

terms, if any, upon which the holders may convert or exchange the debt securities into or for our ordinary shares, preferred shares

or other securities or property; |

| |

|

|

| |

● |

whether

we are issuing the debt securities in whole or in part in global form; |

| |

|

|

| |

● |

any

change in the right of the trustee or the requisite holders of debt securities to declare the principal amount thereof due and payable

because of an event of default; |

| |

|

|

| |

● |

the

depositary for global or certificated debt securities, if any; |

| |

|

|

| |

● |

any

material federal income tax consequences applicable to the debt securities, including any debt securities denominated and made payable,

as described in the prospectus supplements, in foreign currencies, or units based on or related to foreign currencies; |

| |

|

|

| |

● |

any

right we may have to satisfy, discharge and defease our obligations under the debt securities, or terminate or eliminate restrictive

covenants or events of default in the Indentures, by depositing money or U.S. government obligations with the trustee of the Indentures; |

| |

|

|

| |

● |

the

names of any trustees, depositories, authenticating or paying agents, transfer agents or registrars or other agents with respect

to the debt securities; |

| |

● |

to

whom any interest on any debt security shall be payable, if other than the person in whose name the security is registered, on the

record date for such interest, the extent to which, or the manner in which, any interest payable on a temporary global debt security

will be paid if other than in the manner provided in the applicable Indenture; |

| |

|

|

| |

● |

if

the principal of or any premium or interest on any debt securities is to be payable in one or more currencies or currency units other

than as stated, the currency, currencies or currency units in which it shall be paid and the periods within and terms and conditions

upon which such election is to be made and the amounts payable (or the manner in which such amount shall be determined); |

| |

● |

the

portion of the principal amount of any debt securities which shall be payable upon declaration of acceleration of the maturity of

the debt securities pursuant to the applicable Indenture if other than the entire principal amount; |

| |

|

|

| |

● |

if

the principal amount payable at the stated maturity of any debt security of the series will not be determinable as of any one or

more dates prior to the stated maturity, the amount which shall be deemed to be the principal amount of such debt securities as of

any such date for any purpose, including the principal amount thereof which shall be due and payable upon any maturity other than

the stated maturity or which shall be deemed to be outstanding as of any date prior to the stated maturity (or, in any such case,

the manner in which such amount deemed to be the principal amount shall be determined); and |

| |

|

|

| |

● |

any

other specific terms of the debt securities, including any modifications to the events of default under the debt securities and any

other terms which may be required by or advisable under applicable laws or regulations. |

Unless

otherwise specified in the applicable prospectus supplement, the debt securities will not be listed on any securities exchange. Holders

of the debt securities may present registered debt securities for exchange or transfer in the manner described in the applicable prospectus

supplement. Except as limited by the applicable Indenture, we will provide these services without charge, other than any tax or other

governmental charge payable in connection with the exchange or transfer.

Debt

securities may bear interest at a fixed rate or a variable rate as specified in the prospectus supplement. In addition, if specified

in the prospectus supplement, we may sell debt securities bearing no interest or interest at a rate that at the time of issuance is below

the prevailing market rate, or at a discount below their stated principal amount. We will describe in the applicable prospectus supplement

any special federal income tax considerations applicable to these discounted debt securities.

We

may issue debt securities with the principal amount payable on any principal payment date, or the amount of interest payable on any interest

payment date, to be determined by referring to one or more currency exchange rates, commodity prices, equity indices or other factors.

Holders of such debt securities may receive a principal amount on any principal payment date, or interest payments on any interest payment

date, that are greater or less than the amount of principal or interest otherwise payable on such dates, depending upon the value on

such dates of applicable currency, commodity, equity index or other factors. The applicable prospectus supplement will contain information

as to how we will determine the amount of principal or interest payable on any date, as well as the currencies, commodities, equity indices

or other factors to which the amount payable on that date relates and certain additional tax considerations.

DESCRIPTION

OF RIGHTS

We

may issue rights to purchase our Securities. The rights may or may not be transferable by the persons purchasing or receiving the rights.

