TIDMCML

RNS Number : 3327T

CML Microsystems PLC

19 November 2013

CML Microsystems Plc

INTERIM RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductor products, primarily for the

global communication and data storage markets, announces Interim

Results for the six months ended 30 September 2013.

Financial Highlights

-- Record first half results

-- Group revenues up 5% to GBP12.99m (2012: GBP12.39m)

-- Gross profit up 7% to GBP9.21m (2012: GBP8.57m)

-- Profit before tax up 29% to GBP3.21m (2012: GBP2.48m)

-- Diluted EPS up 38% to 15.37p (2012: 11.13p)

-- Net cash of GBP9.7m (2012: GBP6.5m)

Operational Highlights

-- Storage revenues up c. 7% as customers transitioned to

higher-performance flash memory controller products

-- Wireless semiconductors revenues up c. 10% due to robust

professional and commercial wireless communication markets

-- Successful exit of Radio Data Technology (RDT) completed on

schedule and at minimum cost leaving the Group as a pure-play

fabless semiconductor business

-- Continued adoption of industrial controllers with positive feedback from sampling customers

-- Expansion of the RF product portfolio to drive growth in wireless markets

Chris Gurry, Managing Director of CML, said:

"The first half of the year has seen record half year results

and reflects the Group's focus on delivering sustainable growth.

Our key addressable markets of storage and wireless each exhibit

compelling growth opportunities.

"Order book visibility continues to be relatively short term and

raw material lead times can extend to 16 weeks in some instances.

This could affect the timing of revenue recognition towards the end

of what is a traditionally weaker second half period. That said,

the Board's expectation remains for a full year of firm growth in

profitability to 31 March 2014."

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Managing Director Tel: 01621 875 500

Nigel Clark, Financial Director

Cenkos Securities Plc Tel: 020 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate Finance)

SP Angel Corporate Finance Tel: 020 3463 2260

LLP

Jeff Keating

Walbrook PR Ltd Tel: 020 7933 8780 or cml@walbrookpr.com

Paul McManus Mob: 07980 541 893

Helen Cresswell Mob: 07841 917 679

Chairman and Chief Executive's statement and operational and

financial review

Introduction

I am pleased to report a further improvement in the Group's

operating performance through the first six-month trading period to

30 September 2013. A steady increase in revenues, coupled with a

diligent focus on product and operational cost management, has

contributed to a 5% uplift in revenues and a 29% advance in profit

before tax being recorded against the comparable period.

Unfortunately, the financial and operational progress achieved

has been overshadowed in recent weeks following the death of two

Board members.

Our founder and Non-Executive Chairman, George Gurry passed away

on 5 October 2013. Although he had announced plans to vacate the

Chairman's role by the end of this financial year, the Board was

expecting to benefit from his wide ranging knowledge and experience

for some time. An inspirational leader, he was highly regarded by

those that knew him and the business legacy he leaves is evidence

of both his success and the gratitude the Group owes to his vision

and commitment for over 45 years.

Unexpectedly, George Bates, Non-Executive Director, passed away

on 21 October 2013. George joined the Group in 1971 and over the

following three and a half decades made an immeasurable

contribution to the Group's engineering activities. In March 2006

he relinquished his executive engineering position but remained on

the Board in a non-executive capacity. His considered and pragmatic

approach will be sorely missed.

Over the coming months the Board will fully assess the situation

and take appropriate action to ensure it has the right mix of

skills and experience to continue executing on its sustainable

growth strategy.

Equipment segment

As reported at the time of the full-year results in June 2013,

the Board took the decision to exit from the Group's loss-making

equipment segment, Radio Data Technology Ltd (RDT), and completed

the exit during the first half of the current financial year.

Following the sale of certain IP and assets to third parties, RDT

went into liquidation on 13 August 2013. As a consequence, the

Group now has only one operating segment, semiconductors, and this

statement and operational review refers to the results of the

continuing operations. A note in the condensed consolidated income

statement highlights the loss from discontinued operations and

notes 1 and 4 of the condensed consolidated financial statements

contain further detailed breakdowns.

