TIDMCML

RNS Number : 7158G

CML Microsystems PLC

11 June 2013

CML Microsystems Plc

PRELIMINARY RESULTS

Organic Growth Generates Record Operating Profit

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductor products, primarily for the

global communication and data storage markets, announces

Preliminary Results for the year ended 31 March 2013.

Financial Highlights

-- Group revenues up 8% to GBP25.24m (2012: GBP23.41m)

-- Gross profit up 8% to GBP17.56m (2012: GBP16.21m)

-- Profit before tax up 28% to GBP5.07m (2012: GBP3.95m)

-- Basic EPS up 22% to 25.59p (2012: 21.06p)

-- Net cash inflow GBP3.74m (2012: GBP2.92m)

-- Cash reserves of GBP9.32m (2012: GBP7.74m)

-- Net cash of GBP8.98m (2012: GBP5.24m)

-- Final dividend increased 37.5% to 5.5p (2012: 4p)

Operational Highlights

-- Storage: 46% of group revenue

- Revenues from solid state storage market up 6.5% to GBP11.55m (2012: GBP10.84)

- CAGR of 23% over the last 5 years

- Volume shipments of the Group's SATA controller commenced in Q4

-- Wireless: 39% of group revenues

- Product revenues grew by approximately 14% to GBP9.80m (2012: GBP8.60)

- CAGR of 8% over the last 5 years

- Multi-chip strategy gaining customer adoption

-- Wireline telecom: 11% of group revenues

- Product revenues slightly decreased to GBP2.68m (2012:GBP2.78m)

- Gross margin increased resulting in maintained profit

- Underlying overall trend is one of stability for the segment

Post Period End Events

The Board has taken the decision to close its equipment segment

comprising of Radio Data Technology Ltd (RDT) due to declining

revenues and increasing losses for the year to 31 March 2013. The

equipment segment represented approximately 2% of Group revenues

with an operating loss of GBP383k for the reported period. An

orderly closure is expected, which will result in a positive impact

on the profitability of the Group going forward despite exit

costs.

Chris Gurry, Managing Director of CML, said: "The results serve

to highlight the very positive effects we are seeing from

progressive revenue growth built on the foundations of a stable

cost base and a focussed product strategy with high technical

barriers to entry. The Group's two main semiconductor market

sectors, storage and wireless, each posted solid revenue gains as

the products emanating from our multi-year research and development

activities gained traction with customers.

"Overall, the Group expects to make further firm progress in

profitability during the coming year."

CML Microsystems plc www.cmlmicroplc.com

Chris Gurry, Managing Director Tel: 01621 875 500

Nigel Clark, Financial Director

SP Angel Corporate Finance LLP Tel: 020 3463 2260

Jeff Keating

Cenkos Securities plc Tel: 020 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate Finance)

Walbrook PR Ltd Tel: 020 7933 8780

Paul McManus paul.mcmanus@walbrookpr.com

Helen Westaway helen.westaway@walbrookpr.com

Chairman's Statement

Introduction

I am pleased to report that the results for the full year to 31

March 2013 demonstrate a further clear performance improvement in

the Group's trading position against the continued backdrop of

economic uncertainty.

Particular encouragement can be drawn from the positive sales

gains that were posted in the two principal market areas of storage

and wireless and from the increased adoption of the Group's

expanded product range. The Operating and Financial review makes

clear the details.

The firm uplift in trading profitability in conjunction with

diligent cost management practices pushed net cash reserves higher

and serves to satisfy the confidence reported by the Board at the

interim stage.

Results

To summarise the results, Group revenues for the year just ended

were GBP25.24m (2012: GBP23.41m) while gross profit was GBP17.56m

(2012: GBP16.21m). A profit before tax of GBP5.07m compares to the

previous year's profit of GBP3.95m.

The Group generated GBP3.74m of cash and further enhanced its

net cash position to GBP8.98m (2012: GBP5.24m). Diluted earnings

per share increased by 20% to 25.18p (2012: 20.94p).

Dividend

Your directors believe that shareholders should receive

appropriate benefit according to the performance of their Company.

Having considered the trading improvement made along with the

current outlook, the Board is recommending payment of a final

dividend of 5.5p per ordinary share (2012: 4.0p per ordinary share)

to be paid on 2 August 2013 to all shareholders whose names appear

on the register at close of business on 20 June 2013.

Property

Efforts directed at realising both income and capital value from

the Group's non-operational property assets continued through the

year. Almost all industrial properties are now let to tenants and

the potential to further develop the Group's headquarters site in

Langford, Essex, is the subject of an on-going planning application

appeal process.

