Tether Reports Record-Breaking $5.2 Billion Net Profit In Latest 2024 Audit

01 Août 2024 - 8:00AM

NEWSBTC

Tether, one of the largest crypto companies in the industry and

issuer of the most widely used stablecoin USDT, has released its

attestation report for the first half of the year, recording

substantial gains that amount to nearly $1 billion per month.

Transition To US Treasuries Pays Off According to the report,

independently audited by accounting firm BDO, Tether’s net

operating profit for the second quarter of 2024 reached a new high

of $1.3 billion, propelling the company’s total net profit for the

first half of the year to over $5 billion. According to the

stablecoin issuer, the foundation of Tether’s financial growth and

stability comes from an income base derived from investments in US

Treasury Bills (T-Bills), which was first implemented after

eliminating commercial paper from its stablecoin reserves and

replacing it with US T-Bills in 2022. Related Reading: XRP

Analyst Thinks The Coin Is Ready To Skyrocket By 21,000% To Over

$150 The report also revealed that in the second quarter of the

year, direct and indirect ownership of US Treasuries within

Tether’s token reserves made notable progress, surpassing $97.6

billion, resulting in a historic high in this metric. This

brings Tether’s exposure to Treasuries across multiple countries,

positioning it as the 18th largest holder of US debt globally and

the 3rd largest purchaser of 3-month US Treasuries after the UK and

the Cayman Islands. Despite fluctuations in Bitcoin (BTC) prices,

which reached an all-time high of $73,700 in March, the report

noted that consolidated equity increased by $520 million in the

second quarter, with gold’s positive performance compensating for

the losses. The company revealed that its consolidated net equity

as of June 30 was $11.9 billion. Tether Commits Profits To

Ecosystem Expansion According to the financial disclosures, as of

June 30, 2024, Tether’s reserves for circulating tokens totaled

$118 billion, exceeding debt by $5.3 billion. In a

strategic move, the firm also revealed that a portion of the second

quarter’s profits is going to be reinvested in “pivotal projects”

to bolster Tether’s ecosystem, while a substantial excess reserve

of $5.3 billion was maintained to fortify token stability.

Investments in sustainable energy, Bitcoin mining, artificial

intelligence (AI) infrastructure, telecommunications technology,

neurotechnology, education and other long-term ventures were also

part of the firm’s portfolio. Related Reading: Elliot Wave Theory

Suggests Bitcoin Price Will Crash Below $40,000 Paolo Ardoino, CEO

of Tether, took to social media to celebrate the company’s growth

and profitability recorded in the first half of the year,

saying: Finally, we realize that our company grew and reached

new, almost unimaginable, levels. It’s truly humbling to find

ourselves in the position to build everything our imagination could

dream. That’s why, for us, Tether is a Once-In-One-Hundred-Year

Opportunity. And being a private company allows us to focus on the

things that truly matter. Featured image from DALL-E, chart from

TradingView.com

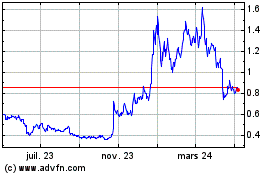

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Juil 2024 à Août 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Août 2023 à Août 2024