Stereotaxis Reports 2022 Second Quarter Financial Results

09 Août 2022 - 3:00PM

Stereotaxis (NYSE: STXS), a pioneer and global leader in surgical

robotics for minimally invasive endovascular intervention, today

reported financial results for the second quarter ended June 30,

2022.

“Despite macro pressures and the poor optics of

our financial results, Stereotaxis is making significant progress

commercially and technologically,” said David Fischel, Chairman and

CEO. “I am pleased with our progress and confident in where we

stand and the path ahead of us. We see continued demand for our

technology, are advancing a transformative innovation pipeline, and

are assembling an all-star commercial team, all while maintaining

financial stability and strength.”

“We received three orders for Genesis systems

during the second quarter, two since our last call and one of which

will become a second active robot at a prestigious US hospital. The

recent CE Mark submission for the MAGiC ablation catheter is

reflective of the methodical progress being made across multiple

fronts on our strategic innovation plan. We continue to anticipate

multiple highly impactful technologies to be launched throughout

2023 and beyond. As these launches approach we are placing

increased focus on ensuring the right commercial team,

infrastructure and processes are in place to drive substantial

revenue growth. The addition of highly experienced commercial

leaders to our team is a testament to the opportunity in front of

us.”

2022 Second Quarter Financial

ResultsRevenue for the second quarter of 2022 totaled $6.2

million, compared to $9.1 million in the prior year second quarter

with the decrease primarily driven by lower revenue recognition of

system sales in the current quarter. System revenue for the second

quarter was $0.6 million and recurring revenue was $5.6

million.

Gross margin for the second quarter of 2022 was

76% of revenue, with system gross margin of 16% and recurring

revenue gross margin of 83%. Operating expenses in the quarter of

$9.8 million include $2.7 million in non-cash stock compensation

expense. Excluding stock compensation expense, adjusted operating

expenses were $7.2 million, consistent with the prior year second

quarter.

Operating loss and net loss for the second

quarter of 2022 were both approximately ($5.2) million, compared to

a ($3.4) million operating loss and a ($1.2) million net loss in

the previous year. Net loss in the prior year quarter reflects a

favorable $2.2 million adjustment for the forgiveness of the

Paycheck Protection Loan. Adjusted operating loss and adjusted net

loss for the quarter, excluding non-cash stock compensation

expense, were both ($2.5) million. Negative free cash flow for the

second quarter was ($1.8) million.

Cash Balance and LiquidityAt

June 30, 2022, Stereotaxis had cash and cash equivalents, including

restricted cash, of $35.1 million and no debt.

Forward Looking

ExpectationsRevenue for the first half of this year

represents a nadir in performance with results in the second half

expected to be substantially higher. Stereotaxis’ current system

backlog of over $12 million supports its prior guidance of overall

revenue growth in 2022. While this guidance remains achievable,

significant variability in hospital construction timelines suggests

that a sufficient portion of backlog may be recognized as revenue

in the following year, introducing caution to this guidance.

Substantial and consistent revenue growth in the coming years is

expected to be supported by new technology launches and an enhanced

commercial organization. Stereotaxis expects to end the year with

approximately $32 million in cash and cash equivalents, maintaining

a robust balance sheet that allows it to reach profitability

without the need for additional financings.

Conference Call and

WebcastStereotaxis will host a conference call and webcast

today, August 9, 2022, at 10:00 a.m. Eastern Time. To access the

conference call, dial 1-888-394-8218 (US and Canada) or

1-856-344-9221 (International) and give the participant pass code

9211068. Participants are asked to call 5-10 minutes prior to the

start time. To access the live and replay webcast, please visit the

investor relations section of the Stereotaxis website at

www.Stereotaxis.com.

About StereotaxisStereotaxis

(NYSE: STXS) is a pioneer and global leader in innovative surgical

robotics for minimally invasive endovascular intervention. Its

mission is the discovery, development and delivery of robotic

systems, instruments, and information solutions for the

interventional laboratory. These innovations help physicians

provide unsurpassed patient care with robotic precision and safety,

expand access to minimally invasive therapy, and enhance the

productivity, connectivity, and intelligence in the operating room.

