- As of June 30, 2024, order backlog at €71.7 million, an

all-time high for Median.

- First major iCRO deals in Japan and South Korea.

- China sales recovering and bookings growth accelerating.

- H1 2024 revenue at €10.9 million

- Selected as a Preferred Vendor to two of the Top 3 global

pharma companies.

- Final results from the Eyonis LCS Independent Verification

Study show continued improvement and provide a high degree of

confidence for the forthcoming Standalone pivotal study readout,

expected in August.

- Cash and cash equivalents at €16 million on

June 30, 2024, Company’s cash horizon: Q2, 2025.

Fredrik Brag, CEO and Founder of Median

Technologies, will provide a Company update and answer

questions via webcast: Wednesday, July 24, 2024 4:00

pm CEST – 10:00 am EDT (English): sign-up link 6:00

pm CEST – 12:00 pm EDT (French): sign-up link

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA/SME eligible,

“Median” or “the Company”) reports today its business indicators

for the first half of 2024, provide an update on recent iCRO1

successful business achievements.

Fredrik Brag, CEO and Founder of Median Technologies

said: “iCRO experienced double-digit order backlog growth in

one year. The strategy initiated in 2023, leveraging our unique AI

capabilities, delivered its first results. H1 2024 revenue was

slightly below H1 2023 revenue, due mainly to the residual impact

from COVID-19 in China. Chinese bookings improved significantly in

H1 2024, and we expect to experience revenue growth in China in the

coming quarters. In May, we announced that Median has been selected

as a preferred vendor of a Top 3 pharma company. Median is now a

preferred imaging services provider to 2 of the Top 3 global pharma

groups. We are very proud to have been selected against our biggest

competitors by this additional leading oncology pharma with a

pipeline 30% bigger than our current largest client. This agreement

should significantly increase our revenues in the coming years.

This is a clear sign of the quality we provide for our clients and

the unique differentiator we bring with our AI expertise. Moreover,

we are very pleased to announce that we have been awarded our first

deals in Japan and South Korea for a total amount of €3.1 million.

These new deals outside China considerably increase Median’s reach

on the very dynamic East Asia clinical trial market. We expect

these achievements to be major catalysts for strong business growth

in the upcoming quarters.

We’re very encouraged by the final results of the eyonis™ LCS

independent verification study. All the primary endpoint and

secondary endpoints were met. Therefore, we have a high degree of

confidence in the forthcoming results of the Standalone pivotal

study, which will be reported in August.”

iCRO: paving the way for growth

acceleration

Leveraging AI expertise to partner with global players in the

pharma industry

Median's revised sales strategy, initiated in 2023, underpinned

by the Company’s distinctive AI capabilities, targets big pharma

groups and strategic partnerships with global CROs2. This approach

is designed to enhance Median’s iCRO core business, delivering

significant added value through its unique AI imaging expertise.

The success of the Company’s revised sales strategy is translating

into accelerating order backlog3 growth.

Median was awarded its first iCRO projects in Japan and South

Korea, extending its reach in the fast-growing East Asian oncology

clinical trials market. The project awards consist of two large

oncology phase III studies, for a total amount of €3.1 million.

These first awards in Asia outside of China are a breakthrough and

create excellent momentum for the growth of Median’s iCRO business

in this highly dynamic geography.

In May, Median was selected as preferred vendor by a Top 3

pharmaceutical company, adding another one of the largest global

pharmaceutical companies to its client portfolio. Median

Technologies is now a preferred provider for 2 of the Top 3 pharma

companies, based on oncology sales. Median will provide imaging

services, primarily for late phase clinical trials in the new

client’s oncology pipeline. Median’s recognized expertise in AI

applied to medical images has served as a powerful technological

differentiator throughout the various negotiation phases; this

unique asset sets it apart from the standard offering of the

Company’s competitors, as well as a significant catalyst for

accelerating growth opportunities for Median.

H1 2024 revenue at €10.9 million, order backlog at an all-time

high of €71.7 million

In Q2 2024, the Company's revenue stands at €5.6 million, up by

3.7% from Q1 2024 revenue and 5.7% compared to Q4 2023 revenue. H1

2024 revenues were €10.9 million, versus €11.4 million in H1 2023.

The residual impact of COVID-19 in China created temporary revenue

headwinds in H1 2024. However, Chinese bookings improved

significantly in H1 2024, and the Company expects to experience

revenue growth in China in the coming quarters. All the revenue

comes from the iCRO business, which provides imaging services to

the global bio-pharmaceutical industry.

