- Hospitex, a world leader in Thin Layer Cytology and Cancer

Diagnostics, providing a competitive solution based on a patented

and cutting-edge technology, the Nephelometric Smart Technology

(NST)

- A key milestone in the deployment of Ikonisys’ growth

strategy, with strong technological and commercial synergies to

drive continuous improvement in revenue and profitability by:

- Combining two proprietary technologies, expanding Ikonisys’

existing expertise upstream in the value chain adding Hospitex’s

superior solution for slide preparation;

- Building on the complementary organization of Hospitex to

become a player of excellence in cancer diagnostics with a

comprehensive vertical solution;

- Strengthening the geographical reach, leveraging on Ikonisys’

commercial network in the USA and Hospitex’s established network in

Europe.

Regulatory News:

Ikonisys SA (Euronext Growth Paris: ALIKO) (the

“Issuer”), a company specializing in the early and accurate

detection of cancer through a unique fully automated solution for

medical analysis laboratories, today announces its entry into an

agreement (the “Agreement”) in order to acquire 100% of

Hospitex International (“Hospitex”), an Italian-based world

leader in Thin Layer Cytology and Cancer Diagnostics (the

“Transaction”).

Hospitex is a technological world leader for laboratory

instrumentations in cytology and has developed a unique patented

platform for slide preparation called Nephelometric Smart

Technology (NST). Thanks to its proprietary CYTOfast system,

Hospitex provides the most advanced solution for very accurate

standardized single-layer liquid-based cytology (LBC) slides. This

cutting-edge technology enables Hospitex to produce high-quality

thin layer diagnostic slides for any organ targeted. These superior

quality slides will ensure best-in-class images when analyzed by

the Ikoniscope fully automated solution.

In addition to its core business, Hospitex already operates in

three other complementary business units:

- Hospitex Labs: provider of turn-key laboratories for cancer

diagnostics;

- Hospitex Digital: integrator of ICT systems for healthcare

laboratories, through AI development and Big Data in oncology;

and

- Urine24: manufacturer and supplier of a BtoC solution, the

first urinary tract cancer screening test sold in pharmacies.

In 2022, Hospitex generated €1.8 million revenues with an EBITDA

margin of 21%. Hospitex has 23 employees and relies on an extensive

sales network, tapping into agents and distributors to promote its

solutions across Europe.

With this strategic acquisition, Ikonisys will integrate

Hospitex's extensive expertise in slide preparation upstream in the

value chain, offering an integrated solution to pathology

laboratories and completing its existing product line for automated

slide analysis. This will result in an additional increase in

efficiency and effectiveness of the cancer diagnostic process. In

addition, the Issuer will benefit from business synergies and cost

optimizations derived by a complementary, integrated, and vertical

offer to the same customers.

Together, the companies will offer premium efficient cancer

diagnostic solutions on a global scale.

Mario Crovetto, CEO of Ikonisys, stated: "We are pleased

to announce this strategic acquisition. Hospitex has proven its

ability to develop a cutting-edge patented technology, which is

truly complementary to Ikonisys’ solutions. By combining our

expertise, we aim to enhance both final diagnosis and laboratory

processes, through advanced automation and digitalization of the

entire value chain of pathology labs, from slide preparation to

analysis. Thanks to our comprehensive vertical solution, we are a

player of excellence in cancer diagnostics and look forward to

become a world leader in this field."

Francesco Trisolini, CEO of Hospitex International,

added: “By combining our technology with Ikonisys, we are

exploiting a great opportunity to expand our technical, commercial

and geographical reach. The opportunity to combine technologies for

first- and second-level diagnosis opens the way to important

breakthroughs, such as liquid biopsy, also on urinary matrix.

Together, we will further strengthen our impact on the cancer

diagnostics field by providing a comprehensive fully integrated

solution to the pathology laboratories. Finally, we can deploy

Ikonisys technology in our mass screening solutions, to reach a

potential unlimited customer basis.”

Consideration

Under the terms of the Agreement, Ikonisys will complete the

acquisition of 100% of Hospitex International for a total

consideration of €4.5 million, paid through the issuance of 2

million new Ikonisys shares at a price of €2.25 per share,

corresponding to a premium of 61% on the volume-weighted average

price of the shares observed on Euronext Growth Paris over the 5

trading days preceding this announcement. The Transaction, which is

subject to customary conditions precedent, is expected to be

completed by February 2024.

