TIDMPAF

Pan African Resources PLCPan African Resources Funding Company

(Incorporated and registered in England and Wales Limited

under Companies Act 1985 with registered Incorporated in the Republic of South

Africa

number 3937466 on 25 February 2000)with limited liability

Share code on AIM: PAFRegistration number: 2012/021237/06

Share code on JSE: PANAlpha code: PARI

ISIN: GB0004300496

ADR code: PAFRY

("Pan African" or "the Company" or "the Group")

RESULTS OF ANNUAL GENERAL MEETING AND SALIENT DIVID DATES

1. RESULTS OF ANNUAL GENERAL MEETING

Pan African shareholders (Shareholders) are advised that at the annual general

meeting (AGM) of Shareholders held on Thursday, 23 November 2023, all the

ordinary and special resolutions, as set out in the notice of AGM dated 31

October 2023, other than Resolution 13, were approved by the requisite majority

of Shareholders present or represented by proxy.

The total number of Pan African ordinary shares (Shares) eligible to vote at the

AGM is 2,222,862,046.

All resolutions proposed at the AGM, together with the percentage of shares

abstained, as well as the percentage of votes carried for and against each

resolution, are as follows:

Resolution 1: To receive the accounts and the report of the directors of the

Company and the auditors' report thereon

Shares Voted Abstained For Against

2,755,908 1,551,119,329 1,909

1,551,121,238

0.12% 100% 0.00%

69.78%

Resolution 2: To approve the payment of a final dividend for the year ended 30

June 2023

Shares Voted Abstained For Against

265,492 1,553,609,133 2,521

1,553,611,654

0.01% 100% 0.00%

69.89%

Resolution 3: To re-elect JAJ Loots as an executive director of the Company

Shares Voted Abstained For Against

403,079 1,551,981,236 1,492,831

1,553,474,067

0.02% 99.90% 0.10%

69.89%

Resolution 4: To re-elect GP Louw as an executive director of the Company

Shares Voted Abstained For Against

453,579 1,550,620,365 2,803,202

1,553,423,567

0.02% 99.82% 0.18%

69.88%

Resolution 5: To re-elect D Earp as a member of the audit and risk committee

Shares Voted Abstained For Against

449,338 1,546,394,104 7,033,704

1,553,427,808

0.02% 99.55% 0.45%

69.88%

Resolution 6: To re-elect CDS Needham as a member of the audit and risk

committee

Shares Voted Abstained For Against

449,338 1,547,846,908 5,580,900

1,553,427,808

0.02% 99.64% 0.36%

69.88%

Resolution 7: To re-elect TF Mosololi as a member of the audit and risk

committee

Shares Voted Abstained For Against

453,579 1,497,610,478 55,813,089

1,553,423,567

0.02% 96.41% 3.59%

69.88%

Resolution 8: To increase the limit for ordinary aggregate fees payable to the

non-executive directors (Note 1)

Shares Voted Abstained For Against

5,408,683 1,125,839,313 422,629,150

1,548,468,463

0.24% 72.71% 27.29%

69.66%

Resolution 9: To endorse the Company's remuneration policy (Notes 1 and 2)

Shares Voted Abstained For Against

626,493 1,033,502,912 519,747,741

1,553,250,653

0.03% 66.54% 33.46%

69.88%

Resolution 10: To endorse the Company's remuneration implementation report

(Notes 1 and 2)

Shares Voted Abstained For Against

731,183 780,828,115 772,317,848

1,553,145,963

0.03% 50.27% 49.73%

69.87%

Resolution 11: To reappoint PwC as auditors of the Company and to authorise the

directors to determine their remuneration

Shares Voted Abstained For Against

586,048 1,552,976,094 315,004

1,553,291,098

0.03% 99.98% 0.02%

69.88%

Resolution 12: To authorise the directors to allot equity securities (Note 1)

