U.S. Dollar Higher As Fed Meeting Nears

19 Septembre 2022 - 10:06AM

RTTF2

The U.S. dollar advanced against its major counterparts during

European deals on Monday, as investors awaited the Federal

Reserve's interest rate decision due this week amid expectations

for another super-sized hike to fight inflation.

The Federal Reserve will announce its interest rate decision on

Wednesday, with investors expecting a 0.75 percentage point rate

hike for the third consecutive meeting.

Apart from the Fed, market participants will focus on central

bank meetings in Japan, U.K. and the Switzerland.

European markets fell on concerns about more aggressive rate

hikes by major central banks and its impact on global growth.

U.S. treasury yields rose, with the benchmark 2-year yield

touching 3.925 percent. Yields move opposite to bond prices.

The greenback touched a 10-day high of 0.9696 against the franc.

The greenback may locate resistance near the 0.98 area.

The greenback was up against the loonie, at nearly a 2-year high

of 1.3324. Next key resistance for the greenback is seen around the

1.35 region.

The greenback edged up to 1.1355 against the pound and 0.9966

against the euro, off its early lows of 1.1442 and 1.0029,

respectively. The greenback is seen finding resistance around 1.11

against the pound and 0.97 against the euro.

The greenback rose to 0.5942 against the kiwi and 0.6672 against

the aussie, up from its previous 4-day lows of 0.6002 and 0.6734,

respectively. The greenback is likely to challenge resistance

around 0.57 against the kiwi and 0.64 against the aussie.

The greenback reversed from an early 5-day low of 142.64 against

the yen and climbed to 143.57. If the greenback climbs further,

145.00 is likely seen as its next resistance level.

Looking ahead, Canada industrial product and raw materials price

indexes for August and U.S. NAHB housing market index for September

will be released in the New York session.

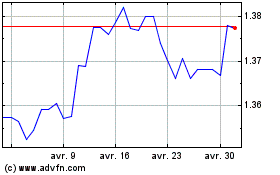

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024