FLOW TRADERS Q322 TRADING UPDATE

FLOW TRADERS Q322 TRADING UPDATE

Amsterdam, the Netherlands - Flow Traders N.V.

(Euronext: FLOW) announces its

unaudited

Q322

trading update.

Highlights

- Flow Traders recorded Normalized

total income of €112.2m in Q322 comprising Normalized NTI of

€111.7m reflecting a more active fixed income market and trading

environment and Normalized other income of €0.4m derived from the

strategic investments portfolio. YTD 9m22 Normalized total income

was €346.7m vs €304.1m in YTD 9m21

- Flow Traders Value Traded was flat

quarter-on-quarter whereas the overall ETP market was down as

increases in fixed income and currency, crypto and commodity

trading were offset by lower equity trading, highlighting the

success of the trading diversification strategy

- Normalized operating expenses of

€63.3m incurred in Q322 contributing to YTD 9m22 Normalized

operating expenses of €186.7m. 16.5% year-on-year increase in fixed

operating expenses when adjusted for effect of USD strengthening

and targeted base compensation increases

- Normalized employee expenses reflect

increased variable remuneration due to an improved operating

result, impact of strategic headcount growth and the full effect of

the targeted base compensation increases

- 639 FTEs as at 30 September 2022

compared to 611 FTEs as at 30 June 2022 - new graduate intake

classes welcomed in Trading and Technology in September

- Normalized EBITDA in Q322 reached

€48.8m representing a margin of 44% contributing to YTD 9m22

Normalized EBITDA of €159.9m with a margin of 47%

- Q322 Normalized net profit amounted

to €34.5m with Normalized basic EPS of €0.79. YTD 9m22 Normalized

net profit amounted to €116.6m with Normalized basic EPS of

€2.67

- Regulatory Own Funds Requirement

(OFR) as at 30 September 2022 was €323m, resulting in excess

capital of €228m as at 30 September 2022. Trading capital stood at

€634m at the end of the third quarter

- Existing share buyback program of up

to €25m increased by a further €15m for a total size of up to €40m

- €9.1m of shares already repurchased since 22 July 2022

Financial Overview

|

€million |

Q322 |

Q222 |

Change |

YTD 9m22 |

YTD 9m21 |

Change |

|

Normalized total income |

112.2 |

86.2 |

30% |

346.7 |

304.1 |

14% |

|

Normalized net trading

income |

111.7 |

83.7 |

33% |

343.9 |

303.7 |

13% |

|

EMEA |

87.4 |

50.4 |

74% |

246.3 |

186.0 |

32% |

|

Americas |

14.4 |

18.6 |

(23%) |

54.7 |

66.3 |

(18%) |

|

APAC |

9.9 |

14.7 |

(33%) |

42.9 |

51.4 |

(17%) |

|

|

|

|

|

|

|

|

|

Normalized other income |

0.4 |

2.5 |

(83%) |

2.8 |

0.4 |

- |

|

Normalized employee expenses1 |

40.1 |

28.5 |

41% |

122.6 |

111.0 |

10% |

| Technology

expenses |

16.1 |

14.9 |

8% |

44.8 |

36.5 |

23% |

| Other

expenses2 |

7.1 |

6.3 |

13% |

19.4 |

13.5 |

43% |

|

Normalized operating

expenses |

63.3 |

49.7 |

27% |

186.7 |

161.0 |

16% |

|

Normalized EBITDA1 |

48.8 |

36.5 |

34% |

159.9 |

143.1 |

12% |

|

Depreciation / amortisation |

4.4 |

3.9 |

|

12.1 |

11.4 |

|

| Write off of (in)

