Current Report Filing (8-k)

04 Août 2022 - 2:17PM

Edgar (US Regulatory)

0001136294

false

0001136294

2022-08-03

2022-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 3, 2022

Williams Industrial Services Group Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-16501 |

|

73-1541378 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

200 Ashford Center North, Suite

425

Atlanta, Georgia 30338

(Address of Principal Executive Offices, Zip Code)

Registrant’s telephone number, including

area code: 770-879-4400

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

|

WLMS |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On August 3, 2022, Williams Industrial Services Group Inc. (the

“Company”) entered into an amendment (the “RC Amendment”) to its Revolving Credit and Security

Agreement, dated December 16, 2020, by and among the Company and certain of its subsidiaries as borrowers or guarantors, PNC Bank,

National Association, as agent for the lenders, and the lenders party thereto (as amended, the “RC Agreement”).

Among other things, the RC Amendment (i) amends the calculation of EBITDA (as defined in the RC Agreement), effective as of June 30,

2022, to include (or “add back”) certain non-recurring losses and expenses relating to projects executed in

Jacksonville, Florida, one-time costs and expenses incurred in connection with the Company’s transmission and

distribution business unit start-up, and costs and expenses arising out of the Company’s litigation with a designated former

executive and his employer (in each case, subject to certain specified dollar limits), (ii) permits advances against certain

eligible receivables of one of the Company’s joint ventures (also subject to specified dollar limits), (iii) includes

provisions that replace the London Interbank Offered Rate (LIBOR) interest rate with customary provisions based on the secured

overnight financing rate (SOFR), and (iv) provides for the payment of a $25,000 amendment fee, plus applicable fees and

expenses.

Also on August 3, 2022 (the “Signing Date”), but

with an effective date of June 30, 2022, the Company entered into an amendment (the “Term Loan Amendment”) to its Term

Loan, Guarantee and Security Agreement, dated December 16, 2020, by and among the Company and certain of its subsidiaries as borrowers

or guarantors, EICF Agent LLC, as agent for the lenders, and the lenders party thereto (as amended, the “Term Loan Agreement”).

Among other things, the Term Loan Amendment (i) amends and increases the Total Leverage Ratio (as defined in the Term Loan Agreement)

applicable to the Company for certain periods, (ii) amends the calculation of Consolidated EBITDA (as defined in the Term Loan Agreement)

to include (or “add back”) certain non-recurring losses and expenses relating to projects executed in Jacksonville, Florida, one-time

costs and expenses incurred in connection with the Company’s transmission and distribution business unit start-up, and costs and

expenses arising out of the Company’s litigation with a designated former executive and his employer (in each case, subject to certain

specified dollar limits), (iii) provides for a fee of 1% of the then-outstanding principal balance due upon maturity of the term loan

without duplication of fees paid in connection with the Company’s prepayment fee structure, (iv) extends the Company’s existing

prepayment fee structure to require upon repayment (a) prior to the first anniversary of the Signing Date, a fee of 3% of the principal

amount being repaid, (b) on or after the first anniversary of the Signing Date and prior to the second anniversary of the Signing Date,

a fee of 2% of the principal amount being repaid, and (c) on or after the second anniversary of the Signing Date, a fee of 1% of the principal

amount being repaid, and (v) provides for the payment of a $175,000 amendment fee, plus applicable fees and expenses.

The Company expects to include each of the RC Amendment and Term Loan

Amendment as an exhibit to a future periodic report, to be filed with the U.S. Securities and Exchange Commission. The foregoing descriptions

do not constitute a complete summary of the terms of the RC Amendment or the Term Loan Amendment and are qualified in their entirety by

reference to the full text of the respective amendment.

| Item 2.02 | Results of Operations and Financial Condition. |

On August 4, 2022, the Company issued a press release providing revised

guidance for the results of operations expected for the full fiscal year ending December 31, 2022. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or

other document filed under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language

contained in such filing. Without limiting the generality of the foregoing, the text of the press release set forth under the heading

entitled “Forward-looking Statement Disclaimer” is incorporated by reference into this Item 2.02.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 1.01 of this Current Report on Form

8-K is incorporated by reference into this Item 2.03.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Date: August 4, 2022 |

Williams Industrial Services Group Inc. |

| |

|

| |

|

| |

By: |

/s/ Charles E. Wheelock |

| |

Charles E. Wheelock |

| |

Senior Vice President, Chief Administrative Officer, General Counsel & Secretary |

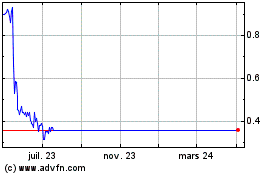

Williams Industrial Serv... (AMEX:WLMS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Williams Industrial Serv... (AMEX:WLMS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024