In connection with any rights offering, we may enter into a standby underwriting or other arrangement with one or more underwriters or

other persons pursuant to which such underwriters or other persons would purchase any offered Securities remaining unsubscribed for after

such rights offering. Each series of rights will be issued under a separate rights agent agreement to be entered into between us and

one or more banks, trust companies or other financial institutions, as rights agent, which we will name in the applicable prospectus

supplement. The rights agent will act solely as our agent in connection with the rights and will not assume any obligation or relationship

of agency or trust for or with any holders of rights certificates or beneficial owners of rights.

The

prospectus supplement relating to any rights that we offer will include specific terms relating to the offering, including, among other

matters:

| |

● |

the

date of determining the security holders entitled to the rights distribution; |

| |

|

|

| |

● |

the

aggregate number of rights issued and the aggregate amount of Securities purchasable upon exercise of the rights; |

| |

● |

the

exercise price; |

| |

|

|

| |

● |

the

conditions to completion of the rights offering; |

| |

|

|

| |

● |

the

date on which the right to exercise the rights will commence and the date on which the rights will expire; and |

| |

|

|

| |

● |

any

applicable federal income tax considerations. |

Each

right would entitle the holder of the rights to purchase for cash the principal amount of Securities at the exercise price set forth

in the applicable prospectus supplement. Rights may be exercised at any time up to the close of business on the expiration date for the

rights provided in the applicable prospectus supplement. After the close of business on the expiration date, all unexercised rights will

become void.

If

less than all of the rights issued in any rights offering are exercised, we may offer any unsubscribed Securities directly to persons

other than our security holders, to or through agents, underwriters or dealers or through a combination of such methods, including pursuant

to standby arrangements, as described in the applicable prospectus supplement.

DESCRIPTION

OF DEPOSITARY SHARES

We

may offer fractional ordinary shares and preferred shares, rather than full ordinary shares or preferred shares. If we decide to offer

fractional ordinary shares or preferred shares, we will issue receipts for depositary shares. Each depositary share will represent a

fraction of a share of a particular series of our ordinary shares or preferred shares, and the applicable prospectus supplement will

indicate that fraction. The ordinary shares and preferred shares represented by depositary shares will be deposited under a deposit agreement

between us and a depositary that is a bank or trust company that meets certain requirements and is selected by us. The depositary will

be specified in the applicable prospectus supplement. Each owner of a depositary share will be entitled to all of the rights and preferences

of the ordinary shares or preferred shares represented by the depositary share. The depositary shares will be evidenced by depositary

receipts issued pursuant to the deposit agreement. Depositary receipts will be distributed to those persons purchasing the fractional

ordinary shares or preferred shares in accordance with the terms of the offering. We will file as exhibits to the registration statement

of which this prospectus is a part, or will incorporate by reference from a report on Form 6-K that we file with the SEC, forms of the

deposit agreement, form of certificate of designation relating to preferred shares, form of depositary receipts and any other related

agreements.

Dividends

and Other Distributions. The depositary will distribute all cash dividends or other cash distributions received by it in respect

of the ordinary shares or preferred shares to the record holders of depositary shares relating to such ordinary shares or preferred shares

in proportion to the numbers of depositary shares held on the relevant record date.

In

the event of a distribution other than in cash, the depositary will distribute securities or property received by it to the record holders

of depositary shares in proportion to the numbers of depositary shares held on the relevant record date, unless the depositary determines

that it is not feasible to make such distribution. In that case, the depositary may make the distribution by such method as it deems

equitable and practicable. One such possible method is for the depositary to sell the securities or property and then distribute the

net proceeds from the sale as provided in the case of a cash distribution.

Redemption

of Depositary Shares. Whenever we redeem the ordinary shares or preferred shares, the depositary will redeem a number of depositary

shares representing the same number of preferred shares so redeemed. If fewer than all of the depositary shares are to be redeemed, the

depositary shares to be redeemed will be selected by lot, pro rata or by any other equitable method as the depositary may determine.

Voting

of Underlying Shares. Upon receipt of notice of any meeting at which the holders of our ordinary shares or preferred shares of

any series are entitled to vote, the depositary will mail the information contained in the notice of the meeting to the record holders

of the depositary shares relating to ordinary shares or that series of preferred shares. Each record holder of the depositary shares

on the record date will be entitled to instruct the depositary as to the exercise of the voting rights represented by the number of preferred

shares underlying the holder’s depositary shares. The depositary will endeavor, to the extent it is practical to do so, to vote

the number of whole ordinary shares or preferred shares underlying such depositary shares in accordance with such instructions. We will

agree to take all action that the depositary may deem reasonably necessary in order to enable the depositary to do so. To the extent

the depositary does not receive specific instructions from the holders of depositary shares relating to such ordinary shares or preferred

shares, it will abstain from voting such ordinary shares or preferred shares.

