FY 2021 results: Sustained sales growth, in particular in the fourth quarter Profitability negatively impacted by inflation – Continued increases in sale prices

16 Février 2022 - 5:45PM

FY 2021 results: Sustained sales growth, in particular in the

fourth quarter Profitability negatively impacted by inflation –

Continued increases in sale prices

FY 2021 results:

Sustained sales growth, in particular in the fourth

quarter

Profitability negatively impacted by inflation –

Continued increases in sale prices

FY 2021 results:

- Sustained activity in Q4: revenue up strongly, by

+16.5% as compared with Q4 2020, including +6.3% due to increased

sale prices

- In 2021, net sales up by +6.0% over the fiscal year

(+6.4% at constant exchange rates and scope of

consolidation)

- Adjusted EBITDA of €229 million in 2021, or 8.2% of

sales

- Unprecedented increases in purchasing costs: €178

million as compared with 2020, in line with the estimates given in

Q3, of which €93 million offset by increases in sale

prices

- Continued structural cost reductions: €65 million in

savings in 2021, bringing the total cost reduction to €143 million

in three years, surpassing the initial objective of €120 million

over the 2019-2022 period

- Net profit of €15 million in 2021, as compared with a

loss of -€19 million in 2020

- Positive free cash flow of €20 million, despite the

increase in working capital requirement resulting from activity

levels and inflation

- Net debt stable at €476 million, controlled leverage of

2.1x adjusted EBITDA as of the end of December 2021

- Continued increases in sale prices with the objective

of neutralizing the impact of inflation on purchasing costs in

2022

Paris, February 16, 2022: The

Supervisory Board of Tarkett (Euronext Paris: FR0004188670 TKTT),

which met today, reviewed the Group’s consolidated results for the

2021 fiscal year.

- Tarkett_FY 2021_Results_EN_2021

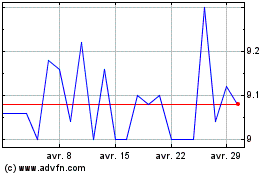

Tarkett (EU:TKTT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tarkett (EU:TKTT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024