Equipment Segment

The Board has taken the decision to exit from the Group's loss

making equipment segment, Radio Data Technology Ltd (RDT). For the

year to 31 March 2013, RDT posted revenues of GBP590k and recorded

a trading loss of GBP383k. The exit of this business segment is

scheduled to be completed during the first half of the current

financial year.

Prospects

There is no doubt that the continuing economic uncertainty

remains a concern for most global companies. That said, the

evidence at this stage is for further profitable growth by your

Company through the year ahead and, subject to unforeseen

circumstances, I am confident that my expectations will be

realised.

In concluding, I would like to once again express the Board's

thanks to our worldwide employee base for their skills, the

dedication they show and their on-going commitment towards the

Group's success.

G W Gurry

Chairman

10 June 2013

Operating and financial review

Overview

The 12 month trading period to 31 March 2013 represented another

year of firm progress for the Group as a whole as we continued to

execute our sustainable growth strategy.

With a clear focus on industrial application areas, our policy

has been to combine our resources and proprietary technology

together with an intimate knowledge of the target market

applications to develop class-leading semiconductor products. These

products typically address difficult-to-solve customer problems

linked to technical performance and cost.

The Group's two main semiconductor market sectors, storage and

wireless, each posted solid revenue gains as the products emanating

from our multi-year research and development activities gained

traction with customers.

The following results serve to highlight the very positive

effects we are seeing from progressive revenue growth built on the

foundations of a stable cost base and a focussed product strategy

with high technical barriers to entry.

Financial results

Overall Group revenues for the year ended 31 March 2013 grew by

almost 8% to GBP25.24m (2012: GBP23.41m) driven once again by

improved sales of semiconductors into the storage and wireless

equipment sectors. The Group's equipment segment, Radio Data

Technology, posted a disappointing fall in sales to GBP590k (2012:

GBP759k). Revenues from the semiconductor segment alone were

GBP24.65m against a prior year comparable of GBP22.65m representing

growth of just under 9%.

Whilst the majority of customer transactions were denominated in

US Dollars, the Group had exposure to a number of foreign

currencies throughout the year. The effects of foreign exchange

recognised in the income statement amounted to a profit GBP219k

(2012: profit GBP160k).

Gross profit recorded was GBP17.56m representing an increase of

over to 8% against the prior year (2012: GBP16.21m) and the overall

gross margin remained stable at 69%.

The figure recorded for the Group's distribution and

administration expenses shows an overall reduction to GBP12.74m

from GBP13.05m in the previous year. The main reason for the

comparative decrease is a reduction in the amortisation of

development costs to GBP2.52m (2012: GBP2.94m). A constant

amortisation charge year on year would have seen overall expenses

at GBP13.17m which is a better reflection of the fact that real

costs increased over the period.

At the operating level, and prior to the effects of other

operating income, profits rose by 52% to GBP4.82m (2012: GBP3.16m)

representing a record achievement for the Group.

Other operating income consists mainly of EU grant funding and

rental income from Group-owned industrial properties that are

surplus to operational requirements. The level of EU funding

reduced from GBP206k in 2012 to GBP71k this year whilst the level

of rental income also fell to GBP117k (GBP2012: GBP166k) reflecting

the lack of a full year contribution from new tenants.

The Group's improved cash position led to net finance income of

GBP25k (2012 net expense of GBP30k) excluding pensions effects.

Profit before taxation rose by 28% to total GBP5.07m (2012:

GBP3.95m).

The Group generated a healthy level of cash through the year.

Net cash inflow was GBP3.74m (2012: GBP2.92m) following payment of

a GBP631k dividend (2012: GBP550k) relating to the prior financial

year and a decrease in bank loans and short term borrowings of

GBP2.16m. At 31 March 2013 cash reserves stood at GBP8.98m (2012:

GBP5.24m) and bank loans and overdrafts had reduced to GBP338k

(2012: GBP2.50m).

Inventory levels were well managed through the year and closed

at GBP1.69m, slightly down on the prior year end position of

GBP1.78m.

Total research and development expenses reduced to GBP3.75m

(2012: GBP4.59m). Of this, an amount of GBP698k (2012: GBP1.07m)

was written off through the consolidated income statement. Internal

development costs increased from GBP2.47m in 2012 to GBP2.75m this

year but a large decrease in external expenditure with third party

partners to GBP302k (2012: GBP1.05m) produced an overall

decline.

Income tax expense amounted to GBP1.02m against a prior year

expense of GBP633k. The change was largely attributable to deferred

tax movements and equated to an effective tax rate of 20% (2012:

16%) being recorded.

