Bonduelle - 2021-2022 Financial Year Revenue: Growth of annual

revenue over this financial year - Quarter 4 particularly dynamic

BONDUELLE

A French SCA (Partnership Limited by Shares) with

a capital of 57 102 699,50 EurosHead Office: La Woestyne 59173

Renescure, FranceRegistered under number: 447 250 044

(Dunkerque Commercial and Companies Register)

2021-2022 Financial Year

Revenue(July 1, 2021 - June 30, 2022)

Growth of annual revenue for

Bonduelle over this

financial yearQuarter 4 particularly

dynamic

- Overall growth driven by

canned and frozen activities

- Fresh ready-to-eat business

activity down in North America

- Annual revenue growth

strengthened by foreign exchange rates

- Expected profitability

below annual guidance

The Bonduelle Group's revenue for FY 2021-2022

stands at € 2,891.7 million (excluding the effect of IFRS 5) versus

€ 2,778.6 million last financial year, an increase of +1.8% on a

like for like basis*, including the North American canned and

frozen activities sold on June 30, 2022. In a context once again

disrupted by the sanitary crisis, a difficult climate, coupled with

geopolitical tensions and their consequences, the group once again

demonstrated the resilience of its business.

In accordance with

IFRS 5, the income statement items relating to the North American

canned and frozen activities, divested on June 30, 2022, will be

combined in the income statement of the published financial

statements under the heading "net profit from discontinued

operations". The revenue published in the consolidated income

statement will therefore, in accordance with IFRS 5, exclude the

divested activities. Given the date of disposal of the activities,

June 30, 2022, the closing date of the financial year, the total

revenue is disclosed, by region and by technology on a like for

like basis*, i.e. including the revenue of the divested activities,

the development of which is detailed below. The change in revenue

in accordance with IFRS 5, i.e. excluding revenue from the North

American canned and frozen activities for 2020-2021 restated and

2021-2022, is shown in the appendix.

Global Revenue

Activity by Geographic Region

|

Total consolidated revenue(in €

million) |

FY2021-2022 |

Excluding IFRS 5 - not restated for divested

activities |

|

FY2021-2022 |

FY2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

Q42021-2022 |

Q42020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

|

Europe Zone |

1,357.3 |

1,357.3 |

1,271.7 |

6.7% |

6.9% |

357.5 |

316.3 |

13.-% |

13.4% |

|

Non-Europe Zone |

845.3 |

1,534.4 |

1,506.9 |

1.8% |

-2.4% |

365.5 |

346.3 |

5.5% |

-3.6% |

|

Total |

2,202.6 |

2,891.7 |

2,778.6 |

4.1% |

1.8% |

723.- |

662.5 |

9.1% |

4.5% |

Activity by Operating Segments

|

Total consolidated revenue(in €

million)Total consolidated

revenue(in € million) |

FY2021-2022 |

Excluding IFRS 5 - not restated for divested

activities |

|

FY2021-2022 |

FY2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

Q42021-2022 |

Q42020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

|

Canned |

958.4 |

1,149.3 |

1,087.7 |

5.7% |

4.4% |

275.7 |

247.7 |

11.3% |

9.7% |

|

Frozen |

238.4 |

736.6 |

655.1 |

12.4% |

8.8% |

174.9 |

150.1 |

16.6% |

9.2% |

|

Fresh processed |

1,005.9 |

1,005.9 |

1,035.8 |

-2.9% |

-5.3% |

272.4 |

264.8 |

2.8% |

-3.1% |

|

Total |

2,202.6 |

2,891.7 |

2,778.6 |

4.1% |

1.8% |

723.- |

662.5 |

9.1% |

4.5% |

At € 2,891.7 million, the group's revenue

(excluding the effect of IFRS 5), including the long life business

activities in North America, increased by +1.8% on a like for like

basis* and +4.1% on reported figures (excluding the effect of IFRS

5) over FY 2021-2022 (July 1, 2021 - June 30, 2022). Currency

fluctuations had a favorable effect of +2.3% on the group's growth

this year, notably with a significant appreciation of the US and

Canadian dollars. Quarter 4 showed a strong growth of +4.5% on a

like for like basis* and +9.1% on reported figures (excluding the

effect of IFRS 5), driven by the dynamism of the food service

business in Europe and North America, which was close to pre-covid

levels, coupled with favorable comparisons due to the lack of

products in the previous financial year.