tangible assets |

- |

- |

|

0.2 |

- |

|

|

Normalized profit

before

tax |

44.5 |

32.6 |

37% |

147.7 |

131.8 |

12% |

|

Normalized tax |

9.9 |

6.4 |

|

31.0 |

25.7 |

|

|

Normalized net

profit |

34.5 |

26.1 |

32% |

116.6 |

106.1 |

10% |

|

Normalized basic EPS3 (€) |

0.79 |

0.60 |

|

2.67 |

2.42 |

|

| Normalized EBITDA

margin |

44% |

44% |

|

47% |

47% |

|

Value Traded Overview

|

€billion |

Q322 |

Q222 |

Change |

YTD 9m22 |

YTD 9m21 |

Change |

|

Flow Traders ETP Value Traded |

409 |

449 |

(9%) |

1,379 |

1,131 |

22% |

|

Europe |

178 |

193 |

(8%) |

609 |

522 |

17% |

|

Americas |

212 |

230 |

(8%) |

697 |

538 |

30% |

|

Asia |

20 |

26 |

(24%) |

74 |

70 |

5% |

|

|

|

|

|

|

|

|

|

Flow Traders non-ETP Value Traded |

1,182 |

1,165 |

2% |

3,781 |

2,978 |

27% |

|

Flow Traders Value Traded4 |

1,591 |

1,614 |

(1%) |

5,160 |

4,108 |

26% |

|

Equity |

714 |

831 |

(14%) |

2,567 |

2,251 |

14% |

|

Fixed income |

344 |

298 |

15% |

960 |

758 |

27% |

|

Currency, Crypto, Commodity |

495 |

463 |

7% |

1,489 |

970 |

53% |

|

Other |

37 |

21 |

72% |

141 |

129 |

10% |

|

|

|

|

|

|

|

|

|

Market ETP Value Traded5 |

11,410 |

13,676 |

(17%) |

40,170 |

26,169 |

54% |

|

Europe |

532 |

567 |

(6%) |

1,866 |

1,503 |

24% |

|

Americas |

9,638 |

11,951 |

(19%) |

34,894 |

21,954 |

59% |

|

Asia |

1,240 |

1,158 |

7% |

3,411 |

2,712 |

26% |

|

Asia ex China |

395 |

400 |

(1%) |

1,187 |

1,033 |

15% |

Regional Highlights

EUROPE:

- Strong trading performance in the

region with the successful leverage of the investments made across

the fixed income business. Flow Traders once again maintained its

position as the leading liquidity provider in ETPs, both on- and

off-exchange

- Corporate credit trading business

continues to gain further traction across the market. Flow Traders’

coverage of the EM bond market has been further strengthened during

the quarter. Continued to see a quote rate of >80% for the

majority of the Bloomberg Barclays Corporate Bond index and have

retained Top 5 Bloomberg dealer rankings for executed tickets and

volume in Flow Traders’ Euro IG universe

- Continued to support new products

and listings across the crypto space - worked extensively with

exchanges and ETP issuers around the Ethereum upgrade. Further

investments made by Flow Traders Capital are aligned with growing

focus on DeFi given Flow Traders is one of the leading global

architects for maturing this proposition

AMERICAS:

- Acted as Lead Market Maker (LMM) on

the Charles Schwab Crypto Thematic ETF USA, the iShares Water

Management Multisector ETF (IWTR), the full Bondbloxx treasury

suite and on SPKX and SPKY from Convexity Shares as Flow Traders’

LMM presence in the US grows

- Further build-out of the fixed

income business as Flow Traders commenced pricing IG bonds in the

US with 2,500 ISINs currently covered with a plan in place to

expand the coverage universe to 8,000 - 12,000 ISINs

ASIA:

- Successfully obtained QFII license

approval in China which is a key step in the overall China market

strategy and has enabled the execution of the first on-shore

trades

- Flow Traders is committed to growing

the Hong Kong ETP markets and as part of this has joined the HKEx

Cash Market Consultative Panel - also further strengthens the

continuing cooperation with HKEx

Flow Traders Capital

- Fewer investments during the third

quarter given the developments across the crypto and digital asset

space. Announced new investments in Crossover Markets, GoGo pool,

Infinity Exchange, Kemet Trading, and Sei Network as well as

providing additional funding for two existing investments. Flow

Traders total investment in the third quarter amounted to €5.1m and

now has a total of 23 current investments to date representing a

total value of €28.5m

- Corporate venture capital strategy

is already paying off by selecting and entering investments that

provide Flow Traders with an immediate benefit for the existing

core liquidity providing business

Outlook

- Flow Traders announces an increase

of the existing share buyback program of up to €25m by an

additional amount of up to €15m for a total size of up to €40m over

a period of 12 months from the start of the forthcoming open

period. As of 26 October 2022, the total number of shares purchased

under this program since 22 July 2022 is 469,434 shares at an

average price of €19.46 for a total consideration of €9.1m. The

purpose of the buyback is to return excess capital to shareholders.

The intention is that shares repurchased as part of this program

will initially be held in treasury. 3,259,529 shares are held in

treasury as at 26 October 2022 with 58% of these treasury shares

repurchased for the purpose of satisfying the requirements of

various employee incentive plans and the remaining 42% repurchased

for the purpose of returning excess capital to shareholders

- On 21 October 2022, Flow Traders

announced a proposed implementation of an updated corporate holding

structure, as an enabler of its global strategic ambition. This

proposed update will involve a top holding company in Bermuda and

is the result of a thorough legal and capital structure review.