This year, the income statement benefited from a small

improvement associated with pensions accounting under IAS 19 and

distribution and administration costs fell by GBP158k as a result.

However, there was a material adverse effect on the Group's balance

sheet due to the liability associated with the Group's defined

benefit pension scheme that has been closed to new entrants and

future accruals for many years. The deficit now stands at GBP6.12m

(2012: GBP4.54m).

This substantial increase in the Group's retirement benefit

obligation is attributable to a number of factors but the one

significant variable that contributes is that of the discount rate

applied. The scheme actuary, in keeping with current practice, has

reduced the discount rate used from 4.80% in 2012 to 4.25% this

year. As a comparison, in our 2008 report and accounts the rate

used was 6.70%. Whilst it is impossible to predict future discount

rates, the effect of this one variable is clearly visible when

considering that if the 2008 discount rate was applied this year,

the scheme would be significantly in surplus.

In the year to 31 March 2013 the overall performance of the

investments in the pension fund exceeded the predictions made by

the actuary in the previous annual report and the Company made

additional contributions in accordance with the agreed deficit

reduction plan.

Markets review

Storage

During the year under review, revenues from the shipment of

flash memory controller integrated circuits (IC's) into the solid

state storage market increased by 6.5% to GBP11.55m year on year

(2012: GBP10.84m). This represented 46% of total Group revenues and

equated to a five year compound annual growth rate (CAGR) of 23%.

The main contributing growth factor was the increase in shipment

volumes. Average selling prices were fractionally ahead of the

prior year as a result of product mix.

The majority of semiconductors sold into this category contained

a PATA host interface and were used within industrial compact flash

card applications amongst many of the top networking and telecom

equipment manufacturers. Meaningful deliveries of industrial SD

controllers were also made to address the growing trend within

certain applications to utilise this form factor. Production

quantity shipments of the Group's first SATA controller commenced

during the final quarter of the year to initial lead customers

developing CFast and other industry standard SATA SSD form

factors.

The Group had only one customer accounting for more than 10% of

overall revenues. The contribution to revenue from this customer

was 13.5% (2012: 10.5%).

Following full production release of the SATA controller during

the year, engineering resources focussed on the development of next

generation solutions that will integrate updated and alternative

host interface technologies. A key objective is to also ensure high

levels of compatibility with the third party NAND flash memory

technology that is expected to dominate our end markets over the

coming years. It is expected that the first of these products, a

next generation SD controller, will be sampled to customers during

the summer months.

Wireless

Wireless product revenues grew by approximately 14% to a total

of GBP9.80m (2012: GBP8.60) and represented close to 39% of overall

group sales. Average selling prices remained stable with the growth

being delivered through higher shipment quantities. Across the

prior five full financial years, the Group has achieved a CAGR of

8% in revenue terms for the wireless sector.

Only three of the Group's top twenty wireless customers failed

to increase their spend year on year and no single customer

accounted for more than 6% of total Group revenues.

The product mix was dominated by the shipment of analogue and

digital baseband processing IC's for voice centric analogue and

digital two-way radio sub-markets as well as a strong year of

growth from the Group's complementary high performance radio

frequency (RF) products. The revenue levels from legacy

semiconductors targeted at data specific application areas was

slightly down but progress with newer higher speed products that

interface to the RF portfolio was encouraging. The year under

review demonstrated that our strategy for developing high

performance multi-chip wireless solutions has started to deliver

meaningful revenue growth.

The potential exists for contractual volatility within certain

public safety wireless applications as was evidenced by the

contrasting revenues between the first six month period and the

second half. The relative effects of this are expected to diminish

over time as a growing number of customers enter production using

Group multi chip solutions.

Engineering development activities were directed at expanding

the functionality and performance of the RF product range, ensuring

our configurable FirmASIC technology is optimised for future

performance and cost requirements and for developing next

generation connectivity IC's for digital radio standards.

Wireline telecom

The sales recorded from wireline telecom semiconductors as a

whole were slightly down at GBP2.68m (2012: GBP2.78m) representing

11% of group revenues. This follows from the two prior years where

revenue gains of 6% (2012) and 13% (2011) were posted. There was no

impact at the gross profit level due to product mix.

The main reason for the reduction was lower value shipments into

Chinese point of payment terminals. Apart from this one application

area there was a measurable increase in sales across the other

wireline telecom application areas. A healthy level of customer

design activity surrounds the wireline modem product family and the

underlying overall trend is one of stability in this sector.

Engineering activities remained focussed on ensuring that the

telecom product range is price and performance competitive for the

sub-markets addressed and that the Group can continue to benefit

from the low rates of product obsolescence that customers associate

with the CML name.

