Intermediate declaration by the

Board of Directors

Regulatory News: (Paris:XFAB)

Highlights Q2 2021:

› Revenue was USD 161.0 million, exceeding

the guidance of USD 154-160 million, up 36% year-on-year (YoY) and

up 4% quarter-on-quarter (QoQ)

› Bookings came in at USD 209.1 million

remaining at a high level, up 110% YoY and flat QoQ

› EBITDA margin of 26.9%, clearly above the

17-21% guidance

› EBITDA was USD 43.3 million, up 173% YoY

and up 22% QoQ

› EBIT was USD 24.6 million, up USD 27.4

million YoY and up USD 7.6 million QoQ

Outlook:

› Q3 2021 revenue is expected in the range of

USD 162-170 million with an EBITDA margin in the range of

18-22%.

› Full year revenue guidance has been

increased to USD 640-660 million (previously USD 610-630 million)

with an EBITDA margin in the range of 21.5-23.5% (previously

18-21%)

› The guidance is based on an average

exchange rate of 1.20 USD/Euro.

Revenue breakdown per quarter:

in millions of USD

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q2 y-o-y growth

Automotive

60.5

56.7

68.3

61.6

40.8

65.4

83.5

82.8

35%

Industrial

24.4

20.1

22.1

23.9

23.9

27.3

32.4

35.2

47%

Medical

8.8

6.3

6.5

7.3

7.7

12.0

8.7

10.4

43%

Subtotal core business

93.7

83.2

96.9

92.7

72.3

104.7

124.6

128.4

38%

71.8%

73.3%

76.4%

78.1%

75.2%

77.1%

80.1%

79.8%

CCC1

36.7

30.1

29.7

25.9

23.7

30.9

30.6

32.4

25%

Others

0.0

0.1

0.3

0.2

0.1

0.3

0.3

0.1

Total revenues

130.5

113.4

126.9

118.8

96.1

135.9

155.4

161.0

36%

1 Consumer, Communications & Computer

in millions of USD

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q2 y-o-y growth

CMOS

114.4

98.1

112.8

103.4

81.1

115.0

135.9

137.5

33%

MEMS

9.5

9.9

9.6

10.4

9.8

14.6

14.4

16.2

56%

Silicon carbide

6.5

5.5

4.5

5.0

5.2

6.3

6.1

7.2

44%

Total revenues

130.5

113.4

126.9

118.8

96.1

135.9

155.4

161.0

36%

Business development

Business continued to grow strongly throughout the second

quarter and across all end markets. Total quarterly revenues

amounted to USD 161.0 million, exceeding the guided USD 154-160

million and recording an increase of 36% year-on-year and 4%

quarter-on-quarter.

X-FAB’s core business targeting the Automotive, Industrial and

Medical markets recorded revenues of USD 128.4 million, up 38%

year-on-year and 3% quarter-on-quarter. Quarterly CCC revenues

(Consumer, Communications & Computer) came in at USD 32.4

million, corresponding to a growth of 25% year-on-year and 6%

quarter-on-quarter.

Bookings remained strong throughout the second quarter and came

in at USD 209.1 million, up 110% year-on-year and roughly at the

level of the previous quarter.

In the second quarter, demand continued to be driven by the

ongoing volume recovery following the COVID-19-related weakness in

2020 but also by adding new customers and projects, and by

transferring existing development projects into volume production.

Interest in X-FAB’s specialty technologies is strong as they enable

smart solutions which are key to address today’s societal

challenges. These include climate change with the need for greener

energy and transportation (SiC), the COVID-19 era and aging

societies with the need for fast and reliable point-of-care

diagnostics (lab-on-a-chip) or the globalized and increasingly

connected world requiring all kinds of sensor applications.

Prototyping and production revenue per quarter and end

market:

in millions

of USD

Revenue

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q2 y-o-y growth

Automotive

Prototyping

2.3

2.6

3.6

3.2

3.0

31%

Production

59.3

38.2

61.8

80.4

79.8

35%

Industrial

Prototyping

7.2

7.2

8.2

9.0

10.3

43%

Production

16.7

16.6

19.0

23.3

24.9

49%

Medical

Prototyping

3.3

3.4

6.9

2.2

2.9

-12%

Production

4.0

4.2

5.1

6.4

7.5

88%

CCC

Prototyping

2.6

2.6

3.2

4.3

4.1

57%

Production

23.3

21.0

27.7

26.3

28.3

22%

With the consistently strong order intake and factories running

at high utilization levels, the allocation of capacity to customers

had to be continued throughout the second quarter. X-FAB’s first

priority remains to ensure its customers receive minimum supply to

avoid any disruptions in their supply chain. An important part of

this effort is to move business to X-FAB France, where free

capacities are still available. In the second quarter, the share of

the French site’s revenues based on X-FAB technologies went up to

20% and is expected to increase significantly during the second

half of 2021.