Operational and financial review

Revenues from continuing operations increased year on year by

almost 5% to GBP12.99m (2012: GBP12.39m) driven by progress in the

Group's two key semiconductor market areas, storage and

wireless.

Storage revenues advanced by close to 7% as a number of

customers transitioned to higher-performance flash memory

controller products. The Group also benefitted from the first full

reporting period where its SATA interface controllers were in mass

production.

Revenues from the sale of semiconductors into professional and

commercial wireless applications improved by approximately 10%. The

growth was driven by increased shipments of digital baseband

products and high performance RF ICs.

Telecom revenues were down approximately 5% but remained broadly

in line with expectations.

Geographically, the improvement in sales revenues was not

attributable to any one single area, with increases posted in all

three major regions; the Far East, the Americas and Europe.

Gross margins improved to 71% (2012: 69%) largely as a result of

product mix, leading to a reported gross profit of GBP9.21m (2012:

GBP8.57m), an increase of just over 7% year on year. Distribution

and administration costs were fractionally lower at GBP6.16m (2012:

GBP6.18m) driving a 28% improvement in operational profits (before

other income, share-based payments and net finance effects) to

GBP3.06m (2012: GBP2.39m).

Other operating income rose to GBP192k (2012: GBP124k)

reflecting the increased occupancy of group owned non--operational

commercial properties.

There were no finance costs during the period and a small

finance income was reported of GBP35k (2012: GBP5k).

Profit before tax increased by 29% to GBP3.21m (2012:

GBP2.48m).

Once again the Group posted a pleasing performance in terms of

cash generation, despite high levels of investment in new product

development activities, the repayment of all bank loans and the

payment of an GBP873k cash dividend (2012: GBP631k). At 30

September 2013, the Group had net cash reserves of GBP9.74m (2012:

GBP6.51).

Diluted earnings per share increased by 38% to 15.37p (2012:

11.13p) and shareholders' equity rose to GBP22.94m (2012:

GBP20.12m).

Summary and outlook

Performance through the first half year was in line with both

management and market expectations for firm improvement. The exit

from the equipment segment was completed on schedule and at minimum

cost leaving the Group focused as a pure-play fabless semiconductor

business.

Our key addressable markets of storage and wireless each exhibit

compelling growth opportunities. Within storage we expect adoption

of our industrial SATA controller to continue whilst the early

feedback from sampling customers with our new industrial SD

controller has been positive. For our target wireless markets, we

expect the growth drivers to be digital radio technology along with

opportunities for chip-set design wins within data centric

applications. The expansion of the RF product portfolio is a key

catalyst in this regard. In short, engineering development

activities are being targeted to underpin the sustainable growth

strategy that has been communicated in recent years.

Order book visibility continues to be relatively short term and

raw material lead times can extend to 16 weeks in some instances.

This could affect the timing of revenue recognition towards the end

of what is a traditionally weaker second half period. That said,

the Board's expectation remains for a full year of firm growth in

profitability to 31 March 2014.

On behalf of the Board, I would like to express sincere thanks

and appreciation to our employees for the commitment and loyalty

they continue to demonstrate and, without whom, success would not

be possible.

It remains for me to convey my appreciation to all Group

stakeholders and friends who have offered their support in recent

weeks following the loss of our founder. He set high standards for

business acumen, ethics and achievement that are embedded across

the Group and will remain a constant reference as we move

forward.

C. A. Gurry

Chairman and Chief Executive

19 November 2013

Condensed consolidated income statement

for the six months ended 30 September 2013

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

-------------------------------------------------------- ------------ ------------ --------

Continuing operations

Revenue 12,989 12,390 24,648

Cost of sales (3,777) (3,825) (7,313)

-------------------------------------------------------- ------------ ------------ --------

Gross profit 9,212 8,565 17,335

Distribution and administration costs (6,156) (6,180) (12,131)

-------------------------------------------------------- ------------ ------------ --------

3,056 2,385 5,204

Other operating income 192 124 297

-------------------------------------------------------- ------------ ------------ --------

Profit before share-based payments 3,248 2,509 5,501

Share-based payments (69) (38) (102)