Shares Voted Abstained For Against

328,780 985,460,309 568,088,057

1,553,548,366

0.01% 63.43% 36.57%

69.89%

Resolution 13: To approve the disapplication of pre-emption rights and general

authority to issue shares for cash

Shares Voted Abstained For Against

400,625 870,263,150 683,213,371

1,553,476,521

0.02% 56.02% 43.98%

69.89%

Resolution 14: To approve market purchases of ordinary shares

Shares Voted Abstained For Against

516,325 1,445,809,162 107,551,659

1,553,360,821

0.02% 93.08% 6.92%

69.88%

Resolution 15: To amend the Articles of Association of the Company

Shares Voted Abstained For Against

464,652 1,553,283,529 128,965

1,553,412,494

0.02% 99.99% 0.01%

69.88%

Notes

· Percentages of shares voted are calculated in relation to the total issued

ordinary share capital of Pan African.

· Percentages of shares voted for and against each resolution are calculated

in relation to the total number of shares voted in respect of each resolution.

· Abstentions are calculated as a percentage in relation to the total issued

ordinary share capital of Pan African.

1. In accordance with the UK Corporate Governance Code, when 20% or more of the

votes have been cast against the board recommendation for a resolution, the

Company will consult with those shareholders who voted against resolution

numbers 8, 9, 10 and 12 (Resolutions), (Dissenting Shareholders) in order to

ascertain the reasons for doing so, following which an update on the views

expressed by such Dissenting Shareholders and the subsequent actions taken by

the Company will be issued.

2. Furthermore, as required in terms of the King IV Report on Corporate

Governance for South Africa, 2016 and paragraph 3.84(j) of the JSE Limited

Listings Requirements, Pan African invites those Dissenting Shareholders who

voted against ordinary resolution number 9 and/or ordinary resolution 10 to

engage with the Company regarding their views on the Company's remuneration

policy and/or implementation report.

Dissenting Shareholders may forward their concerns / questions pertaining to the

Resolutions to the Company Secretary via email at

general@corpserv.co.uk (phil.dexter@corpserv.co.uk) by close of business on

8December 2023. The Company will then respond in writing to these Dissenting

Shareholders, and if required, engage further with the Dissenting Shareholders

in this regard.

2. SALIENT DIVID DATES

Shareholders are referred to the Group's provisional summarised audited results

that were released on 13 September 2023, wherein an exchange rate of South

African Rand (ZAR) to the British Pound (GBP) of GBP/ZAR:23.93 and an exchange

rate of ZAR to the US Dollar (USD) of USD/ZAR:18.83 was used for illustrative

purposes to convert the proposed ZAR dividend of 18.00000 ZA cents per share

into GBP and USD, respectively.

Shareholders are advised that, following the approval of the final dividend at

the AGM, the exchange rate for conversion of the final ZAR dividend into GBP has

been fixed at an exchange rate of GBP/ZAR: 23.61 which translates to a final GBP

dividend of 0.76239 pence per share and the exchange rate for conversion of the

final ZAR dividend into USD for illustrative purposes is USD/ZAR: 18.85, which

translates to an illustrative final USD dividend of US 0.95491 cents per share.

The following salient dates apply:

+------------------------------+---------------------------+

|Currency conversion date |Thursday, 23 November 2023 |

+------------------------------+---------------------------+

|Last date to trade on the JSE |Tuesday, 28 November 2023 |

+------------------------------+---------------------------+

|Last date to trade on the LSE |Wednesday, 29 November 2023|

+------------------------------+---------------------------+

|Ex-dividend date on the JSE |Wednesday, 29 November 2023|

+------------------------------+---------------------------+

|Ex-dividend date on the LSE |Thursday, 30 November 2023 |

+------------------------------+---------------------------+

|Record date on the JSE and LSE|Friday, 1 December 2023 |

+------------------------------+---------------------------+

|Payment date |Tuesday, 12 December 2023 |

+------------------------------+---------------------------+

Notes

· No transfers between the Johannesburg and London registers, between the

commencement of trading on Wednesday, 29 November 2023 and close of business on

Friday, 1 December 2023 will be permitted.

