Bitcoin As The New S&P 500 Of Our Time? This CEO Thinks So

09 Janvier 2025 - 5:30AM

NEWSBTC

Anthony Pompliano shares a different perspective on Bitcoin.

According to the CEO of Professional Capital Management, Bitcoin is

creating a novel position in the investment sector. He recently

compared the world’s leading crypto asset to the S&P 500,

implying that it has become the preferred benchmark for younger

investors. Related Reading: SUI Skyrockets: Bullish Momentum Drives

Push Toward $6 Bitcoin appears to be occupying the center stage for

a new generation of investors who are seeking alternatives to

conventional financial instruments as digital assets continue to

gain prominence. A Digital Age Benchmark Pompliano’s argument

centers on how Bitcoin has evolved into a reliable performance

gauge for millennial and Gen Z investors. Just as the S&P 500

has historically been a cornerstone for measuring returns in

traditional finance, Bitcoin is now serving a similar role for

those seeking to invest in the digital economy. Bitcoin’s capacity

to serve as a hedge against inflation and its decentralized

character are the primary factors that are propelling this

transition. Bitcoin operates in a global, borderless manner,

trading 24/7, in contrast to the S&P 500, which monitors a

basket of traditional companies. This consistent activity further

solidifies its status as a distinctive benchmark for the new era,

as it is highly responsive to liquidity trends. Reasons For The

Preference Of Bitcoin Among Millennials One of the elements for

Bitcoin’s growing appeal is its availability. The S&P 500

reflects the success of American-listed companies; Bitcoin is not

constrained by regional limitations. For younger investors who

might be reluctant to negotiate conventional markets, it offers a

straightforward entry point. Bitcoin’s growing fame is partly due

to the fact that it is easy to acquire. The S&P 500 tracks how

companies in the United States are performing. Bitcoin, on the

other hand, is not limited by geography. It makes investing easy

for new buyers who might be afraid to go into traditional markets.

On MicroStrategy & Trump Crypto Vision In a recent discussion,

Pompliano brought up two important issues related to Bitcoin: the

use of MicroStrategy as a stand-in for BTC exposure and the

possible effects of President-elect Donald Trump’s plans for a

strategic reserve. Pompliano emphasized that prospective crypto

owners should educate themselves on the cryptocurrency’s

fundamentals. He recommended reading the Bitcoin whitepaper and

learning self-custody before considering secondary options like

MicroStrategy stock. Related Reading: Bitcoin Dominance Fuels $585

Million Crypto ETP Inflows In 2025 When asked about Trump’s plan

for a Bitcoin reserve, Pompliano played down worries that it would

hurt crypto’s long-term chances. He said that the coin’s growth has

nothing to do with what the government does. He did say, though,

that short-term market instability could be caused by a lack of

government support. Broader Perspective Pompliano’s point of view

fits those of other market watchers. With many people seeing

Bitcoin as a reasonable substitute for stocks and bonds, analysts

note that younger groups’ adoption rate of the cryptocurrency is

rising. Featured image from Pexels, chart from TradingView

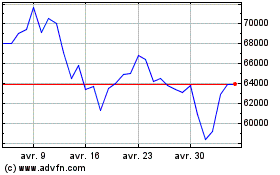

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025