The order backlog is €71.7 million as of June 30, 2024, up by

5.1% compared to the order backlog on March 31, 2024 (€68.2

million) and up by 11% on June 30, 2023 (€64.6 million). As of June

30, 2024, the order backlog is at its highest level ever

reached.

eyonis™ LCS: On-Track for

Standalone pivotal study readout in August

Final results from the eyonis™ LCS Independent Verification

Study show continued improvement, all of the primary and secondary

endpoints were met. This provides a high degree of confidence for

the forthcoming Standalone pivotal study readout, expected in

August.

Cash of €16 million on June 30,

2024

As of June 30, 2024, Median Technologies' cash and cash

equivalents stand at €16 million, compared to €20.9 million as of

March 31, 2024. The Company expects operations to be fully financed

until the second quarter of 2025.

Next financial release on October 24, 2024,

after market close: Half Year Financial Report

Disclaimer: The preliminary figures set forth above are based on

management’s initial review of the Company’s operations for the

period ending June 30, 2024, and are subject to revision based upon

the finalization of the limited review conducted on the full year

financial statements by the Group's statutory auditors. Actual

results may differ materially from these preliminary figures as a

result of the completion of H1 closing procedures, final

adjustments and other developments arising between now and the time

that the Company’s financial results are finalized, and such

changes could be material. In addition, these preliminary figures

are not a comprehensive statement of the Company’s financial

results for H1 2024, should not be viewed as a substitute for

condensed interim financial statements prepared in accordance with

generally accepted accounting principles, and are not necessarily

indicative of the Company’s results for any future period.

Forward-looking statements: This press release contains

forward-looking statements. These statements are not historical

facts. They include projections and estimates as well as the

assumptions on which these are based, statements concerning

projects, objectives, intentions, and expectations with respect to

future financial results, events, operations, services, product

development and potential, or future performance. These

forward-looking statements can often be identified by the words

"expects," "anticipates," "believes," "intends," "estimates" or

"plans" and similar expressions. Although Median's management

believes that these forward-looking statements are reasonable,

investors are cautioned that forward-looking statements are subject

to numerous risks and uncertainties, many of which are difficult to

predict and generally beyond the control of Median Technologies,

that could cause actual results and events to differ materially

from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include, but are not limited to, the uncertainties

inherent in research and development, future clinical data and

analysis, and decisions by regulatory authorities, Median

Technologies' ability to take advantage of external growth

opportunities and to complete related transactions and/or obtain

regulatory approvals, risks associated with intellectual property,

any future litigation in this area and the outcome of such

litigation, changes in foreign exchange rates and interest rates,

volatility in economic conditions the impact of cost containment

initiatives and changes of the same, the average number of shares

outstanding, as well as those developed or identified in the

documents available on the Median Technologies' website and in

particular the “Specific Risk Factors” section of the financial

annual report for the year ended December 31, 2023, published on

April 25, 2024. Median Technologies does not undertake to update

any forward-looking information or statements, subject to

applicable regulations, in particular Articles 223-1 et seq. of the

General Regulation of the French Autorité des Marchés

Financiers.

About Median Technologies: Pioneering innovative imaging

solutions and services, Median Technologies harnesses cutting-edge

AI to enhance the accuracy of early cancer diagnoses and

treatments. Median's offerings include iCRO, which provides medical

image analysis and management in oncology trials, and eyonis™, an

AI/ML tech-based suite of software as medical devices (SaMD).

Median empowers biopharmaceutical entities and clinicians to

advance patient care and expedite the development of novel

therapies. The French-based company, with a presence in the U.S.

and China, trades on the Euronext Growth market (ISIN:

FR0011049824, ticker: ALMDT). Median is also eligible for the

French SME equity savings plan scheme (PEA-PME). For more

information, visit www.mediantechnologies.com.

1 Imaging Contract Research Organization 2 CROs: Contract

Research Organization 3 The order backlog is the sum of orders

received but not yet fulfilled. An increase or decrease in the

order backlog corresponds to the order intake of the reporting

period, net of invoiced services, completed or cancelled contracts,

and currency impact for projects in foreign currency (re-evaluated

at the exchange rate on closing date). Orders are booked once the

customer confirms, in writing, its retention of the Company’s

services for a given project. The contract is usually signed a few

months after written confirmation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240718990412/en/

Median Technologies Emmanuelle Leygues Head of Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Press - ALIZE RP Caroline Carmagnol +33 6 64 18 99 59

median@alizerp.com

Investors - ACTIFIN Ghislaine Gasparetto +33 6 21 10 49

24 ghislaine.gasparetto@seitosei-actifin.com

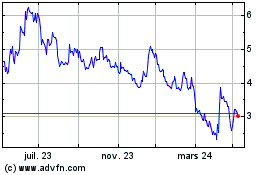

Median Technologies (EU:ALMDT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

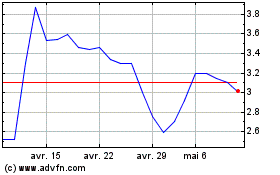

Median Technologies (EU:ALMDT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024