Pound Weakens After Soft U.K. Inflation Data

20 Mars 2024 - 11:53AM

RTTF2

The pound fell against its most major counterparts in the

European session on Wednesday, as UK consumer price inflation

weakened in February to the lowest since 2021.

The consumer price index registered an annual growth of 3.4

percent, slower than the 4.0 percent rise in January. The rate was

the lowest since September 2021. Prices were expected to climb 3.5

percent.

On a monthly basis, consumer prices gained 0.6 percent,

offsetting January's 0.6 percent fall.

Core inflation that excludes energy, food, alcohol and tobacco

weakened to 4.5 percent from 5.1 percent in the previous month. The

rate was seen at 4.6 percent.

Data showed that output prices grew 0.4 percent on a yearly

basis, in contrast to the 0.3 percent fall in January. Prices were

expected to ease 0.1 percent.

At the same time, input prices dropped 2.7 percent in February,

as expected, following a revised 2.8 percent decrease a month

ago.

Month-on-month, producer input prices fell 0.4 percent and

output prices gained 0.3 percent in February.

The pound reached as low as 1.2684 against the greenback. If the

currency falls further, it is likely to test support around the

1.24 region.

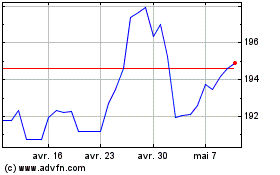

The pound eased to 1.1298 against the franc and 192.29 against

the yen, from an early multi-month high of 1.1323 and a multi-year

high of 192.85, respectively. The pound is seen finding support

around 1.11 against the franc and 183.00 against the yen.

In contrast, the pound was trading at 0.8539 against the euro,

up from an early 2-day low of 0.8558. Next key resistance for the

currency may be located around the 0.84 level.

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024