Aperam : actualisation sur les tendances du marché et des finances pour le deuxième trimestre 2024

01 Juillet 2024 - 6:59AM

EQS Non-Regulatory

|

Aperam S.A. / Mot-clé(s) : Autres

Aperam : actualisation sur les tendances du marché et des finances

pour le deuxième trimestre 2024

01-Juil-2024 / 06:59 CET/CEST

Aperam update on Q2

2024 market & financial trends

Luxembourg, July 1,

2024 (07:00 CET) - In preparation of

the quarterly results release scheduled for 1 August 2024, we would

like to remind market participants of the standing guidance,

earnings drivers and events that should be considered.

The Q2 outlook, as specified in the Q1 presentation, the

management podcast and during the conference call was:

-

Q2 group adj. EBITDA higher than

Q1-24 (EUR55m) but below Bloomberg consensus at the time of the

earnings release on 3 May 2024. This was based on slightly higher

volumes, the segment trends stated in the table below and stable

commodity prices resulting in a neutral inventory

valuation.

-

This compares to the Aperam

compiled Q2 adj. EBITDA consensus at EUR73m currently. The

consensus is updated & published at

https://www.aperam.com/investors/news-contacts/results/

|

Recycling &

Renewables:

|

Normalised annual EBITDA of EUR80-85m. We projected Q2 to be

a normal quarter for the segment.

|

|

Stainless & Electrical

Europe

|

For Q2 we projected the segment to benefit from a neutral

inventory valuation and a seasonal volume improvement in Europe.

This will be partly offset by a price / cost squeeze in

Europe.

|

|

Stainless & Electrical

Brazil

|

The delayed ramp-up of the hot rolling mill was followed by

operational instability. This will fully impact Q2 with

~EUR10m.

|

|

Alloys & Specialties:

|

For Q2 we expected a somewhat lower EBITDA in line with Q4-23

after completion of a one off project.

|

|

Services & Solutions:

|

Assuming no further distortion from raw material prices, we

expected a comparable EBITDA in Q2 and the year should demonstrate

a clear step towards the 2025 improvement target.

|

|

Others & Eliminations

|

Q1 was consistent with the normal high single digit negative

EBITDA that should be expected. For Q2, it could be a negative low

double digit number.

|

|

Cash Flow & Net Fin.

Debt:

|

NWC: EUR120m release till YE-24 with some release in

Q2.

Capex EUR150m for 2024, Q2 capex lower than Q1 (EUR81m) and

within the EUR150m capex guidance for 2024.

Q2 net debt: Lower due to the release of net working

capital.

|

Please note that forward guidance for adj. EBITDA, cash flow

and net debt is always provided on a stable commodity price

assumption.

Commodity prices

& FX:

|

|

|

MAR 24

|

APR 24

|

MAY 24

|

JUN 24

|

|

Nickel LME

|

USD/t

|

17,409

|

18,204

|

19,605

|

17,602

|

|

Ferrochrome

|

USD/t

|

3,483

|

3,218

|

3,174

|

3,163

|

|

Stainless Scrap

|

USD/t

|

1,478

|

1,463

|

1,552

|

1,538

|

|

Stainless CR 2mm 304

|

USD/t

|

2,889

|

2,944

|

3,040

|

3,191

|

|

USD/EUR

|

x

|

1.09

|

1.07

|

1.08

|

1.08

|

|

USD/BRL

|

x

|

4.98

|

5.13

|

5.14

|

5.38

|

Source: Bloomberg, Fastmarkets

|

Other

items:

|

|

|

Seasonality:

|

In a normal market, Q2 is the seasonal peak in Europe while

Q3 marks the peak quarter in Brazil.

|

|

Leadership Journey Phase

5:

|

On track to realise the target gains of EUR75m in

2024.

|

|

Commodity prices & inventory

valuation:

|

At face value, the commodity price development would indicate

a positive high single digit / very low double digit inventory

valuation. It should remain consistent with the EBITDA ceiling

guided for Q2.

|

|

Brazil hot rolling mill:

|

The mill is operating normally and no further impact is

expected post Q2.

|

|

Distributor Inventory:

|

Marked a new post GFC all time low.

|

|

Current trading:

|

A positive price / volume correlation can be observed more

recently. However, it remains open if this is the start of a

sustained recovery or short lived pre-buying ahead of the summer

holiday season

|

|

Restructuring:

|

Negotiations with our workforce are ongoing.

|

Forward Looking

Statements

This document may contain forward-looking information and

statements about Aperam SA and its subsidiaries. These statements

include financial projections and estimates and their underlying

assumptions, statements regarding plans, objectives and

expectations with respect to future operations, products and

services, and statements regarding future performance.

Forward-looking statements may be identified by the words

‘’believe’’, ‘’expect’’, ‘’anticipate’’, ‘’target’’ or similar

expressions. Although Aperam’s management believes that the

expectations reflected in such forward-looking statements are

reasonable, investors and holders of Aperam’s securities are

cautioned that forward-looking information and statements are

subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Aperam,

that could cause actual results and developments to differ

materially and adversely from those expressed in, or implied or

projected by, the forward-looking information and statements. These

risks and uncertainties include those discussed or identified in

Aperam’s filings with the Luxembourg Stock Market Authority for the

Financial Markets (Commission de Surveillance du Secteur

Financier). The information is valid only at the time of release

and Aperam does not assume any obligation to update or revise its

forward-looking statements on the basis of new information, future

events, subject to applicable regulation.

Contact

Company Secretary / Delphine Féraud

Valendru: aperam.corporate@aperam.com

Investor Relations / Thorsten

Zimmermann: +352 27 36 27 304;

thorsten.zimmermann@aperam.com

Diffusion d’une information Réseau Financier transmis par EQS

Group.

Le contenu relève de la responsabilité de l’émetteur.

|

1936231 01-Juil-2024 CET/CEST

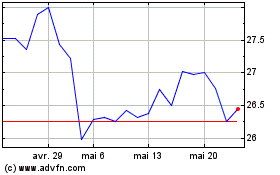

Aperam (EU:APAM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Aperam (EU:APAM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025