Equipment

The Chairman's report highlighted the disappointing performance

from Radio Data Technology (RDT), which represents the Group's

equipment segment. Revenues dropped to GBP590k from GBP759k in the

prior year and contributed 2% to overall Group revenues. The

segment posted a loss of GBP383k compared to a loss of GBP55k in

the prior year.

The traditional wireless markets addressed by RDT have suffered

from a downturn associated with the global economic volatility of

the last few years whilst a trend amongst the customers to use more

recent technologies has not played to the company's historical

technical strengths.

The Board decided to take appropriate action to address the

negative effect of RDT's trading on the Group's performance and

this has culminated in an exit from the business being agreed.

An orderly closure of the company has been initiated which is

expected to be completed during the first six months trading period

of the current financial year to 31 March 2014. Thereafter, the

Group's sole reporting segment will be semiconductors.

Summary and outlook

One of the priorities reported in the 2012 Operating and

Financial Review, was to drive increased sales revenues by

focussing on multi-year sustainable end market opportunities. Given

the niche nature of the markets addressed, and the lengthy customer

design and qualification periods that are prevalent, this on-going

process will take time. Nevertheless, the trading performance

reported for the year highlights the advances that are being

made.

The record profit posted at the Operating level was a pleasing

result as was the recorded increase in net cash reserves. This

performance comes whilst we continue to invest in class leading

semiconductors for our storage and wireless market areas, expand

our valuable engineering resources and look to enhance financial

resources further by capitalising on our non-operational property

assets.

A consistent level of engineering expenditure targeted at

standard product offerings has led to good levels of new customer

design-in opportunities. The Group's internal and external selling

resources are focussed on positioning us appropriately with those

companies that are or will be the leading equipment manufacturers

of the future in each of the focus end markets. This is a key

requirement to drive sustainable growth.

Within the industrial storage markets addressed, flash memory

controller technology is key to the performance required by some of

the world's most demanding manufacturers. The market is growing as

more and more applications switch to solid state storage and away

from traditional hard disk technology.

Revenues to date have largely been derived from the sale of

controllers into compact flash applications with relatively small

contribution from SD controllers. The year ahead will be the first

full year that the Group can benefit from a production ready SATA

controller and through the year ahead we aim to expand the product

range further.

For the wireless markets addressed there are a number of drivers

that are expected to deliver increasing revenues through the years

ahead. The gradual migration of the analogue radio technology

within two-way radio applications to the newer digital standards

has started and the move to higher data rates within the narrowband

wireless data end markets is also underway. As already reported,

the Group's RF product range is expanding and customers are

increasingly adopting Group multi-chip solutions.

During April 2013, the Group announced the expansion of its UK

engineering team with the opening of a design office in Sheffield,

England. The integration of this team is proceeding according to

plan. As reported at the time, the combined capabilities of the

enlarged development group will enable us to expand our wireless

product roadmap to capitalise on a wider range of growth

opportunities.

For the year ahead we expect additional revenue growth although

the exit of the equipment segment will lead to 2013 revenues being

restated within the income statement next year. At the operating

level, the higher expenses associated with the expansion of our

engineering team will be partially offset by the reduction in

operating expenses from the equipment segment.

Overall, the Group expects to make further firm progress in

profitability during the coming year as we make the transition to a

fully focussed semiconductor operation.

The Board is pleased with the positive developments made through

the course of the year and looks forward to delivering increased

shareholder value for the full year to 31 March 2014.

C A Gurry

Managing Director

10 June 2013

Consolidated income statement

for the year ended 31 March 2013

Unaudited Audited

2013 2012

GBP GBP

---------------------------------------------------- ------------ ------------

Continuing operations

Revenue 25,237,939 23,409,402

Cost of sales (7,673,852) (7,196,586)

---------------------------------------------------- ------------ ------------

Gross profit 17,564,087 16,212,816

Distribution and administration costs (12,742,667) (13,050,186)

---------------------------------------------------- ------------ ------------

4,821,420 3,162,630

Other operating income 296,547 458,745

---------------------------------------------------- ------------ ------------

Profit from operations 5,117,967 3,621,375

Share-based payments (101,525) (63,255)

---------------------------------------------------- ------------ ------------

Profit after share-based payments 5,016,442 3,558,120

Net profit on properties sold or revalued - 328,143

Finance costs (34) (38,514)

Finance income 54,668 101,780

---------------------------------------------------- ------------ ------------

Profit before taxation 5,071,076 3,949,529

Income tax expense (1,016,895) (633,251)

