false

0001289340

0001289340

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(D) of the Securities Exchange Act Of 1934

Date

of report (Date of earliest event reported): March 4, 2024

STEREOTAXIS,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

Delaware

(State

or Other Jurisdiction of Incorporation)

| 001-36159 |

|

94-3120386 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

| 710

North Tucker Boulevard, Suite 110, St. Louis, Missouri |

|

63101 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(314)

678-6100

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

STXS |

|

NYSE

American LLC |

| Item

2.02 |

Results

of Operations and Financial Condition |

On

March 4, 2024, Stereotaxis, Inc. (the “Company”) issued a press release (the “Earnings Press Release”) setting

forth its financial results for the 2023 fourth quarter and full year. A copy of the Earnings Press Release is being filed as Exhibit

99.1 hereto, and the statements contained therein are incorporated by reference herein.

Forward-Looking

Statements and Additional Information

Statements

are made herein or incorporated herein that are “forward-looking statements” as defined by the Securities and Exchange Commission

(the “SEC”). All statements, other than statements of historical fact, included or incorporated herein that address activities,

events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements.

These statements are not guarantees of future events or the Company’s future performance and are subject to risks, uncertainties

and other important factors that could cause events or the Company’s actual performance or achievements to be materially different

than those projected by the Company. For a full discussion of these risks, uncertainties and factors, the Company encourages you to read

its documents on file with the SEC. Except as required by law, the Company does not intend to update or revise its forward-looking statements,

whether as a result of new information, future events or otherwise.

In

accordance with General Instruction B.2. of Form 8-K, the information contained in Item 2.02 and Exhibit 99.1 attached hereto shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item

9.01 |

Financial

Statements and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

STEREOTAXIS,

INC. |

| |

|

|

| Date:

March 4, 2024 |

By: |

/s/

Kimberly R. Peery |

| |

Name: |

Kimberly

R. Peery |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Stereotaxis

Reports 2023 Full Year Financial Results

ST.

LOUIS, MO, Mar. 4, 2024 (GLOBE NEWSWIRE) – Stereotaxis (NYSE: STXS), a pioneer and global leader in surgical robotics

for minimally invasive endovascular intervention, today reported financial results for the fourth quarter and full year ended December

31, 2023.

“We

enter 2024 having made significant progress in realizing our strategic transformation. This is the year in which we expect all the key

puzzle pieces to come together, setting us up for breakout growth to follow,” said David Fischel, Chairman and CEO.

“Our

innovation strategy has a strong foundation, and we are pleased with where we stand. Regulatory submissions for our proprietary robotically-navigated

ablation catheter have been made in both Europe and the United States, following stellar results from initial clinical use. We have begun

formal testing of our smaller highly-accessible robot, and anticipate achieving European regulatory clearance mid-year followed by FDA

clearance in the second half of the year. We also expect commercial launches later this year of a guidewire that expands our technology

into several new indications, a comprehensive product ecosystem in China, and a digital surgery solution enabling broad operating room

connectivity. These innovations collectively serve as a foundational product ecosystem for a high-growth medical robotics company poised

to transform endovascular surgery. They are transformational as they structurally improve our clinical, commercial, financial, and strategic

foundation.”

“Revenue

growth amidst this transition has remained challenging. Revenue in 2023 was pressured by the loss of royalties and recurring shortages

of catheters from our partner, highlighting the importance of overcoming key product dependencies. These headwinds counteracted growth

in robotic system revenue for the year. System revenue remains lumpy, but we continue to benefit from a significant backlog and pipeline

of orders. We were pleased in the fourth quarter to receive our first greenfield robotic system order from Germany in over a decade,

and we anticipate continued growth in orders and system revenue as it becomes clear to physicians and hospitals that the supply of robotic

catheters is secure.”

“We

retain a strong balance sheet which allows us to bring our transformative product ecosystem to market, fund its commercialization, and

reach profitability. We have multiple shots on goal for breakout growth in 2025.”

2023

Fourth Quarter and Full Year Financial Results

Revenue

for the fourth quarter of 2023 totaled $4.6 million, compared to $7.3 million in the prior year fourth quarter. System revenue of $0.1

million and recurring revenue of $4.5 million, compared to $2.2 million and $5.1 million, respectively, in the prior year fourth quarter.

System revenue was weaker than expected due to delays in hospital construction schedules but does not reflect our normalized expectation.

Recurring revenue was in line with recent quarters. Revenue for the full year 2023 totaled $26.8 million compared to $28.1 million in

2022. Full year system revenue was $8.7 million compared to $6.8 million in the prior year, reflecting increased system deliveries. We

started 2024 with system backlog of $14.7 million. Full year recurring revenue was $18.0 million compared to $21.3 million, reflecting

the absence of catheter royalties received in the prior year and recurring catheter production shortages by our partner.

Gross

margin for the fourth quarter and full year 2023 were approximately 60% and 56% of revenue, respectively. Full year gross margins were

79% for recurring revenue and 8% for system revenue. System gross margins reflect significant allocations of overhead and other direct

expenses. Operating expenses in the fourth quarter were $8.0 million. Excluding $2.6 million in non-cash stock compensation expense,

adjusted operating expenses in the current quarter were $5.4 million, down from the prior year adjusted operating expenses of $6.2 million.

