Current Report Filing (8-k)

21 Décembre 2022 - 11:01PM

Edgar (US Regulatory)

0000089140

false

0000089140

2022-12-19

2022-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 19, 2022

Servotronics, Inc.

(Exact name of registrant as specified in its charter.)

Commission File Number: 001-07109

| Delaware |

16-0837866 |

| (State or other jurisdiction |

(IRS Employer |

| of incorporation) |

Identification No.) |

1110 Maple Street

Elma, New York 14059-0300

(Address of principal executive offices,

including zip code)

(716) 655-5990

(Registrant's telephone number, including area

code)

(Former name or former address, if changed

since last report)

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock |

|

SVT |

|

NYSE American |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

2022 Long-Term Equity Award

On December 19, 2022, the Compensation Committee

(the “Committee”) of the Board of Directors of Servotronics, Inc. (the “Company”) awarded 14,546 shares of restricted

stock to William Farrell, Jr., Chief Executive Officer of the Company. As previously disclosed, Mr. Farrell’s target long-term equity

incentive compensation was set at 40% of his base salary (prorated for the partial year due to his appointment in April 2022). Recognizing

the transitional nature of Mr. Farrell’s first partial year of employment with the Company, the Committee considered various performance

goals as part of a comprehensive qualitative review of his performance and awarded him long-term equity incentive compensation equal to

approximately 170% of target. The restricted stock award was made under the Company’s 2022 Equity Incentive Plan and the restricted

stock will vest one-third on the first anniversary of the date of grant and one-third each on April 1, 2024 and 2025.

The foregoing description of the Restricted Stock

Award Agreement is qualified in its entirety by reference to the Restricted Stock Award Agreement, a form of which is attached hereto

as Exhibit 10.1 and incorporated herein by reference.

2023 Executive Compensation Program

The Committee is also in the process of developing

a well-balanced compensation program for 2023. The executive officer compensation program is expected to contain three primary components:

base salary, an annual cash incentive award and long-term equity incentive awards subject to both performance-based vesting (earned over

a three-year performance period) and service-based vesting (over a three-year period), as summarized below. The performance metrics for

the annual and long-term incentive awards as well as the total compensation opportunity for each executive officer are expected to be

established by the Committee in the first quarter of 2023.

Base Salary. The base salaries for the

Company’s executive officers will be reviewed annually by the Committee and adjusted from time to time to recognize competitive

market data based on the officer’s level of responsibility, outstanding individual performance, promotions and internal equity considerations.

Annual Cash Incentive Awards. The executive

officers will also have an opportunity to earn annual incentive awards, paid in cash, designed to reward annual corporate performance

(75%) and individual performance (25%). Each year the Committee will establish a target annual incentive award opportunity for each executive

officer following a review of their individual scope of responsibilities, experience, qualifications, individual performance and contributions

to the Company. Both the corporate performance metrics and the individual goals will be aligned with the Company’s overall strategic

priorities.

The Committee expects to set the target annual

cash incentive equal to a percentage of annual base salary. If the target goal for a corporate performance metric is achieved, then the

corporate performance metric will be deemed to be earned at 100%. If the threshold or maximum goal for a performance metric is achieved,

then the corporate performance metric will be deemed to be earned at 50% or 200%, respectively. Results below threshold result in a zero

payout and achievement at levels between threshold and maximum will be determined via linear interpolation.

Long-term Equity Incentive Awards. The

executive officers will also have an opportunity to earn long-term equity incentive awards intended to provide incentives for the creation

of value and the corresponding growth of the Company’s stock price over time. The Committee will set the target for the three-year

LTIP award equal to a percentage of base salary. The Committee believes that the long-term equity incentive awards should provide an appropriate

balance between performance incentive and retention awards, accordingly, for each three-year LTIP award, 75% of the target award will

be performance-based and 25% of the target award will be service-based. If the target goal for a performance metric is achieved, then

the performance metric will be deemed to be earned at 100%. If the threshold or maximum goal for a performance metric is achieved, then

the performance metric will be deemed to be earned at 50% or 200%, respectively. Results below threshold result in a zero payout and achievement

at levels between threshold and maximum are determined via linear interpolation. The performance-based portion of the LTIP award will

vest immediately upon the Committee’s determination that the applicable performance metrics have been achieved at the end of the

performance period. The service-based portion of the LTIP award vests one-third per year over three years.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Signature(s)

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 21, 2022 | | |

| | | |

| | Servotronics, Inc. |

| | | |

| | By: | /s/Lisa F. Bencel, Chief Financial Officer |

| | | Lisa F. Bencel |

| | | Chief Financial Officer |

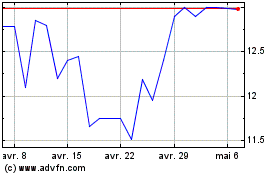

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024