---------------------------------------------------- ------------ ------------

Profit after taxation attributable to equity owners

of the parent 4,054,181 3,316,278

---------------------------------------------------- ------------ ------------

Profit per share

Basic 25.59p 21.06p

---------------------------------------------------- ------------ ------------

Diluted 25.18p 20.94p

---------------------------------------------------- ------------ ------------

Consolidated statement of comprehensive income

for the year ended 31 March 2013

Unaudited Unaudited Audited Audited

2013 2013 2012 2012

GBP GBP GBP GBP

------------------------------- ----------- ----------- ----------- -----------

Profit for the year 4,054,181 3,316,278

Other comprehensive income,

net of tax

Foreign exchange differences 180,620 6,432

Actuarial loss on retirement

benefit obligations (1,768,000) (1,962,000)

Deferred tax on actuarial

losses 406,640 457,840

------------------------------- ----------- ----------- ----------- -----------

Other comprehensive income

for the year net of taxation

attributable to equity owners

of the parent (1,180,740) (1,497,728)

------------------------------- ----------- ----------- ----------- -----------

Total comprehensive income

for the year 2,873,441 1,818,550

------------------------------- ----------- ----------- ----------- -----------

Consolidated statement of financial position

for the year ended 31 March 2013

Unaudited Unaudited Audited Audited

2013 2013 2012 2012

GBP GBP GBP GBP

---------------------------------- --------- ---------- --------- ----------

Assets

Non-current assets

Property, plant and equipment 5,094,035 5,155,713

Investment properties 3,450,000 3,450,000

Development costs 4,674,421 4,153,659

Goodwill 3,512,305 3,512,305

Deferred tax asset 2,737,409 2,731,219

---------------------------------- --------- ---------- --------- ----------

19,468,170 19,002,896

Current assets

Inventories 1,692,599 1,780,688

Trade receivables and prepayments 2,522,168 1,566,207

Current tax assets 138,720 135,241

Cash and cash equivalents 9,322,957 7,742,038

---------------------------------- --------- ---------- --------- ----------

13,676,444 11,224,174

Non-current assets classified

as held for sale properties 109,977 104,519

---------------------------------- --------- ---------- --------- ----------

Total assets 33,254,591 30,331,589

---------------------------------- --------- ---------- --------- ----------

Liabilities

Current liabilities

Bank loans and overdrafts 338,267 2,500,431

Trade and other payables 3,308,282 2,603,646

Current tax liabilities 56,851 102,034

---------------------------------- --------- ---------- --------- ----------

3,703,400 5,206,111

Non-current liabilities

Deferred tax liabilities 2,063,299 1,672,425

Retirement benefit obligation 6,122,000 4,542,000

---------------------------------- --------- ---------- --------- ----------

8,185,299 6,214,425

---------------------------------- --------- ---------- --------- ----------

Total liabilities 11,888,699 11,420,536

---------------------------------- --------- ---------- --------- ----------

Net assets 21,365,892 18,911,053

---------------------------------- --------- ---------- --------- ----------

Capital and reserves attributable

to equity owners of the parent

Share capital 793,630 788,117

Share premium 4,977,531 4,872,587

Share-based payments reserve 171,199 108,085

Foreign exchange reserve 513,532 332,912

Accumulated profits 14,910,000 12,809,352

---------------------------------- --------- ---------- --------- ----------

Shareholders' equity 21,365,892 18,911,053

---------------------------------- --------- ---------- --------- ----------

Consolidated cash flow statement

for the year ended 31 March 2013

Unaudited Audited

2013 2012

GBP GBP

--------------------------------------------------- ----------- -----------

Operating activities

Net profit for the year before taxation 5,071,076 3,949,529

Adjustments for:

Depreciation 241,546 213,394

Amortisation of development costs 2,517,374 2,944,039

Revaluation of investment properties/properties

held for sale - 68,847

Movement in pensions deficit (188,000) 66,000

Share-based payments 101,525 63,255

Finance costs 34 38,514

Finance income (24,668) (6,780)

Increase in working capital (163,686) (492,187)

--------------------------------------------------- ----------- -----------

Cash flows from operating activities 7,555,201 6,844,611

Income tax paid (70,620) (398,274)

--------------------------------------------------- ----------- -----------

Net cash flows from operating activities 7,484,581 6,446,337

--------------------------------------------------- ----------- -----------

Investing activities

Purchase of property, plant and equipment (179,448) (145,077)

Investment in development costs (3,048,481) (3,518,010)

