Bitcoin Drops Below 200-Day MA – Next Key Support Lies At $66K According To Mayer Multiple

12 Mars 2025 - 12:00AM

NEWSBTC

Bitcoin (BTC) is under severe selling pressure, having lost the

$85,000 level just a few days ago. This breakdown has pushed the

market to its lowest levels since November 2024, increasing fear

and uncertainty among investors. The entire crypto market has been

struggling, weighed down by negative macroeconomic conditions and

an overall shift in risk-off sentiment. Related Reading: Charts

Reveal Cardano Holds Key Support Zone – Staying Above Could ‘Set

The Next Move’ U.S. President Trump’s policies have added to the

volatility and instability, as rising global trade war fears and

erratic economic decisions continue to rattle investors. The U.S.

stock market has dropped to its lowest point since September 2024,

further fueling concerns that broader financial markets are

weakening, dragging Bitcoin and other cryptocurrencies down with

them. According to Glassnode data, the Mayer Multiplier suggests

that the next key support level for Bitcoin sits at $66,000. If the

current sell-off continues, BTC could test this level in the coming

weeks, marking a significant correction from its recent highs. With

Bitcoin at a crucial point, traders and investors are closely

watching whether BTC can stabilize and reclaim key levels or if

further downside is ahead. The coming days will be critical for

Bitcoin’s short-term outlook. Bitcoin Struggles Below 200-Day MA

Bitcoin has been in a consistent downtrend since late January,

with fear dominating investor sentiment. Many now believe that the

bull cycle is over, as BTC continues to set lower highs and break

key support levels. With selling pressure mounting, the market

remains under bearish control, and lower targets are being set by

cautious investors. Related Reading: Bitcoin Could Rally Above ATH

To $128K – On-Chain Indicator Signals Potential Recovery Since the

U.S. elections in November 2024, macroeconomic uncertainty and

volatility have been major drivers of the market. The rise in

global trade tensions, erratic economic policies, and shaken

investor confidence have all contributed to Bitcoin’s extended

correction. With U.S. stock markets also struggling, Bitcoin has

failed to find the momentum needed for a recovery. Top analyst Ali

Martinez shared insights on X, highlighting that Bitcoin is now

trading below the 200-day moving average, a key technical indicator

that often signals long-term trend direction. According to the

Mayer Multiple, the next major support level sits at $66,000. If

BTC fails to stabilize above current levels, further selling

pressure could send Bitcoin toward this lower support zone in the

coming weeks. For Bitcoin to reverse its downward trend, bulls must

reclaim the 200-day MA around $83,500. A break and hold above this

level would indicate strength returning to the market and could

prevent further downside. However, if BTC fails to regain momentum,

fear and uncertainty will continue to drive prices lower, making

the next few weeks crucial for Bitcoin’s market structure.

Investors are closely watching price action as Bitcoin remains

at a critical point that could define its mid-term trend. BTC Eyes

$85K For Recovery Bitcoin is currently trading at $81,700

after losing the 200-day Moving Average (MA) at $83,450, a key

technical level that previously supported its bullish momentum.

With BTC now trading below this critical indicator, the market

remains under bearish pressure, and traders are closely watching

for signs of a potential reversal. For bulls to regain control, BTC

must reclaim the $85,000 mark in the coming days. A strong push

above this level would indicate renewed buying interest,

potentially setting the stage for a recovery rally. However, if BTC

fails to break above $85K, the market could see further downside

pressure. Related Reading: Cardano Bulls Eye $10 Target – Analyst

Reveals Key Levels To Break If BTC drops below the $80,000–$78,000

range, it will increase the likelihood of a decline toward the next

major support levels at $75,000–$72,000. Such a move would

reinforce bearish sentiment, delaying any chances of a meaningful

recovery in the near term. The next few trading sessions will be

critical, as Bitcoin remains in a vulnerable position where either

a reclaim of key levels or a deeper correction is imminent.

Featured image from Dall-E, chart from TradingView

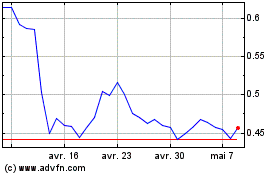

Cardano (COIN:ADAUSD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Cardano (COIN:ADAUSD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025