-------------------------------------------------------- ------------ ------------ --------

Profit after share-based payments 3,179 2,471 5,399

Finance costs - - -

Finance income 35 5 55

-------------------------------------------------------- ------------ ------------ --------

Profit before taxation 3,214 2,476 5,454

Income tax expense (710) (638) (1,017)

-------------------------------------------------------- ------------ ------------ --------

Profit after taxation from continuing operations 2,504 1,838 4,437

Profit/(loss) from discontinued operations (see note 4) - (68) (383)

-------------------------------------------------------- ------------ ------------ --------

Profit for period attributable to equity owners of

the parent 2,504 1,770 4,054

-------------------------------------------------------- ------------ ------------ --------

Basic earnings per share

From continuing operations 15.73p 11.63p 28.01p

-------------------------------------------------------- ------------ ------------ --------

From profit for the year 15.73p 11.20p 25.59

-------------------------------------------------------- ------------ ------------ --------

From discontinued operations - (0.43p) (2.42p)

-------------------------------------------------------- ------------ ------------ --------

Diluted earning per share

From continuing operations 15.37p 11.56p 27.56p

-------------------------------------------------------- ------------ ------------ --------

From profit for the year 15.37p 11.13p 25.18p

-------------------------------------------------------- ------------ ------------ --------

From discontinued operations - (0.43p) (2.38p)

-------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2013

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------ ------------ --------

Profit for the period 2,504 1,770 4,054

Other comprehensive income:

Foreign exchange differences (214) (65) 180

Actuarial loss on retirement benefit obligations - - (1,768)

Income tax on actuarial loss - - 407

-------------------------------------------------------------------------------- ------------ ------------ --------

Other comprehensive income for the period net of tax (214) (65) (1,181)

-------------------------------------------------------------------------------- ------------ ------------ --------

Total comprehensive income for the period net of tax attributable to equity

owners of the

business 2,290 1,705 2,873

-------------------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of financial position

as at 30 September 2013

Unaudited Unaudited Audited

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

------------------------------------------------------------ --------- --------- --------

Assets

Non-current assets

Property, plant and equipment 5,025 5,132 5,094

Investment properties 3,450 3,450 3,450

Development costs 5,611 4,372 4,674

Goodwill 3,512 3,512 3,512

Deferred tax asset 2,242 2,398 2,738

------------------------------------------------------------ --------- --------- --------

19,840 18,864 19,468

------------------------------------------------------------ --------- --------- --------

Current assets

Inventories 1,536 2,017 1,692

Trade receivables and prepayments 4,187 2,693 2,522

Current tax assets - - 139

Cash and cash equivalents 9,737 7,864 9,323

------------------------------------------------------------ --------- --------- --------

15,460 12,574 13,676

------------------------------------------------------------ --------- --------- --------

Non-current assets classified as held for sale - properties 103 103 110

------------------------------------------------------------ --------- --------- --------

Total assets 35,403 31,541 33,254

------------------------------------------------------------ --------- --------- --------

Liabilities

Current liabilities

Bank loans and overdrafts - 1,354 338

Trade and other payables 3,863 3,604 3,308

Current tax liabilities 422 255 57

------------------------------------------------------------ --------- --------- --------

4,285 5,213 3,703

------------------------------------------------------------ --------- --------- --------

Non-current liabilities

Deferred tax liabilities 2,058 1,671 2,064

Retirement benefit obligation 6,122 4,542 6,122

------------------------------------------------------------ --------- --------- --------

8,180 6,213 8,186

------------------------------------------------------------ --------- --------- --------

Total liabilities 12,465 11,426 11,889

------------------------------------------------------------ --------- --------- --------

Net assets 22,938 20,115 21,365

------------------------------------------------------------ --------- --------- --------

Capital and reserves attributable to equity owners of

the parent

Share capital 798 793 794

Share premium 5,060 4,959 4,977

Share-based payments reserve 240 146 171

Foreign exchange reserve 299 268 513

Accumulated profits 16,541 13,949 14,910

------------------------------------------------------------ --------- --------- --------

Shareholders' equity 22,938 20,115 21,365

------------------------------------------------------------ --------- --------- --------