In addition, if certain revenue targets are reached by Hospitex

by December 31, 2024, an additional €1.125 million will be paid by

Ikonisys in June 2025 through the issuance of additional 0.5

million new Ikonisys shares at a price of €2.25 (together with the

initial 2 million new Ikonisys shares, the “Consideration

Shares”).

The issuance of the Consideration Shares shall occur with

cancellation of the shareholders’ preferential subscription

right.

The total value of the transaction has been validated by an

independent expert.

The Consideration Shares which may be issued shall be admitted

to trading on Euronext Growth Paris, on the same line as existing

Ikonisys shares (ISIN: FR00140048X2 – Ticker: ALIKO).

The issuance of the Consideration Shares will not require the

approval of a prospectus by the AMF.

Lock-up commitment of the sellers

The sellers agreed to grant a lock-up commitment on all

Consideration Shares that they may receive in consideration for the

Transaction, until June 30, 2025 (the “Lock-Up Commitment”),

except in customary circumstances or with the prior approval of the

Issuer.

Right to a board seat

In the framework of the Transaction, the appointment of Mr.

Francesco Trisolini, current chief executive officer of Hospitex,

shall be submitted to the vote of the next shareholders’ meeting of

the Issuer for a duration of three (3) years.

Theoretical impact of the issuance of the Consideration

Shares

Based on the 9,784,757 shares outstanding and the equity as at

December 31, 2022 (i.e., €17,671,473), the theoretical impact on

equity per share would be:

Theoretical impact on equity per

share

Non-diluted basis

Diluted basis

Before the closing

€1.81

€1.73

After the issuance of 2,000,000 new

shares

€1.88

€1.82

After the issuance of 500,000 new shares

due to the potential earn-out

€1.90

€1.83

Based on the 9,784,757 shares outstanding, the theoretical

impact on a shareholder holding a 1% stake in the Issuer’s share

capital prior to the Transaction would be:

Theoretical impact on a shareholder

holding a 1% stake in Ikonisys’ share capital prior to the

closing

Non-diluted basis

Diluted basis

Before the closing

1.00%

0.96%

After the issuance of 2,000,000 new

shares

0.83%

0.80%

After the issuance of 500,000 new shares

due to the potential earn-out

0.80%

0.77%

Main risks associated with the Issuer

The main risks associated with the Issuer are set out in the

2022 annual financial report for the financial year ended December

31, 2022, published on April 29, 2023, and in the half-year report

2023, published on October 31, 2023 and available on the website of

the Issuer (www.Ikonisys.com).

Main risks associated with the issuance of the Consideration

Shares

The main risks associated with the issuance of the Consideration

Shares are the following:

- risk of dilution of the Issuer’s shareholders: the Issuer’s

shareholders will suffer dilution upon issuance of the

Consideration Shares;

- risk relating to the evolution of the Ikonisys share price: the

expiry of the Lock-Up Commitment may create strong pressure

downward trend on Ikonisys’ share price, and the Issuer’s

shareholders may, upon such expiry, suffer a loss of their invested

capital due to a significant decrease in the value of Ikonisys’

shares;

- risk of availability and liquidity of the Issuer’s shares: the

sale on the market of the Consideration Shares upon the expiry of

the Lock-Up Commitment is likely to have significant consequences

on the availability and liquidity of Ikonisys’ shares.

Tentative schedule

- Completion of the Transaction: February 2024

- Issuance of 500,000 Ikonisys shares as payment of the earn-out

(as the case may be): June 2025

- Expiry of the Lock-Up Commitment: June 30, 2025

Allocation of the share capital before and after the issuance

of the Consideration Shares

The shareholding table below presents the allocation of the

share capital as of the day of this announcement:

Number of shares

% capital

Cambria Co-Invest. Fonds LP

5,268,989

53.85%

Cambria Equity Partners, LP

2,374,049

24.26%

MC Consulting S.r.l.*

351,464

3.59%

Free-float

1,790,255

18.30%

9,784,757

100.00%

* Holding of Mr Mario Crovetto, CEO of

Ikonisys.