· No shares may be dematerialised or rematerialised between Wednesday, 29

November 2023 and Friday, 1December 2023, both days inclusive.

· The final dividend per share was calculated on 2,222,862,046 total shares in

issue equating to 18.00000 ZA cents per share or 0.76239 pence or 0.95491 US

cents per share.

· The South African dividends tax rate is 20% per ordinary share for

shareholders who are liable to pay the dividends tax, resulting in a net

dividend of 14.40000 ZA cents per share 0.60991 pence per share and US 0.76393

cents per share for these shareholders. Foreign investors may qualify for a

lower dividend tax rate, subject to completing a dividend tax declaration and

submitting it to Computershare Investor Services Proprietary Limited or Link

Group who manage the SA and UK register, respectively. The Company's South

African income tax reference number is 9154588173. The dividend will be

distributed from South African income reserves/ retained earnings, without

drawing on any other capital reserves.

Johannesburg

24 November 2023

+-----------------------------------------------+---------------------------+

|Corporate information |

+-----------------------------------------------+---------------------------+

|Corporate office |Registered office |

| | |

|The Firs Building |2nd Floor |

| | |

|2nd Floor, Office 204 |107 Cheapside |

| | |

|Corner Cradock and Biermann Avenues |London |

| | |

|Rosebank, Johannesburg |EC2V 6DN |

| | |

|South Africa |United Kingdom |

| | |

|Office: + 27 (0) 11 243 2900 |Office: + 44 (0) 20 7796 |

| |8644 |

|info@paf.co.za | |

| |info@paf.co.za |

+-----------------------------------------------+---------------------------+

|Chief executive officer |Financial director and debt|

| |officer |

|Cobus Loots | |

| |Deon Louw |

|Office: + 27 (0) 11 243 2900 | |

| |Office: + 27 (0) 11 243 |

| |2900 |

+-----------------------------------------------+---------------------------+

|Head investor relations |Website: |

| |www.panafricanresources.com|

|Hethen Hira | |

|Tel: + 27 (0) 11 243 2900 | |

|Email: hhira@paf.co.za | |

+-----------------------------------------------+---------------------------+

|Company secretary |Nominated adviser and joint|

| |broker |

|Jane Kirton | |

| |Ross Allister/ Bhavesh |

|St James's Corporate Services Limited |Patel |

| | |

|Office: + 44 (0) 20 7796 8644 |Peel Hunt LLP |

| | |

| |Office: +44 (0) 20 7418 |

| |8900 |

+-----------------------------------------------+---------------------------+

|JSE sponsor |Joint broker |

| | |

|Ciska Kloppers |Thomas Rider/Nick Macann |

| | |

|Questco Corporate Advisory Proprietary Limited |BMO Capital Markets Limited|

| | |

|Office: + 27 (0) 11 011 |Office: +44 (0) 20 7236 |

|9200 (https://www.google.co.za/search?q=questco|1010 |

|&rlz=1C1EJFC_enZA816ZA818&oq=q | |

|uestco&aqs=chrome..69i57j0l5.1 | |

|159j0j4&sourceid=chrome&ie=UTF-8) | |

+-----------------------------------------------+---------------------------+

| |Joint broker |

| | |

| |Matthew Armitt/Jennifer Lee|

| | |

| |Joh. Berenberg, Gossler & |

| |Co KG |

| | |

| |Office: +44 (0) 20 3207 |

| |7800 |

+-----------------------------------------------+---------------------------+

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 24, 2023 02:00 ET (07:00 GMT)

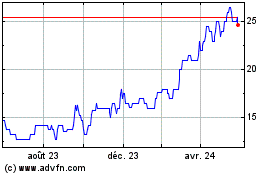

Pan African Resources (AQSE:PAF.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

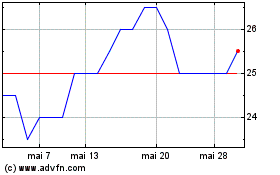

Pan African Resources (AQSE:PAF.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025