Condensed consolidated cash flow statements

for the six months ended 30 September 2013

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------------- ------------ ------------ --------

Operating activities

Profit for the period before income taxes and discontinued activities 3,217 2,408 5,071

Adjustments for:

Depreciation 124 109 242

Amortisation of development costs 1,109 1,146 2,517

Movement in pensions deficit - - (188)

Share-based payments 69 38 102

Finance income (35) (5) (24)

Increase in working capital (959) (362) (164)

---------------------------------------------------------------------- ------------ ------------ --------

Cash flows from operating activities 3,525 3,334 7,556

Income tax refunded/(paid) 65 19 (71)

---------------------------------------------------------------------- ------------ ------------ --------

Net cash flows from operating activities 3,590 3,353 7,485

---------------------------------------------------------------------- ------------ ------------ --------

Investing activities

Purchase of property, plant and equipment (58) (88) (179)

Investment in development costs (2,067) (1,460) (3,048)

Disposals of property, plant and equipment 4 - -

Finance income 35 5 24

---------------------------------------------------------------------- ------------ ------------ --------

Net cash flows from investing activities (2,086) (1,543) (3,203)

---------------------------------------------------------------------- ------------ ------------ --------

Financing activities

Issue of ordinary shares 87 92 111

Decrease in bank loans and short-term borrowings (338) (1,146) (2,163)

Dividend paid to Group shareholders (873) (631) (631)

---------------------------------------------------------------------- ------------ ------------ --------

Net cash flows from financing activities (1,124) (1,685) (2,683)

---------------------------------------------------------------------- ------------ ------------ --------

Increase in cash and cash equivalents 380 125 1,599

---------------------------------------------------------------------- ------------ ------------ --------

Movement in cash and cash equivalents:

At start of period/year 9,323 7,742 7,742

Increase in cash and cash equivalents 380 125 1,599

Effects of exchange rate changes 34 (3) (18)

---------------------------------------------------------------------- ------------ ------------ --------

At end of period/year 9,737 7,864 9,323

---------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2013

Foreign

Share Share Share-based exchange Accumulated

capital premium payments reserve profits Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 31 March 2012 788 4,872 108 333 12,809 18,910

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 1,770 1,770

Other comprehensive income:

Foreign exchange differences (65) (65)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - (65) 1,770 1,705

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners:

Dividend paid (631) (631)

Issue of ordinary shares 5 87 92

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners: 5 87 - - (631) (539)

Share-based payments 38 38

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2012 793 4,959 146 268 13,948 20,114

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 2,284 2,284

Other comprehensive income:

Foreign exchange differences 245 245

Actuarial loss on retirement benefit obligation (1,768) (1,768)

Deferred tax on actuarial losses 407 407

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - 245 923 1,168

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners:

Issue of ordinary shares 1 18 19

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners: 1 18 - - - 19

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 64 64

Cancelation/transfer of share-based payments (39) 39 -

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 31 March 2013 794 4,977 171 513 14,910 21,365

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 2,504 2,504

Other comprehensive income:

Foreign exchange differences (214) (214)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - (214) 2,504 2,290

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners:

Dividend paid (873) (873)

Issue of ordinary shares 4 83 87

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners: 4 83 - - (873) (786)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 69 69

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2013 798 5,060 240 299 16,541 22,938

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Notes to the condensed consolidated financial statements

1 Segmental analysis

Business segments

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Semi- Semi- Semi-

Discontinued conductor Discontinued conductor Discontinued conductor

Equipment components Group Equipment components Group Equipment components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Revenue

By origination 282 21,497 21,779 308 20,824 21,132 590 40,494 41,084

Inter-segmental

revenue - (8,508) (8,508) - (8,434) (8,434) - (15,846) (15,846)

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Segmental

revenue 282 12,989 13,271 308 12,390 12,698 590 24,648 25,238

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Profit/(loss)

Segmental result 3 3,179 3,182 (68) 2,471 2,403 (383) 5,399 5,016

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Net financial

income 35 5 55

Income tax (713) (638) (1,017)