The order backlog accumulated at the end of the second quarter

remains at a high level and will contribute positively to business

growth over the coming quarters.

Quarterly prototyping revenues totaled USD 20.4 million, up 31%

year-on-year and 8% quarter-on-quarter, reflecting the strong

interest in X-FAB’s technology portfolio.

Operations update

In the second quarter, X-FAB’s factories continued to run at

high utilization rates and the focus on execution excellence and

productivity improvements remained essential to ensure the best

supply to X-FAB’s customers. In light of the strong demand, X-FAB

is making every effort to ensure operations run smoothly at all

locations. This includes the hire of additional staff, activities

to secure the raw material supply but also the strict compliance

with the safety measures which are in place to prevent any

COVID-19-related disruptions.

The silicon carbide (SiC) activities progressed well and X-FAB

was able to further expand its SiC customer base and projects

pipeline mainly driven by existing customers expanding their

portfolio of offerings. Quarterly SiC bookings more than doubled

year-on-year and SiC revenues in the second quarter came in at USD

7.2 million, up 44% year-on-year and up 19% quarter-on-quarter.

Demand for X-FAB’s in-house SiC epitaxy line is also strong. About

half of X-FAB’s SiC customers are either in the process of

qualifying or already producing SiC epitaxy at X-FAB’s in-house

line. SiC epitaxy refers to the process of depositing a thin

epitaxial layer on a SiC raw wafer, which is a significant

value-add step in the overall process of manufacturing silicon

carbide semiconductors.

Capital expenditures in the second quarter amounted to USD 14.2

million, up 90% compared to the same quarter last year. The growth

in capex was mainly related to prepayments for new equipment which

was part of the investment projects initiated in the first quarter.

In the second quarter, X-FAB launched additional capex projects for

the expansion of capacity that have a total value of USD 85

million, most of which will be due for payment in 2022.

Financial update

Second quarter EBITDA was USD 43.3 million with an EBITDA margin

of 26.9%, clearly exceeding the guided 17-21%. The positive

earnings development is mainly due to the strong revenue growth.

Additionally, the inventory of unfinished and finished goods

significantly increased by USD 5.3 million, also contributing

positively to second quarter profitability.

In 2020 and in the context of a COVID-19 government support

scheme, X-FAB Texas received a loan of USD 6.5 million to secure

payroll and utility payments. Under the terms of the program, X-FAB

Texas was able to apply for loan forgiveness after having fulfilled

certain conditions regarding the retention of employees. This loan

forgiveness was approved by the authorities in June 2021. Thus, the

balance of the loan was released to income and offset against cost

of sales, which also had a positive effect on the profitability of

the second quarter. Excluding this one-off effect, EBITDA would

still have been above guidance at 22.9%.

Based on the positive business development and an expected

further increase in profitability, deferred tax assets from loss

carry forwards increased by USD 2.9 million in the second

quarter.

Cash and cash equivalents at the end of the second quarter were

at USD 205.1 million, up 5% against the end of the first

quarter.

In the second quarter, the

share of Euro-denominated sales amounted to 33%, therefore limiting

the impact of exchange rate fluctuations on profitability and

ensuring a natural hedging of the business. X-FAB will continue its

efforts to further increase the share of Euro-denominated sales up

to a level of approximately 40%, which corresponds to the share of

costs incurred in Euro.

The actual US-Dollar/Euro exchange rate for the second quarter

of 2021 was 1.20 leading to an EBITDA margin of 26.9%. At a

constant exchange rate of 1.10, as experienced in the second

quarter of last year, the EBITDA margin would have been 27.8%.