This will be formally proposed to shareholders at an Extraordinary

General Meeting, scheduled to take place on 2 December 2022 at

14.00 CET

Management Board Comments

Dennis Dijkstra, CEO,

stated:“This quarter delivered further proof

points with respect to the diligent execution of our strategic

growth agenda, particularly in fixed income. Our liquidity

provision across the fixed income space which includes ETFs as well

as corporate credit and emerging markets sovereign bonds continues

to be positively received by the buy-side and we were delighted to

be the lead sponsor once again at the recent Fixed Income

Leadership Summit in Nice. Another landmark for Flow Traders was

the successful approval of our QFII license which is a key part of

our plan to enter the mainland China market. Given the strong

financial performance in the quarter and within the context of our

capital allocation framework, we have elected to increase the

current share buyback program to a new total size of up to €40

million. This buyback will further enhance the capital returns to

our shareholders.

“We have also worked hard this quarter on laying the groundwork

for the future. The proposed update to the corporate holding

structure was announced on 21 October 2022 and is a natural enabler

for the strategic ambition which the team outlined at the Capital

Markets Update held in July. In addition, we created an Executive

Committee in order to accelerate the implementation of our strategy

as well as to ensure that our leadership talent pool grows

alongside the needs of the business. Lastly, it is also pleasing

that in a highly competitive employment market, we are still able

to attract and recruit the best talent and we welcomed a large

intake of 18 new graduates in September to complement our already

highly talented team.”

Folkert Joling, Chief

Trading Officer,

added:“The third quarter saw a more active fixed

income market given interest rate and inflation impacts. This

contributed to an overall strong trading performance, which was

particularly evident in EMEA. Across other asset classes, realized

volatility remained subdued compared to earlier in the year. Our

trading footprint continues to grow as we successfully executed our

first ever on-shore China trades. From a broader trading

perspective, we remained focused on executing our growth plans with

respect to our business lines of Equity, Fixed Income and Crypto,

Currencies and Commodities. We have enduring confidence in our

ability to expand our trading activities across these various asset

classes going forward.”

Mike Kuehnel, Chief

Financial

Officer,

added:“Indicative of the success of our trading

diversification strategy, Flow Traders achieved a return on trading

capital of 67% in Q3. Once again, the firm’s trading capital

continues to generate attractive and economically accretive

returns. From an operating cost perspective, we have had to contend

with a changing macro environment which has brought rising

inflation as well as a strengthening US dollar. We are therefore

seeking to absorb these impacts while at the same time ensuring we

continue to invest in the business in order to execute our strategy

and deliver sustainable returns for our stakeholders. The adjusted

profit-sharing percentage continues to effectively ensure that the

base compensation increases implemented in Q2 are income statement

neutral as communicated before. A key focus for the remainder of

this year and next is to further increase the underlying efficiency

of the business as we prepare ourselves for Flow Traders’ next

stage of growth.

“A key takeaway from the recent Capital Markets Update was the

importance of engaging more intensely in the ecosystem we operate

and thrive in. With that in mind, we have continued to support new

products and listings across the crypto space and, notably, worked

with exchanges and ETP issuers around the Ethereum upgrade. The

pace of our strategic investments has naturally slowed somewhat

with the advent of the ‘crypto winter’ which has allowed for more

time to work with partners on build-out and development.

Nonetheless, Flow Traders Capital still announced five investments

during the third quarter.“

Preliminary Financial Calendar

2 December

2022 EGM12 January

2023

Start

Silent Period ahead of Q422 / FY22 results9 February

2023 Release

Q422 / FY22 results (incl. analyst conference call)24 February 2023

Release 2022 Annual

Report 31 March 2023

Start

Silent Period ahead of Q123 trading update 21 April 2023

Release

Q123 trading update (no analyst conference call)26 April 2023

AGM

Contact Details

Flow Traders N.V.

InvestorsJonathan BergerPhone:

+31 20

7996149Email: investor.relations@flowtraders.com

MediaLaura PeijsPhone:

+31 20

7996125Email: press@flowtraders.com

About Flow Traders

Flow Traders is a leading global financial technology-enabled

liquidity provider in financial products, historically specialized

in Exchange Traded Products (ETPs), now expanding into other asset

classes. Flow Traders ensures the provision of liquidity to support

the uninterrupted functioning of financial markets. This allows

investors to continue to buy or sell ETPs or other financial

instruments under all market circumstances. We continuously grow

our organization, ensuring that our trading desks in Europe, the

Americas and Asia can provide liquidity across all major exchanges,

globally, 24 hours a day. Founded in 2004, we continue to cultivate

the entrepreneurial, innovative and team-oriented culture that has

been with us since the beginning. Please visit www.flowtraders.com

for more information.