Disposal of property, plant and equipment 450 9,039

Disposal of assets held for sale - 668,590

Finance income 24,668 6,780

--------------------------------------------------- ----------- -----------

Net cash flows from investing activities (3,202,811) (2,978,678)

--------------------------------------------------- ----------- -----------

Financing activities

Issue of ordinary shares 110,457 55,283

Dividend paid to shareholders (630,584) (549,938)

Finance costs (34) (38,514)

Decrease in bank loans and short-term

borrowings (2,162,164) (1,418,980)

--------------------------------------------------- ----------- -----------

Net cash flows from financing activities (2,682,325) (1,952,149)

--------------------------------------------------- ----------- -----------

Increase/(Decrease) in cash and cash

equivalents 1,599,445 1,515,510

--------------------------------------------------- ----------- -----------

Movement in cash and cash equivalents:

At start of year 7,742,038 6,245,694

Increase in cash and cash equivalents 1,599,445 1,515,510

Effects of exchange rate changes (18,526) (19,166)

--------------------------------------------------- ----------- -----------

At end of year 9,322,957 7,742,038

--------------------------------------------------- ----------- -----------

Consolidated statement of changes in equity

for the year ended 31 March 2013

Share Share Share-based Foreign exchange Accumulated

capital premium payments reserve profits Total

Audited GBP GBP GBP GBP GBP GBP

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

At 31 March 2011 785,335 4,820,086 297,886 326,480 11,294,116 17,523,903

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Profit for year 3,316,278 3,316,278

Other comprehensive income net of

taxes

Foreign exchange differences 6,432 6,432

Net actuarial loss recognised directly

to equity (1,962,000) (1,962,000)

Deferred tax on actuarial losses 457,840 457,840

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Total comprehensive income for year - - - 6,432 1,812,118 1,818,550

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

785,335 4,820,086 297,886 332,912 13,106,234 19,342,453

Transactions with owners in their

capacity as owners

Issue of ordinary shares 2,782 52,501 55,283

Dividend paid (549,938) (549,938)

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Total transactions with owners in

their capacity as owners 2,782 52,501 - - (549,938) (494,655)

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Share-based payments in year 63,255 63,255

Cancellation/transfer of share-based

payments (253,056) 253,056 -

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

At 31 March 2012 788,117 4,872,587 108,085 332,912 12,809,352 18,911,053

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Unaudited

Profit for year 4,054,181 4,054,181

Other comprehensive income net of

taxes

Foreign exchange differences 180,620 180,620

Net actuarial loss recognised directly

to equity (1,768,000) (1,768,000)

Deferred tax on actuarial losses 406,640 404,640

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

Total comprehensive income for year - - - 180,620 (1,361,360) (1,182,740)

--------------------------------------- -------- --------- ----------- ---------------- ----------- -----------

788,117 4,872,587 108,085 513,532 15,502,173 21,784,494

Transactions with owners in their

capacity as owners

Issue of ordinary shares 5,513 104,944 110,457

Dividend paid (630,584) (630,584)

------------------------------------- ------- --------- -------- ------- ---------- ----------

Total transactions with owners in

their capacity as owners 5,513 104,944 - - (630,584) (520,127)

------------------------------------- ------- --------- -------- ------- ---------- ----------

Share-based payments in year 101,525 101,525

Cancellation/transfer of share-based

payments (38,411) 38,411 -

------------------------------------- ------- --------- -------- ------- ---------- ----------

At 31 March 2013 793,630 4,977,531 171,199 513,532 14,910,000 21,365,892

------------------------------------- ------- --------- -------- ------- ---------- ----------

Notes to the financial statements

1. Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

Information about revenue, profit/loss, assets and

liabilities

Unaudited Audited

2013 2012

--------------------------------------- --------------------------------------

Semiconductor Semiconductor

Equipment components Group Equipment components Group

GBP GBP GBP GBP GBP GBP

------------------------ --------- ------------- ------------ --------- ------------- ------------

Revenue

By origination 589,919 40,493,752 41,083,671 758,700 38,245,773 39,004,473

Inter-segmental

revenue - (15,845,732) (15,847,732) - (15,595,071) (15,595,071)

------------------------ --------- ------------- ------------ --------- ------------- ------------

Total segmental

revenue 589,919 24,648,020 25,237,939 758,700 22,650,702 23,409,402

------------------------ --------- ------------- ------------ --------- ------------- ------------

Segmental result (383,207) 5,399,649 5,016,442 (55,474) 3,613,594 3,558,120

--------- ------------- --------- -------------

Net profit on

properties sold

or revalued - 328,143

Finance expense (34) (38,514)

Finance income 54,688 101,780

Income tax (1,016,895) (633,251)

