Form 8-K - Current report

26 Juillet 2023 - 10:05PM

Edgar (US Regulatory)

0001682220

false

0001682220

2023-07-26

2023-07-26

0001682220

us-gaap:CommonStockMember

2023-07-26

2023-07-26

0001682220

sach:Notes7.125PercentDue2024Member

2023-07-26

2023-07-26

0001682220

sach:Notes6.875PercentDue2024Member

2023-07-26

2023-07-26

0001682220

sach:Notes7.75percentDue2025Member

2023-07-26

2023-07-26

0001682220

sach:Notes6.00percentDue2026Member

2023-07-26

2023-07-26

0001682220

sach:Notes6.00percentDue2027Member

2023-07-26

2023-07-26

0001682220

sach:Notes7.125PercentDue2027Member

2023-07-26

2023-07-26

0001682220

sach:Notes8.00percentDue2027Member

2023-07-26

2023-07-26

0001682220

us-gaap:SeriesAPreferredStockMember

2023-07-26

2023-07-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 26, 2023

SACHEM

CAPITAL CORP.

(Exact name of Registrant as specified in its

charter)

| New

York |

|

001-37997 |

|

81-3467779 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 698 Main Street, Branford, Connecticut |

|

06405 |

| (Address

of Principal Executive Office) |

|

(Zip

Code) |

Registrant's

telephone number, including area code (203)

433-4736

| (Former

Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Ticker

symbol(s) |

Name

of each exchange on which registered |

| Common

Shares, par value $.001 per share |

SACH |

NYSE American LLC |

| 7.125%

Notes due 2024 |

SCCB |

NYSE American LLC |

| 6.875%

Notes due 2024 |

SACC |

NYSE American LLC |

| 7.75%

notes due 2025 |

SCCC |

NYSE American LLC |

| 6.00%

notes due 2026 |

SCCD |

NYSE American LLC |

| 6.00%

notes due 2027 |

SCCE |

NYSE American LLC |

| 7.125%

notes due 2027 |

SCCF |

NYSE American LLC |

| 8.00%

notes due 2027 |

SCCG |

NYSE American LLC |

| 7.75%

Series A Cumulative Redeemable Preferred Stock, Liquidation Preference $25.00 per share |

SACHPRA |

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company

¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On July 26, 2023, Sachem Capital Corp. issued a

press release, a copy of which is attached hereto as Exhibit 99.1, announcing that its board of directors authorized and declared a quarterly

dividend of $0.13 per share to be paid on August 11, 2023 to shareholders of record as of August 7, 2023.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

* * * * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Sachem Capital Corp. |

| |

|

| |

|

| Dated: July 26, 2023 |

By: |

/s/ John L. Villano |

| |

|

John L. Villano, CPA |

| |

|

Chief Executive Officer |

Exhibit Index

Exhibit 99.1

SACHEM CAPITAL CORP. ANNOUNCES DIVIDEND OF

$0.13 PER SHARE

BRANFORD, CT, July 26, 2023 (GLOBE NEWSWIRE) -- Sachem Capital

Corp. (NYSE American: SACH) announced today that its board of directors authorized and declared a quarterly dividend of $0.13 per share

to be paid to shareholders of record as of the close of trading on the NYSE American on August 7, 2023. The dividend is payable on August

11, 2023.

About Sachem Capital Corp.

Sachem Capital Corp. is a mortgage REIT that specializes in originating,

underwriting, funding, servicing, and managing a portfolio of loans secured by first mortgages on real property. It offers short-term

(i.e., three years or less) secured, nonbanking loan to real estate investors to fund their acquisition, renovation, development, rehabilitation,

or improvement of properties. The company’s primary underwriting criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or commercial real estate and, typically, are held for resale or investment.

Each loan is secured by a first mortgage lien on real estate and is personally guaranteed by the principal(s) of the borrower. The company

will also make opportunistic real estate purchases apart from its lending activities.

Forward Looking Statements

This press release may contain forward-looking statements. All statements

other than statements of historical facts contained in this press release, including statements regarding our future results of operations

and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “anticipate,”

“estimate,” “expect,” “project,” “plan,” “seek,” “intend,” “believe,”

“may,” “might,” “will,” “should,” “could,” “likely,” “continue,”

“design,” and the negative of such terms and other words and terms of similar expressions are intended to identify forward-looking

statements. These forward-looking statements are based primarily on management’s current expectations and projections about future

events and trends that management believes may affect the company’s financial condition, results of operations, strategy, short-term

and long-term business operations and objectives and financial needs. These forward-looking statements are subject to several risks, uncertainties

and assumptions as described in the Annual Report on Form 10-K for 2022filed with the U.S. Securities and Exchange Commission on March

31, 2023, as supplemented by our subsequently filed Quarterly Reports on Form 10-Q. Because of these risks, uncertainties and assumptions,

the forward-looking events and circumstances discussed in this press release may not occur, and actual results could differ materially

and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements

as predictions of future events. Although the company believes that the expectations reflected in the forward-looking statements are reasonable,

the company cannot guarantee future results, level of activity, performance, or achievements. In addition, neither the company nor any

other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The company disclaims

any duty to update any of these forward-looking statements. All forward-looking statements attributable to the company are expressly qualified

in their entirety by these cautionary statements as well as others made in this press release. You should evaluate all forward-looking

statements made by the company in the context of these risks and uncertainties.

Investors:

Sachem Capital

Investor Relations

Email: investors@sachemcapitalcorp.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes7.125PercentDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.875PercentDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes7.75percentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.00percentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes6.00percentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes7.125PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sach_Notes8.00percentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

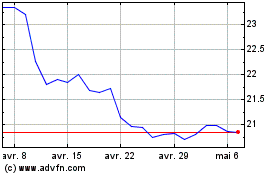

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025