Tocvan

Channel Samples 19.8 meters of 0.73 g/t Au and 19.5 meters of 0.61

g/t Au, Releases Trench Program Results

Calgary, Alberta

- January 18, 2022 --

InvestorsHub NewsWire -- Tocvan Ventures Corp.

(the "Company") (CSE: TOC; OTCQB: TCVNF; WKN: TV3/A2PE64), is pleased to announce

trench results from its Pilar Au-Ag Project in Sonora, Mexico. A

total of four trenches were completed in December, 2021 totalling

80 meters length. All four trenches intersected mineralization with

two trenches yielding consistent mineralization across the entire

length of the trench. T-21-2, intersected 19.5 meters of 0.61 g/t Au across

the entire length of the trench in an area along the developing

4-Trench Trend. T-21-3, yielded 19.8 meters of 0.73 g/t Au and was

targeted to provide key geochemical information across the Main

Zone where mineralization outcrops at surface. Initial bulk-sample

material from T-21-3 will be submitted to SGS Laboratories in

Durango, Mexico and used for column leach studies. Follow-up

metallurgical studies will utilize the surface material extracted

from the other three trenches.

Trench Results Highlights

-

T-21-1 - 4.9m

at 0.55 g/t Au and 11 g/t Ag

-

T-21-2 - 19.5m

at 0.61 g/t Au and 6 g/t Ag

- Including, 11.5m at 0.87

g/t Au and 7 g/t Ag

- Including, 2.7m at 3.01 g/t

Au and 20 g/t Ag

-

T-21-3 - 19.8m

at 0.73 g/t Au and 8 g/t Ag

- Including 8.6m at 1.27 g/t

Au and 12 g/t Ag

-

T-21-4 - 7m at

0.54 g/t Au and 5 g/t Ag

"The results from our trench

program are very encouraging, especially in regard to defining key

material for advanced metallurgical studies and showcasing the

surface continuity of gold values.", commented CEO,

Brodie Sutherland. "Material

from these trenches will be utilized for advanced column leach

studies to build off our encouraging bottle roll results from 2021

that yielded over 90% recovery of gold. Trench T-21-2 has yielded

promising results in our developing 4-Trench Trend which we will

follow up with systematic drill targeting."

Discussion of Trench

Results

Trenches completed were 20 meters long, up to 5 meters wide

and up to 2 meters deep. Samples were collected as channel samples

perpendicular to structures over intervals up to 2 meters in length

and adjusted to match changes in lithology or

alteration.

T-21-1: This trench was

completed to test a broad mineralized zone with visible copper

oxide mineralization along the northwestern most extent of the

Pilar main vein trend. The trench totalled 21.5 meters in length

and intersected 4.9 meters of

0.55 g/t Au and 11 g/t Ag. Weak anomalous copper

values averaged 0.1% across the entire length of the trench. Copper

mineralization is a unique characteristic to this northwestern area

of the property.

T-21-2: This trench was

completed to better understand the controls of mineralization along

the 4-Trench Trend. The trench returned significant mineralization

across the entire length of the trench, intersecting

19.5 meters of 0.61 g/t Au and 6 g/t

Ag. A mineralized fault structure returned higher

grades across 2.7 meters with

3 g/t Au and 20 g/t Ag. The results from

this trench further confirms the prospectivity of the 4-Trench

target and the importance of continuing systematic exploration

across the trend. Material from this trench will be selected for

later metallurgical test work.

T-21-3: This trench was

completed to collect fresh channel samples across the surface

expression of the Main Zone showing. Significant mineralization was

intersected across the entire length of the trench,

returning 19.8 meters of 0.73

g/t Au and 8 g/t Ag, including 8.6 meters of 1.3 g/t Au and 12 g/t

Ag. Historic sampling suggests the mineralized zone

extends on either side of the trench. Material from this trench

will be bulk sampled for detailed column leach metallurgical test

work.

T-21-4: This trench was

completed to test the northwestern extent of the Main Zone surface

expression where a historic artisanal adit is located along the

mineralized trend. The trench totalled 21 meters in length and

intersected 7 meters of 0.54

g/t Au and 5 g/t Ag. Material from this trench will be

selected for later metallurgical test work.