------------------------ --------- ------------- ------------ --------- ------------- ------------

Profit after

taxation 4,054,181 3,316,278

------------------------ --------- ------------- ------------ --------- ------------- ------------

Assets and liabilities

Segmental assets 273,128 26,545,357 26,818,485 610,697 23,299,913 23,910,610

--------- ------------- --------- -------------

Unallocated

corporate assets

Investment properties 3,450,000 3,450,000

Properties held

for sale 109,977 104,519

Deferred taxation 2,737,409 2,731,219

Current tax

receivable 138,720 135,241

------------------------ --------- ------------- ------------ --------- ------------- ------------

Consolidated

total assets 33,254,591 30,331,589

------------------------ --------- ------------- ------------ --------- ------------- ------------

Segmental liabilities 228,325 3,079,957 3,308,282 182,761 2,420,885 2,603,646

--------- ------------- --------- -------------

Unallocated

corporate liabilities

Deferred taxation 2,063,299 1,672,425

Current tax

liability 56,851 102,034

Bank loans and

overdrafts 338,267 2,500,431

Retirement benefit

obligation 6,122,000 4,542,000

----------------------- ---------- ----------

Consolidated

total liabilities 11,888,699 11,420,536

----------------------- ---------- ----------

Other segmental information

Unaudited Audited

2013 2012

----------------------------------- -----------------------------------

Semiconductor Semiconductor

Equipment components Group Equipment components Group

GBP GBP GBP GBP GBP GBP

------------------------- --------- ------------- --------- --------- ------------- ---------

Property, plant

and equipment additions - 179,448 179,448 4,068 141,009 145,077

------------------------- --------- ------------- --------- --------- ------------- ---------

Development cost

additions 58,964 2,989,517 3,048,481 78,352 3,439,658 3,518,010

------------------------- --------- ------------- --------- --------- ------------- ---------

Depreciation 1,120 240,426 241,546 5,925 207,469 213,394

------------------------- --------- ------------- --------- --------- ------------- ---------

Amortisation 171,073 2,346,301 2,517,374 73,840 2,870,199 2,944,039

------------------------- --------- ------------- --------- --------- ------------- ---------

Other non-cash

expenditure/(income) - 188,000 188,000 - (41,848) (41,848)

------------------------- --------- ------------- --------- --------- ------------- ---------

Inter-segmental transfers or transactions are entered into under

commercial terms and conditions appropriate to the location of the

business entity whilst considering that the parties are related. It

is the director's intention to exit the equipment segment in the

year ended 31 March 2014.

Geographical Information

UK Germany Americas Far East Total

GBP GBP GBP GBP GBP

------------------------------ ----------- ----------- --------- ---------- ------------

Year ended 31 March 2013

- Unaudited

Revenue by origination 13,383,113 11,402,649 6,258,588 10,039,321 41,083,671

Inter-segmental revenue (6,244,716) (9,601,016) - - (15,845,732)

------------------------------ ----------- ----------- --------- ---------- ------------

Revenue to third parties 7,138,397 1,801,633 6,258,588 10,039,321 25,237,939

------------------------------ ----------- ----------- --------- ---------- ------------

Property, plant and equipment 4,887,586 60,187 136,348 9,914 5,094,035

------------------------------ ----------- ----------- --------- ---------- ------------

Investment properties 3,450,000 - - - 3,450,000

------------------------------ ----------- ----------- --------- ---------- ------------

Property held for sale - - 109,977 - 109,977

------------------------------ ----------- ----------- --------- ---------- ------------

Goodwill - 3,512,305 - - 3,512,305

------------------------------ ----------- ----------- --------- ---------- ------------

Development cost 1,969,306 2,714,115 - - 4,674,421

------------------------------ ----------- ----------- --------- ---------- ------------

Total assets 25,088,461 5,135,199 1,404,040 1,626,891 33,254,591

------------------------------ ----------- ----------- --------- ---------- ------------

Year ended 31 March 2012

- Audited

Revenue by origination 12,361,850 10,529,275 6,278,721 9,834,627 39,004,473

Inter-segmental revenue (6,705,257) (8,859,116) - (30,698) (15,595,071)

------------------------------ ----------- ----------- --------- ---------- ------------

Revenue to third parties 5,656,593 1,670,159 6,278,721 9,803,929 23,409,402

------------------------------ ----------- ----------- --------- ---------- ------------

Property, plant and equipment 4,968,013 55,416 115,995 16,289 5,155,713

------------------------------ ----------- ----------- --------- ---------- ------------

Investment properties 3,450,000 - - - 3,450,000

------------------------------ ----------- ----------- --------- ---------- ------------

Property held for sale - - 104,519 - 104,519

------------------------------ ----------- ----------- --------- ---------- ------------

Goodwill - 3,512,305 - - 3,512,305

------------------------------ ----------- ----------- --------- ---------- ------------

Development cost 1,907,456 2,246,203 - - 4,153,659

------------------------------ ----------- ----------- --------- ---------- ------------

Total assets 22,882,808 5,058,799 1,184,699 1,205,283 30,331,589

------------------------------ ----------- ----------- --------- ---------- ------------

Inter-segmental transfers or transactions are entered into under

commercial terms and conditions appropriate to the location of the

business entity whilst considering that the parties are

related.

