TIDMSTVG

RNS Number : 8647S

STV Group PLC

09 November 2023

9(th) November 2023

STV Group plc

Trading Update

-- STV operating profit* expected to be c.GBP20m in 2023,

impacted by weak national TV advertising in Q4 and the related

effect on the rate of commissioning in Studios

-- Group revenue up over 30% for first 9 months, more than offsetting linear advertising decline

-- Digital and Studios revenue and operating profit* expected to

be materially up on 2022, underlining the continued success of

STV's diversification strategy

-- Studios operating profit* now expected to be at least GBP5m

-- Regional (Scottish) advertising expected to continue to outperform National

Simon Pitts, STV Chief Executive, said:

"STV continues to make strong strategic progress despite a

challenging linear advertising and commissioning market impacted by

ongoing economic uncertainty in the UK.

Our diversification strategy delivered total revenue growth of

more than 30% for the first 9 months of the year as well as

material profit growth in our Digital and Studios businesses.

While the linear advertising picture is weaker than expected in

Q4, VOD advertising on STV Player continues to show good growth in

2023 and STV regional advertising is once again outperforming

national thanks to the ongoing effectiveness of the STV Growth

Fund.

We remain confident in our future growth prospects, with a

strong content line-up on STV and STV Player, a compelling pipeline

of new programme ideas across the expanded STV Studios, and a clear

growth strategy, ensuring that we are well placed for the economic

recovery when it comes."

-- STV Group plc today announces that it expects operating

profit * for the year ended 31 December 2023 to be around GBP20m

due to ongoing weakness in the linear TV advertising and

commissioning markets relating to UK macroeconomic uncertainty.

-- STV's total advertising revenue (TAR) improved in Q3 and

performed in line with guidance at +3%, benefitting from a strong

programme line-up including the FIFA Women's World Cup and the

Men's Rugby World Cup. As a result, TAR for the 9 months to the end

of September improved to -9% from -14% at the half year.

-- As expected, year on year advertising performance in Q4 2023

has been impacted by the presence of the FIFA Men's World Cup in Q4

2022. However, the underlying linear advertising market has also

been softer than expected due to the ongoing economic uncertainty

in the UK. As a result, we expect Q4 TAR to be down around 15% and

full year TAR to be down around 10% versus 2022, which was the year

of the second highest advertising revenue performance ever for

STV.

-- Within that, VOD advertising is up 14% for the 9 months to

the end of September, with 9 consecutive months of year on year

growth, and we expect STV's digital operating profit to be up at

least 10% for the full year.

-- Regional advertising is down 10% for the 9 months to the end

of September, ahead of national linear advertising (-14%), and we

expect Regional to continue to outperform National for the full

year.

-- STV Studios (including Greenbird) has continued its momentum

in 2023, producing a record 70 series this year while securing c.50

new commissions and recommissions, despite the global commissioning

market also being impacted by the economic slowdown.

-- STV Studios revenue will nearly treble this year to

GBP65-70m, comfortably in excess of our GBP40m target, with

operating profit of at least GBP5m. This is below previous guidance

of GBP70m of revenue and GBP6-6.5m of operating profit due to

commissioning softness in the second half of 2023. Within this

Greenbird will contribute GBP15-20m revenue and c.GBP3m of profit

in the second half, broadly as guided.

-- Overall, STV Group revenue for the first 9 months of 2023 was

GBP114m, +32% on the same period in 2022 (+41% including

Greenbird), comfortably offsetting the decline in linear

advertising revenue.

-- The combination of continued strong cash generation across

the business and management actions means that year end net debt

will be between GBP30-35m. There continues to be strong focus on

cost control across the Group, with cumulative cost savings of

c.GBP3.5m delivered across 2022 and 2023 so far, and the

integration of Greenbird Media is on track, with synergies of at

least GBP750k p.a. from 2024 reconfirmed.

The information contained in within this announcement is deemed

by the Company to constitute inside information as stipulated under

the UK version of the Market Abuse Regulation (EU) No 596/2014 as

it forms part of UK law by virtue of the European Union

(withdrawal) Act 2018. Upon publication of this announcement, this

inside information is now considered to be in the public

domain.

ENDS

Enquiries:

STV Group plc:

Kirstin Stevenson, Head of Communications, Tel: 07803 970106

Camarco:

Geoffrey Pelham-Lane, Partner, Tel: 07733 124 226

Ben Woodford, Partner, Tel: 07790 653 341

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZMGMZRFGFZZ

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

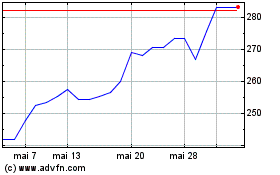

Stv (AQSE:STVG.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Stv (AQSE:STVG.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025