Ethereum Leaves Bitcoin Behind, But Is This Rally Sustainable?

27 Février 2024 - 4:00AM

NEWSBTC

Ethereum has left Bitcoin in the dust with its latest rally towards

$3,100. Here’s whether this run is sustainable based on futures

market data. Ethereum Has Separated From Bitcoin With Over 7% Jump

In Past Week While Bitcoin has been in consolidation lately,

Ethereum appears to have been putting together bullish momentum

entirely of its own, as the asset has jumped more than 7% in the

past week. Related Reading: XRP Forms Buy Signal, Analyst Predicts

Surge To This Target The chart below shows how ETH has performed

during the last month. The price of the coin seems to have been

climbing recently | Source: ETHUSD on TradingView In the last 24

hours, Ethereum reached a peak of $3,130 level, a mark it only

reached for the first time since the first half of April 2022.

Since then, the coin has come down a bit, as it now floats around

$3,100. Nonetheless, despite this small retrace, ETH has still

performed notably better than the original cryptocurrency. Now, the

asset’s investors might be wondering if the coin could continue

this run. Perhaps data related to the futures market might shed

some light. ETH Funding Rates Have Been At Positive Levels Recently

As pointed out by an analyst in a CryptoQuant Quicktake post, the

ETH funding rate has had positive values recently. The “funding

rate” is an indicator that keeps track of the periodic fees that

traders on the futures market are exchanging between each other

right now. When the value of this metric is positive, it means that

the long holders are currently paying a premium to the short

investors to hold onto their holdings. Such a trend implies the

majority sentiment in the futures market is bullish. On the other

hand, the indicator being negative implies a bearish sentiment is

dominant in the sector right now as the short holders outweigh the

long traders. Now, here is a chart that shows the trend in the

30-day simple moving average (SMA) of the Ethereum funding rate

over the past couple of years: Looks like the value of the metric

has been heading up in recent days | Source: CryptoQuant As the

above graph shows, the 30-day SMA Ethereum funding rate had shot up

to extremely high levels in the first half of January.

Interestingly, this is when the market top due to the Bitcoin spot

ETFs occurred. After the price drawdown following the event, the

funding rate calmed as the longs that had piled up saw liquidation.

As the recent rally in the coin has occurred, the funding rate has

once again gone up. However, This time, the 30-day SMA Ethereum

funding rate isn’t quite at the extreme levels it was last month.

This could mean that the futures market isn’t yet too overheated.

Related Reading: SingularityNET (AGIX) Rallies 128% As On-Chain

Activity Heats Up Naturally, this could potentially allow for the

current Ethereum rally to go on for a while still. It should be

noted, though, that as the funding rates go higher, the chances of

a long squeeze taking place go up. Thus, while ETH may not be quite

at the same risk as last month, a long squeeze could still be on

the horizon, becoming more probable to happen as the speculators

continue to open up more positions. Featured image from Kanchanara

on Unsplash.com, CryptoQuant.com, chart from TradingView.com

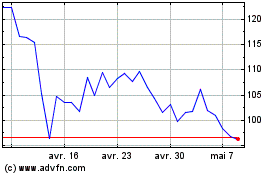

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024