Stereotaxis technology has been used to treat over 100,000 patients

across the United States, Europe, Asia, and elsewhere. For more

information, please visit www.Stereotaxis.com.

This press release includes statements that may

constitute "forward-looking" statements, usually containing the

words "believe”, "estimate”, "project”, "expect" or similar

expressions. Forward-looking statements inherently involve risks

and uncertainties that could cause actual results to differ

materially. Factors that would cause or contribute to such

differences include, but are not limited to, the Company's ability

to manage expenses at sustainable levels, acceptance of the

Company's products in the marketplace, the effect of global

economic conditions on the ability and willingness of customers to

purchase its technology, competitive factors, changes resulting

from healthcare policy, dependence upon third-party vendors, timing

of regulatory approvals, the impact of pandemics or other

disasters, and other risks discussed in the Company's periodic and

other filings with the Securities and Exchange Commission. By

making these forward-looking statements, the Company undertakes no

obligation to update these statements for revisions or changes

after the date of this release. There can be no assurance that the

Company will recognize revenue related to its purchase orders and

other commitments because some of these purchase orders and other

commitments are subject to contingencies that are outside of the

Company's control and may be revised, modified, delayed, or

canceled.

| Investor Contacts: |

|

|

Media Contact: |

| David L. Fischel |

|

|

Bethanne Schluter |

| Chairman and Chief Executive Officer |

|

|

Director, Marketing & Communications |

| |

|

|

|

| Kimberly Peery |

|

|

|

| Chief Financial Officer |

|

|

|

| |

|

|

|

| 314-678-6100 |

|

|

|

| Investors@Stereotaxis.com |

|

|

|

|

STEREOTAXIS, INC. |

|

STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| (in thousands, except share

and per share amounts) |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

Systems |

$ |

602 |

|

|

$ |

2,686 |

|

|

$ |

2,236 |

|

|

$ |

5,289 |

|

| Disposables, service and

accessories |

|

5,550 |

|

|

|

6,118 |

|

|

|

10,953 |

|

|

|

11,892 |

|

| Sublease |

|

- |

|

|

|

247 |

|

|

|

- |

|

|

|

493 |

|

| Total revenue |

|

6,152 |

|

|

|

9,051 |

|

|

|

13,189 |

|

|

|

17,674 |

|

| |

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

| Systems |

|

509 |

|

|

|

1,390 |

|

|

|

1,801 |

|

|

|

2,825 |

|

| Disposables, service and

accessories |

|

973 |

|

|

|

882 |

|

|

|

1,794 |

|

|

|

1,808 |

|

| Sublease |

|

- |

|

|

|

247 |

|

|

|

- |

|

|

|

493 |

|

| Total cost of revenue |

|

1,482 |

|

|

|

2,519 |

|

|

|

3,595 |

|

|

|

5,126 |

|

| |

|

|

|

|

|

|

|

| Gross margin |

|

4,670 |

|

|

|

6,532 |

|

|

|

9,594 |

|

|

|

12,548 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

2,893 |

|

|

|

2,717 |

|

|

|

5,340 |

|

|

|

5,084 |

|

|

Sales and marketing |

|

3,279 |

|

|

|

3,045 |

|

|

|

6,225 |

|

|

|

5,992 |

|

|

General and administrative |

|

3,677 |

|

|

|

4,161 |

|

|

|

7,297 |

|

|

|

6,391 |

|

| Total operating expenses |

|

9,849 |

|

|

|

9,923 |

|

|

|

18,862 |

|

|

|

17,467 |

|

| Operating loss |

|

(5,179 |

) |

|

|

(3,391 |

) |

|

|

(9,268 |

) |

|

|

(4,919 |

) |

| |

|

|

|

|

|

|

|

| Interest (expense) income,

net |

|

45 |

|

|

|

(3 |

) |

|

|

48 |

|

|

|

(7 |

) |

| Gain on extinguishment of

debt |

|

- |

|

|

|

2,183 |

|

|

|

- |

|

|

|

2,183 |

|

| Net loss |

$ |

(5,134 |

) |

|

$ |

(1,211 |

) |

|

$ |

(9,220 |

) |

|

$ |

(2,743 |

) |

| Cumulative dividend on

convertible preferred stock |

|

(335 |

) |

|

|

(335 |

) |

|

|

(666 |

) |

|

|

(668 |

) |

| Net loss attributable to

common stockholders |

$ |

(5,469 |

) |

|

$ |

(1,546 |

) |

|

$ |

(9,886 |

) |

|

$ |

(3,411 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share attributed

to common stockholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.07 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

