false

0000061398

0000061398

2024-02-22

2024-02-22

0000061398

us-gaap:CommonStockMember

2024-02-22

2024-02-22

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

February 22, 2024 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On February 22, 2024,

Tellurian Inc. (“Tellurian” or the “Company”) entered into a letter agreement (the “Letter

Agreement”) with an institutional investor (the “Investor”) providing for, among other things, amendments

to the indentures governing its 10.00% senior secured notes due 2025 (the “Senior Notes”) and its 6.00% senior secured

convertible notes due 2025 (the “Convertible Notes,” and together with the Senior Notes, the “Notes”)

previously issued to the Investor.

At the closing of the transactions

contemplated by the Letter Agreement, (i) Tellurian will pay $4.0 million of the top-up amount contemplated by the previously

disclosed letter agreement between Tellurian and the Investor dated December 28, 2023 in cash, with the balance of such top-up amount,

if any, to be added to the principal amount of the Senior Notes, (ii) certain terms of the indentures governing the Notes will be

amended as summarized below, (iii) the Investor will receive all shares of common stock of the Company in respect of the interest

payments due on the Notes through maturity, subject to certain lock-up provisions and anti-shorting restrictions, and (iv) Tellurian

Investments LLC, a wholly owned subsidiary of the Company (“Tellurian Investments”), will provide a non-recourse pledge

of all of its equity interests in Driftwood LNG Holdings LLC, a wholly owned subsidiary of Tellurian Investments that owns the principal

properties of the Company comprising the Driftwood Project (“Driftwood LNG Holdings”).

Key terms of the amendments

to the indentures governing the Notes to be made pursuant to the transaction are as follows:

E&P Asset Disposition.

The indenture governing the Senior Notes will require the Company to use its reasonable best efforts to sell its upstream natural

gas exploration and production assets (the “E&P Sale”) and to use the proceeds from such sale to repay amounts

due under the Senior Notes.

April 2024 Interest

Payment. The indentures governing the Notes will provide that the quarterly cash interest payment due, and any stock shortfall payment

owed, on April 1, 2024 in respect of the Notes will be added to the aggregate principal amounts of the applicable Notes.

Minimum Liquidity. The

Company’s minimum liquidity requirement will be reduced from $40.0 million to (i) $25.0 million for the period commencing

in February 2024 through and including April 30, 2024; (ii) $30.0 million for the period commencing on May 1,

2024 through and including May 31, 2024; (iii) $35.0 million for the period commencing on June 1, 2024 through and

including June 30, 2024; and (iv) $40.0 million for the period commencing July 1, 2024 and thereafter.

From and after the earlier

of the E&P Sale and the repayment in full of the Senior Notes, the minimum liquidity requirement in the indenture governing the Convertible

Notes will be replaced with a requirement to have $35.0 million held in a blocked account for the benefit of the collateral trustee

thereunder, with such required amount reducing to $25.0 million when the outstanding principal amount of the Convertible Notes is

less than $50.0 million.

Between July 1, 2024

and October 1, 2024, any excess cash flow generated by Tellurian’s upstream properties after the payment of certain expenses

will be used to pay principal and interest on the Senior Notes on a monthly basis.

Convertible Notes. The

Convertible Notes will become convertible at a price of approximately $1.05 per share, with the number of shares of common stock of

the Company issuable upon conversion limited to approximately 42.7 million. Once that limitation is reached, the remaining

principal amount of the Convertible Notes will remain outstanding as a non-convertible instrument. The Convertible Notes will

amortize on a straight-line basis over 10 months beginning on January 1, 2025. The right of the holder of the Convertible Notes

to cause the Company to redeem those notes on or after October 1, 2024 as a result of a failure to satisfy a liquidity threshold

will be eliminated.

Collateral. Tellurian

Investments will provide a non-recourse pledge of all of its equity interests in Driftwood LNG Holdings and a certain intercompany note

to secure the obligations under the indentures governing the Notes.

Certain additional upstream

natural gas exploration and production assets of the Company’s subsidiary Tellurian Production Holdings LLC will be subject to additional

security interests and mortgages to secure the obligations under the indentures governing the Notes.