Management comments & outlook

Rudi De Winter, CEO of X-FAB Group, said: “It is a great

pleasure to see the high level of interest in our technology

offerings. All end markets we serve are performing very well and

this is not only related to the ongoing recovery after the past two

difficult years. Societies are in transformation, mainly driven by

climate change and the COVID-19 pandemic, and while the outcome is

still open, it is clear that smart technological solutions are

essential to tackle the challenges ahead of us. We, as X-FAB, take

pride in offering technologies which enable such smart solutions

and I see X-FAB well positioned for future growth. In the

short-term and in light of the challenges related to the

extraordinary demand situation, all our customers can rest assured

that their reliable supply is our first priority. Our teams across

all X-FAB sites are working very hard to deliver excellent results

and to further increase output.”

Procedures of the independent auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs

d’Entreprises BV, represented by Jos Briers, has confirmed that

their review procedures, which have been substantially completed,

have not revealed any significant matters requiring adjustment of

the condensed consolidated financial information included in this

press release as of and for the six months ended June 30, 2021.

X-FAB Quarterly Conference Call

X-FAB’s second quarter results will be discussed in a live

conference call on Thursday, July 29, 2021, at 6.30 p.m. CET. The

conference call will be in English. Please register in advance of

the conference using the following link:

http://emea.directeventreg.com/registration/2492570.

Upon registering, you will be provided with participant dial-in

numbers, Direct Event passcode and a unique registrant ID. In the

10 minutes prior to the call, you will need to use the conference

access information provided in the email received at the point of

registering.

The conference call will be available for replay from July 29,

2021, 11.30 p.m. CET until August 5, 2021, 11.30 p.m. CET. The

replay number will be +44 (0) 3333009785, conference ID

2492570.

The third quarter 2021 results will be communicated on October

28, 2021.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 to 0.13 µm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs about 4,000 people worldwide.

For more information, please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 30 Jun 2020

unaudited

Quarter

ended 31 Mar 2021

unaudited

Half-year

ended 30 Jun 2021

unaudited

Half-year

ended 30 Jun 2020

unaudited

Revenue

160,955

118,756

155,420

316,375

245,650

Revenues in USD in %

66

67

67

67

69

Revenues in EUR in %

33

32

33

33

30

Cost of sales

-119,230

-107,942

-120,419

-239,649

-220,361

Gross Profit

41,725

10,814

35,001

76,726

25,289

Gross Profit margin in %

25.9

9.1

22.5

24.3

10.3

Research and development expenses

-8,692

-5,891

-8,482

-17,174

-11,791

Selling expenses

-2,008

-2,118

-2,119

-4,127

-4,130

General and administrative expenses

-7,649

-6,992

-8,150

-15,800

-14,648

Rental income and expenses from investment

properties

668

183

627

1,295

223

Other income and other expenses

559

1,210

155

714

776

Operating profit

24,602

-2,794

17,032

41,635

-4,281

Finance income

3,470

3,410

4,283

7,753

6,909

Finance costs

-3,104

-5,260

-7,167

-10,271

-13,695

Net financial result

366

-1,850

-2,884

-2,518

-6,786

Profit before tax

24,968

-4,644

14,148

39,117

-11,067

Income tax

1,769

-1,243

-1,374

395

-1,544

Profit for the period

26,737

-5,887

12,775

39,512

-12,611

Operating profit (EBIT)