- |

|

|

|

|

|

|

Diluted |

$ |

(0.07 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of

common shares and equivalents: |

|

|

|

|

|

|

|

|

Basic |

|

75,953,916 |

|

|

|

75,547,574 |

|

|

|

75,915,864 |

|

|

|

75,362,521 |

|

| |

|

|

|

|

|

|

|

|

Diluted |

|

75,953,916 |

|

|

|

75,547,574 |

|

|

|

75,915,864 |

|

|

|

75,362,521 |

|

|

STEREOTAXIS, INC. |

|

BALANCE SHEETS |

|

|

|

|

| (in thousands, except share

amounts) |

June 30, 2022 |

|

December 31, 2021 |

|

|

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

33,498 |

|

|

$ |

38,739 |

|

|

Restricted cash - current |

|

618 |

|

|

|

454 |

|

|

Accounts receivable, net of allowance of $225 and $180 at 2022 and

2021, respectively |

|

3,748 |

|

|

|

5,406 |

|

|

Inventories, net |

|

7,786 |

|

|

|

4,433 |

|

|

Prepaid expenses and other current assets |

|

991 |

|

|

|

2,356 |

|

| Total current assets |

|

46,641 |

|

|

|

51,388 |

|

| Property and equipment,

net |

|

3,260 |

|

|

|

2,632 |

|

| Restricted cash |

|

1,006 |

|

|

|

952 |

|

| Operating lease right-of-use

assets |

|

5,553 |

|

|

|

5,735 |

|

| Prepaid and other non-current

assets |

|

218 |

|

|

|

278 |

|

| Total assets |

$ |

56,678 |

|

|

$ |

60,985 |

|

| |

|

|

|

| Liabilities and stockholders'

equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

4,244 |

|

|

$ |

4,189 |

|

| Accrued liabilities |

|

2,126 |

|

|

|

2,528 |

|

| Deferred revenue |

|

6,959 |

|

|

|

6,277 |

|

| Current portion of operating

lease liabilities |

|

328 |

|

|

|

268 |

|

| Total current liabilities |

|

13,657 |

|

|

|

13,262 |

|

| Long-term deferred

revenue |

|

1,630 |

|

|

|

2,238 |

|

| Operating lease

liabilities |

|

5,663 |

|

|

|

5,842 |

|

| Other liabilities |

|

202 |

|

|

|

219 |

|

| Total liabilities |

|

21,152 |

|

|

|

21,561 |

|

| |

|

|

|

| Series A - Convertible

preferred stock: |

|

|

|

|

Convertible preferred stock, Series A, par value $0.001; 22,386 and

22,387 shares outstanding at 2022 and 2021, respectively |

|

5,584 |

|

|

|

5,584 |

|

| Stockholders' equity: |

|

|

|

|

Convertible preferred stock, Series B, par value $0.001; 10,000,000

shares authorized, 5,610,121 shares outstanding at 2022 and

2021 |

|

6 |

|

|

|

6 |

|

|

Common stock, par value $0.001; 300,000,000 shares authorized,

74,686,056 and 74,618,240 shares issued at 2022 and 2021,

respectively |

|

75 |

|

|

|

75 |

|

| Additional paid-in

capital |

|

537,963 |

|

|

|

532,641 |

|

| Treasury stock, 4,015 shares

at 2022 and 2021 |

|

(206 |

) |

|

|

(206 |

) |

| Accumulated deficit |

|

(507,896 |

) |

|

|

(498,676 |

) |

| Total stockholders'

equity |

|

29,942 |

|

|

|

33,840 |

|

| Total liabilities and

stockholders' equity |

$ |

56,678 |

|

|

$ |

60,985 |

|

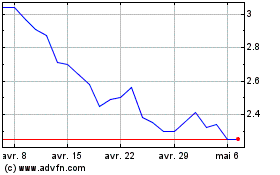

Stereotaxis (AMEX:STXS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Stereotaxis (AMEX:STXS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024