Normalized performance

- Flow Traders makes certain

adjustments to various IFRS expense and profit measures in order to

derive Alternative Performance Measures (APM). The policy is to

exclude or adjust items that are considered to be significant in

both nature or size and where the treatment as an adjusted item

provides stakeholders with useful information to assess the

year-on-year or quarter-on-quarter underlying performance. On this

basis, the following items were adjusted or excluded for the Q322

trading update:

- Removal of IFRS 2 treatment of

share-based payments which include the deferral of a portion of the

current year share plans as well as recognition of prior years’

share plans. This adjustment provides insights into the

relationship between the current year variable employee expenses

and current year trading performance

- Other income line includes all the

realized and unrealized results on Flow Traders’ long-term equity

investments whether accounted for as Fair Value Other Comprehensive

Income (FV OCI), Fair Value Profit and Loss (FVPL) or Results of

Equity Accounted Investments

- Exclusion of one-off expenses which

relate specifically to the proposed corporate holding structure

update and the Capital Markets Update. These are not considered to

be part of the underlying operating expenses of the business

- Tax expenses are adjusted based upon

the pre-tax adjustments and/or excluded items above

Normalized to IFRS reconciliation

|

€million |

Q322 |

Q222 |

Change |

YTD 9m22 |

YTD 9m21 |

Change |

|

Total income |

111.7 |

83.5 |

34% |

343.1 |

303.7 |

13% |

|

Net trading income |

111.8 |

84.0 |

33% |

344.5 |

303.7 |

13% |

|

Other income |

(0.1) |

(0.5) |

- |

(1.3) |

- |

- |

|

Employee expenses1 |

39.9 |

35.4 |

13% |

130.2 |

119.2 |

9% |

| Technology

expenses |

16.1 |

14.9 |

8% |

44.8 |

36.5 |

23% |

| Other

expenses |

7.1 |

6.3 |

13% |

19.4 |

11.6 |

67% |

|

One off expenses |

0.8 |

8.5 |

(91%) |

12.5 |

1.9 |

- |

|

Total operating

expenses |

63.9 |

65.1 |

(2%) |

207.0 |

169.3 |

22% |

|

EBITDA |

47.8 |

18.3 |

161% |

136.2 |

134.5 |

1% |

|

Profit before

tax |

43.4 |

14.3 |

204% |

123.7 |

123.2 |

0% |

|

Net profit |

33.8 |

11.2 |

203% |

97.4 |

98.9 |

(2%) |

|

Basic EPS3 (€) |

0.78 |

0.26 |

|

2.23 |

2.25 |

|

| Fully diluted

EPS6 (€) |

0.75 |

0.25 |

|

2.16 |

2.18 |

|

| EBITDA

margin |

43% |

22% |

|

40% |

44% |

|

- Normalized EBITDA and margin are

based on the relevant profit share percentage of operating result

for the relevant financial period without any IFRS 2 adjustments

for share-based payments. The profit share percentage was adjusted

to 32.5% in Q222 from 35%. €0.8m of one-off expenses is also

excluded

- Tax based on estimated expected

effective tax rate for the relevant financial period: Q322 - 22.3%;

Q222 - 19.7%; YTD 9m22 - 21.0%; YTD 9m21 - 19.5%

- A summary reconciliation of

Normalized to IFRS is presented below:

|

€million |

Q322 |

Q222 |

YTD 9m22 |

YTD 9m21 |

|

Normalized EBITDA |

48.8 |

36.5 |

159.9 |

143.1 |

|

FV OCI adjustment |

(0.5) |

(2.9) |

(3.7) |

(0.3) |

|

Results of equity-accounted investments |

- |

0.1 |

0.2 |

(0.1) |

|

One off expenses |

(0.8) |

(8.5) |

(12.5) |

- |

|

Prior year share plans |

(4.2) |

(6.2) |

(18.3) |

(18.7) |

|

Current year share plan deferral |

4.4 |

0.4 |

10.6 |

10.5 |

|

Other variable remuneration adjustment |

- |

(1.1) |

- |

- |

|

|

|

|

|

|

|

IFRS EBITDA |

47.8 |

18.3 |

136.2 |

134.5 |

|

Normalized net

profit |

34.5 |

26.1 |

116.6 |

106.1 |

|

Profit before tax IFRS adjustments |

(1.1) |

(18.3) |

(24.0) |

(8.6) |

|

Tax difference |

0.4 |

3.3 |

4.7 |

1.4 |

|

|

|

|

|

|

|

IFRS net

profit |

33.8 |

11.2 |

97.4 |

98.9 |

Notes

- Fixed employee

expenses: Q322 - €19.0m; Q222 - €18.2m; YTD 9m22 - €53.3m; YTD 9m21

- €40.2m

- YTD 9m21 other expenses includes

€1.9m of business continuity plan-related expenses previously

classified as one-off expenses

- Weighted average shares outstanding:

Q322 - 43,615,044; Q222 - 43,731,905; YTD 9m22 - 43,620,841; YTD

9m21 - 43,875,028. 43,439,853 shares outstanding as at 30 September

2022

- Value traded comprises ETPs, Futures

and Cash

- Source - Flow Traders analysis

- Determined by adjusting the basic

EPS for the effects of all dilutive share-based payments to

employees

Important Legal Information

This press release is prepared by Flow Traders N.V. and is for

information purposes only. It is not a recommendation to engage in

investment activities and you must not rely on the content of this

document when making any investment decisions. The information in

this document does not constitute legal, tax, or investment advice

and is not to be regarded as investor marketing or marketing of any

security or financial instrument, or as an offer to buy or sell, or

as a solicitation of any offer to buy or sell, securities or

financial instruments. The information and materials contained in

this press release are provided ‘as is’ and Flow Traders N.V. or

any of its affiliates (“Flow Traders”) do not warrant the accuracy,

adequacy or completeness of the information and materials and

expressly disclaim liability for any errors or omissions. This

press release is not intended to be, and shall not constitute in

any way a binding or legal agreement, or impose any legal

obligation on Flow Traders. All intellectual property rights,

including trademarks, are those of their respective owners. All

rights reserved. All proprietary rights and interest in or

connected with this publication shall vest in Flow Traders. No part

of it may be redistributed or reproduced without the prior written

permission of Flow Traders. This press release may include

forward-looking statements, which are based on Flow Traders’

current expectations and projections about future events, and are

not guarantees of future performance. Forward looking statements

are statements that are not historical facts, including statements

about our beliefs and expectations. Words such as “may”, “will”,

“would”, “should”, “expect”, “intend”, “estimate”, “anticipate”,

“project”, “believe”, “could”, “hope”, “seek”, “plan”, “foresee”,

“aim”, “objective”, “potential”, “goal” “strategy”, “target”,

“continue” and similar expressions or their negatives are used to

identify these forward-looking statements. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors because they relate to

events and depend on circumstances that will occur in the future

whether or not outside the control of Flow Traders. Such factors

may cause actual results, performance or developments to differ

materially from those expressed or implied by such forward-looking

statements. Accordingly, no undue reliance should be placed on any

forward-looking statements. Forward-looking statements speak only

as at the date at which they are made. Flow Traders expressly

disclaims any obligation or undertaking to update, review or revise

any forward-looking statements contained in this press release to

reflect any change in its expectations or any change in events,

conditions or circumstances on which such statements are based

unless required to do so by applicable law. Financial objectives

are internal objectives of Flow Traders to measure its operational

performance and should not be read as indicating that Flow Traders

is targeting such metrics for any particular fiscal year. Flow

Traders’ ability to achieve these financial objectives is

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

beyond Flow Traders’ control, and upon assumptions with respect to

future business decisions that are subject to change. As a result,

Flow Traders’ actual results may vary from these financial

objectives, and those variations may be material. Efficiencies are

net, before tax and on a run-rate basis, i.e. taking into account

the full-year impact of any measure to be undertaken before the end

of the period mentioned. The expected operating efficiencies and

cost savings were prepared on the basis of a number of assumptions,

projections and estimates, many of which depend on factors that are

beyond Flow Traders’ control. These assumptions, projections and

estimates are inherently subject to significant uncertainties and

actual results may differ, perhaps materially, from those

projected. Flow Traders cannot provide any assurance that these

assumptions are correct and that these projections and estimates

will reflect Flow Traders’ actual results of operations.

By accepting this document you agree to the terms set out above.

If you do not agree with the terms set out above please notify

legal.amsterdam@nl.flowtraders.com immediately and delete or

destroy this document.

Market Abuse Regulation

This press release contains information within the meaning of

Article 7(1) of the EU Market Abuse Regulation and is an

announcement pursuant to Article 5(1) of the EU Market Abuse

Regulation.

- Flow Traders - Q322 Trading Update vF

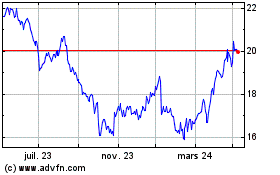

Flow Traders (EU:FLOW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

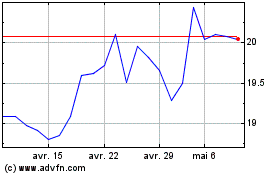

Flow Traders (EU:FLOW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025