Europe ZoneThe revenue for the

Europe Zone, representing 46.9% of the business activity in FY

2021-2022 (excluding the effect of IFRS 5) posted a high growth

rate of +6.7% on reported figures and +6.9% on a like for like

basis*, growth recorded in all technologies. Branded sales grew by

circa +4.-% in the retail sector, resulting, in particular for

Cassegrain, in market share gains in both volume and value, in line

with the group's strategy. Food service business, mainly frozen and

fresh, grew by more than 30%, exceeding the market's recovery rate,

resulting in a return to a level of activity close to that of the

pre-covid period.

Non-Europe ZoneRevenue

(excluding the effect of IFRS 5) for the non-Europe Zone in FY

2021-2022, including the canned and frozen activities in North

America, represented 53.1% of total revenue, down -2.4% on a like

for like* and up +1.8% on reported figures (excluding the effect of

IFRS 5).In North America, the long life activities (canned and

frozen), divested on June 30, 2022, posted solid growth over the

financial year as a whole, driven, as in Europe, by the strong

growth in the food service business in both Canada and the United

States along with the resilience of the retail sector despite its

normalization following the Covid 19 sanitary crisis. The

ready-to-eat fresh activities of the Bonduelle Fresh Americas

business unit declined significantly over the financial year. This

decline is explained by significant price increases aimed at

preserving margins in a particularly inflationary environment, a

less dynamic market, and the cessation of sales of non-contributing

ranges to certain clients, which was not offset by new clients

acquisitions. In Eurasia, the brands (Bonduelle and Globus) posted

growth over the financial year as a whole, despite a Q4 marked by

geopolitical tensions and their impacts on consumption and

inflation.

Highlights

Bonduelle sold 65%

of Bonduelle Americas Long Life

to the Fonds de

solidarité FTQ and CDPQOn June

30, 2022, the Bonduelle Group obtained the approval from U.S and

Canadian regulatory authorities and the waiver of conditions

precedent allowing it to finalize the agreement with the

institutional investors Fonds de solidarité FTQ and CDPQ, for the

acquisition, in equal shares between them, of 65% of Bonduelle

Americas Long Life (BALL) and on the basis of an enterprise value

at 100% of C$ 850 million (approximately € 625 million), or an

EBITDA multiple for 2020-2021 of 8.2x. With a revenue of C$ 989

million for financial year 2021-2022, this business activity is

dedicated to the processing and marketing of canned and frozen

vegetables in the United States and Canada, in the retail

supermarket and food service sectors, with private labels, third

party brands and own brands such as Arctic Gardens and Del Monte.

This operation enables the group to continue to deploy its

activities, particularly in brands, in line with its strategic

priorities and its ambition of sustainable growth with positive

impact. The sale, for which the net proceeds will be determined

based on the financial statements as of the date of the

transaction, which are currently being prepared, will be recorded

in the Bonduelle Group's financial statements for the year ending

June 30, 2022.

Outlooks

Based on the development of the business in FY

2021-2022, on the one hand, and taking into account an

unprecedented wave of inflation affecting all cost components,

which became more pronounced towards the end of the financial year,

on the other hand, and lastly, taking into account the recovery

that has begun but is more difficult than expected in its North

American fresh ready-to-eat business, the Bonduelle Group confirms

that the expected growth in current operating margin (excluding the

effect of IFRS 5) should fall short of the stated objective of 3.6%

on a like for like basis* and at constant exchange rates for FY

2021-2022.The difficulties encountered by the Bonduelle Fresh

Americas business unit have led the group to review its medium-term

profitability prospects, which may result in the impairment of

tangible and/or intangible assets and deferred tax assets of this

business.