The shareholding table below presents the theoretical allocation

of the share capital following the issuance of 2 million Ikonisys

shares:

Number of shares

% capital

Cambria Co-Invest. Fonds LP

5,268,989

44.71%

Cambria Equity Partners, LP

2,374,049

20.15%

MC Consulting S.r.l.*

351,464

2.98%

Free float

1,790,255

15.19%

Sellers (previous Hospitex

shareholders)

2,000,000

16.97%

11,784,757

100.00%

* Holding of Mr Mario Crovetto, CEO of

Ikonisys.

The shareholding table below presents the theoretical allocation

of the share capital following the issuance of the Consideration

Shares:

Number of shares

% capital

Cambria Co-Invest. Fonds LP

5,268,989

42.89%

Cambria Equity Partners, LP

2,374,049

19.33%

MC Consulting S.r.l.*

351,464

2.86%

Free-float

1,790,255

14.57%

Sellers (previous Hospitex

shareholders)

2,500,000

20.35%

12,284,757

100.00%

* Holding of Mr Mario Crovetto, CEO of

Ikonisys.

About Hospitex International

Hospitex International is the world leading company for cytology

standardized monolayer preparations. With CYTOfast it has

re-invented the cytological diagnostics. Hospitex offers a full

range of integrated solutions aimed at streamlining diagnostic

processes in cytology. The global shortage of expertise in

pathology requires tools and technologies that enable diagnostic

safety, efficiency and capacity building. In this area, Hospitex is

recognized as the precision diagnostics player in cytology.

For more information: https://www.hospitex.com/en/

About Ikonisys

Ikonisys SA is a cell-based diagnostics company based in Paris

(France), New Haven (Connecticut, USA) and Milan (Italy)

specialized in the early and accurate detection of cancer. The

company develops, produces and markets the proprietary

Ikoniscope20® and Ikoniscope20max® platforms, fully-automated

solutions designed to deliver accurate and reliable detection and

analysis of rare and very rare cells. Ikonisys has received FDA

clearance for several automated diagnostic applications, which are

also marketed in Europe under CE certification. Through its

breakthrough fluorescence microscopy platform, the company

continues to develop a stream of new tests, including liquid biopsy

tests based on Circulating Tumor Cells (CTC).

For further information, please go to www.Ikonisys.com

Disclaimer

This press release contains forward-looking statements about the

Company's prospects and development. These statements are sometimes

identified by the use of the future tense, the conditional tense

and forward-looking words such as "believe", "aim to", "expect",

"intend", "estimate", "believe", "should", "could", "would" or

"will" or, where appropriate, the negative of these terms or any

other similar variants or expressions. This information is not

historical data and should not be construed as a guarantee that the

facts and data set forth will occur. This information is based on

data, assumptions and estimates considered reasonable by the

Company. It is subject to change or modification due to

uncertainties relating to the economic, financial, competitive and

regulatory environment. This information contains data relating to

the Company's intentions, estimates and objectives concerning, in

particular, the market, strategy, growth, results, financial

situation and cash flow of the Company. The forward-looking

information contained in this press release is made only as of the

date of this press release. The Company does not undertake to

update any forward-looking information contained in this press

release, except as required by applicable law or regulation. The

Company operates in a competitive and rapidly changing environment

and therefore cannot anticipate all of the risks, uncertainties or

other factors that may affect its business, their potential impact

on its business or the extent to which the materialization of any

one risk or combination of risks could cause results to differ

materially from those expressed in any forward-looking information,

it being recalled that none of this forward-looking information

constitutes a guarantee of actual results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231129839137/en/

Hospitex International Marco Testini Investor Relations

marketing@hospitex.com

Ikonisys Alessandro Mauri CFO investors@ikonisys.com

NewCap Louis-Victor Delouvrier/Aurélie Manavarere

Investor Relations Ikonisys@newcap.eu Tel.: +33 (0)1 44 71 94

94

NewCap Nicolas Merigeau Media Relations

Ikonisys@newcap.eu Tel.: +33 (0)1 44 71 94 98

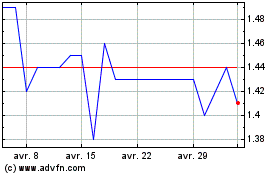

Ikonisys (EU:ALIKO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ikonisys (EU:ALIKO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024