------- ------- --------

Profit after

taxation 2,504 1,770 4,054

------- ------- --------

Assets and

liabilities

Segmental assets - 29,608 29,608 659 24,931 25,590 272 26,545 26,817

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Unallocated

corporate assets

Investment

property

(including held

for sale) 3,553 3,553 3,560

Deferred

taxation 2,242 2,398 2,738

Current tax

receivable - - 139

------- ------- --------

Consolidated

total assets 35,403 31,541 33,254

------- ------- --------

Segmental

liabilities - 3,863 3,863 298 3,306 3,604 228 3,080 3,308

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Unallocated

corporate assets

Deferred

taxation 2,058 1,671 2,063

Current tax

liability 422 255 57

Bank loans and

overdrafts - 1,354 338

Retirement

benefit

obligation 6,122 4,542 6,122

------- ------- --------

Consolidated

total

liabilities 12,465 11,426 11,888

------- ------- --------

Other segmental

information

Property, plant

and equipment

additions - 58 58 - 88 88 - 179 179

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Development cost

additions - 2,067 2,067 35 1,425 1,460 59 2,989 3,048

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Depreciation - 124 124 1 108 109 1 241 242

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Amortisation - 1,109 1,109 32 1,114 1,146 171 2,346 2,517

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Other

significant

non-cash income - - - - - - - 188 188

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Geographical segments

UK Germany Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2013

Revenue by origination 6,610 6,956 2,981 5,232 21,779

Inter-segmental revenue (2,870) (5,638) - - (8,508)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 3,740 1,318 2,981 5,232 13,271

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,826 70 123 6 5,025

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - 103 - 3,553

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 2,148 3,463 - - 5,611

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 23,918 7,134 1,930 2,421 35,403

---------------------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2012

Revenue by origination 6,121 6,407 3,106 5,498 21,132

Inter-segmental revenue (3,134) (5,300) - - (8,434)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 2,987 1,107 3,106 5,498 12,698

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,926 58 134 14 5,132

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - 103 - 3,553

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 2,029 2,343 - - 4,372

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 22,176 5,894 1,562 1,909 31,541

---------------------------------------------- ------- ------- -------- -------- --------

Audited

Year ended 31 March 2013

Revenue by origination 13,383 11,403 6,259 10,039 41,084

Inter-segmental revenue (6,245) (9,601) - - (15,846)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 7,138 1,802 6,259 10,039 25,238

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,888 60 136 10 5,094

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - 110 - 3,560

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 1,960 2,714 - - 4,674

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 25,088 5,135 1,404 1,627 33,254

---------------------------------------------- ------- ------- -------- -------- --------

On 13 August 2013 Radio Data Technology Ltd which represents

100% of the equipment segment went into liquidation and

consequently after that date the Group only has one segment.

Reported segments and their results in accordance with IFRS 8,

is based on internal management reporting information that is

regularly reviewed by the chief operating decision maker. The

measurement policies the Group uses for segmental reporting under

IFRS 8 are the same as those used in its financial statements.

2 Dividend paid and proposed

A dividend of 5.5p per 5p ordinary share in respect of the year

ended 31 March 2013 was paid on 2 August 2013 (2012: 4.0p per

ordinary share of 5p in respect of the year ended 31 March 2012).

No dividend is proposed in respect of the six months period ended

30 September 2013 (2012: GBPNil per ordinary share of 5p in respect

of the period ended 30 September 2012).

3 Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

------------------------------ ------------ ------------ --------

UK income tax charge/(credit) - - (142)

Overseas income tax charge 174 326 382

------------------------------ ------------ ------------ --------

Total current tax charge 174 326 240

Deferred tax charge 536 312 777

------------------------------ ------------ ------------ --------

Reported income tax charge 710 638 1,017

------------------------------ ------------ ------------ --------

4 Discontinued operations

On 13 August 2013 Radio Data Technology Ltd went into

liquidation and consequently qualifies as a discontinued operation.