24,602

-2,794

17,032

41,635

-4,281

Depreciation

18,718

18,657

18,551

37,269

37,488

EBITDA

43,320

15,863

35,583

78,903

33,207

EBITDA margin in %

26.9

13.4

22.9

24.9

13.5

Earnings per share at the end of

period

0.20

-0.05

0.10

0.30

-0.10

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.20429

1.10006

1.20628

1.20528

1.10140

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Quarter ended 30 Jun 2021

unaudited

Quarter ended

30 Jun 2020

unaudited

Year ended

31 Dec 2020

audited

ASSETS

Non-current assets

Property, plant, and equipment

325,812

350,156

336,848

Investment properties

8,265

8,843

8,556

Intangible assets

4,807

4,988

4,726

Other non-current assets

48

7,729

68

Deferred tax assets

33,223

33,248

30,392

Total non-current assets

372,156

404,964

380,590

Current assets

Inventories

162,235

165,268

153,711

Trade and other receivables

66,994

48,442

54,576

Other assets

48,641

35,106

38,054

Cash and cash equivalents

205,109

191,636

205,867

Total current assets

482,979

440,451

452,208

TOTAL ASSETS

855,135

845,415

832,798

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

-80,465

-146,823

-120,603

Cumulative translation adjustment

-594

-582

-747

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

699,626

633,279

659,334

Non-controlling interests

341

365

344

Total equity

699,967

633,644

659,677

Non-current liabilities

Non-current loans and borrowings

34,899

82,753

44,413

Other non-current liabilities and

provisions

4,241

7,407

4,371

Total non-current liabilities

39,140

90,159

48,784

Current liabilities

Trade payables

26,809

27,778

27,882

Current loans and borrowings

24,321

30,875

31,796

Other current liabilities and

provisions

64,898

62,958

64,658

Total current liabilities

116,029

121,611

124,336

TOTAL EQUITY AND LIABILITIES

855,135

845,415

832,798

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 30 Jun 2020

unaudited

Quarter

ended 31 Mar 2021

unaudited

Half-year

ended 30 Jun 2021

unaudited

Half-year

ended 30 Jun 2020

unaudited

Income before taxes

24,968

-4,644

14,148

39,117

-11,067

Reconciliation of net income to cash

flow arising from operating activities:

12,079

18,427

21,592

33,670

44,649

Depreciation and amortization, before

effect of grants and subsidies

18,718

18,657

18,551

37,269

37,488

Recognized investment grants and subsidies

netted with depreciation and amortization

-848

-851

-841

-1,689

-1,752

Interest income and expenses (net)

-117

1,114

-122

-240

1,632

Loss/(gain) on the sale of plant,

property, and equipment (net)

-280

-34

-112

-392

-315

Loss/(gain) on the change in fair value of

derivatives (net) and financial assets (net)

0

0

0

0

-420

Other non-cash transactions (net)

-5,393

-458

4,116

-1,277

8,016

Changes in working capital:

-12,864

16,687

-20,195

-33,059

11,032

Decrease/(increase) of trade

receivables

-943

15,547

-11,293

-12,236

6,617

Decrease/(increase) of other receivables

& prepaid expenses

-6,055

3,107

-5,499

-11,554

15,276

Decrease/(increase) of inventories

-6,055

-4,984

-2,469

-8,524

-10,620

(Decrease)/increase of trade payables

-126

-4,950

526

400

-8,499

(Decrease)/increase of other

liabilities

316

7,967

-1,460

-1,144

8,257

Income taxes (paid)/received

-14

-92

-1,733

-1,747

-720

Cash Flow from operating

activities

24,169

30,379

13,812

37,981

43,895

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-14,216

-7,492

-9,702

-23,917

-17,094

Proceeds from sale of financial assets

0

0

0

0

1,156

Payments for loan investments to related

parties

-38

-42

-91

-129

-138

Proceeds from loan investments related

parties

45

51

80

125

113

Proceeds from sale of property, plant, and

equipment

285

40

117

402

318

Interest received

468

475

471

938

970

Cash Flow used in investing

activities

-13,456

-6,967

-9,125

-22,582

-14,674

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 30 Jun 2020

unaudited

Quarter

ended 31 Mar 2021

unaudited

Half-year

ended 30 Jun 2021

unaudited

Half-year

ended 30 Jun 2020

unaudited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

4,479

8,813

0

4,479

8,813

Repayment of loans and borrowings

-4,231

-6,547

-7,619

-11,850

-12,938

Payments of lease installments

-1,529

-1,453

-1,174

-2,702

-2,811

Receipt of government grants and

subsidies

0

0

0

0

696

Interest paid

-350

-260

-348

-698

-442

Distribution to non-controlling

interests

0

0

-12

-12

-12

Cash Flow from (used in) financing

activities

-1,630

553

-9,153

-10,783

-6,693

Effect of changes in foreign currency

exchange rates on cash

217

1,084

-5,591

-5,374

-4,102

Increase/(decrease) of cash and cash

equivalents

9,083

23,965

-4,466

4,617

22,527

Cash and cash equivalents at the beginning

of the period

195,810

166,587

205,867

205,867

173,211

Cash and cash equivalents at the end

of

the period

205,109

191,636

195,810

205,109

191,636

###

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210729005852/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

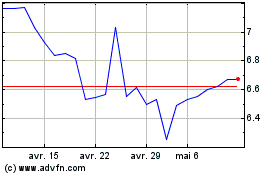

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024