Adjusted operating expenses for the full year 2023 were $26.2 million, compared to $26.8 million in the prior year.

Operating

loss and net loss for the fourth quarter of 2023 were ($5.3) million and ($5.0) million, respectively, compared to ($4.5) million and

($4.2) million in the previous year. Adjusted operating loss and adjusted net loss for the quarter, excluding non-cash stock compensation

expense, were ($2.7) million, and ($2.4) million, respectively, compared to ($1.9) million and ($1.6) million in the previous year. For

the full year 2023, adjusted operating loss of ($11.3) million and adjusted net loss of ($10.2) million compared to an adjusted operating

loss of ($8.3) million and an adjusted net loss of ($7.8) million in the prior year. Negative free cash flow for the full year 2023 was

($9.1) million compared to ($10.8) million for the full year 2022.

Cash

Balance and Liquidity

At

December 31, 2023, Stereotaxis had cash and cash equivalents, including restricted cash, of $20.6 million and no debt.

Forward

Looking Expectations

Stereotaxis

anticipates double digit revenue growth for the full year 2024 driven by revenue recognition of system backlog and new system orders.

Cognizant of the volatility in quarterly revenue and challenge in reliably anticipating revenue in any specific quarter, Stereotaxis

is providing specific revenue guidance only for the first quarter of 2024 of approximately $7.0 million.

Stereotaxis’

balance sheet allows it to advance its transformative product ecosystem to market, fund its commercialization, and reach profitability

without the need for additional financing.

Conference

Call and Webcast

Stereotaxis

will host a conference call and webcast today, March 4, 2024, at 4:30 p.m. Eastern Time. To access the conference call, dial 1-800-715-9871

(US and Canada) or 1-646-307-1963 (International) and give the participant pass code 7954885. Participants are asked to call 5-10 minutes

prior to the start time. To access the live and replay webcast, please visit the investor relations section of the Stereotaxis website

at www.Stereotaxis.com.

About

Stereotaxis

Stereotaxis

(NYSE: STXS) is a pioneer and global leader in innovative surgical robotics for minimally invasive endovascular intervention. Its mission

is the discovery, development and delivery of robotic systems, instruments, and information solutions for the interventional laboratory.

These innovations help physicians provide unsurpassed patient care with robotic precision and safety, expand access to minimally invasive

therapy, and enhance the productivity, connectivity, and intelligence in the operating room. Stereotaxis technology has been used to

treat over 100,000 patients across the United States, Europe, Asia, and elsewhere. For more information, please visit www.Stereotaxis.com.

This

press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe”,

“estimate”, “project”, “expect” or similar expressions. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results to differ materially. Factors that would cause or contribute to such differences

include, but are not limited to, the Company’s ability to manage expenses at sustainable levels, acceptance of the Company’s

products in the marketplace, the effect of global economic conditions on the ability and willingness of customers to purchase its technology,

competitive factors, changes resulting from healthcare policy, dependence upon third-party vendors, timing of regulatory approvals, the

impact of pandemics or other disasters, and other risks discussed in the Company’s periodic and other filings with the Securities

and Exchange Commission. By making these forward-looking statements, the Company undertakes no obligation to update these statements

for revisions or changes after the date of this release. There can be no assurance that the Company will recognize revenue related to

its purchase orders and other commitments because some of these purchase orders and other commitments are subject to contingencies that

are outside of the Company’s control and may be revised, modified, delayed, or canceled.

Company

Contacts:

David

L. Fischel

Chairman

and Chief Executive Officer

Kimberly

R. Peery

Chief

Financial Officer

314-678-6100

Investors@Stereotaxis.com

STEREOTAXIS, INC.

STATEMENTS OF OPERATIONS

(Unaudited)

