Good start to the year, confirming full-year

targets Moody's ESG Solutions confirms FDJ Group's highest

A1+ sustainability rating

- Strong growth in revenue (+14%)

- Very good momentum at points of sale (stakes up 12%), thanks

to the Group’s marketing and sales initiatives and a return to

normal of the environment

- Confirmation of a solid base of online stakes, which

represent 11.4% of total stakes

- Moody's ESG Solutions A1+ rating confirmed for the 4th year

in a row, with a rating of 72/100 (+2 points)

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), France’s leading gaming

operator, announces its Q2 2022 revenue.

Stéphane Pallez, Chairwoman and CEO of FDJ Group, said:

“The start of the year was marked by strong growth in all our

business lines, across all sales channels. The strong growth in

lottery and sports betting revenues was driven by our network of

30,000 retail outlets and a solid online activity. We are also very

proud of Moody’s ESG Solutions’ A1+ sustainability rating awarded

to FDJ for the fourth year in a row. This good financial and

extra-financial performance underpins our strategy of sustainable

and profitable growth, and our outlook for 2022.”

Revenue up +14.0% in Q1

2022

In Q1 2022, compared to Q1 2021, FDJ posted revenue growth of

+14.0%, to €613 million, with stakes up +10.2%, to €5,061

million.

The Group reminds that in Q1 2021, the measures taken by the

French authorities to stem the Covid-19 epidemic had affected its

activity at points of sale, with nearly 10% of its network closed,

mainly bars. On the other hand, the digital activity recorded

exceptional growth.

Activity increased across all channels, despite a near absence

of a long cycle for draw games (high jackpots), unlike in Q1

2021:

- Point-of-sale stakes increased by +11.5%, to €4.5 billion,

thanks to the Group’s marketing and sales initiatives and a return

to normal of the environment;

- Online stakes came out at a high level of €575 million. This

performance, at +1% in light of an extremely high comparison base

in Q1 2021, demonstrates the solidity of the Group’s online

activity. Online stakes account for more than 11% of total

stakes.

Revenue increased across all of the Group's activities:

- Lottery revenue was €467 million, up +14.0%, driven by growth

in betting (+15.3%):

- Draw game stakes amounted to €1.5 billion, up +9.5%, due to the

growth of Amigo, whose stakes now exceed their pre-pandemic level.

The performance of Loto and EuroMillions is affected by the near

absence of long cycles;

- Instant game stakes reached €2.5 billion, up 19% with the

successful launches and relaunches during the quarter (Baraka in

January, then Cash and finally “3 in 1” in March).

- Sports betting revenue was €129 million, up +13.4%. The

persistence of a low player payout ratio since the end of 2021,

74.7% in Q1 2022, down -4.2 points compared to Q1 2021, contributed

to the drop in stakes of -5.2%. This was mainly due to unexpected

sports results, particularly for football.

This good start to the year confirms the Group's achievement of

its 2022 targets in terms of both business growth and margin

growth.

Moody’s A1+ ESG rating

For the fourth year in a row, FDJ Group has been awarded the A1+

Sustainability Rating by Moody's ESG Solutions, a provider of

environmental, social and governance (ESG) assessments and data.

This top-ranking sustainability rating confirms FDJ's position

among the most active companies assessed in terms of ESG

criteria.

The Group ranks 15th out of nearly 5,000 companies worldwide

monitored by Moody's ESG Solutions. In the Hotels, Leisure and

Services sector, composed of 45 international companies, which

includes gambling players, FDJ is No. 1 in the rankings.

FDJ's ESG score of 72/100, up +2 points compared to the previous

financial year and +6 points compared to 2020, confirms the

relevance of the Group's CSR policy, which enabled the Group to

obtain these good extra-financial results.

FDJ obtains 70/100 on environmental criteria, 74/100 on social

criteria, and 69/100 in terms of governance; these results are

above averages in the Hotels, Leisure and Services sector, at

32/100, 33/100 and 45/100 respectively.

Annual General Meeting

FDJ will hold its Annual General Meeting on 26 April at the

Palais des Congrès in Issy-les-Moulineaux. The event will also be

broadcast live on its website

https://www.groupefdj.com/fr/actionnaires/assemblees-generales-fdj.html.

On this occasion, the Group will offer its shareholders a

dividend of €1.24 per share for FY 2021, the payment of which will

take place on 4 May 2022.

The Group's next financial communication

FDJ will publish its half-year results on 28 July 2022 after

market close.

Appendices

In millions of euros

Q1 2022

Q1 2021

Change

Stakes*

5,061.1

4,591.1

+10.2%

Attributable to

Lottery

3,989.2

3,461.5

+15.3%

Draw games

1,468.8

1,341.1

+9.5%

Instant games**

2,520.3

2,120.4

+19.0%

Attributable to Sports

betting

1,061.3

1,120.0

-5.2%

Offline distribution

network

4,483.6

4,021.4

+11.5%

* Stakes reflect wagers by players, and do not constitute the

revenue of the FDJ Group* ** Mainly scratch games (in points of

sale and online)

In millions of euros

Q1 2022

Q1 2021

Change

Revenue

613.0

537.7

+14.0%

Attributable to

Lottery

466.7

409.4

+14.0%

Attributable to Sports

betting

128.5

113.4

+13.4%

About La Française des Jeux (FDJ Group)

France’s national lottery and leading gaming operator, the #2

lottery in Europe and #4 worldwide, FDJ offers secure, enjoyable

and responsible gaming to the general public in the form of lottery

games (draws and instant games) and sports betting (ParionsSport),

available from physical outlets and online. FDJ’s performance is

driven by a portfolio of iconic and recent brands, the #1 local

sales network in France, a growing market, recurring investment and

a strategy of innovation to make its offering and distribution more

attractive with an enhanced gaming experience.

FDJ Group is listed on the Euronext Paris regulated market

(Compartment A – FDJ.PA) and is included in indices such as the

SBF 120, Euronext Vigeo 20, STOXX Europe 600, MSCI Europe and

FTSE Euro.

For more information, www.groupefdj.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421005858/en/

Media Relations +33 (0)1 41 10 33 82

Investor Relations +33 (0)1 41 04 19 74

FDJ Group | La Française des Jeux 3-7, Quai du Point du Jour -

CS10177 92650 Boulogne-Billancourt Cedex www.groupefdj.com

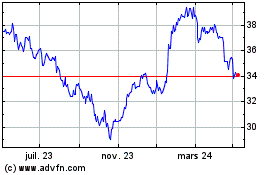

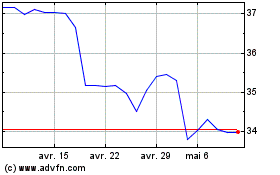

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024