* at constant currency exchange rate and scope

of consolidation basis. The revenues in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows:

- For businesses acquired (or gain of

control) during the current period, revenue generated since the

acquisition date is excluded from the organic growth

calculation;

- For businesses acquired (or gain of

control) during the prior fiscal year, revenue generated during the

current period up until the first anniversary date of the

acquisition is excluded;

- For businesses divested (or loss of

control) during the prior fiscal year, revenue generated in the

comparative period of the prior fiscal year until the divestment

date is excluded;

- For businesses divested (or loss of

control) during the current fiscal year, revenue generated in the

period commencing 12 months before the divestment date up to the

end of the comparative period of the prior fiscal year is

excluded.

In the specific case of the 2021-2022 financial

year, the revenue from the North American canned and frozen

activities divested on June 30, 2022 is recorded for the full

financial year.

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com.

Next financial event:

- 2021-2022 FY Results:

October

3, 2022 (prior to stock exchange trading session)

Appendix

Total revenue after application of IFRS

5On June 30, 2022, the Bonduelle Group divested its canned

and frozen activities in North America. This disposal qualifies as

a "discontinued" operation in accordance with IFRS 5.As a result,

the published FY 2021-2022 revenue excludes sales from these

divested activities, and the 2020-2021 period is restated in the

table below.

Activity by Geographic Region

|

Total consolidated revenue(in €

million) |

FY2021-2022 |

FY2020-2021IFRS

5** |

Variation Reported figures |

Variation Like for like

basis* |

Q42021-2022 |

Q42020-2021IFRS

5** |

Variation Reported figures |

Variation Like for like

basis* |

|

Europe Zone |

1,357.3 |

1,271.7 |

6.7% |

6.9% |

357.5 |

316.3 |

13.-% |

13.4% |

|

Non-Europe Zone |

845.3 |

891.9 |

-5.2% |

-8.4% |

203.9 |

212.1 |

-3.9% |

-12.-% |

|

Total |

2,202.6 |

2,163.6 |

1.8% |

0.6% |

561.4 |

528.4 |

6.2% |

3.2% |

** 2020-2021 data excluding revenues from the

North American canned and frozen activities

Activity by Operating Segments

|

Total consolidated revenue(in €

million) |

FY2021-2022 |

FY2020-2021IFRS

5** |

Variation Reported figures |

Variation Like for like

basis* |

Q42021-2022 |

Q42020-2021IFRS

5** |

Variation Reported figures |

Variation Like for like

basis* |

|

Canned |

958.4 |

912.5 |

5.-% |

4.8% |

232.1 |

212.7 |

9.1% |

9.-% |

|

Frozen |

238.4 |

215.3 |

10.7% |

10.8% |

56.9 |

50.9 |

11.8% |

12.2% |

|

Fresh processed |

1,005.9 |

1,035.8 |

-2.9% |

-5.3% |

272.4 |

264.8 |

2.8% |

-3.1% |

|

Total |

2,202.6 |

2,163.6 |

1.8% |

0.6% |

561.4 |

528.4 |

6.2% |

3.2% |

** 2020-2021 data excluding revenues from the

North American canned and frozen activities

About

the Bonduelle Group

We want to inspire the

transition toward a plant-based diet, to contribute to people’s

well-being and planet health. We are a French family business with

11,900 employees and we have been innovating with our farming

partners since 1853. Our products are cultivated on 73,000 acres

and marketed in 100 countries, with a revenue of € 2,203 million

(data as of June 30, 2022).

Our 4 strong brands

are Bonduelle, Ready Pac Foods, Cassegrain and Globus.

Bonduelle is listed on

Euronext compartment B

Euronext indices: CAC

MID & SMALL - CAC FOOD PRODUCERS - CAC ALL SHARESBonduelle is

part of the Gaïa non-financial performance index and employee

shareholder index (I.A.S.)Code ISIN : FR0000063935 - Code Reuters :

BOND.PA - Code Bloomberg : BON FP

Find out about the

group’s current events and news on Twitter @Bonduelle_Group, and

its financial news on @BonduelleCFO

- Bonduelle - Annual Revenue FY 21-22

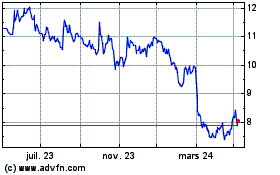

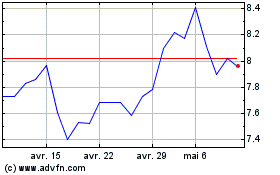

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024