Table 1. Summary of Trench Program

Results.

|

Trench

|

Cutoff (Au

g/t)

|

From

|

To

|

Length (m)

|

Au (g/t)

|

Ag (g/t)

|

Cu

(ppm)

|

Pb

(ppm)

|

Zn

(ppm)

|

|

T-21-1

|

None

|

0.0

|

21.5

|

21.5

|

0.18

|

5

|

1219.86

|

49.96

|

256.25

|

|

T-21-1

|

0.1

|

3.5

|

15.8

|

12.3

|

0.28

|

7

|

1136.35

|

60.97

|

279.73

|

|

T-21-1

|

0.5

|

4.6

|

9.5

|

4.9

|

0.55

|

11

|

1162.16

|

109.27

|

235.12

|

|

T-21-2

|

None

|

0.0

|

21.5

|

21.5

|

0.57

|

6

|

457.73

|

512.09

|

5816.81

|

|

T-21-2

|

0.1

|

2.0

|

21.5

|

19.5

|

0.61

|

6

|

498.12

|

497.84

|

6140.59

|

|

T-21-2

|

0.5

|

6.0

|

17.5

|

11.5

|

0.87

|

7

|

578.20

|

491.47

|

6558.39

|

|

T-21-2

|

1

|

6.0

|

8.7

|

2.7

|

3.01

|

20

|

1979.44

|

1404.44

|

11827.78

|

|

T-21-3

|

0.1

|

0.0

|

19.8

|

19.8

|

0.73

|

8

|

268.53

|

112.09

|

3336.15

|

|

T-21-3

|

0.5

|

1.2

|

13.8

|

12.6

|

1.02

|

9

|

344.22

|

147.86

|

4259.03

|

|

T-21-3

|

1

|

1.2

|

9.8

|

8.6

|

1.27

|

12

|

279.67

|

198.72

|

5739.51

|

|

T-21-4

|

None

|

0.0

|

21.0

|

21.0

|

0.24

|

2

|

246.90

|

39.07

|

1597.48

|

|

T-21-4

|

0.1

|

10.0

|

21.0

|

11.0

|

0.43

|

4

|

359.36

|

51.50

|

2613.18

|

|

T-21-4

|

0.5

|

12.0

|

19.0

|

7.0

|

0.54

|

5

|

401.57

|

56.36

|

3110.71

|

| |

|

|

|

|

|

|

|

|

|

|

|

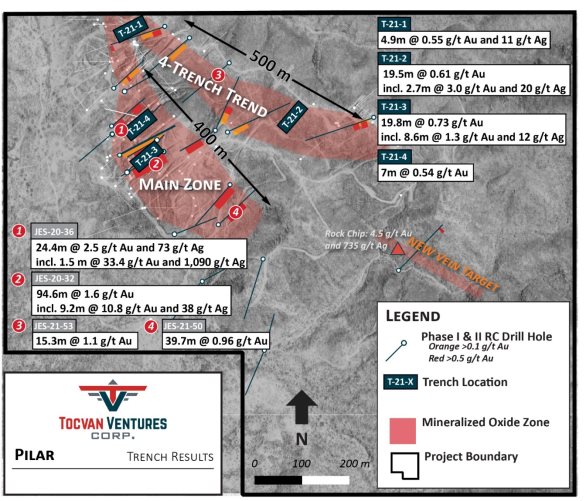

Figure 1. Plan Map of Highlighting

Trench Program.

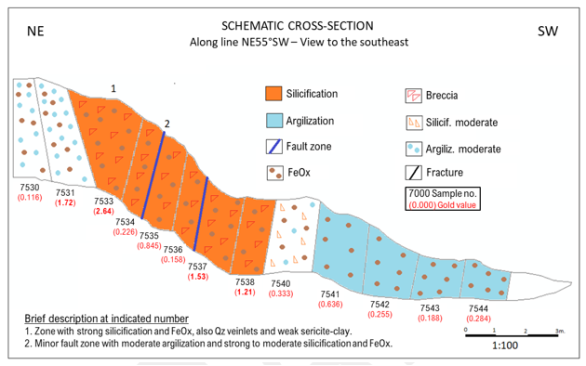

Figure 2. Schematic Cross-Section

along trench T-21-3

About the Pilar Property

The Pilar Gold-Silver property is interpreted as a

structurally controlled low-sulphidation epithermal project hosted

in andesite rocks. Three zones of mineralization have been

identified in the north-west part of the property from historic

surface work and drilling and are referred to as the Main Zone,

North Hill and 4-Trench. Structural features and zones of

mineralization within the structures follow an overall NW-SE trend

of mineralization. Over 22,700 m of drilling have been completed to

date. Significant results are highlighted below:

-

2021 Phase II

RC Drilling Highlights include (all

lengths are drilled thicknesses):

-

39.7m @ 0.96

g/t Au, including 1.5m @ 14. g/t Au

-

47.7m @ 0.70

g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

-

29m @ 0.71g/t

Au

-

35.1m @ 0.66

g/t Au

-

2020 Phase I RC

Drilling Highlights include (all

lengths are drilled thicknesses):

-

94.6m @ 1.6 g/t

Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

-

41.2m @ 1.1 g/t

Au, including 3.1m @ 6.0g/t Au and 12 g/t Ag ;

- 24.4m @ 2.5 g/t Au and 73

g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

-

17,700m of

Historic Core & RC drilling. Highlights include:

-

61.0m @ 0.8 g/t

Au

-

16.5m @ 53.5g/t

Au and 53 g/t Ag

-

13.0m @ 9.6 g/t

Au

-

9.0m @ 10.2 g/t

Au and 46 g/t Ag

Soil and Rock sampling results from

undrilled areas indicate mineralization extends towards the

southeast from the Main Zone and 4-Trench Zone. Recent Surface

exploration has defined three new target areas: Triple Vein Zone,

SE Vein Zone and 4 Trench Extension.

Brodie A. Sutherland, P.Geo., CEO for Tocvan Ventures Corp.

and a qualified person ("QP") as defined by Canadian National

Instrument 43-101, has reviewed and approved the technical

information contained in this release.

Quality Assurance / Quality

Control

RC chips were shipped for sample preparation to ALS Limited

in Hermosillo, Sonora, Mexico and for analysis at the ALS

laboratory in North Vancouver. The ALS Hermosillo and North

Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold

was analyzed using 50-gram nominal weight fire assay with atomic

absorption spectroscopy finish. Over limits for gold (>10 g/t),

were analyzed using fire assay with a gravimetric finish. Silver

and other elements were analyzed using a four-acid digestion with

an ICP finish. Over limit analyses for silver (>100 g/t) were

re-assayed using an ore-grade four-acid digestion with ICP-AES

finish. Control samples comprising certified reference samples and

blank samples were systematically inserted into the sample stream

and analyzed as part of the Company's robust quality assurance /

quality control protocol.

About Tocvan Ventures

Corp.

Tocvan is a well-structured exploration development company.

Tocvan was created in order to take advantage of the prolonged

downturn the junior mining exploration sector, by identifying and

negotiating interest in opportunities where management feels they

can build upon previous success. Tocvan has approximately 32

million shares outstanding and is earning into two exciting

opportunities in Sonora, Mexico: the Pilar Gold-Silver project and

the El Picacho Gold-Silver project. Management feels both projects

represent tremendous opportunity to create shareholder

value.

Cautionary Statement Regarding

Forward Looking Statements

This news release contains

"forward-looking information" which may include, but is not limited

to, statements with respect to the activities, events or

developments that the Company expects or anticipates will or may

occur in the future. Forward-looking information in this news

release includes statements regarding the use of proceeds from the

Offering. Such forward-looking information is often, but not

always, identified by the use of words and phrases such as "plans",

"expects", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "believes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved.

These forward-looking statements,

and any assumptions upon which they are based, are made in good

faith and reflect our current judgment regarding the direction of

our business. Management believes that these assumptions are

reasonable. Forward-looking information involves known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

information. Such factors include, among others, risks related to

the speculative nature of the Company's business, the Company's

formative stage of development and the Company's financial

position. Forward-looking statements contained herein are made as

of the date of this news release and the Company disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results, except as may

be required by applicable securities laws.

There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information.

For more

information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

950-736 6 Ave SW

Calgary, Alberta T2P 3T7

Telephone: 403-668-7855

Email: bsutherland@tocvan.ca

This news release does not

constitute an offer to sell or a solicitation of an offer to sell

any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

Tocvan Ventures (CSE:TOC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Tocvan Ventures (CSE:TOC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025