| (in thousands, except share and per share amounts) | |

Three Months Ended

December 31, | | |

Year Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Systems | |

$ | 66 | | |

$ | 2,196 | | |

$ | 8,739 | | |

$ | 6,845 | |

| Disposables, service and accessories | |

| 4,499 | | |

| 5,105 | | |

| 18,032 | | |

| 21,302 | |

| Total revenue | |

| 4,565 | | |

| 7,301 | | |

| 26,771 | | |

| 28,147 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Systems | |

| 749 | | |

| 1,985 | | |

| 8,058 | | |

| 5,802 | |

| Disposables, service and accessories | |

| 1,078 | | |

| 1,007 | | |

| 3,853 | | |

| 3,875 | |

| Total cost of revenue | |

| 1,827 | | |

| 2,992 | | |

| 11,911 | | |

| 9,677 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross margin | |

| 2,738 | | |

| 4,309 | | |

| 14,860 | | |

| 18,470 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,212 | | |

| 2,400 | | |

| 10,273 | | |

| 10,558 | |

| Sales and marketing | |

| 2,791 | | |

| 2,988 | | |

| 12,376 | | |

| 12,325 | |

| General and administrative | |

| 3,039 | | |

| 3,377 | | |

| 14,050 | | |

| 14,363 | |

| Total operating expenses | |

| 8,042 | | |

| 8,765 | | |

| 36,699 | | |

| 37,246 | |

| Operating loss | |

| (5,304 | ) | |

| (4,456 | ) | |

| (21,839 | ) | |

| (18,776 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 3 | | |

| - | | |

| 30 | | |

| - | |

| Interest income, net | |

| 261 | | |

| 302 | | |

| 1,096 | | |

| 484 | |

| Net loss | |

$ | (5,040 | ) | |

$ | (4,154 | ) | |

$ | (20,713 | ) | |

$ | (18,292 | ) |

| Cumulative dividend on convertible preferred stock | |

| (339 | ) | |

| (338 | ) | |

| (1,343 | ) | |

| (1,343 | ) |

| Net loss attributable to common stockholders | |

$ | (5,379 | ) | |

$ | (4,492 | ) | |

$ | (22,056 | ) | |

$ | (19,635 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributed to common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.07 | ) | |

$ | (0.06 | ) | |

$ | (0.27 | ) | |

$ | (0.26 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

$ | (0.07 | ) | |

$ | (0.06 | ) | |

$ | (0.27 | ) | |

$ | (0.26 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares and equivalents: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 82,702,722 | | |

| 76,308,259 | | |

| 80,702,358 | | |

| 76,061,183 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

| 82,702,722 | | |

| 76,308,259 | | |

| 80,702,358 | | |

| 76,061,183 | |

STEREOTAXIS, INC.

BALANCE

SHEETS

| (in thousands, except share amounts) | |

December 31,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 19,818 | | |

$ | 8,586 | |

| Restricted cash - current | |

| 525 | | |

| 525 | |

| Short-term investments | |

| - | | |

| 19,844 | |

| Accounts receivable, net of allowance of $672 and $235 at 2023 and 2022, respectively | |

| 3,822 | | |

| 5,090 | |

| Inventories, net | |

| 8,426 | | |

| 7,876 | |

| Prepaid expenses and other current assets | |

| 676 | | |

| 1,325 | |

| Total current assets | |

| 33,267 | | |

| 43,246 | |

| Property and equipment, net | |

| 3,304 | | |

| 3,831 | |

| Restricted cash | |

| 219 | | |

| 744 | |

| Operating lease right-of-use assets | |

| 4,982 | | |

| 5,384 | |

| Prepaid and other non-current assets | |

| 137 | | |

| 208 | |

| Total assets | |

$ | 41,909 | | |

$ | 53,413 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,190 | | |

$ | 3,270 | |

| Accrued liabilities | |

| 2,972 | | |

| 3,306 | |

| Deferred revenue | |

| 6,657 | | |

| 7,342 | |

| Current portion of operating lease liabilities | |

| 428 | | |

| 373 | |

| Total current liabilities | |

| 13,247 | | |

| 14,291 | |

| Long-term deferred revenue | |

| 1,637 | | |

| 1,654 | |

| Operating lease liabilities | |

| 5,062 | | |

| 5,488 | |

| Other liabilities | |

| 43 | | |

| 51 | |

| Total liabilities | |

| 19,989 | | |

| 21,484 | |

| | |

| | | |

| | |

| Series A - Convertible preferred stock: | |

| | | |

| | |

| Convertible preferred stock, Series A, par value $0.001; 22,358 and 22,383 shares

outstanding at 2023 and 2022, respectively | |

| 5,577 | | |

| 5,583 | |

| Stockholders’ equity: | |

| | | |

| | |

| Convertible preferred stock, Series B, par value $0.001; 10,000,000 shares authorized, 5,610,121 shares outstanding at 2022 | |

| - | | |

| 6 | |

| Common stock, par value $0.001; 300,000,000 shares authorized, 80,949,697 and 74,874,459 shares issued at 2023 and 2022, respectively | |

| 81 | | |

| 75 | |

| Additional paid-in capital | |

| 554,148 | | |

| 543,438 | |

| Treasury stock, 4,015 shares at 2023 and 2022 | |

| (206 | ) | |

| (206 | ) |

| Accumulated deficit | |

| (537,680 | ) | |

| (516,967 | ) |

| Total stockholders’ equity | |

| 16,343 | | |

| 26,346 | |

| Total liabilities and stockholders’ equity | |

$ | 41,909 | | |

$ | 53,413 | |

v3.24.0.1

Cover

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity File Number |

001-36159

|

| Entity Registrant Name |

STEREOTAXIS,

INC.

|

| Entity Central Index Key |

0001289340

|

| Entity Tax Identification Number |

94-3120386

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

710

North Tucker Boulevard

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

St. Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63101

|

| City Area Code |

(314)

|

| Local Phone Number |

678-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

STXS

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

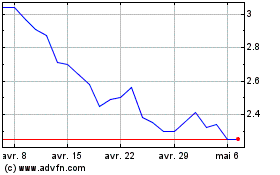

Stereotaxis (AMEX:STXS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Stereotaxis (AMEX:STXS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024