Cardano Daily Transaction Volume Up, But ADA Prices Remain Sluggish

22 Février 2022 - 7:27PM

NEWSBTC

Cardano is now positioning itself among the rapidly growing

blockchain networks by 24-hour transaction volume, surpassing

Ethereum and threatening to surpass Bitcoin. Along with this

demand, however, is its soaring price. The total number of

transactions on Cardano has increased at around 500%, skyrocketing

from 5.5 million in March last year to around 32 million this

month, according to Google’s Cardano Blockchain Insights. ADA,

Cardano’s internal cryptocurrency, currently has a total market cap

of $29.245 billion. It is listed on the No. 7 spot in

CoinMarketCap’s rankings of the leading cryptocurrencies. ADA is

currently trading at $0.871949, according to Coingecko’s chart.

Cardano TVL up 25% The digital token’s price also rose by 30%

within the past week and over 20% in the last month. DeFi

Llama data show that Cardano now has around $3 million worth of

digital assets locked in its TVL which is a 25% growth within the

last 24 hours alone. Still, despite the potential exhibited by

Cardano network, the digital currency is still far away from

overcoming its all-time high of $3.09 which was its price in early

September of last year. Moreover, the ADA coin has lost around 2%

of its gains within the last 24 hours, with its trading price at

$1.49, according to CryptoSlate. ADA total market cap at $29.245

billion in the daily chart | Source: TradingView.com Related

Article | Survey Predicts Cardano (ADA) Hitting $58 By Year 2030 –

And Finish 2022 At $2.72 Project Launch, Cheaper Fees Blockchain

analysis states that ADA’s recent surge can be attributed to the

mainnet launch of SundaeSwap, a native, scalable decentralized

exchange and automated liquidity provision protocol, last

January. This project attracted investors for its Initial

Stake Pool Offering (ISO), enabling Cardano owners to streamline

their respective coins. It also increased their chances of earning

rewards after a certain period of time. Aside from this project,

the blockchain conditions of both Bitcoin and Ethereum were

simultaneously declining in network activity. Bitcoin,

Ethereum Down Bitcoin’s 24-hour volume was down by around 80% from

its 3-month peak of $116 billion. Meanwhile, Ether

blockchain’s transactions have been decreasing since its

three-month peak of $20 billion last December. It hit as low as 82%

to a three-month low of nearly $4 billion on Feb. 19. Some analysts

further say that this spike is also because transacting on Cardano

is a lot cheaper than in Ethereum. For context: while hitting

a record-high in daily transactions and overcoming Ethereum,

Cardano only generated less than $100k in transaction fees compared

to the latter which earned more than $40 million in fees

alone. Related Article | Verlux, A Cardano Based Project

Announces Updates On Its Up-Coming Staking Platform Featured image

from VOI, chart from TradingView.com

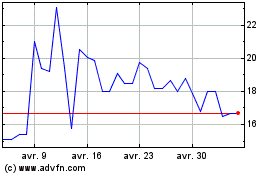

NEO (COIN:NEOUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

NEO (COIN:NEOUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025

Real-Time news about NEO (Cryptomonnaies): 0 recent articles

Plus d'articles sur NEO