The results of the discontinued operation which have been included

in the consolidated income statement are presented below:

6 months end 6 months end Year end

30/09/13 30/09/12 31/03/13

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ --------

Revenue 282 308 590

Cost of sales (171) (140) (361)

------------------------------------------- ------------ ------------ --------

Gross profit 111 168 229

Distribution and administration costs (108) (236) (612)

------------------------------------------- ------------ ------------ --------

Profit/(loss) before taxation 3 (68) -

Taxation (3) - -

------------------------------------------- ------------ ------------ --------

Profit/(loss) from discontinued operations - (68) (383)

------------------------------------------- ------------ ------------ --------

5 Earnings per share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2013 15,915,946 16,296,334

----------------------------------- ---------- ----------

Six months ended 30 September 2012 15,809,707 15,903,421

----------------------------------- ---------- ----------

Year end 31 March 2013 15,841,435 16,098,376

----------------------------------- ---------- ----------

6 Investment properties

Investment properties are revalued at each discrete period end

by the Directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At 31 March 2012 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis.

7 Analysis of cash flow movement in net debt

Net cash at 6 months end Net cash at 6 months end Net cash at 6 months end Net cash at

01/04/12 30/09/12 30/09/12 31/03/2013 31/03/13 30/09/13 30/09/13

Cash flow Cash flow Cash flow

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

Cash and cash

equivalents 7,742 122 7,864 1,459 9,323 414 9,737

Bank loans and

overdrafts (2,501) 1,147 (1,354) 1,016 (338) 338 -

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

5,241 1,269 6,510 2,475 8,985 752 9,737

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

8 Retirement benefit obligations

The Directors have not obtained an actuarial report in respect

of the defined benefit pension scheme for the purpose of this Half

Yearly Report.

9 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency would have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored; however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly-competitive

global market, which is undergoing continual geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

10 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

a) the condensed financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position and profit of the Group and

the undertakings included in the consolidation taken as a whole;

and

b) the condensed set of financial statements have been prepared

in accordance with IAS 34 "Interim Financial Reporting"; and

c) the Chairman and Chief Executive's statement and operational

and financial review include a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole

together with a description of the principal risks and

uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

11 Basis of preparation

The basis of preparation and accounting policies used in

preparation of the Half Yearly Financial Report are the same

accounting policies set out in the year ended 31 March 2013

financial statements.

12 General

Other than already stated within the Chairman and Chief

Executive's statement and operational and financial review there

have been no important events during the first six months of the

financial year that have impacted this Half Yearly Financial

Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 9 above.

In the segmental analysis (note 1) inter-segmental transfers or

transactions are entered into under commercial terms and conditions

appropriate to the location of the entity whilst considering that

the parties are related.

This Half Yearly Financial Report includes a fair review of the

information required by DTR 4.2.7/8 (indication of important events

and their impact, and description of principal risks and

uncertainties for the remaining six months of the financial

year).

This Half Yearly Financial Report does not include all the

information and disclosures required in the Annual Report, and

should be read in conjunction with the consolidated Annual Report

for the year ended 31 March 2013.

The financial information contained in this Half Yearly

Financial Report has been prepared using International Financial

Reporting Standards as adopted by the European Union. This Half

Yearly Financial Report does not constitute statutory accounts as

defined by Section 434 of the Companies Act 2006. The financial

information for the year ended 31 March 2013 is based on the

statutory accounts for the financial year ended 31 March 2013 that

have been filed with the Registrar of Companies and on which the

Auditor gave an unqualified audit opinion.

The Auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Financial Report has not been audited or reviewed

by the Group Auditor.

A copy of this Half Yearly Financial Report can be viewed on the

Company website www.cmlmicroplc.com.

13 Approvals

The Directors approved this Half Yearly Report on 19 November

2013.

Glossary

fabless a company that designs the semiconductor but

subcontracts the wafer fabrication process

IC integrated circuit

IP intellectual property

RDT Radio Data Technology Ltd

RF radio frequency

SATA serial ATA interface

SD secure digital

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGGWGGUPWGMR

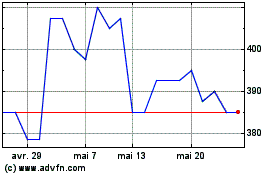

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2024 à Août 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Août 2023 à Août 2024