2. Dividend paid and proposed

It is proposed to pay a dividend of 5.5p per Ordinary Share of

5p in respect of the year end 31 March 2013 (2012: 4.0p per

Ordinary Share of 5p).

3. Income Tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

Unaudited Audited

2013 2012

GBP GBP

----------------------------- ---------- ----------

UK income tax (142,549) (133,870)

Overseas income tax 382,549 446,721

----------------------------- ---------- ----------

Total current tax credit 240,000 312,851

Deferred tax 776,895 320,400

----------------------------- ---------- ----------

Reported income tax expense 1,016,895 633,251

----------------------------- ---------- ----------

4. Profit per ordinary share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year.

Weighted Weighted

average average

number Profit number Profit

per per

Profit of shares share Profit of shares share

2013 2013 2013 2012 2012 2012

GBP Number p GBP Number p

------------------------- --------- ---------- ------ --------- ---------- ------

Basic profit per share 4,054,181 15,841,435 25.59 3,316,278 15,743,946 21.06

------------------------- --------- ---------- ------ --------- ---------- ------

Diluted profit per share

Basic profit per share 4,054,181 15,841,435 25.59 3,316,278 15,743,946 21.06

Dilutive effect of share

options - 256,941 (0.42) - 91,376 (0.12)

------------------------- --------- ---------- ------ --------- ---------- ------

Diluted profit per share 4,054,181 16,098,376 25.18 3,316,278 15,835,322 20.94

------------------------- --------- ---------- ------ --------- ---------- ------

5. Investment properties

Investment properties are revalued at each discrete period end

by the directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At the 31 March 2012 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis. The

directors do not consider that the properties require a change in

valuation at 31 March 2013 having considered the local property

market.

6. Analysis of cash flow movement in net debt

The cash flow below is a combination of the actual cash flow and

the exchange movement.

Audited Unaudited Unaudited Unaudited

Net cash Exchange Net cash

at at

1 April Cash flow movement 31 March

2012 2013

GBP GBP GBP GBP

-------------------------- ----------- --------- --------- ---------

Cash and cash equivalents 7,742,038 1,599,445 (18,526) 9,322,957

Bank loans and overdrafts (2,500,431) 2,162,164 - (338,267)

-------------------------- ----------- --------- --------- ---------

5,241,607 3,761,609 (18,526) 8,984,690

-------------------------- ----------- --------- --------- ---------

7. Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive

global market, which is undergoing continual and geographical

change. The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

8. Directors' statement pursuant to the disclosure and transparency rules

The directors confirm that, to the best of their knowledge:

a. the condensed consolidated financial statements, prepared in

accordance with IFRS as adopted by the EU give a true and fair view

of the assets, liabilities, financial position and loss of the

company and the undertakings included in the consolidation taken as

a whole; and

b. the Chairman's statement and operating and financial review

includes a fair review of the development and performance of the

business and the position of the company and the undertakings

included in the consolidation taken as a whole together with a

description of the principal risks and uncertainties that they

face.

The directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

9. Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2012 financial statements.

10. General

The results for the year have been prepared using the

recognition and measurement principles of international financial

reporting standards as adopted by the EU.

The audited financial information for the year ended 31 March

2012 is based on the statutory accounts for the financial year

ended 31 March 2012 that have been filed with the Registrar of

Companies. The auditor reported on those accounts: their report was

(i) unqualified, (ii) did not include references to any matters to

which the auditor drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2013 are

expected to be finalised and signed following approval by the board

of directors on 21 June 2013 and delivered to the Registrar of

Companies following the Company's annual general meeting on 31 July

2013.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2013

or 2012 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com.

11. Approval

The Directors approved this annual results announcement on 10

June 2013.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKKEFADDEFF

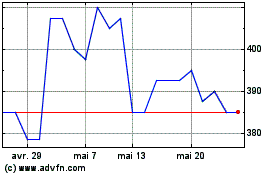

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024