Upon repayment in full of

the Senior Notes, substantially all collateral securing the Convertible Notes will be released.

The Letter Agreement contains

customary representations, warranties, and agreements by the Company, obligations of the parties, termination provisions, and closing

conditions.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.03.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 5.07.

Pursuant to, and concurrent

with the execution of, the Letter Agreement, the Investor was deemed to have consented to each of the amendments to the supplemental indentures

contemplated by the Letter Agreement. The Investor is the holder of the Notes.

| Item 7.01 |

Regulation FD Disclosure. |

On February 22, 2024, the Company issued a press release regarding the Letter Agreement. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

The information set forth

in this Item 7.01, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be

deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: February 22, 2024 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Tellurian announces agreement for debt amendment

to support upstream asset sale

HOUSTON, Texas – (BUSINESS WIRE) February 22, 2024

-- Tellurian Inc. (Tellurian) (NYSE American: TELL) announced today an agreement for an amendment to the terms of certain debt instruments.

The amendment is expected to enhance near-term liquidity and provide the company with flexibility to successfully complete the sale of

its upstream assets. Among other items, the amendment provisions include a reduction in Tellurian’s minimum cash balance requirement

and the ability for the company to make its upcoming interest payments in-kind.

Chief Executive Officer Octávio Simões said,

“This amendment to our debt agreement is pivotal towards establishing a sustainable capital structure and accelerating our strategic

priority, Driftwood LNG. It also provides us the time and flexibility to complete the sale of our upstream assets in a manner that maximizes

value for our shareholders while we maintain our focus on the intensive negotiations associated with the commercialization of Driftwood

LNG.”

About Tellurian Inc.

Tellurian intends to create value for shareholders by

building a low-cost, global natural gas business, profitably delivering natural gas to customers worldwide. Tellurian is developing a

portfolio of LNG marketing and trading, infrastructure that includes an ~ 27.6 mtpa LNG export facility and an associated pipeline. Tellurian

is based in Houston, Texas, and its common stock is listed on the NYSE American under the symbol “TELL”.

For more information, please visit www.tellurianinc.com.

Follow us on Twitter at twitter.com/TellurianLNG

CAUTIONARY

INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements

within the meaning of U.S. federal securities laws. The words “anticipate,” “assume,” “believe,” “budget,”

“estimate,” “expect,” “forecast,” “initial,” “intend,” “may,”

“plan,” “potential,” “project,” “proposed,” “should,” “will,”

“would,” and similar expressions are intended to identify forward- looking statements. Forward-looking statements herein relate

to, among other things, the capacity, timing, and other aspects of the Driftwood LNG project, capital structure, liquidity, commercial

and strategic matters and the potential sale of the company’s upstream assets. These statements involve a number of known and unknown

risks, which may cause actual results to differ materially from expectations expressed or implied in the forward-looking statements. These

risks include the matters discussed in Item 1A of Part I of the Annual Report on Form 10-K of Tellurian for the fiscal year ended December

31, 2022, filed by Tellurian with the Securities and Exchange Commission (the SEC) on February 22, 2023, and other Tellurian filings with

the SEC, all of which are incorporated by reference herein. The forward-looking statements in this press release speak as of the date

of this release. Although Tellurian may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment

to do so except as required by securities laws. The closing of the transaction described herein is subject to certain customary conditions.

Contact

| Media: |

Investors: |

Joi Lecznar

EVP Public and Government Affairs

Phone +1.832.962.4044

joi.lecznar@tellurianinc.com |

Matt Phillips

Vice President, Investor Relations

Phone +1.832.320.9331

matthew.phillips@tellurianinc.com |

1201 Louisiana Street Suite 3100 | Houston, TX 77002

| TEL + 1 832 962 4000 | www.tellurianinc.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

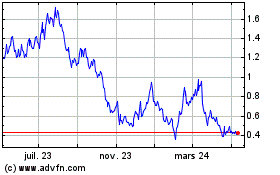

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

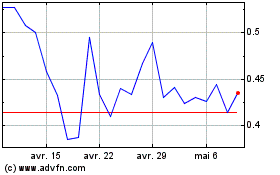

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025