Trending: Eni Posts Lower 4Q Profit, Shares New Shareholder Remuneration Policy

23 Février 2023 - 7:16PM

Dow Jones News

1746 GMT - Eni SpA is among the most mentioned topics across

news items over the past 12 hours, according to Factiva data, after

it posted results for the fourth quarter and a new shareholder

remuneration plan as part of a new strategy until 2026. The Italian

oil-and-gas major booked a quarterly net profit of 550 million

euros ($583.4 million), down from EUR3.52 billion in the

year-earlier period. The result was affected by fair-valued

commodity derivatives, asset impairments and extraordinary,

solidarity tax contributions. On an adjusted basis, net profit was

EUR2.50 billion, the company said. Separately, Eni unveiled a plan

to simplify its shareholder remuneration policy as part of a

strategy from 2023 to 2026, and raised the dividend for the current

year by 7% to EUR0.94 a share. Eni said it aims to distribute

between 25%-30% of annual cash flow from operations through a

combination of dividend and share buyback. Analysts at RBC Capital

Markets say in a note that Eni's updated corporate plans look

weaker than expected, given a higher capex run-rate relative to

consensus while volume targets look broadly in line. "The

simplification of the distribution policy, while expected, should

be taken well, although we believe some investors had expected a

higher payout ratio," the analysts say. Dow Jones & Co. owns

Factiva. (cecilia.butini@wsj.com)

(END) Dow Jones Newswires

February 23, 2023 13:01 ET (18:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

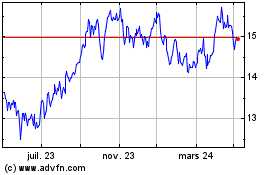

Eni (BIT:ENI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

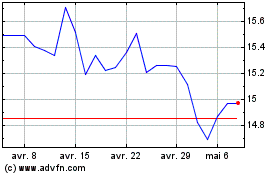

Eni (BIT:ENI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024