Withdrawal

of Shares. Upon surrender of depositary receipts representing any number of whole shares at the depositary’s office, unless

the related depositary shares previously have been called for redemption, the holder of the depositary shares evidenced by the depositary

receipts will be entitled to delivery of the number of whole shares of the ordinary shares or the related series of preferred shares

and all money and other property, if any, underlying such depositary shares. However, once such an exchange is made, the ordinary shares

or preferred shares cannot thereafter be re-deposited in exchange for depositary shares. Holders of depositary shares will be entitled

to receive whole shares of the ordinary shares or the related series of preferred shares on the basis set forth in the applicable prospectus

supplement. If the depositary receipts delivered by the holder evidence a number of depositary shares representing more than the number

of whole ordinary shares or preferred shares of the related series to be withdrawn, the depositary will deliver to the holder at the

same time a new depositary receipt evidencing the excess number of depositary shares.

Amendment

and Termination of Depositary Agreement. The form of depositary receipt evidencing the depositary shares and any provision of

the applicable depositary agreement may at any time be amended by agreement between us and the depositary. We may, with the consent of

the depositary, amend the depositary agreement from time to time in any manner that we desire. However, if the amendment would materially

and adversely alter the rights of the existing holders of depositary shares, the amendment would need to be approved by the holders of

at least a majority of the depositary shares then outstanding.

The

depositary agreement may be terminated by us or the depositary if:

| |

● |

all

outstanding depositary shares have been redeemed; or |

| |

|

|

| |

● |

there

has been a final distribution in respect of the preferred shares of the applicable series in connection with our liquidation, dissolution

or winding up and such distribution has been made to the holders of depositary receipts. |

Resignation

and Removal of Depositary. The depositary may resign at any time by delivering to us notice of its election to do so. We may

remove a depositary at any time. Any resignation or removal will take effect upon the appointment of a successor depositary and its acceptance

of appointment.

Charges

of Depositary. We will pay all transfer and other taxes and governmental charges arising solely from the existence of any depositary

arrangements. We will pay all charges of each depositary in connection with the initial deposit of the ordinary shares or preferred shares

of any series, the initial issuance of the depositary shares, any redemption of such ordinary shares or preferred shares and any withdrawals

of such ordinary shares or preferred shares by holders of depositary shares. Holders of depositary shares will be required to pay any

other transfer taxes.

Notices.

Each depositary will forward to the holders of the applicable depositary shares all notices, reports and communications from us which

are delivered to such depositary and which we are required to furnish the holders of the ordinary shares or preferred shares represented

by such depositary shares.

Miscellaneous.

The depositary agreement may contain provisions that limit our liability and the liability of the depositary to the holders of depositary

shares. Both the depositary and we are also entitled to an indemnity from the holders of the depositary shares prior to bringing, or

defending against, any legal proceeding. We or any depositary may rely upon written advice of counsel or accountants, or information

provided by persons presenting ordinary shares or preferred shares for deposit, holders of depositary shares or other persons believed

by us to be competent and on documents believed by us or them to be genuine.

DESCRIPTION

OF UNITS

We

may issue units consisting of any combination of the other types of Securities offered under this prospectus in one or more series. We

may evidence each series of units by unit certificates that we may issue under a separate agreement. We may enter into unit agreements

with a unit agent. Each unit agent, if any, may be a bank or trust company that we select. We will indicate the name and address of the

unit agent, if any, in the applicable prospectus supplement relating to a particular series of units. Specific unit agreements, if any,

will contain additional important terms and provisions. We will file as an exhibit to the registration statement of which this prospectus

is a part, or will incorporate by reference from a report that we file with the SEC, the form of unit and the form of each unit agreement,

if any, relating to units offered under this prospectus.

If

we offer any units, certain terms of that series of units will be described in the applicable prospectus supplement, including, without

limitation, the following, as applicable

| |

● |

the

title of the series of units; |

| |

|

|

| |